Stock Futures Wobble Ahead of Earnings Flurry

April 20 2021 - 5:19AM

Dow Jones News

By Will Horner

U.S. stock futures wobbled Tuesday ahead of a bumper day of

earnings reports from blue-chip companies.

Futures on the S&P 500 and the Dow Jones Industrial Average

ticked up less than 0.1%. Technology-heavy Nasdaq-100 futures rose

0.1%, a day after faltering tech companies dragged major indexes

lower.

Investors are looking to companies' first-quarter earnings and

their outlook for the rest of the year to gauge whether valuations

on stocks are justified. Progress in rolling out Covid-19 vaccines

and strong economic data has bolstered expectations, and fueled the

recent rally that has left the major indexes hovering close to

record highs.

"Companies are doing even better than was expected -- which in

many ways is shocking -- but that is also one of the reasons why

the market is at an all-time high," said Andrew Slimmon, a managing

director and senior portfolio manager at Morgan Stanley Investment

Management. "The earnings season is validating what a lot of

companies' stock prices have already been saying."

Johnson & Johnson is set to report earnings around 6:45 a.m.

ET, followed by Procter & Gamble, Philip Morris International,

Lockheed Martin and Abbott Laboratories. Netflix is expected to

post its results after markets close.

"The only risk is that expectations across the board are so

high, they are going to be very difficult to meet," said Seema

Shah, chief strategist at Principal Global Investors. "We are

getting into territory -- both with earnings and economic data --

where it will be very difficult to have positive surprises."

Investors are also keeping an eye on the bond market, with

yields climbing higher for a third consecutive day. The 10-year

U.S. Treasury yield edged up to 1.622%, from 1.599% on Monday.

Yields rise as prices fall.

Dogecoin, the cryptocurrency created as a joke, extended its

gains after climbing more than 8,000% this year. It rose over 7% to

42 cents, according to CoinDesk. Some users of online forums have

said they plan to push the cryptocurrency to $1 by Tuesday, in what

some have called "Doge Day."

In commodity markets, Brent crude, the international benchmark

for oil, rose 1.3% to $67.93 a barrel.

Overseas, the pan-continental Stoxx Europe 600 fell 0.6%.

In Asia, major stock indexes were mixed by the close of trading.

Japan's Nikkei 225 fell almost 2% while Hong Kong's Hang Seng

ticked up 0.1%. The Shanghai Composite Index edged down 0.1%.

Write to Will Horner at William.Horner@wsj.com

(END) Dow Jones Newswires

April 20, 2021 05:04 ET (09:04 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

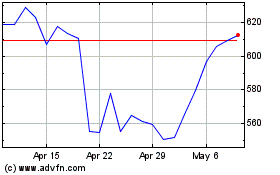

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

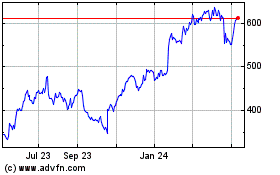

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024