Agile Therapeutics Reports First Quarter 2021 Financial Results

May 04 2021 - 4:05PM

Agile Therapeutics, Inc. (Nasdaq: AGRX), a women's healthcare

company, today reported financial results for the three months

ended March 31, 2021 and provided a corporate update.

“In December 2020, we began our initial commercial shipments of

Twirla® to wholesalers, who have been working down their

inventories during the first quarter of 2021. As wholesalers

complete the inventory work-down, we expect product revenue from

wholesalers will more closely reflect script demand growth for

Twirla at the retail level. We are encouraged by recent

trends, which we believe reflect our anticipated momentum and show

steady, increasing demand for our product and a growing base of

prescribers.” said Chairman and Chief Executive Officer, Al

Altomari. “We continue to be optimistic about Twirla’s trajectory

and are encouraged by the response to our product, the first and

only weekly contraceptive patch that delivers a low dose of

estrogen.”

Recent Corporate Developments and First Quarter 2021

Results:

Twirla Performance and Updates

- During the first quarter 2021, total prescriptions were 1,853.

The growth was driven by an increase in the number of prescribers,

which as of March 31, 2021 was more than 850 HCPs, and growing

refill rates. As of March 31, 2021, 447 of prescriptions dispensed

at pharmacies were refills. The Company also saw an increase in the

number of total prescriptions by prescriber.

- The Company believes its momentum in prescriptions reflects

underlying demand for Twirla and is supported by steady growth in

the first quarter, which has continued into the early second

quarter.

- The Company continues to focus on expanding access and

reimbursement coverage for Twirla across managed care and

government health insurance plans. During the first quarter 2021,

the Company made progress in obtaining Medicaid coverage for

Twirla. Currently, Twirla is covered with no prior authorization in

20 states with expected coverage pending in Texas in May 2021. The

Medicaid market represents a large number of combined hormonal

contraceptive (“CHC”) users; Medicaid volumes for oral CHC total

prescriptions in 2020 were nearly eight million.

- In February 2021, the Company entered into a specialty

distribution agreement with Sterling Specialty Pharmacy

(“Sterling”). The Company believes that the relationship with

Sterling will facilitate increased access to Twirla based on early

results, which have been productive in increasing uptake of Twirla.

Agile continues to explore the potential to expand its distribution

network through other channels that can support growth of Twirla

demand including telemedicine.

Marketing Campaign Updates

- The Company continues to support I’m So Done, an

education and empowerment unbranded awareness campaign that

encourages women to think about their current contraceptive method

and decision-making journey. The Company has seen increased

activity on its website and various applications, including Tik

Tok.

- Beginning in the second quarter the Company plans to shift a

significant portion of its investment in marketing to its branded

campaign. The Company plans to focus its branded campaign efforts

on driving awareness and trial of Twirla, with a goal of meeting

women throughout their everyday routine with a targeted digital

strategy.

- Ongoing efforts include a multi-channel creative campaign that

positions Twirla as the first and only weekly contraceptive patch

that delivers a low dose of estrogen.

- The Company plans to expand its digital reach to other

applications including Tinder and OkCupid, as well as

Spotify. These three applications reach millions of U.S.

women between the ages of 18 and 34 on a monthly basis.

First Quarter 2021 Financial Results

- Net revenue: The Company delivered $116,000 in

net product sales revenue in the first quarter, as wholesalers

worked down their inventory levels after the initial stocking of

Twirla in the prior quarter.

- Cost of product revenues: The cost of product

revenues for the quarter ended March 31, 2021 was $1.2 million

which included expenses supporting our manufacturing and

distribution efforts, including personnel costs and approximately

$500,000 of non-cash depreciation expense. The Company expects

these relatively fixed costs to become less significant as a

percentage of sales with anticipated volume increases. There

was no direct cost of product revenue during the three months ended

March 31, 2021, as all product sold consisted of validation

inventory which was previously expensed as research and development

expense in the fourth quarter of 2020. The Company expects

all validation inventory with a carrying value of zero to be

utilized in 2021.

