Current Report Filing (8-k)

May 04 2021 - 4:17PM

Edgar (US Regulatory)

false000170471500017047152021-04-282021-04-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): April 28, 2021

ALPHA METALLURGICAL RESOURCES, INC.

(Exact Name of Registrant as Specified in Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

|

|

001-38735

|

81-3015061

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

340 Martin Luther King Jr. Blvd.

Bristol, Tennessee 37620

|

|

(Address of Principal Executive Offices, zip code)

|

(423) 573-0300

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

AMR

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On April 28, 2021, the Compensation Committee of the board of directors adopted an Executive Officer Incentive Compensation Recoupment (Clawback) Policy, effective as of that date. The policy provides for the recoupment of certain executive officer compensation in the event of an accounting restatement resulting from material noncompliance with financial reporting requirements under the federal securities laws.

A copy of the policy is attached hereto as Exhibit 10.1.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On April 29, 2021, the Company held its Annual Meeting of Stockholders (the “Annual Meeting”) via internet webcast. As of the record date for the Annual Meeting, March 3, 2021, there were 18,389,139 shares of common stock outstanding and eligible to vote. 14,794,688 of these shares, or 80.45%, were represented in person or by proxy at the Annual Meeting. The final results of the matters voted on at the Annual Meeting are provided below.

Proposal 1: The election of seven (7) directors nominated by our board of directors for a term of one year. Each of the nominees was elected.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominee

|

|

For

|

|

Withheld

|

|

Broker Non-Votes

|

|

Kenneth S. Courtis

|

|

11,071,680

|

|

|

310,080

|

|

|

3,412,928

|

|

|

Albert E. Ferrara, Jr.

|

|

9,993,480

|

|

|

1,388,280

|

|

|

3,412,928

|

|

|

Elizabeth A. Fessenden

|

|

10,945,854

|

|

|

435,906

|

|

|

3,412,928

|

|

|

Michael J. Quillen

|

|

11,053,140

|

|

|

328,620

|

|

|

3,412,928

|

|

|

Daniel D. Smith

|

|

11,071,429

|

|

|

310,331

|

|

|

3,412,928

|

|

|

David J. Stetson

|

|

10,985,659

|

|

|

396,101

|

|

|

3,412,928

|

|

|

Scott D. Vogel

|

|

9,387,275

|

|

|

1,994,485

|

|

|

3,412,928

|

|

Proposal 2: The amendment of the Company’s certificate of incorporation to replace stockholder supermajority approval requirements with majority approval requirements. This proposal required the approval of two-thirds of shares of common stock outstanding. The proposal was not approved.

|

|

|

|

|

|

|

|

|

|

|

For:

|

|

10,805,402

|

|

|

Against:

|

|

147,551

|

|

|

Abstain:

|

|

428,807

|

|

|

Broker Non-Votes:

|

|

3,412,928

|

|

Proposal 3: Increasing the number of shares of our common stock reserved for awards under the Company’s 2018 Long-Term Incentive Plan by 500,000 shares. The proposal was approved.

|

|

|

|

|

|

|

|

|

|

|

For:

|

|

10,492,015

|

|

|

Against:

|

|

388,523

|

|

|

Abstain:

|

|

501,222

|

|

|

Broker Non-Votes:

|

|

3,412,928

|

|

Proposal 4: The ratification of RSM US LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021. The proposal was approved.

|

|

|

|

|

|

|

|

|

|

|

For:

|

|

14,481,831

|

|

|

Against:

|

|

7,006

|

|

|

Abstain:

|

|

305,851

|

|

|

Broker Non-Votes:

|

|

0

|

|

Proposal 5: Advisory approval of the Company’s executive compensation. The proposal was approved.

|

|

|

|

|

|

|

|

|

|

|

For:

|

|

10,525,086

|

|

|

Against:

|

|

371,674

|

|

|

Abstain:

|

|

485,000

|

|

|

Broker Non-Votes:

|

|

3,412,928

|

|

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

10.1

|

Executive Officer Incentive Compensation Recoupment (Clawback) Policy

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

Alpha Metallurgical Resources, Inc.

|

|

|

|

|

|

Date: May 4, 2021

|

By:

|

/s/ C. Andrew Eidson

|

|

|

|

Name: C. Andrew Eidson

|

|

|

|

Title: President and Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

10.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

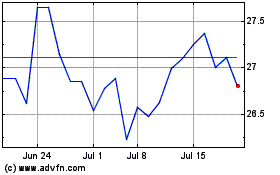

Coterra Energy (NYSE:CTRA)

Historical Stock Chart

From Mar 2024 to Apr 2024

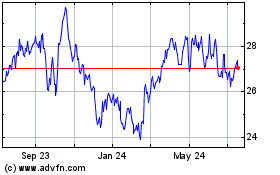

Coterra Energy (NYSE:CTRA)

Historical Stock Chart

From Apr 2023 to Apr 2024