UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

______________________

FORM

10

GENERAL

FORM FOR REGISTRATION OF SECURITIES

Pursuant

to Section 12(b) or (g) of The Securities Exchange Act of 1934

IMPERALIS

HOLDING CORP.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

20-564-8820

|

|

(State or other jurisdiction of incorporation

or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

30

N Gould Street, Suite 11023

Sheridan,

Wyoming

|

|

82801

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

Registrant’s

telephone number, including area code: 888-662-8444

Copies

to:

Mark

Crone, Esq.

Joe

Laxague, Esq.

The

Crone Law Group, P.C.

500

Fifth Avenue

Suite

938

New

York, NY 10110

Telephone:

646-861-7891

Securities

to be registered pursuant to Section 12(b) of the Act:

|

Title of each class to be so registered

|

|

Name of each exchange on which each class

is to be registered

|

|

N/A

|

|

N/A

|

|

|

|

|

Securities

to be registered pursuant to Section 12(g) of the Act:

Common

Stock, Par Value $0.001

(Title

of class)

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated

filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange

Act.

|

Large-Accelerated Filer

|

[ ]

|

Accelerated Filer

|

[ ]

|

|

Non-Accelerated Filer

|

[X]

|

Smaller reporting company

|

[X]

|

|

|

|

Emerging growth company

|

[X]

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

EXPLANATORY NOTE

We are filing this General

Form for Registration of Securities on Form 10 to register our common stock, par value $0.001 per share (the “Common Stock”),

pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Once this Registration

Statement is deemed effective, we will be subject to the requirements of Regulation 13A under the Exchange Act, which will require

us to file annual reports on Form 10-K; quarterly reports on Form 10-Q; and current reports on Form 8-K. We will be required to

comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section

12(g) of the Exchange Act. Unless otherwise noted, references in this Registration Statement to the “Registrant”,

the “Company”, “we”, “our”, or “us” means “Imperalis Holding Corp.”

and/or its subsidiaries, The Crypto Currency Mining Company, CannaCure Sciences and The Dollar Shots Club. All references

in this Registration Statement to “$” or “dollars” are to United States dollars, unless specifically stated

otherwise.

FORWARD LOOKING STATEMENTS

There are statements in this Registration

Statement that are not historical facts or that are based on good faith estimates of management. These “forward-looking

statements” can be identified by use of terminology such as “believe,” “hope,” “may,”

“anticipate,” “should,” “intend,” “plan,” “will,” “expect,”

“estimate,” “project,” “positioned,” “strategy” and similar expressions. You should

be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control. For a discussion

of these risks, you should read this entire Registration Statement carefully, especially the risks discussed under the section

entitled “Risk Factors.” Although management believes that the assumptions underlying the forward- looking statements

included in this Registration Statement are reasonable, they do not guarantee our future performance, and actual results could

differ from those contemplated by these forward-looking statements. The assumptions used for purposes of the forward-looking statements

specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes

in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other

information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise

of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected

results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. In light of these

risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking statements

contained in this Registration Statement will in fact transpire. You are cautioned to not place undue reliance on these forward-looking

statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking statements.

TABLE OF CONTENTS

Item 1. Business

Overview

Imperalis Holding Corp. (the “Company”

or “IMHC”), acts as a holding company for its operating subsidiary, CannaCure

Sciences, Inc. (“CannaCure”). Through CannaCure, we are developing a lineup of personal care products containing

Cannabidiol (CBD). We currently offer CBD-based lotions and oils to the consumer markets. Our products are all-natural, cruelty-free

products that aim to provide an alternative to synthetic personal care products. We hold

two additional subsidiaries whose operations are currently dormant, The Crypto Currency Mining Company, a Wyoming Corporation,

and Dollar Shots Club, Inc., a Nevada corporation.

Corporate History

We were incorporated on April 5, 2005 in Nevada,

under the name Coloured (US) Inc. On March 25, 2011, we changed our name to Imperalis Holding Corp. On December 28, 2017, we acquired

100% of the issued and outstanding common stock of The Crypto Currency Mining Company, Inc. (“Crypto”), in exchange

for our issuance of 56,996,444 shares of common stock to Vincent Andreula, the sole shareholder of Crypto. Following our acquisition

of Crypto, Mr. Andreula became our CEO and majority shareholder and we focused on the mining of cryptocurrencies as our primary

business. On February 21, 2018, we acquired all of the issued and outstanding capital stock of Dollar Shots Club, Inc. (“Dollar

Shots”) in exchange for our issuance of 1,342,050 shares of common stock to the former shareholders of Dollar Shots. Through

Dollar Shots, we marketed flavored energy “shots” and similar beverages through a monthly subscription service. The

operations on Crypto and Dollar Shots are currently dormant.