- Total operating expenses: Total

operating expenses were $15.2 million for the quarter

ended March 31, 2021, compared to $7.6 million for

the comparable period in 2020. The increase in year-over-year

expenses mostly reflected higher selling and marketing expenses,

including our contract sales force expenses and brand-building

expenses. The Company anticipates its second quarter 2021 total

operating expenses will be approximately $18 to $20 million

reflecting increased commercial costs from product samples and

spending on branded marketing.

- Research and development (R&D)

expenses: R&D expenses were

approximately $2.1 million for the quarter

ended March 31, 2021, compared to $3.2 million for

the comparable period in 2020. The decrease in period-over-period

R&D expenses was primarily attributable to the absence of 2020

pre-validation manufacturing costs for commercial manufacturing of

Twirla by Corium, the Company’s contract manufacturer, offset in

part by higher clinical development and personnel-related

expenses.

- Selling and marketing expenses: Selling and

marketing expenses were $9.2 million for the quarter ended March

31, 2021, compared to $1.7 million for the comparable period in

2020. The increase in period-over-period selling and marketing

expenses was due to higher costs associated with activities for

Twirla, including brand building and advocacy, and development of

the Company’s contract sales force.

- General and administrative (G&A)

expenses: G&A expenses were $3.9

million for the quarter ended March 31, 2021, compared

to $2.7 million for the comparable period in 2020.

The increase in year-over-year G&A expenses reflected higher

personnel costs and professional fees in preparation for product

launch and commercial activities, as well as an increase in stock

compensation expense.

- Net loss: Net loss was $17.1

million, or $0.20 per share, for the quarter

ended March 31, 2021, compared to a net loss of $7.9

million, or $0.10 per share, for the comparable period in

2020.

- Cash, cash equivalents and marketable

securities: As of March 31, 2021, Agile had $40.1 million

of cash, cash equivalents and marketable securities, compared to

$54.5 million as of December 31, 2020.

- Shares Outstanding: As of March 31, 2021,

Agile had 88,263,741 shares of common stock outstanding.

Financial Update

- Agile has $25 million of capital potentially available through

its loan facility with Perceptive Advisors, including a tranche of

$15 million in 2021, and a tranche of $10 million, which will be

available through June 2022, both contingent on achieving a

pre-determined revenue target.

- Additionally, the Company has the potential to access

additional capital through its existing at-the-market arrangement,

under which Agile may sell up to an aggregate of $50 million in

gross proceeds through the sale of shares of common stock.

Conference Call and Webcast Agile

Therapeutics will host a conference call and webcast to

discuss financial results for the first quarter ended March

31, 2021, today at 4:30 pm ET. Investors interested in

listening to the conference call may do so by dialing (866)

324-3683 for domestic callers or (509) 844-0959 for international

callers. A live webcast will be available in the Events and

Presentations section of the Investor Relations page

at https://ir.agiletherapeutics.com/events-and-presentations/,

or by clicking here.

Please log in approximately 10 minutes prior to the scheduled

start time. The archived webcast will be available in the Events

and Presentations section of the Company's website.

About Twirla® Twirla (levonorgestrel and

ethinyl estradiol) transdermal system is a once-weekly combined

hormonal contraceptive (CHC) patch that contains the active

ingredients levonorgestrel (LNG), a type of progestin, and ethinyl

estradiol (EE), a type of estrogen. Twirla is indicated for use as

a method of contraception by women of reproductive potential with a

body mass index (BMI) < 30 kg/m2 for whom a combined hormonal

contraceptive is appropriate. Healthcare providers (HCPs) are

encouraged to consider Twirla’s reduced efficacy in women with a

BMI ≥ 25 to <30 kg/m2 before prescribing. Twirla is

contraindicated in women with a BMI ≥ 30 kg/m2. Twirla is

contraindicated in women over 35 years old who smoke. Cigarette

smoking increases the risk of serious cardiovascular events from

CHC use. Twirla is designed to be applied once weekly for

three weeks, followed by a week without a patch.

