SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2021

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Juscelino Kubitschek 1830 |03º andar| Conj. 32 Torre 2 - Cond. São Luiz

São Paulo, SP, 04543- 000

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): N/A

Financial Statements

Gafisa S.A.

December 31, 2020

Independent Auditor’s Report on the Financial Statements

(A free

translation of the original report in Portuguese as published in Brazil)

Gafisa S.A.

Financial Statements

December 31, 2020

Contents

|

Management Report

|

1

|

|

Independent Auditor’s Report on the Financial Statements

|

7

|

|

|

|

|

Audited financial statements

|

|

|

|

|

|

Statements of financial position

|

13

|

|

Statement of profit or loss

|

15

|

|

Statement of comprehensive income

|

16

|

|

Statement of changes in equity

|

17

|

|

Statement of cash flows

|

18

|

|

Statement of value added

|

19

|

|

Notes to the financial statements

|

20

|

|

Statement of the executive officers about the financial statements

|

78

|

|

Statement of the executive officers about the opinion report of the independent auditors

|

79

|

|

Minutes of the Audit Committee’s meeting

|

80

|

|

Minutes of the Board of Directors’ meeting

|

81

|

|

Earnings release 4Q20

|

82

|

2020

MANAGEMENT REPORT

GAFISA RESUMES SUSTAINABLE GROWTH AND PROFITABILITY

IN 2020

Recurring net income of R$ 29 million for the 4Q20 as

compared to R$ 23 million down for the 4Q19, an increase of R$ 52 million.

Dear Shareholders,

In 2020 we have reaped the first fruits of the

restructuring process initiated in 2019 in an incisive and assertive way. Supported by a capital structure strengthened by our shareholders,

combined with the current Management’s determination and focus on results, we have successfully responded to the extraordinary challenges

of an unprecedent crisis and achieved impressive results. The resumption of Gafisa’s growth has materialized in 2020 in the operational,

financial and strategic levels.

In the operational level, we have launched R$898.0

million in TSV, the best annual performance since 2016. The resumption of launches in 2020 is a direct consequence of the Company’s

growth strategy in organic way as well as through M&As, considering that 67.5% of launches arise from the assets acquired by the new

management through M&A. Two transactions are worth noting: the acquisition of Upcon and four Calçada projects in Rio. In both,

besides the landbank, there was an important Human Capital addition, with the joining of cooperative and high performance teams. The acquisition

of Calçada also enabled “Gafisa Rio” to start its operations with an iconic launch already in the 4Q20, and to have

active operations on a local office’s initiative.

In terms of landbank, we have a acquired a total

of 14 land in 2020 with potential TSV of R$2.1 billion, considering that approximately 60.0% are also from M&A transactions. In the

fourth quarter, our sales amounted to R$292.0 million, doubling our sales for the 3Q20, and the best quarterly sales performance since

2Q18. This increase shows that not only Gafisa’s launches resumed with differentiated ventures, but also the continuous strengthening

of our sales force. Additionally, we have delivered a total of 12 ventures in 2020, with over 2,000 units and R$ 1.1 billion in TSV, all

within the terms renegotiated by the new management with customers, which shows the Company’s focus on results and great delivery

capacity. This large delivery volume was made in a year marked by the challenges posed by the pandemic, which reaffirms the great commitment

and consistency of the new Management’s work with all of its stakeholders.

It is worth noting that the year 2020 was deeply

marked by the Covid-19 pandemic, which required rapid and assertive changes to work practices, adjustments in operational and financial

planning, among other changes introduced to assure that construction works continued, but without failing to give priority to the safety

of our employees, customers and suppliers. As Company and part of a deeply shaken society, Gafisa understands its role and shows solidarity

with the innumerous victims of this crisis. This experience heightened our sense of responsibility and our commitment to work for the

benefit of the society, the environment and governance.

Our financial results for the 4Q20 and 2020 reflect

the growth of our operating activities and start to reflect the new project era. We recorded a growth in adjusted gross margin from 24.6%

for the 3Q20 to 29% for the 4Q20. Net revenue reached R$579.9 million, a growth above 290.0% as compared to the 3Q20, being determining

factor in generating a net income of R$29 million (all of which recurring). When compared to the recurring net income for the 4Q19, which

was R$ 23 million down, we have an increase of R$ 52 million in the latest quarter. It is also worth mentioning that the REF margin (unrecognized

profit or loss) is still at a very healthy level of 32.8%.

This year can be considered as the company’s

recovery in the credit agenda in the financial and capital markets. New funding for projects were negotiated at rates from CDI + 3.5%

p.a. All projects that were launched have identified financing calculations, as well as all construction works in progress. Moreover,

we have adopted for some projects the rationale of obtaining finance in advance, considering the business lifecycle, partially or fully

refunding land disbursement and guaranteeing funds for completing works. We thus started to re-leverage the Company, with discipline and

well-developed projects, to maximize the return of capital of shareholders and enjoying the good moment in the credit market.

We rely on a well-devised business planning for

the next cycles, and for 2021 we have disclosed the Launch Guidance of R$1.5 to R$1.7 billion. Our short and medium-term landbank considers

a pipeline of 18 projects and approximately R$2.5 billion in estimated TSV. We continue to intensely seek growth through acquisitions

of both land and assets for Gafisa or Gafisa Propriedades.

Also in 2020, we have structured Gafisa Propriedades

according to our strategic planning devised in the end of 2019 and that included the transformation of Gafisa into a broad real estate

business platform, with new business lines and use of innovation and technology to diversify its income generation. We gained leverage

from the Company’s extensive expertise in the real estate sector, this new business unit will be Gafisa’s vehicle for real

estate investment, development and management focused on income generation.

Gafisa understands its power and relevance in

the development and construction market, potentialized by the tradition of its trademark – one of the top recognized trademarks

in this sector of the Brazilian market. Our new management model has been adopted with energy and discipline, reviving the Company’s

history of success and creation of value to our shareholders.

OPERATIONAL AND FINANCIAL

PERFORMANCE

The year 2020 marked the consistent recovery

of good operational performance by the Company, of which sales, launches and deliveries of construction works were noteworthy.

In the year 2020, the Company resumed its launches,

relying on five ventures that totaled a TSV estimated at R$898 million. It is worth noting that the Covid-19 pandemic - that restricted

travels, closed sales stands and affected the country’s economic activities - postponed for some months the launches planned for

the beginning of the year, demonstrating our focus and commitment to the Company’s growth recovery.

Sales

In 2020, the Company recorded gross sales of

R$ 516.9 million (without including a transaction between Gafisa and Gafisa Propriedades), 77.0% up on 2019. The growth can be explained

by the resumption of launches, which had been discontinued from the 1Q19, besides the continuous strengthening of our sales force. Cancelled

contracts totaled R$78.9 million, 18.1% drop from 2019, of R$96.4 million.

