PayPal Wants More Customers to Pay Using Crypto Assets

May 06 2021 - 7:21PM

Dow Jones News

By Nina Trentmann

PayPal Holdings Inc. is looking to expand its lucrative business

of enabling customers to pay merchants with crypto assets, but the

digital payments company doesn't yet plan to invest in these

assets, Chief Financial Officer John Rainey said.

"It is still a highly volatile asset right now," Mr. Rainey

said, referring in general to fluctuations in price of

cryptocurrency assets. "But if in a couple of years, there is more

stability, I would never say no," he said. Mr. Rainey declined to

comment on what he would define as more stability.

The value of crypto assets such as bitcoin, ether and dogecoin

have risen in recent weeks on the back of strong market sentiment

and the rise of nonfungible tokens, among other factors. Some

companies, including Tesla Inc. and Square Inc., earlier this year

disclosed corporate investments in cryptocurrencies.

However, most CFOs have been cautious so far, pointing to the

risks associated with spending corporate cash on bitcoin and other

crypto assets. "We are managing our cash very consistently,"

PayPal's Mr. Rainey said. The company held $19.1 billion in cash,

cash equivalents and investments at the end of its latest

quarter.

San Jose, Calif.-based PayPal in November introduced a feature

enabling most U.S. customers to buy, sell and hold bitcoin, ether,

litecoin and Bitcoin Cash. Earlier this year, it launched an option

for people to use their holdings in these currencies to pay

merchants.

Those transactions are more attractive for PayPal than those

involving a credit or debit card, as there are no card issuers or

network providers that need to be paid. The payments company still

charges its merchants a standard transaction fee of around 2.9%,

but gets to keep more of that money, Mr. Rainey said. "It's a high

margin transaction for us," he said.

PayPal has to pay Paxos Trust Co., a company that converts the

crypto assets into U.S. dollars before they are sent to the

merchant. The execution risk lies with Paxos, Mr. Rainey said.

PayPal on Wednesday reported revenue of $6.03 billion for its

latest quarter, up 29% compared with the prior-year period. Total

payment volume rose 46% to $285.45 billion. The company is now

expecting payment volume to grow by about 30% this year, up from

its prior guidance of the high-20% range.

Building out its crypto offering enables PayPal to connect with

customers that are more engaged than those using other forms of

payment, said Harshita Rawat, a managing director and senior

research analyst at financial services firm AllianceBernstein

Holding LP. About half of PayPal's crypto users open its app every

day, the company said.

"Both cryptocurrencies and the underlying technology have become

a big strategic focus for the company," Ms. Rawat said.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

May 06, 2021 19:06 ET (23:06 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

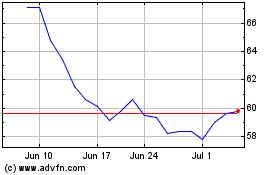

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Apr 2023 to Apr 2024