Corporate Bond Gauge Signals Dwindling Economic Risk -- Update

April 22 2021 - 2:45PM

Dow Jones News

By Sam Goldfarb

A key measure of the perceived risk in low-rated corporate bonds

is hovering around its lowest level in more than a decade,

highlighting investors' mounting confidence in the economic

outlook.

The average extra yield, or spread, investors demand to hold

speculative-grade corporate bonds over U.S. Treasurys dropped below

3 percentage points this month to as low as 2.90 percentage points

for the first time since 2007, when it set a record of 2.33

percentage points, according to Bloomberg Barclays data.

Yields on low-rated corporate bonds already hit a record low of

3.89% in February. That data point is especially important for

businesses, because it signals how cheaply they can borrow when

they issue new bonds. Companies including Charter Communications

Inc. and United Airlines Holdings Inc. have issued a total of

$186.1 billion of speculative-grade bonds this year through

Wednesday, the highest over that period on record, according to

LCD, a unit of S&P Global Market Intelligence.

The spread relative to Treasurys, however, is arguably an even

better measure of investors' outlook for the economy, since it

shows how much investors feel they need to be compensated for the

risk that companies may default on their debt.

The narrow speculative-grade bond spreads indicate debt

investors think that the economic environment for businesses over

the next several years could be better than at any time since the

2008-2009 financial crisis -- a striking development after many

feared a severe, long-lasting economic downturn just last year.

As of Wednesday, the average speculative-grade bond spread was

2.98 percentage points. That was slightly higher than earlier in

the month but still down from 3.60 percentage points at the end of

last year and 4.42 percentage points on Nov. 6, the last full

trading session before Pfizer Inc. announced highly encouraging

results from its coronavirus-vaccine trial.

Investors and analysts say that two major factors have been

responsible for that decline. One is improving economic data,

especially consumer spending on goods, which analysts closely link

to the two economic relief measures that Congress passed in recent

months. The other is optimism for a broader economic rebound later

in the year, as people feel more comfortable spending money on

services, such as airline travel and restaurant dining.

Despite the setback last week when U.S. health authorities

recommended a pause in the use of Johnson & Johnson's Covid-19

vaccine, many investors and analysts are still pleased with the

pace of vaccinations in the U.S. They note that the large majority

of doses are supplied by Pfizer and Moderna Inc., which have been

ramping up production. Already, about a third of U.S. adults have

been fully vaccinated, and more than half have received at least

one dose, according to the Centers for Disease Control and

Prevention.

Some analysts take a skeptical view of the corporate bond

rally.

Speculative-grade bond spreads should be about twice their

current level based on a fair-value model that takes into account

current economic conditions and other factors, said Marty Fridson,

chief investment officer at Lehmann Livian Fridson Advisors

LLC.

According to the Federal Reserve, manufacturers, miners and

utilities were using about 74% of their theoretical production

capacity in March, he noted, well below the more than 81% level

reached in 2007 when corporate bond spreads were at comparable

levels. Current spreads suggest investors aren't just optimistic

about the economy but feel emboldened that the Fed will protect

them from significant losses after the central bank's extraordinary

interventions last year, he said.

Others, though, say the economic trajectory does justify strong

demand for corporate bonds. Aneta Markowska, chief economist at

Jefferies LLC, said that industrial production is still being

suppressed by pandemic-related supply challenges and could reach

80% of capacity by the summer just by catching up to current

demand.

Overall, she said, the economy is better poised now than it was

for years after the financial crisis because households "are

sitting on tons of cash," and the government has been pumping

trillions of dollars into the economy.

If anything, debt investors may be in a more comfortable

position than equity investors because they won't worry if growth

slows substantially two years from now, as long as it remains

positive.

"If you've accumulated massive earnings in the last two years

that you haven't spent, that also creates a big buffer on your

balance sheet," Ms. Markowska said. "That's what's going to keep

default risk pretty low for the foreseeable future."

Write to Sam Goldfarb at sam.goldfarb@wsj.com

(END) Dow Jones Newswires

April 22, 2021 14:30 ET (18:30 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

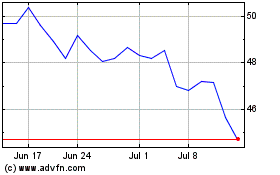

United Airlines (NASDAQ:UAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

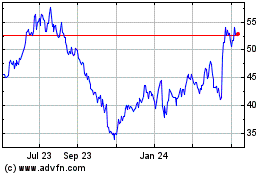

United Airlines (NASDAQ:UAL)

Historical Stock Chart

From Apr 2023 to Apr 2024