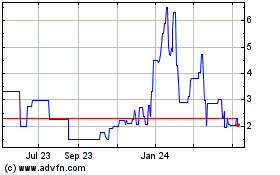

Changes in Gross Sales and

Cancelled Contracts (R$ million)

Total deliveries in 2020 was above the estimate

of 10 ventures, reaching 12 delivered projects, with 2,115 units and a total TSV of R$1.1 billion. Such large delivery volume in a year

marked by the pandemic, and little longer than 18 months after the new Management took over the Company.

Net revenue reached R$579.9 million for the 4Q20,

an increase of over 290.0% as compared to the 3Q20, a result of the increase in sales, acquisitions made over the period, and construction

progress. In relation to the same period of the previous year, the growth was nearly 400.0%. Considering yearly figures, in 2020 net revenue

totaled R$884.0 million, up 120.8% from 2019.

Gafisa’s adjusted gross profit for the

fourth quarter amounted to R$168.0 million, as compared to the R$36.6 million reported for the 3Q20 and R$44.2 million for the 4Q19. The

adjusted gross margin for the quarter was 29.0%, a 4.4 p.p. increase quarter-on-quarter, due to the start of the recognition of the new

management projects, which have overall shown better margins as compared to previous managements.

In the year-over-year comparison, we also note

a growth in total adjusted gross profit, which reached R$260.9 million in 2020, up 76.1% from 2019.

1 Adjusted

for capitalized interest

The net income was recorded in the amount of

R$29.0 million for the 4Q20, while a net loss was recorded in the amount of R$56.5 million for the 3Q20, and profit of R$47.0 million

was recorded for the 4Q19 – a drop of 38.3% year-over-year. Meanwhile, in the 4Q19 nearly R$ 33 million was non-recurring. Considering

recurring net income, the 4Q20 is double as compared to the one recorded for the 4Q19. In relation to yearly amounts, the net loss for

2020 amounted to R$76.5 million.

The net income for the 4Q20 starts to reflect

the new era of ventures, with differentiated projects and more robust margins.

HUMAN RESOURCES

We have an experienced team who is at the vanguard

of the Brazilian real estate sector and other business types, which positively contributes to the continuous improvement in our processes,

client satisfaction and respect, as well as to attain favorable results to our Company.

Occupational safety and accident are central

themes for Gafisa. Therefore, we maintain a continuous program of risk identification, prevention and mitigation, which aims, besides

preserving the physical integrity of our direct or indirect staff, to offer a basis for a healthier life. For us, investing in safety

is a guarantee of wellness in and out of the work environment. We offer training programs to the team in the field (directly related to

construction works), as well as to our collaborators of third-party companies, who provide services in our sites and some ventures.

The Company has 277 employees (base December

2020).

CORPORATE GOVERNANCE

Gafisa’s Board of Directors is responsible

for making decisions and formulating general guidelines and policies for the Company’s business, including its long-term strategies.

In addition, the Board also appoints executive officers and supervises their activities. The decisions of the Board of Directors are taken

by the majority vote of its members. In the event of a disagreement, the Chair of the Board of Directors has, in addition to her/his personal

vote, to cast a tie-breaking vote.

The current Board is formed by eight members,

most of whom are independent (62.5%). The members serve for a unified term of office of two years*, according to the Listing Rules of

Novo Mercado, with reelection and removal being permitted by shareholders in Shareholders’ Meeting. The members of Board of Directors

are shown in the following table.

|

Name

|

Birth date

|

Position

|

Election date

|

|

Leo Julian Simpson

|

03/30/1956

|

Chairman

|

April 15, 2019

|

|

Antonio Carlos Romanoski

|

02/12/1945

|

Effective Member

|

April 15, 2019

|

|

Eduardo Larangeira Jácome

|

10/15/1955

|

Effective Member

|

April 15, 2019

|

|

Nelson Sequeiros Rodriguez Tanure

|

11/21/1951

|

Effective Member

|

April 15, 2019

|

|

João Antonio Lopes Filho

|

08/12/1963

|

Effective Member

|

February 7, 2020

|

|

Thomas Cornelius Azevedo Reichenheim

|

12/04/1947

|

Effective Member

|

April 15, 2019

|

|

Nelson de Queiroz Sequeiros Tanure

|

05/28/1985

|

Effective Member

|

August 7, 2020

|

|

Gilberto Benevides

|

07/24/1951

|

Effective Member

|

April 30, 2020

|

FISCAL COUNCIL

Gafisa’s Articles of Incorporation provide

for a non-permanent Fiscal Council, the Shareholders’ Meeting being able to determine its installation and members, as provided

in the Law. The Fiscal Council, when installed, will comprise three to five members, and an equal number of alternates. The operations

of the Fiscal Council, when installed, ends in the first Annual Shareholders’ Meeting (ASM) held after its installation, the re-election

of its members being permitted. The compensation of fiscal council members is set at the Shareholders’ Meeting that elect them.

The Company’s Fiscal Council is not currently installed.

EXECUTIVE MANAGEMENT

The Executive Management is the Company’s

body mainly responsible for managing and daily monitoring the general policies and guidelines established at the Shareholders’ Meeting

and Board of Directors. Gafisa’s Executive Management shall be composed of a minimum of two and a maximum of eight members, including

the CEO, the CFO and the IR Officer, elected by the Board of Directors for a three-year term of office, reelection being permitted, as

established in the Articles of Incorporation. In the current term of office, six members comprise the Executive Management:

|

NAME

|

POSITION

|

DATE OF LAST INVESTITURE

|

TERM OF OFFICE

|

|

Ian Monteiro de Andrade

|

CFO and Investor Relations Officer

|

March 2, 2020

|

March 2, 2023

|

|

Guilherme Augusto Soares Benevides

|

COO

|

May 17, 2019

|

May 16, 2022

|

|

Guilherme Luis Pesenti e Silva

|

Statutory Officer

|

January 28, 2020

|

January 28, 2023

|

|

Luiz Fernando Ortiz

|

Statutory Officer

|

January 28, 2020

|

January 28, 2023

|

|

Fabio Freitas Romano

|

Statutory Officer

|

March 2, 2020

|

March 2, 2023

|

|

André Ackermann

|

Statutory Officer

|

March 2, 2020

|

March 2, 2023

|

AUDIT COMMITTEE

The Audit Committee supervises the Company’s

accounting and financial reporting, planning and analysis processes, including those of quarterly and financial reporting. It guides the

involvement and disclosure of auditors throughout the auditing process, assuring the full compliance with legal requirements and accounting

standards. Moreover, it is responsible for monitoring the internal control and internal audit processes, and choosing the accounting policies.

The members are Gilberto Braga, Pedro Carvalho de Mello and Thomas Cornelius Azevedo Reichenheim.