About Agile Therapeutics, Inc. Agile

Therapeutics is a forward-looking women's healthcare company

dedicated to fulfilling the unmet health needs of today’s

women. Our product and product candidates are designed to

provide women with contraceptive options that offer freedom from

taking a daily pill, without committing to a longer-acting

method. Our initial product, Twirla®, (levonorgestrel and

ethinyl estradiol), a transdermal system, is a non-daily

prescription contraceptive. Twirla is based on our proprietary

transdermal patch technology, called Skinfusion®, which is designed

to allow drug delivery through the skin. For more information,

please visit the company website

at www.agiletherapeutics.com. The Company may

occasionally disseminate material, nonpublic information on the

Company’s website.

Forward-Looking Statement Certain information

contained in this press release includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. We may in some cases use terms such as

“predicts,” “believes,” “potential,” “continue,” “anticipates,”

“estimates,” “expects,” “plans,” “intends,” “may,” “could,”

“might,” “likely,” “will,” “should” or other words that convey

uncertainty of the future events or outcomes to identify these

forward-looking statements. Our forward-looking statements are

based on current beliefs and expectations of our management team

that involve risks, potential changes in circumstances,

assumptions, and uncertainties, including statements regarding our

ongoing and planned manufacturing and commercialization of Twirla®,

the potential market acceptance and uptake of Twirla, including the

increasing demand for Twirla, our results of operations, revenues,

financial condition, liquidity, prospects, growth and strategies,

the expected benefits of our marketing and sales distribution

strategies, including the use of samples to grow prescriptions,

current and future Medicare coverage for Twirla, the development of

our other potential product candidates, the length of time that we

will be able to continue to fund our operating expenses and capital

expenditures and our expected financing needs and sources of

financing, including our debt financing from Perceptive

Advisors. Any or all of the forward-looking statements may

turn out to be wrong or be affected by inaccurate assumptions we

might make or by known or unknown risks and uncertainties. These

forward-looking statements are subject to risks and uncertainties

including risks related to our ability to maintain regulatory

approval of Twirla, the ability of Corium to produce commercial

supply in quantities and quality sufficient to satisfy market

demand for Twirla, our ability to successfully commercialize

Twirla, the accuracy of our estimates of the potential market and

the market demand for Twirla, regulatory and legislative

developments in the United States and foreign countries,

our ability to obtain and maintain intellectual property protection

for Twirla, our strategy, business plans and focus, the effects of

the COVID-19 pandemic on our operations and the operations of third

parties we rely upon as well as on our potential customer base, our

ability to meet or exceed the revenue thresholds necessary to

permit us to access the remaining amount available under our

existing debt financing from Perceptive Advisors and the other

risks set forth in our filings with the U.S. Securities and

Exchange Commission, including our Annual Report on Form 10-K and

our Quarterly Reports on Form 10-Q. For all these reasons,

actual results and developments could be materially different from

those expressed in or implied by our forward-looking statements.

You are cautioned not to place undue reliance on these

forward-looking statements, which are made only as of the date of

this press release. We undertake no obligation to publicly update

such forward-looking statements to reflect subsequent events or

circumstances.

Contact: Matt Riley Head of Investor

Relations & Corporate Communications

mriley@agiletherapeutics.com

Agile Therapeutics,

Inc.Balance

Sheets(Unaudited)(in thousands,

except par value and share data)