We entered our current line of business in

a common control transaction on April 29, 2019, when we acquired all of the issued and outstanding capital stock of CannaCure in

exchange for the issuance of 60,000,000 shares of common stock to the former shareholders of CannaCure, who included Mr. Andreula,

our CEO and sole director, as well as our Chief Marketing Officer, Michael Andreula, and our head of Research and Development,

Kristie Andreula.

CBD Products

Since our acquisition of CannaCure, we have

been focused on identifying relationships and pursuing opportunities to develop a business in developing, marketing and selling

CBD-based personal care and cosmetic products. CBD is derived from industrial hemp, and because of its low Tetrahydrocannabinol

(THC) content, is lawful in the United States and has no measurable psychoactive effects. THC is the principal psychoactive constituent

of cannabis. High quality raw materials made from hemp are essential to produce the isolates and distillates used to produce CBD

products. Industrial hemp is defined as plants with less than 0.3% of the psychoactive compound THC found in cannabis plants. Our

Chief Executive Officer will primarily oversee product development, manufacturing, testing, sales and marketing of our CBD-based

health and cosmetic products. The Company has a very little prior experience in this rapidly evolving segment.

We seek to take advantage of an emerging worldwide

trend to utilize the production of industrial hemp in consumer products. Hemp is being used today in cosmetics and nutritional

supplements where we intend to focus our efforts. The market for hemp-derived products is expected to increase substantially over

the next five years, and we are endeavoring to prepare the Company to be positioned as a significant player in the industry. We

expect to realize revenue through our efforts, if successful, to sell wholesale and retail finished products to third parties.

However, as we are in a start-up phase in a new business venture in a rapidly evolving industry, and many of our costs and challenges

are new and unknown. In order to fund our activities, we will need to raise additional capital either through the issuance of equity

and/or the issuance of debt. In the event we are unsuccessful in raising sufficient additional capital to fund our efforts, we

may need to curtail, abandon or delay our plans to enter into this segment.

Current Products

Broad Spectrum Advanced Nano-Tincture

We use a proprietary nano-emulsion technology

system to process CBD-rich hemp extract into smaller particles for easier and better absorption. The resulting particles are called

“Nano Particles”, and they disperse throughout water and offer a higher bioavailability.

Our Broad Spectrum Advanced Nano-Tincture is

suitable for sublingual use, and it is perfect for those who want a CBD product that they can add to a beverage to receive a more

consistent dose of CBD without re-dosing. No flavorings, colors or sweeteners are added. Due to the size of the particles and increased

bioavailability, you may find that the effects of the CBD are noticeable more quickly with this Nano-Tincture, and you may also

find that you can use less product for the same effects.

Broad Spectrum PCR Tincture

Our Broad Spectrum PCR Tincture is made with

our CBD oil blended with Hemp oil, grapeseed oil and MCT (medium-chain triglyceride) oil. This tincture is ideal for those who

prefer the traditional CBD oil product and is suitable for sublingual use. Unlike many competitors, our Broad Spectrum PCR Tincture

DOES NOT include any artificial flavorings or colors, and no additives, preservatives or sweeteners. You can feel confident that

you’re using the purest product available on the market, in a regulated dosage for ease of administration.

Coconut Sugar Scrub

Coconut sugar is made from the boiling down

of coconut sap. It is a humectant, which means it draws moisture into the skin. Containing natural glycolic acid, coconut sugar

is a superior exfoliator that is especially good at smoothing small bumps caused by ingrown hairs. It can be used before or after

shaving for a far superior result, and unlike salt, it won’t sting freshly shaved skin. The natural glycolic acid is also

helpful at fading old acne scars and dark marks on skin.

Our Coconut Sugar Scrub is blended with shea

butter for extra hydration, and apricot and hemp oils to smooth rough dry skin. We also blend in a natural vanilla fragrance oil.