DIVIDENDS, SHAREHOLDERS RIGHTS

AND SHARE DATA

In order to protect the interest of all shareholders

equally, the Company establishes that, according to the effective legislation and the best governance practices, the following rights

are entitled to Gafisa’s shareholders:

|

|

ü

|

Vote in annual or extraordinary

Shareholders' Meeting, and make recommendations and provide guidance to the Board of Directors on decision making;

|

|

|

ü

|

Receive dividends and participate

in profit sharing or other share-related distributions, in proportion to their interests in capital;

|

|

|

ü

|

Supervise Gafisa's management,

according to its Articles of Incorporation, and step down from the Company in the cases provided in the Brazilian Corporate Law; and

|

|

|

ü

|

Receive at least 100% of the

price paid for common share of the controlling stake, according to the Listing Rules of Novo Mercado, in case of public offering of shares

as a result of the disposal of the Company's control.

|

Under the terms of article 47, paragraph 2 (b)

of Articles of Incorporation, the balance of net income for the year, calculated after the deductions provided in the Articles of Incorporation

and adjusted according to article 202, of the Brazilian Corporate Law, will have 25% of it allocated to the payment of mandatory dividend

to all shareholders of the Company.

Considering that the Company recognized loss

for the year ended December 31, 2020, there is no proposal for allocation of net income and dividend distribution for such year.

CAPITAL MARKETS

The Company has diluted capital, and its securities

are traded in the Brazilian market and abroad through American Depositary Receipt (ADR). From December 17, 2018, Gafisa’s shares

are no longer listed on the New York Stock Exchange (NYSE), and its ADRs started to be traded Over the Counter (OTC). The Company’s

delisting process was approved in the meeting of the Board of Directors held on November 26, 2018.

Gafisa is currently reevaluating the re-listing

process of the New York Stock Exchange (NYSE), aiming to increase the visibility of the Company and access to new markets.

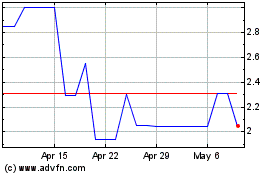

In 2020, we reached an average daily trading

volume of R$35.6 million on B3 and US$ 33,071 on NYSE/OTC. The Company’s shares ended the year 2020 quoted at R$4.35 (GFSA3) and

US$1.62 (GFASY).

INDEPENDENT AUDITORS

The Company’s policy on commissioning non-external

audit services to independent auditors is based on principles that preserve their autonomy. These internationally accepted principles

consist of the following: (a) the auditor cannot audit its own work, (b) the auditor cannot function in the role of management in its

client, and (c) the auditor cannot promote the interests of its client. According to Article 2 of CVM Instruction 381/03, Gafisa informs

that BKR Lopes Machado, the independent audit firm of the Company and its subsidiaries, did not provide services other than independent

audit in 2020.

MANAGEMENT STATEMENT

The Executive Management declares, in compliance

with article 25, paragraph 1, items V and VI, of CVM Instruction 480/2009, that it revised, discussed and agrees with the Financial Statements

contained in this Report and the opinion issued in the Independent Auditor’s Report on them.

INDEPENDENT AUDITOR’S REPORT ON INDIVIDUAL

AND CONSOLIDATED FINANCIAL STATEMENTS

To

Shareholders and Management of

Gafisa S.A.

São Paulo, SP

Opinion

We have audited the accompanying individual and consolidated

financial statements of Gafisa S.A. (“Gafisa” or “Company”), identified as Company and Consolidated,

respectively, which comprise the statement of financial position as of December 31, 2020, and the respective statement of profit or loss,

statement of comprehensive income, statement of changes in equity, and statement of cash flows for the year then ended, as well as the

corresponding explanatory notes, including the summary of significant accounting policies.

Opinion on the individual financial statements

In our opinion, the aforementioned individual financial

statements present fairly, in all material respects, the financial position of Gafisa S.A. as of December 31, 2020, and the performance

of its operations and cash flows for the year then ended, in accordance with the accounting practices adopted in Brazil, applicable to

real estate development entities in Brazil, registered with the Brazilian Securities and Exchange Commission (CVM).

Opinion on the consolidated financial statements

In our opinion, the aforementioned consolidated financial

statements present fairly, in all material respects, the consolidated financial position of Gafisa S.A. as of December 31, 2020, and its

consolidated performance of its operations and cash flows for the year then ended, in accordance with the accounting practices adopted

in Brazil and the International Financial Reporting Standards (IFRS), issued by the International Accounting Standards Board (IASB), applicable

to real estate development entities in Brazil, registered with the Brazilian Securities and Exchange Commission (CVM).

Basis for opinion on the individual and consolidated

financial statements

We conducted our audit in accordance with the Brazilian

and International Standards on Auditing. Our responsibilities, according to such standards, are described in the following section, entitled

“Auditor’s responsibility for the audit of individual and consolidated financial statements”. We are independent of

the Company and its subsidiaries, according to the relevant ethical principles established in the Accountant’s Code of Professional

Ethics and the professional standards issued by the Federal Accounting Council (CFC), and comply with other ethical responsibilities according

to such standards. We believe that the audit evidence we have obtained is sufficient and appropriate to base our opinion.

Emphasis

Accounting practices adopted in Brazil applicable

to real estate development entities in Brazil, registered with the CVM

As described in Note 2.1, the individual (Company)

and consolidated financial statements have been prepared in accordance with the accounting practices adopted in Brazil and the International

Financial Reporting Standards (IFRS), issued by the International Accounting Standards Board (IASB), applicable to real estate development

companies in Brazil, registered with the CVM. Accordingly, the determination of the accounting policy to be adopted by entity, on recognition

of revenue from purchase and sale of real estate unit not yet completed, on aspects related to transfer of control, follows the understanding expressed by CVM in the

Circular Letter/CVM/SNC/SEP 02/2018 on the application of NBC TG 47 (IFRS 15).

Our opinion does not contain exception in relation

to this matter.

Key audit matters

Key Audit Matters (KAM) are those that, in our professional

judgment, were of most significance in our audit of the current year. These matters were addressed in the context of our audit of the

individual and consolidated financial statements as a whole, and in forming our opinion thereon, and, therefore, we do not provide a separate

opinion on these matters.

The Company recognizes real estate sales revenue during

construction as established in the Circular Letter CVM/SNC/SEP 02/2018, as described in the Notes 2.1 and 2.2.2 to the individual and

consolidated financial statements. The recognition of the revenue of the Company and its subsidiaries requires the measurement of progress

and satisfaction of performance obligation over time. This measurement requires significant and timely judgment by the Management of the

Company and its subsidiaries of the estimate of inputs and expenditures necessary for satisfying the respective performance obligations,

considering, for example, the costs to be incurred until the completion of construction works and measurement of the progress of the respective

real estate ventures.

