Healthcare, Energy Stocks Lead Major Indexes Lower

May 06 2021 - 10:34AM

Dow Jones News

By Joe Wallace

U.S. stocks bounced around the flatline Thursday as investors

sold shares of healthcare and energy companies.

The S&P 500 fell 0.1% shortly after the opening bell, while

the Nasdaq Composite slid 0.4%, putting the tech-heavy benchmark on

pace for a fifth straight daily decline. The Dow Jones Industrial

Average added around 73 points.

Many healthcare stocks in the S&P 500 traded in the red

after the U.S. said a day earlier it would support the temporary

waiver of intellectual property provisions that would allow

developing countries to produce Covid-19 vaccines created by

pharmaceutical companies. Vaccine makers including Pfizer and

Johnson & Johnson were among the market's losers on

Thursday.

Energy stocks also struggled, while tech and material stocks

notched minor losses.

Still, major U.S. indexes stand at or close to all-time highs,

bolstered by a surge of economic growth and corporate earnings as

restrictions on some activities are relaxed. Some investors say the

speed of the U.S. recovery, which stands in contrast to some other

regions where Covid-19 vaccines aren't as widespread, will keep

stocks on an upward trajectory.

"We should see cash flows and company cash flows really improve,

especially with the reopenings happening," said Mary Nicola, a fund

manager at PineBridge Investments. Although valuations are high,

stocks remain attractive compared with low-yielding bonds, she

added.

The Labor Department said jobless claims dipped below 500,000

last week for the first time during the Covid-19 pandemic as

layoffs declined and hiring accelerated. Initial claims for

unemployment benefits, a proxy for layoffs, fell to 498,000 from

590,000 a week before.

The upbeat economic news appeared to have little impact on the

market though as investors focused on corporate developments.

Shares of vaccine makers led most other healthcare stocks lower.

Pfizer shed nearly 3%, while Johnson & Johnson slipped 0.4%.

Moderna fell 9.2% and AstraZenecas was recently down 1.3%.

Energy stocks in the S&P 500 slipped 0.8% alongside a mild

pullback in oil prices.

Elsewhere, shares of Etsy dropped more than 12% after the online

crafts marketplace projected a decline in revenue in the second

quarter.

News Corp, The Wall Street Journal's parent company, and Beyond

Meat are scheduled to report earnings after markets close.

Companies have blown past forecasts so far this earnings season.

Of the 381 companies on the S&P 500 that had reported through

Wednesday, 84% had topped analysts' expectations, according to

FactSet.

Yet many companies beating forecasts have seen a lackluster

response in their share price. Some investors say that is a sign,

alongside recent volatility in tech stocks, that the rally that

began last March is beginning to flag.

"Although the S&P is just 1% off its high, I think equity

markets are beginning to look very fatigued," said Paul O'Connor,

head of multiasset investments at Janus Henderson.

Indicators including surveys by the American Association of

Individual Investors suggest investors are almost uniformly

bullish, a setup that tends to precede a pullback in stocks,

according to Mr. O'Connor. "There are such high expectations

embedded in markets that we're going to need a steady stream of

good news just to maintain the current prices," he said.

In the bond market, the yield on 10-year Treasury notes slipped

to 1.583% from 1.584% Wednesday. Yields, which move in the opposite

direction to bond prices, have fallen for four consecutive

days.

Overseas, the Stoxx Europe 600 slipped 0.3%, weighed down by

shares of oil, gas, travel-and-leisure and technology companies. In

Asia, Japan's Nikkei 225 rose 1.8% and China's Shanghai Composite

slipped 0.2%.

--Michael Wursthorn contributed to this article.

Write to Joe Wallace at Joe.Wallace@wsj.com

(END) Dow Jones Newswires

May 06, 2021 10:19 ET (14:19 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

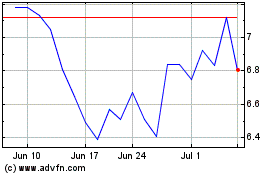

Beyond Meat (NASDAQ:BYND)

Historical Stock Chart

From Mar 2024 to Apr 2024

Beyond Meat (NASDAQ:BYND)

Historical Stock Chart

From Apr 2023 to Apr 2024