Pink Himalayan Salt Scrub

Unlike common table salt, which is heavily

processed to remove most of its mineral content, Himalayan salt is only around 87% sodium chloride; it still contains many beneficial

minerals like potassium, iodine, calcium, sulfur, zinc, copper and iron. Comparatively, table salt is usually 97.5-99% sodium chloride,

with some iodine occasionally added back in, along with some anti-caking agents and other additives.

Our Pink Himalayan Salt Scrub is blended with

avocado oil and sweet almond oil, along with hemp oil to help soften and smooth the skin. The salt will gently exfoliate dead surface

skin cells, revealing vibrant, healthy skin that can more easily absorb the benefits of the Himalayan Salt and nourishing oils.

Our Himalayan Pink Salt Scrub has a delicate citrus scent.

Dead Sea Salt Scrub

The extremely high mineral content in Dead

Sea Salt make it very bitter tasting and inedible, but these minerals are exactly what make it so good for skin health and why

it’s been prized for thousands of years in treating many common skin issues like psoriasis, eczema and acne. The high concentrations

of bromide, magnesium and sulfur are said to help reduce skin inflammation, thereby allowing inflamed skin to heal. The National

Psoriasis Foundation recommends Dead Sea Salt as an effective treatment for psoriasis, and a study published in the International

Journal of Dermatology states that Dead Sea Salt may help in reducing the depth of skin wrinkles.

Our Dead Sea Salt Scrub is blended with sweet

almond and castor oils, and the moisturizing and hydration benefits of hemp oil. It has a light, relaxing coconut ginger scent.

Product Development, Suppliers and Production

Our products are formulated by our head of

Research & Development, Kristie Andreula, in consultation with our CEO, Vincent Andreula. The products are compounded and bottled

in a large garage provided to the Company by our CEO at a rent of $476 per month. We prepare and bottle our products with the assistance

of a kettle mixer, a bottling machine, a shrink-wrapping machine and other minor tools and equipment. We obtain the ingredients

and raw materials for our products at market prices from apothecary supply houses, primarily Jedwards International and Bulk Apothecary.

Our bottles, labels, and similar supplies are sourced from Containers and Packing. We do not have long term contracts with our

suppliers, but we do maintain account relationships under which we acquire our ingredients on a per-purchase order basis.

Customers and Marketing

Our hemp-infused personal care products are

targeted toward health-conscious lifestyle consumers. Our customers include vegan enthusiasts, organic enthusiasts, and spas. Through

our business, we will be targeting individuals between 21- 65 years of age. Our products are currently marketed through our website,

cannacuresciences.com. When and if we are able to obtain additional capital, we intend to invest pay-per-click internet

advertising and similar programs intended to drive customer traffic to our website.

Competition

The Company competes with other start-ups and

with middle market manufacturers and distributors that specialize in brand development. The Company also competes with established

brands and large multi-national firms that manage established brand portfolios.

Future Goals

The Company’s future goals include:

1) To attract a reasonable number of customers through marketing

and make acquisitions.

2) Achieve positive net profit through first year of sales.

3) To make the company an icon brand.

4) To develop an effective, well placed market for sales

of cannabidiol oils and related products.

5) To create an infrastructure for the fulfillment of sales.

Regulatory Requirements

We are subject to numerous federal, state,

local and foreign laws and regulations, including those relating to:

|

|

•

|

The production of CBD cosmetic and other related products

|

|

|

•

|

Environmental protection

|

|

|

•

|

FDA and state agricultural requirements

|

|

|

•

|

Interstate commerce and taxation laws

|

|

|

•

|

Working and safety conditions, minimum wage and other labor requirements

|

Employees

We currently do not have any employees other

than our named executive officers, who perform all formulation, production, marketing, and sales functions for the Company.