Consequently this matter was considered key for our

audit because we consider the high risk of subjectivity in the evaluation of the estimates made by the Company’s Management, linked

to the relevance and amounts involved in revenue recognition.

How our audit conducted this matter:

Our main audit procedures aimed at the appropriate

recognition of the revenue from real estate sales during construction were the following: (i) Evaluation of the effectiveness of the internal

controls directly related to the approval and revision of construction costs (incurred and to be incurred), used in the calculation of

the percentage of completion of real estate ventures; (ii) On sampling basis, we have obtained budget maps – from the commencement

of construction of the qualifiable asset until its latest version - and we compared them with the accounting records. We also compared,

on sampling basis, the documents supporting the incurred costs, units sold, and amount of sales contracts used in revenue calculation.

(iii) Recalculation of revenue recognized based on information extracted from budgets approved by the engineer responsible for the venture.

(iv) analytical reviews of the estimates of costs incurred and to be incurred; and (v) evaluation of the disclosure in the individual

and consolidated financial statements.

Based on the findings of the followed audit procedures,

we understand that: (i) the assumptions adopted by Management to estimate the costs to be incurred are acceptable in the context of the

individual and consolidated financial statements; and (ii) the calculations made by Management about the percentage of completion correspond

to the criteria established in the Circular Letter CVM/SNC/SEP 02/2018.

Provisions and

contingent liabilities

According to Note 2.2.1 – item © and 16,

the Company and its subsidiaries are parties to lawsuits of tax, civil and labor nature, for which Management estimates the involved amounts

and records a provision in the individual and consolidated financial statements for the cases it considers that there will be a probable

loss, as established in the accounting standard CPC 25 (IAS 17) - Provisions, Contingent Liabilities and Contingent Assets. Besides the

lawsuits considered as probable loss, the Company is party to labor and civil lawsuits in progress, for which no provision is recorded,

as the likelihood of loss is considered possible or remote by Management, based on the positions of its legal counsel. The risk evaluation

and loss estimates are prepared by management based on available evidences and opinion of the Company’s legal counsel, involving

high judgment level, given the complexity of themes. The progress of such lawsuits in the many applicable levels may result in change

in the evaluation of risk of loss, and significantly impact the recognized provisions and the profit or loss of the Company and its subsidiaries.

Due to the volume of claims, the criteria established

for timely identifying the need for recognizing a provision and the existence of significant judgments involved in the process of evaluation

and measurement of provisions and disclosures of contingent liabilities, we considered it a key audit matter.

How our audit conducted this matter:

Our audit procedures included, but were not limited

to the following: (i) obtaining, reading and evaluating the mails of the legal counsel of the Company and its subsidiaries, (ii) matching

the total contingent liabilities mentioned by the Company’s legal counsel that are expected to lead to a probable outflow of funds

with the existing provision in the individual and consolidated financial statements, (iii) inspecting the Management’s meeting minutes,

and (iv) analyzing the disclosures made in the notes to the individual and consolidated financial statements.

We consider that the criteria and assumptions adopted

by Management for determining the provision for contingent liabilities, as well as the corresponding disclosures are reasonable, being

consistent with the information received during our audit.

Business combination – Company and Consolidated

As detailed in Notes 2.1 and 9.1.1 to the financial

statements, the Company completed the process of acquisition of the total shares in Upcon S.A. (“UPCON”) on September 23,

2020 and the process of acquisition of a total of four ventures of Calçada S.A. (SPE of Calçada) on November 16, 2020, companies

that carry out operations in the same business segments of the Company. This transaction was recognized by using the acquisition method,

which requires, among other procedures, that the Company determines at the effective control acquisition date, the fair value of the consideration

transferred, the fair value of assets acquired and liabilities assumed, and the determination of goodwill or gain from bargain purchase.

Such procedures often involve a high level of judgment and are subject to a high level of uncertainty. In view of the related high judgment

level and the impact that any change in assumptions may have on the financial statements, we consider this to be a key audit matter.

Performed audit procedures

Our audit procedures included, but were not limited

to, reading the documents that formalized the transaction, such as contracts and minutes, and obtaining evidences that support the determination

of the control acquisition date and consideration transferred, and calculation of the acquisition cost. With the support of our corporate

finance experts, we analyzed the methodology adopted for measuring the previously held interest in acquired assets and liabilities assumed,

and evaluated whether the adopted assumptions for projecting cash flows and making calculations were reasonable, by comparing, when available,

with market information, as well as evaluated the sensitivity analysis regarding the main adopted assumptions and the impacts of possible

changes in such assumptions on the measured amounts and their relevance in relation to the financial statements as a whole.

Based on the analyzed information, we analyzed the

calculation to determine acquisition cost and goodwill, and evaluated the appropriateness of the disclosures made by the Company.

Based on the evidences obtained through the above-summarized

procedures, we consider the balances related to the investments in UPCON and Calçada’s SPE acceptable, and we consider that

the judgments and assumptions adopted by management to evaluate the recoverable amount of goodwill to be reasonable, and the disclosures

are consistent with the obtained data and information.

Other matters

Statements of Value Added

The individual and consolidated statements of value

added (DVA) for the year ended December 31, 2020, prepared under the responsibility of the Company’s management, and presented as

supplementary information for IFRS purposes, were submitted to the audit procedures performed together with the audit of the financial

statements of the Company. To form our opinion, we evaluated whether these statements are reconciled with the financial statements and

accounting records, as applicable, and whether their formats and contents follow the criteria established in the NTC TG 09 – Statement

of Value Added. In our opinion, the accompanying statements of value added were fairly prepared, in all material respects, according to

the criteria established in such Standard and are consistent with the individual and consolidated financial statements taken as a whole.

Other information that accompany the individual

and consolidated financial statements and the auditor’s report

The Company’s Management is responsible for such

other information, which comprise the Management Report.

Our opinion on the individual and consolidated financial

statements does not include the Management Report, and we do not express any type of audit conclusion on such report.

In connection with the audit of the individual and

consolidated financial statements, our responsibility is to read the Management Report, and, in doing so, consider whether such report

is, in material respects, inconsistent with the financial statements or with the knowledge we obtained in the audit or otherwise appears

to be materially misstated If, based on the work we have performed, we conclude that there is material misstatement in the Management

Report, we are required to report such fact. We have nothing to report in this regard.

Management’s and governance responsibility

for the individual and consolidated financial statements

The Company’s Management is responsible for the

preparation and fair presentation of the individual and consolidated financial statements in accordance with the accounting practices

adopted in Brazil and the International Financial Reporting Standards (IFRS), applicable to real estate development entities in Brazil,

registered with the Brazilian Securities and Exchange Commission (CVM), and for the internal controls that it deemed necessary to enable

the preparation of financial statements free from material misstatement, whether due to fraud or error.

