Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

April 26 2021 - 4:13PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

EDAP TMS S.A.

April 26, 2021

Commission File Number 000-29374

EDAP TMS S.A.

Parc Activite La Poudrette Lamartine

4/6 Rue du Dauphine

69120 Vaulx-en-Velin - France

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1) ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7) ¨

Underwriting Agreement

On April 22, 2021, EDAP TMS S.A. (the

“Company”) entered into a Purchase Agreement (the “Underwriting Agreement”) with Piper Sandler & Co.,

as representative of the several underwriters named therein, relating to the offering of 4,150,000 ordinary shares, nominal value €0.13

per share, in the form of American Depositary Shares (“ADSs”), at a public offering price of $6.75 per ADS (the “Offering”).

The net proceeds to the Company from the Offering are approximately $25.6 million, after deducting the estimated expenses related to the

Offering and the underwriting discounts and commissions payable by the Company. The Offering is expected to close on April 27, 2021,

subject to the satisfaction of customary closing conditions.

The Offering was made pursuant to the Company’s

effective shelf registration statement on Form F-3 (File No. 333-255101) filed on April 7, 2021 and including a prospectus,

as supplemented by a prospectus supplement dated April 22, 2021, filed on April 23, 2021.

In the Underwriting Agreement, the Company

makes customary representations, warranties and covenants and also agrees to indemnify the underwriters against certain liabilities, including

liabilities under the Securities Act of 1933, as amended, or to contribute to payments that the underwriters may be required to make because

of such liabilities. The foregoing description of the Underwriting Agreement does not purport to be a complete description of the rights

and obligations of the parties thereunder, and is qualified in its entirety by reference to the Underwriting Agreement that is filed as

Exhibit 1.1 to this Form 6-K and incorporated by reference herein.

The legal opinion of Jones Day relating to

the ordinary shares is filed as Exhibit 5.1 to this Form 6-K and incorporated by reference herein and a consent relating to

the incorporation of such opinion is filed as Exhibit 23.1 by reference to its inclusion within Exhibit 5.1 and incorporated

by reference herein.

This report on Form 6-K and the exhibits

hereto shall be deemed to be incorporated by reference in the Company’s registration statement on Form F-3 (333-255101).

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

EDAP TMS S.A.

|

|

|

(Registrant)

|

|

|

|

|

|

April 26, 2021

|

By:

|

/s/ François Dietsch

|

|

|

|

François Dietsch

|

|

|

|

Chief Financial Officer

|

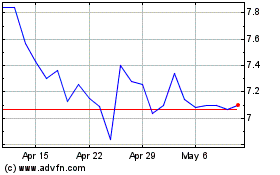

EDAP TMS (NASDAQ:EDAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

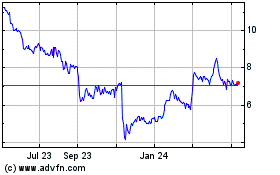

EDAP TMS (NASDAQ:EDAP)

Historical Stock Chart

From Apr 2023 to Apr 2024