Current Report Filing (8-k)

April 30 2021 - 5:01PM

Edgar (US Regulatory)

0000091440false00000914402019-10-172019-10-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 29, 2021

Snap-on Incorporated

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-7724

|

|

39-0622040

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2801 80th Street

|

Kenosha

|

Wisconsin

|

53143-5656

|

|

|

(Address of principal executive offices)

|

(Zip code)

|

(262) 656-5200

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $1.00 par value

|

SNA

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

|

|

|

|

|

|

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

At the 2021 Annual Meeting of Shareholders of Snap-on Incorporated (the “Company”) on April 29, 2021 (the “2021 Annual Meeting”), the Company’s shareholders approved the amendment and restatement of the Snap-on Incorporated 2011 Incentive Stock and Awards Plan (the “2011 Plan”) primarily in order to increase the number of shares authorized for future issuance pursuant to the 2011 Plan by 2,500,000 shares. Other primarily administrative or clarifying changes were also made to the 2011 Plan, including the removal of provisions related to the former performance-based compensation exception under Section 162(m) of the Internal Revenue Code of 1986, as amended, and the addition of clarifying language stating that the total number of shares of common stock subject to grants of stock appreciation rights (“SARs”) that are exercised, and not just the number of shares issued on exercise, will not again be made available for issuance pursuant to the 2011 Plan.

The 2011 Plan is designed to motivate participating officers, employees and directors by offering them the opportunity to acquire shares of the Company’s common stock, receive monetary payments based on the value of those shares or receive other incentive compensation. The 2011 Plan is a cash and stock-based incentive plan, and allows the Company to grant stock options, SARs, restricted stock, restricted stock units, performance shares or performance units, and other management incentive awards, as described in the Company’s Definitive Proxy Statement for the 2021 Annual Meeting, which was filed with the Securities and Exchange Commission on March 12, 2021, and supplemented on March 18, 2021 (collectively, the “2021 Proxy Statement”).

The full text of the 2011 Plan, as amended and restated, is filed as Exhibit 10.1 to this Current Report on Form 8-K, and is incorporated herein by reference.

|

|

|

|

|

|

|

|

Item 5.07

|

Submission of Matters to a Vote of Security Holders.

|

The Company held its 2021 Annual Meeting on April 29, 2021. At the 2021 Annual Meeting, the Company’s shareholders: (i) elected 10 members of the Company’s Board of Directors to each serve a one-year term ending at the 2022 Annual Meeting; (ii) ratified the Audit Committee’s selection of Deloitte & Touche LLP ("Deloitte") as the Company’s independent registered public accounting firm for fiscal 2021; (iii) approved, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the 2021 Proxy Statement; and (iv) approved the amendment and restatement of the 2011 Plan. There were 54,437,708 shares of the Company’s common stock outstanding and eligible to vote as of the close of business on March 1, 2021, the record date for the 2021 Annual Meeting.

The directors elected to the Company’s Board of Directors for terms expiring at the 2022 Annual Meeting, and the number of votes cast for and against, as well as abstentions and broker non-votes with respect to, each individual, are set forth below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director

|

|

For

|

|

Against

|

|

Abstentions

|

|

Broker Non-Votes

|

|

David C. Adams

|

|

42,152,628

|

|

2,120,104

|

|

54,677

|

|

3,743,776

|

|

Karen L. Daniel

|

|

42,175,616

|

|

2,098,824

|

|

52,968

|

|

3,743,776

|

|

Ruth Ann M. Gillis

|

|

43,935,044

|

|

338,732

|

|

53,632

|

|

3,743,776

|

|

James P. Holden

|

|

42,127,721

|

|

2,144,433

|

|

55,253

|

|

3,743,776

|

|

Nathan J. Jones

|

|

41,685,912

|

|

2,584,792

|

|

56,704

|

|

3,743,776

|

|

Henry W. Knueppel

|

|

43,179,813

|

|

1,092,187

|

|

55,408

|

|

3,743,776

|

|

W. Dudley Lehman

|

|

41,853,529

|

|

2,408,058

|

|

65,821

|

|

3,743,776

|

|

Nicholas T. Pinchuk

|

|

39,940,875

|

|

4,319,869

|

|

66,664

|

|

3,743,776

|

|

Gregg M. Sherrill

|

|

42,774,965

|

|

1,498,401

|

|

54,042

|

|

3,743,776

|

|

Donald J. Stebbins

|

|

43,945,786

|

|

335,648

|

|

45,975

|

|

3,743,776

|

The proposal to ratify the Audit Committee’s selection of Deloitte as the Company’s independent registered public accounting firm for fiscal 2021 received the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes for approval:

|

|

46,145,625

|

|

Votes against:

|

|

1,868,300

|

|

Abstentions:

|

|

57,259

|

|

Broker non-votes:

|

|

0

|

|

|

|

|

|

|

|

|

The advisory vote to approve the compensation of the Company’s named executive officers, as disclosed in “Compensation Discussion and Analysis” and “Executive Compensation Information” in the 2021 Proxy Statement, received the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes for approval:

|

|

40,799,573

|

|

Votes against:

|

|

3,412,511

|

|

Abstentions:

|

|

115,324

|

|

Broker non-votes:

|

|

3,743,776

|

|

|

|

|

|

|

|

|

The proposal to approve the amendment to, and restatement of, the 2011 Plan received the following votes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes for approval:

|

|

38,582,450

|

|

Votes against:

|

|

5,584,436

|

|

Abstentions:

|

|

160,522

|

|

Broker non-votes:

|

|

3,743,776

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits:

|

|

|

|

|

|

|

|

|

|

|

|

|

Snap-on Incorporated 2011 Incentive Stock and Awards Plan, as amended and restated as of April 29, 2021.

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

* * * * *

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SNAP-ON INCORPORATED

|

|

|

|

|

|

|

Date: April 30, 2021

|

|

|

|

By:

|

|

/s/ Richard T. Miller

|

|

|

|

|

|

|

|

Richard T. Miller

|

|

|

|

|

|

|

|

Vice President, General Counsel and Secretary

|

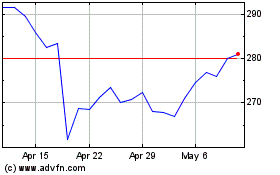

Snap on (NYSE:SNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

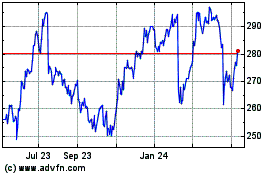

Snap on (NYSE:SNA)

Historical Stock Chart

From Apr 2023 to Apr 2024