In the preparation of the individual and consolidated

financial statements, Management is responsible for assessing the Company’s ability to continue as going concern, disclosing, when

applicable, the matters related to its going concern, and the use of this accounting basis in the preparation of the financial statements,

unless Management intends to liquidate the Company and its subsidiaries, or cease their operations, or do not have any realistic alternative

to avoid the discontinuance of operations.

Those charged with governance of the Company and its

subsidiaries are those with responsibility for supervising the process of preparation of the financial statements.

Independent auditor’s responsibilities for

the audit of financial statements

Our objectives are to obtain reasonable assurance about

whether the individual and consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error,

and to issue an auditor’s report including our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee

that an audit conducted in accordance with Brazilian and International Standards on Auditing will always detect any existing material

misstatements. Misstatements can arise from fraud or error and are considered material if, individually or in aggregate, they could be

reasonably expected to influence the economic decisions of users taken on the basis of such financial statements.

As part of the audit in accordance with Brazilian and

International Standards on Auditing, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

·

Identify and assess risks of material misstatements of

the individual and consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to

those risks, and obtain audit evidence that is sufficient and appropriate to provide basis for our opinion. The risk of not detecting

material misstatement resulting from fraud is higher than for one resulting from error, once fraud may involve collusion, forgery, intentional

omissions, misrepresentations and the override of internal control.

·

Obtain understanding of internal controls relevant to

the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion

on the effectiveness of the internal controls of the Company and its subsidiaries.

·

Evaluate the appropriateness of accounting policies used

and the reasonableness of accounting estimates and related disclosures made by management.

·

Conclusion on the appropriateness of management’s

use of the going concern basis of accounting, and, based on the audit evidence obtained, whether a material uncertainty exists related

to events or conditions that may cast significant doubts on the Company’s ability to continue as a going concern. If we conclude

that a material uncertainty exists, then we are required to draw attention in our auditor’s report to the related disclosures in

the individual and consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are

based on the audit evidences obtained up to the date of our auditor’s report. However, future events or conditions may cause the

Company to cease to continue as a going concern.

·

Evaluate the overall presentation, structure and content

of the financial statements, including the disclosures, and whether the individual and consolidated financial statements represent the

underlying transactions and events in a manner that achieves fair presentation. _ Obtain sufficient appropriate audit evidence regarding

the financial information of the entities or business activities within the group to express an opinion on the individual and consolidated

financial statements. We are responsible for the direction, supervision and performance of the group audit, and, consequently, the audit

opinion.

We communicate with those charged with governance regarding,

among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies

in the internal control that we identify during our audit.

We also provide to those charged with governance with

a statement that we have complied with relevant ethical requirements, including the applicable independence requirements, and communicate

with them all relationships and other matters that may reasonably be thought to bear on our independence and where applicable, related

safeguards.

From the matters communicated with those charged with governance, we determine those that were of most significance in the audit of the financial statements of the current year and are therefore the key audit matters. We describe these matters in our auditor’s report, unless the law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine

that a matter should not be communicated in our report

because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

Rio de Janeiro, March 16, 2021.

|

Mário Vieira Lopes

|

|

Accountant - CRC- RJ 060.611/O-0

|

Gafisa S.A.

Statements of financial position – Assets

Years ended December 31, 2020 and 2019

(In thousands of Brazilian reais)

|

|

|

Company

|

Consolidated

|

|

|

Notes

|

2020

|

2019

|

2020

|

2019

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

Cash and cash equivalents

|

4.1

|

469

|

810

|

29,038

|

12,435

|

|

Short-term investments

|

4.2

|

413,438

|

401,243

|

593,082

|

401,895

|

|

Trade accounts receivable

|

5

|

340,096

|

361,649

|

487,083

|

445,303

|

|

Properties for sale

|

6

|

319,516

|

490,419

|

1,243,841

|

786,660

|

|

Receivables from related parties

|

21.1

|

147,369

|

23,388

|

1,102

|

77,606

|

|

Prepaid expenses

|

-

|

269

|

1,227

|

890

|

1,860

|

|

Non-current assets held for sale

|

8.1

|

3,709

|

3,709

|

7,014

|

7,014

|

|

Other assets

|

7

|

125,498

|

52,455

|

180,837

|

67,395

|

|

Total current assets

|

|

1,350,364

|

1,334,900

|

2,542,887

|

1,800,168

|

|

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

|

|

Trade accounts receivable

|

5

|

182,117

|

98,368

|

217,169

|

112,135

|

|

Properties for sale

|

6

|

194,974

|

230,049

|

305,460

|

279,207

|

|

Receivables from related parties

|

21.1

|

44,972

|

33,416

|

115,502

|

33,416

|

|

Other assets

|

7

|

106,330

|

107,435

|

112,739

|

166,916

|

|

|

|

528,393

|

469,268

|

750,870

|

591,674

|

|

|

|

|

|

|

|

|

Investments in ownership interests

|

9.1

|

1,199,683

|

681,645

|

307,412

|

138,802

|

|

Investment property

|

9.2

|

-

|

-

|

119,119

|

-

|

|

Property and equipment

|

10

|

11,919

|

12,147

|

25,181

|

14,159

|

|

Intangible assets

|

11

|

4,444

|

6,552

|

4,530

|

7,084

|

|

|

|

1,216,046

|

700,344

|

456,242

|

160,045

|

|

|

|

|

|

|

|

|

Total non-current assets

|

|

1,744,439

|

1,169,612

|

1,207,112

|

751,719

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

3,094,803

|

2,504,512

|

3,749,999

|

2,551,887

|

The accompanying notes are an integral part of these financial statements.

Gafisa S.A.

Statements of financial position – Liabilities

Years ended December 31, 2020 and 2019

(Amounts in thousands of Brazilian reais)