| |

|

|

|

|

|

| |

March 31, |

|

December 31, |

| |

2021 |

|

2020 |

| Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

16,464 |

|

|

$ |

14,463 |

|

|

Marketable securities |

|

23,647 |

|

|

|

40,008 |

|

|

Accounts receivable, net |

|

322 |

|

|

|

865 |

|

|

Inventory |

|

1,590 |

|

|

|

— |

|

|

Prepaid expenses and other current assets |

|

1,651 |

|

|

|

1,449 |

|

| Total current assets |

|

43,674 |

|

|

|

56,785 |

|

| Property and equipment, net |

|

13,801 |

|

|

|

14,243 |

|

| Right of use asset |

|

106 |

|

|

|

138 |

|

| Other non-current assets |

|

1,896 |

|

|

|

1,896 |

|

| Total

assets |

$ |

59,477 |

|

|

$ |

73,062 |

|

| |

|

|

|

|

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

5,944 |

|

|

$ |

3,867 |

|

|

Accrued expenses |

|

2,737 |

|

|

|

3,348 |

|

|

Lease liability, current portion |

|

106 |

|

|

|

138 |

|

| Total current liabilities |

|

8,787 |

|

|

|

7,353 |

|

| |

|

|

|

|

|

| Long-term debt |

|

15,636 |

|

|

|

16,381 |

|

| Total

liabilities |

|

24,423 |

|

|

|

23,734 |

|

| Commitments and

contingencies |

|

|

|

|

|

| Stockholders’

equity |

|

|

|

|

|

|

Common stock, $.0001 par value, 150,000,000 shares authorized,

88,263,741 and 87,563,753 issued and outstanding at

March 31, 2021 and December 31, 2020,

respectively |

|

9 |

|

|

|

9 |

|

|

Additional paid-in capital |

|

364,396 |

|

|

|

361,539 |

|

|

Accumulated other comprehensive income |

|

— |

|

|

|

3 |

|

|

Accumulated deficit |

|

(329,351 |

) |

|

|

(312,223 |

) |

| Total stockholders’

equity |

|

35,054 |

|

|

|

49,328 |

|

| Total liabilities and

stockholders’ equity |

$ |

59,477 |

|

|

$ |

73,062 |

|

| |

|

|

|

|

|

|

|

Agile Therapeutics,

Inc.Statements of

Operations(Unaudited)(in

thousands, except per share and share data)

| |

|

|

|

|

|

| |

Three Months Ended |

| |

March 31, |

| |

2021 |

|

2020 |

| |

|

|

|

|

|

|

Revenues, net |

$ |

116 |

|

|

$ |

— |

|

| Cost of product revenues |

|

1,161 |

|

|

|

— |

|

| Gross profit |

|

(1,045 |

) |

|

|

— |

|

| |

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

Research and development |

$ |

2,113 |

|

|

$ |

3,164 |

|

|

Selling and marketing |

|

9,163 |

|

|

|

1,742 |

|

|

General and administrative |

|

3,901 |

|

|

|

2,711 |

|

| Total operating expenses |

|

15,177 |

|

|

|

7,617 |

|

| Loss from operations |

|

(16,222 |

) |

|

|

(7,617 |

) |

| |

|

|

|

|

|

| Other income (expense) |

|

|

|

|

|

|

Interest income |

|

16 |

|

|

|

132 |

|

|

Interest expense |

|

(922 |

) |

|

|

(398 |

) |

| Total other income (expense),

net |

|

(906 |

) |

|

|

(266 |

) |

| Loss before benefit from income

taxes |

|

(17,128 |

) |

|

|

(7,883 |

) |

| Benefit from income taxes |

|

— |

|

|

|

— |

|

| Net loss |

$ |

(17,128 |

) |

|

$ |

(7,883 |

) |

| |

|

|

|

|

|

| Net loss per share (basic and

diluted) |

$ |

(0.20 |

) |

|

$ |

(0.10 |

) |

| |

|

|

|

|

|

| Weighted-average common shares

(basic and diluted) |

|

87,625,990 |

|

|

|

76,652,190 |

|

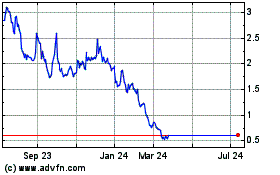

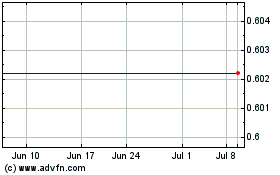

Agile Therapeutics (NASDAQ:AGRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Agile Therapeutics (NASDAQ:AGRX)

Historical Stock Chart

From Apr 2023 to Apr 2024