|

|

|

Company

|

Consolidated

|

|

|

Notes

|

2020

|

2019

|

2020

|

2019

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

Loans and financing

|

12

|

291,270

|

383,647

|

332,447

|

426,124

|

|

Debentures

|

13

|

120,399

|

158,179

|

120,737

|

158,179

|

|

Financial instruments

|

20

|

6,125

|

-

|

6,125

|

-

|

|

Payables for purchase of properties and advances from customers

|

17

|

65,969

|

89,825

|

336,029

|

129,353

|

|

Payables for goods and service suppliers

|

-

|

93,392

|

79,106

|

122,576

|

95,450

|

|

Taxes and contributions

|

-

|

57,280

|

58,556

|

86,831

|

69,868

|

|

Salaries, payroll charges and profit sharing

|

-

|

15,472

|

11,963

|

16,983

|

12,291

|

|

Provisions for legal claims and commitments

|

16

|

145,636

|

139,623

|

147,066

|

140,735

|

|

Obligations assumed on the assignment of receivables

|

14

|

10,829

|

14,755

|

13,296

|

20,526

|

|

Payables to related parties

|

21.1

|

295,261

|

191,364

|

98,430

|

64,384

|

|

Other payables

|

15

|

124,434

|

110,189

|

186,466

|

135,492

|

|

Total current liabilities

|

|

1,226,067

|

1,237,207

|

1,466,986

|

1,252,402

|

|

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

Loans and financing

|

12

|

109,523

|

107,029

|

338,027

|

107,029

|

|

Debentures

|

13

|

18,543

|

39,346

|

143,588

|

39,346

|

|

Payables for purchase of properties and advances from customers

|

17

|

37,175

|

68,515

|

79,400

|

93,075

|

|

Deferred income tax and social contribution

|

19

|

12,114

|

12,114

|

14,649

|

12,114

|

|

Provisions for legal claims and commitments

|

16

|

103,003

|

123,858

|

103,417

|

123,878

|

|

Obligations assumed on the assignment of receivables

|

14

|

9,431

|

16,463

|

10,896

|

19,835

|

|

Other payables

|

15

|

16,570

|

6,272

|

34,648

|

9,065

|

|

Total non-current liabilities

|

|

306,359

|

373,597

|

724,625

|

404,342

|

|

|

|

|

|

|

|

|

Equity

|

|

|

|

|

|

|

Capital

|

18.1

|

1,083,249

|

2,926,280

|

1,083,249

|

2,926,280

|

|

Treasury shares

|

18.1

|

(2,632)

|

(43,517)

|

(2,632)

|

(43,517)

|

|

Reserve for capital and granting stock options

|

-

|

319,569

|

337,611

|

319,569

|

337,611

|

|

Profit reserve

|

18.2

|

162,191

|

-

|

162,191

|

-

|

|

Retained losses

|

18.2

|

-

|

(2,326,666)

|

-

|

(2,326,666)

|

|

|

|

1,562,377

|

893,708

|

1,562,377

|

893,708

|

|

Non-controlling interests

|

|

-

|

-

|

(3,989)

|

1,435

|

|

Total equity

|

|

1,562,377

|

893,708

|

1,558,388

|

895,143

|

|

Total liabilities and equity

|

|

3,094,803

|

2,504,512

|

3,749,999

|

2,551,887

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

Gafisa S.A.

Statement of profit or loss

Years ended December 31, 2020 and 2019

(Amounts in thousands of Brazilian reais, except as otherwise stated)

|

|

|

Company

|

Consolidated

|

|

|

Notes

|

2020

|

2019

|

2020

|

2019

|

|

|

|

|

|

|

|

|

Continuing operations

|

|

|

|

|

|

|

Net operating revenue

|

22

|

412,663

|

360,589

|

884,045

|

400,465

|

|

|

|

|

|

|

|

|

Operating costs

|

|

|

|

|

|

|

Real estate development and sales

|

23

|

(321,733)

|

(238,714)

|

(702,824)

|

(282,684)

|

|

|

|

|

|

|

|

|

Gross profit

|

|

90,930

|

121,875

|

181,221

|

117,781

|

|

|

|

|

|

|

|

|

Operating (expenses)/income

|

|

|

|

|

|

|

Selling expenses

|

23

|

(11,461)

|

(12,020)

|

(28,992)

|

(14,889)

|

|

General and administrative expenses

|

23

|

(78,772)

|

(46,954)

|

(81,553)

|

(54,133)

|

|

Income from equity method investments

|

9

|

49,886

|

46,863

|

(2,339)

|

(5,003)

|

|

Depreciation and amortization

|

10 and 11

|

(6,623)

|

(12,859)

|

(8,278)

|

(14,181)

|

|

Derecognition of goodwill from remeasurement of investment

|

-

|

-

|

(161,100)

|

-

|

(161,100)

|

|

Other income/(expenses), net

|

23

|

(52,474)

|

79,483

|

(56,455)

|

141,771

|

|

|

|

|

|

|

|

|

Profit (loss) before finance income and costs and income tax and social contribution

|

|

(8,514)

|

15,288

|

3,604

|

10,246

|

|

|

|

|

|

|

|

|

Finance costs

|

24

|

(93,478)

|

(82,920)

|

(101,532)

|

(76,830)

|

|

Finance income

|

24

|

25,638

|

16,631

|

28,537

|

17,206

|

|

|

|

|

|

|

|

|

Loss before Income tax and social contribution

|

|

(76,354)

|

(51,001)

|

(69,391)

|

(49,378)

|

|

|

|

|

|

|

|

|

Current income tax and social contribution

|

|

(167)

|

-

|

(7,608)

|

(1,984)

|

|

Deferred income tax and social contribution

|

|

-

|

37,259

|

-

|

37,259

|

|

|

|

|

|

|

|

|

Total income tax and social contribution

|

19.i

|

(167)

|

37,259

|

(7,608)

|

35,275

|

|

|

|

|

|

|

|

|

Net income (loss) from continuing operations

|

|

(76,521)

|

(13,742)

|

(76,999)

|

(14,103)

|

|

|

|

|

|

|

|

|

Net income (loss) from discontinued operations

|

|

-

|

-

|

-

|

-

|

|

|

|

|

|

|

|

|

Loss for the year

|

|

(76,521)

|

(13,742)

|

(76,999)

|

(14,103)

|

|

|

|

|

|

|

|

|

(-) Loss attributable to:

|

|

|

|

|

|

|

Non-controlling interests

|

|

-

|

-

|

(478)

|

(361)

|

|

Owners of the parent

|

|

(76,521)

|

(13,742)

|

(76,521)

|

(13,742)

|

|

|

|

|

|

|

|

|

Weighted average number of shares (in thousands)

|

27

|

179,882

|

68,584

|

|

|

|

|

|

|

|

|

|

|

Basic loss per thousand shares - In reais

|

27

|

(0.425)

|

(0.200)

|

|

|

|

From continuing operations

|

|

(0.425)

|

(0.200)

|

|

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

Diluted loss per thousand shares - In reais

|

27

|

(0.425)

|

(0.200)

|

|

|

|

From continuing operations

|

|

(0.425)

|

(0.200)

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral

part of these financial statements.

Gafisa S.A.

Statement of comprehensive income

Years ended December 31, 2020 and 2019

(Amounts in thousands of Brazilian reais, except as otherwise

stated)

|

|

Company

|

Consolidated

|

|

|

2020

|

2019

|

2020

|

2019

|

|

|

|

|

|

|

|

Loss for the year

|

(76,521)

|

(13,742)

|

(76,999)

|

(14,103)

|

|

|

|

|

|

|

|

Total comprehensive income for the year, net of taxes

|

(76,521)

|

(13,742)

|

(76,999)

|

(14,103)

|

|

|

|

|

|

|

|

Attributable to:

|

|

|

|

|

|

Owners of the parent

|

(76,521)

|

(13,742)

|

(76,521)

|

(13,742)

|

|

Non-controlling interests

|

-

|

-

|

(478)

|

(361)

|

|

|

|

|

|

|

The accompanying notes are an integral part of these

financial statements.

Gafisa S.A.

Statement of changes in equity

Years ended December 31, 2020 and 2019

(Amounts in thousands of Brazilian reais)

|

|

|

|

Attributed to Owners of the Parent

|

|

|

|

|

Notes

|

Capital

|

Treasury shares

|

Reserve for capital and granting shares

|

Profit reserve

|

Retained losses

|

Total Company

|

Non-controlling interests

|

Total consolidated

|

|

Balance as of December 31, 2018

|

|

2,521,319

|

(58,950)

|

337,351

|

-

|

(2,308,403)

|

491,317

|

1,874

|

493,191

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital increase

|

18.1

|

404,961

|

-

|

(157)

|

-

|

-

|

404,804

|

-

|

404,804

|

|

Stock option plan

|

18.3

|

-

|

-

|

417

|

-

|

-

|

417

|

-

|

417

|

|

Treasury shares sold

|

18.1

|

-

|

141

|

-

|

-

|

7

|

148

|

-

|

148

|

|

Treasury shares cancelled

|

18.1

|

-

|

5,747

|

-

|

-

|

(5,747)

|

-

|

-

|

-

|

|

Treasury shares reissued

|

18.1

|

-

|

(20,671)

|

-

|

-

|

20,671

|

-

|

-

|

-

|

|

Share repurchase program

|

18.1

|

-

|

30,216

|

-

|

-

|

(19,452)

|

10,764

|

-

|

10,764

|

|

Recognition of reserves

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

(78)

|

(78)

|

|

Loss for the year

|

-

|

-

|

-

|

-

|

-

|

(13,742)

|

(13,742)

|

(361)

|

(14,103)

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances as of December 31, 2019

|

|

2,926,280

|

(43,517)

|

337,611

|

-

|

(2,326,666)

|

893,708

|

1,435

|

895,143

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital reduction

|

18.1

|

(2,585,032)

|

-

|

|

-

|

2,585,032

|

-

|

-

|

-

|

|

Capital increase

|

18.1

|

742,001

|

-

|

-

|

-

|

-

|

742,001

|

-

|

742,001

|

|

Expenditures for issuing shares

|

18.1

|

-

|

-

|

(18,288)

|

-

|

-

|

(18,288)

|

-

|

(18,288)

|

|

Recognized granted options

|

18.1

|

-

|

-

|

246

|

-

|

-

|

246

|

-

|

246

|

|

Stock option plan

|

18.3

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Treasury shares sold

|

18.1

|

-

|

40,885

|

-

|

-

|

(19,654)

|

21,232

|

-

|

21,232

|

|

Recognition of reserves

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

(2)

|

(2)

|

|

Loss for the year

|

-

|

-

|

-

|

-

|

-

|

(76,521)

|

(76,521)

|

(478)

|

(76,999)

|

|

Acquisition of non-controlling interests

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

(4,945)

|

(4,945)

|

|

Retained earnings

|

|

|

|

|

162,191

|

(162,191)

|

-

|

-

|

-

|

|

Balance as of December 31, 2020

|

|

1,083,249

|

(2,632)

|

319,569

|

162,191

|

-

|

1,562,377

|

(3,989)

|

1,558,388

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral

part of these financial statements.

Gafisa S.A.

Statement of cash flows

Years ended December 31, 2020 and 2019

(Amounts in thousands of Brazilian reais)

|

|

Company

|

Consolidated

|

|

|

2020

|

2019

|

2020

|

2018

|

|

Operating activities

|

|

|

|

|

Profit (loss) before Income tax and social contribution

|

(76,354)

|

(51,001)

|

(69,393)

|

(49,378)

|

|

Expenses/(income) not affecting cash and cash equivalents:

|

|

|

|

|

|

Depreciation and amortization (Notes 10 and 11)

|

6,623

|

12,859

|

8,278

|

14,181

|

|

Stock option plan (Note 18.3)

|

(347)

|

(2,366)

|

(347)

|

(2,366)

|

|

Unrealized interest and charges, net

|

1,664

|

3,068

|

1,009

|

5.448

|

|

Warranty provision (Note 15)

|

9,208

|

(7,521)

|

9,208

|

(7,521)

|

|

Provisions for legal claims and commitments (Note 16)

|

64,302

|

9,990

|

56,148

|

8,300

|

|

Provision for profit sharing (Note 25 (iii))

|

16,194

|

5,000

|

16,194

|

5,000

|

|

Allowance for expected credit losses and cancelled contracts (Note 5)

|

15,822

|

(61,460)

|

43,343

|

(47,257)

|

|

Provision for realization of non-financial assets:

|

|

|

|

|

|

Properties and land for sale (Notes 6 and 8)

|

(68,215)

|

(37,394)

|

(69,282)

|

(36,913)

|

|

Provision for penalties due to delay in construction work (Note 15)

|

(793)

|

3,659

|

2,137

|

5,283

|

|

Income from equity method investments (Note 9)

|

(49,886)

|

(46,863)

|

2,340

|

5,003

|

|

Derecognition of goodwill based on inventory surplus (Note 6 and 9)

|

-

|

3,000

|

-

|

-

|

|

Derecognition of goodwill from remeasurement of investment in associate (Note 9)

|

-

|

161,100

|

-

|

161,100

|

|

Acquisition of subsidiary (Note 9)

|

-

|

(43,954)

|

-

|

-

|

|

Goodwill based on inventory surplus and gain from bargain purchase (Note 9)

|

-

|

(39,886)

|

-

|

-

|

|

Assignment of investment shares (Note 9)

|

-

|

27,843

|

-

|

2,759

|

|

|

-

|

|

|

|

|

Decrease/(increase) in operating assets

|

|

|

|

|

|

Trade accounts receivable

|

(88,976)

|

134,996

|

(206,326)

|

115,003

|

|

Properties for sale and land for sale

|

274,193

|

232,986

|

(414,152)

|

131,581

|

|

Other assets

|

(185,783)

|

(36,498)

|

(151,536)

|

(98,544)

|

|

Prepaid expenses

|

958

|

956

|

970

|

808

|

|

|

|

|

|

|

|

Increase/(decrease) in operating liabilities

|

|

|

|

|

|

Payables for purchase of properties and advances from customers

|

(55,196)

|

(75,759)

|

193,001

|

(87,003)

|

|

Taxes and contributions

|

(1,277)

|

12,888

|

16,963

|

12,592

|

|

Payables for goods and service suppliers

|

14,095

|

(48,714)

|

27,559

|

(37,750)

|

|

Salaries, payroll charges and profit sharing

|

(12,651)

|

835

|

(11,468)

|

511

|

|

Other payables

|

(71,016)

|

(87,818)

|

51,061

|

(76,443)

|

|

Transactions with related parties

|

26,149

|

(56,408)

|

49,006

|

21,608

|

|

Paid taxes

|

(167)

|

-

|

(7,608)

|

(1,983)

|

|

Cash and cash equivalents from (used in) operating activities

|

(181,453)

|

13,538

|

(452,895)

|

44,019

|

|

|

|

|

|

|

|

Investing activities

|

|

|

|

|

|

Acquisition of property and equipment and intangible assets (Notes 10 and 11)

|

(4,287)

|

(3,275)

|

(16,746)

|

(3,581)

|

|

Increase in short-term investments

|

(500,350)

|

(360,294)

|

(564,749)

|

(387,319)

|

|

Redemption of short-term investments

|

488,155

|

61,878

|

373,562

|

90,280

|

|

Investments

|

(30,000)

|

-

|

(30,000)

|

-

|

|

Cash (used in) from investing activities

|

(46,482)

|

(301,691)

|

(237,933)

|

(300,620)

|

|

|

|

|

|

|

|

Financing activities

|

|

|

|

|

|

Increase in loans, financing and debentures

|

98,036

|

113,839

|

625,677

|

122,639

|

|

Payment of loans, financing and debentures - principal

|

(213,524)

|

(200,937)

|

(382,666)

|

(229,846)

|

|

Payment of loans, financing and debentures - interest

|

(28,517)

|

(54,033)

|

(33,774)

|

(56,976)

|

|

Loan transactions with related parties

|

(125,552)

|

(11,179)

|

(12,604)

|

(11,179)

|

|

Treasury shares repurchase program (Note 18.1)

|

19,251

|

7,132

|

19,251

|

7,132

|

|

Capital increase

|

477,900

|

404,962

|

477,900

|

404,962

|

|

Cash and cash equivalents from (used in) financing activities

|

227,594

|

259,784

|

693,784

|

236,732

|

|

|

|

|

|

|

|

Cash acquired from Upcon and Calçada

|

-

|

-

|

13,647

|

-

|

|

Net increase/(decrease) in cash and cash equivalents

|

(341)

|

(28,369)

|

16,603

|

(19,869)

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

|

|

|

At the beginning of the year

|

810

|

29,179

|

12,435

|

32,304

|

|

At the end of the year

|

469

|

810

|

29,038

|

12,435

|

|

|

|

|

|

|

|

Net increase/(decrease) in cash and cash equivalents

|

(341)

|

(28,369)

|

16,603

|

(19,869)

|

The accompanying notes are an integral

part of these financial statements.

Gafisa S.A.

Statement of value added

Years ended December 31, 2020 and 2019

(Amounts in thousands of Brazilian reais)

|

|

Company

|

Consolidated

|

|

|

|

|

|

|

|

|

2020

|

2019

|

2020

|

2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

451,706

|

394,252

|

935,013

|

437,289

|

|

Real estate development and sales

|

467,528

|

332,792

|

978,360

|

390,032

|

|

Reversal (recognition) of allowance for doubtful accounts and cancelled contracts

|

(15,822)

|

61,460

|

(43,347)

|

47,257

|

|

Inputs acquired from third parties (including taxes on purchases)

|

(353,164)

|

(314,103)

|

(737,722)

|

(294,610)

|

|

Operating costs - Real estate development and sales

|

(259,538)

|

(208,823)

|

(623,106)

|

(244,409)

|

|

Materials, energy, outsourced labor and other

|

(93,626)

|

39,228

|

(114,616)

|

94,307

|

|

Gain from bargain purchase

|

-

|

16,592

|

-

|

16,592

|

|

Derecognition of goodwill from remeasurement of investment

|

-

|

(161,100)

|

-

|

(161,100)

|

|

|

|

|

|

|

|

Gross value added

|

98,542

|

80,149

|

197,291

|

142,679

|

|

|

|

|

|

|

|

Depreciation and amortization

|

(6,623)

|

(12,859)

|

(8,278)

|

(14,181)

|

|

|

|

|

|

|

|

Net value added produced by the entity

|

91,919

|

67,290

|

189,013

|

128,498

|

|

|

|

|

|

|

|

Value added received on transfer

|

75,524

|

63,494

|

26,198

|

12,203

|

|

Income from equity method investments

|

49,886

|

46,863

|

(2,339)

|

(5,003)

|

|

Finance income

|

25,638

|

16,631

|

28,537

|

17,206

|

|

|

|

|

|

|

|

Total value added to be distributed

|

167,443

|

130,784

|

215,211

|

140,701

|

|

|

|

|

|

|

|

Value added distribution

|

167,443

|

130,784

|

215,211

|

140,701

|

|

Personnel and payroll charges

|

37,316

|

26,851

|

39,652

|

28,429

|

|

Taxes and contributions

|

47,417

|

1,647

|

67,271

|

7,106

|

|

Interest and rents

|

159,231

|

116,028

|

184,809

|

118,908

|

|

Retained earnings attributable to non-controlling interests

|

-

|

-

|

478

|

361

|

|

Incurred losses

|

(76,521)

|

(13,742)

|

(76,999)

|

(14,103)

|

The accompanying notes are an integral

part of these financial statements.

|

Gafisa S.A.

Notes to the financial statements--Continued

December 31, 2020

(Amounts in thousands of Brazilian Reais, except as otherwise stated)

|

|

|

Gafisa S.A. ("Gafisa" or "Company")

is a publicly-traded company with registered office at Presidente Juscelino Kubitschek, 1.830, conjunto comercial 32, 3o andar,

Bloco 2, in the city and state of São Paulo, Brazil, and began its operations in 1997 with the objectives of: (i) promoting and

managing all forms of real estate ventures on its own behalf or for third parties (in the latter case, as construction company or proxy);

(ii) selling and purchasing real estate properties; (iii) providing civil construction and civil engineering services; (iv) developing

and implementing marketing strategies related to its own and third party real estate ventures; and (v) investing in other companies who

share similar objectives.

The Company enters into real estate development

projects with third parties through special purpose entities (SPEs) or through the formation of consortia and condominiums. Subsidiaries

significantly share the managerial and operating structures, and corporate, managerial and operating costs with the Company. The SPEs,

condominiums and consortia operate solely in the real estate industry and are linked to specific ventures.

The Company has stocks traded on B3 S.A.

– Brasil, Bolsa, Balcão (former BM&FBovespa), reporting its information to the Brazilian Securities and Exchange Commission

(CVM) and the U.S. Securities and Exchange Commission (SEC). The ADSs were delisted on the NYSE on December 17, 2018, and are currently

traded Over the Counter (OTC).

|

|

1.1

|

Coronavirus – COVID-19

|

In the year 2020, there has not been any