Implications of Emerging Growth Company

Status

As a company with less than $1 billion in revenue

in our last fiscal year, we are defined as an “emerging growth company” under the Jumpstart Our Business Startups (“JOBS”)

Act. We will retain “emerging growth company” status until the earliest of:

|

|

•

|

The last day of the fiscal year during which our annual revenues are equal to or exceed $1 billion;

|

|

|

•

|

The last day of the fiscal year following the fifth anniversary of our first sale of common stock pursuant to a registration statement filed under the Securities Act of 1933, as amended, which we refer to in this document as the Securities Act;

|

|

|

•

|

The date on which we have issued more than $1 billion in nonconvertible debt in a previous three-year period; or

|

|

|

•

|

The date on which we qualify as a large accelerated filer under Rule 12b-2 adopted under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (i.e., an issuer with a public float of $700 million that has been filing reports with the U.S. Securities and Exchange Commission (“SEC”) under the Exchange Act for at least 12 months).

|

|

|

•

|

As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to SEC reporting companies. For so long as we remain an emerging growth company we will not be required to:

|

|

|

•

|

Have an auditor report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Wall Street Reform and Consumer Protection Act of 2002;

|

|

|

•

|

Comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

|

|

|

•

|

Submit certain executive compensation matters to stockholder non-binding advisory votes;

|

|

|

•

|

Submit for stockholder approval golden parachute payments not previously approved;

|

|

|

•

|

Disclose certain executive compensation related items, as we will be subject to the scaled disclosure requirements of a smaller reporting company with respect to executive compensation disclosure; and

|

|

|

•

|

Present more than two years of audited financial statements and two years of selected financial data in a registration statement for our initial public offering of our securities.

|

Pursuant to Section 107(b) of the JOBS Act,

we have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2)

of The JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different

effective dates for public and private companies until those standards apply to private companies. As a result, our

financial statements may not be comparable to companies that comply with public company effective dates. Section 107

of the JOBS Act provides that our decision to opt into the extended transition period for complying with new or revised accounting

standards is irrevocable.

We are also a “smaller reporting company,”

which is defined under the Exchange Act as a company that has: (i) a public float of less than $250 million; or (ii) less than

$100 million in annual revenues and no public float or a public float of less than $700 million. Some of the foregoing

reduced disclosure and other requirements are also available to us because we are a smaller reporting company and may continue

to be available to us even after we are no longer an emerging growth company under the JOBS Act but remain a smaller reporting

company under the Exchange Act. As a smaller reporting company we are not required to:

|

|

•

|

Have an auditor report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; and

|

|

|

•

|

Present more than two years of audited financial statements in our registration statements and annual reports on Form 10-K and present any selected financial data in such registration statements and annual reports.

|

Item 1A. Risk Factors

An investment in our common stock involves a

high degree of risk. An investor should carefully consider the following risk factors and the other information in this

registration statement before investing in our common stock. Our business and results of operations could be seriously

harmed by any of the following risks.

We have a limited operating history and

operate in a new industry, and we may not succeed.

The cannabis industry is a highly competitive,

and such competition from companies much bigger than us could adversely affect our operating results.

We compete with many national, regional

and local businesses. We could experience increased competition from existing or new companies in the cannabis and cannabis-based

personal health and cosmetic industry, which could create increasing pressures to grow ours. If we are unable to maintain our competitive

position, we could experience downward pressure on prices, lower demand for our products, reduced margins, the inability to take

advantage of new business opportunities and the loss of channel share, which would have an adverse effect on our operating results.

Other factors that could affect our business are:

• Consumer

tastes

• National,

regional or local economic conditions

• Disposable

purchasing power

• Demographic

trends; and

• The price

of special ingredients that go into our products.

Our business is dependent upon continued

market acceptance by consumers. Even if we obtain new customers, there is no assurance that we will continue to make a profit.

We are substantially dependent on continued

market acceptance of our products by consumers. Although we believe that our products will gain consumer acceptance, we cannot

predict the future growth rate and size of this market. Even if we obtain customers, there is no guarantee that we will be able

to generate a profit. Because we are a small company and have limited capital, we must limit our products and services. Further,

we are subject to raw material pricing which can erode the profitability of our products and put additional negative pressure on

profitability. If we cannot operate profitably, we may have to suspend or cease operations.

Our future success depends on our ability

to grow and expand our customer base. Our failure to achieve such growth or expansion could materially harm our business.

To date, our revenue growth plans have been

derived from projected sales of our products, not actual sales or historical experience. Our success and the planned growth and

expansion of our business depends on us achieving greater and broader acceptance of our products and expanding our customer base.

There can be no assurance that customers will purchase our products or that we will continue to expand our customer base. If we

are unable to effectively market or expand our product offerings, we will be unable to grow and expand our business or implement

our business strategy. This could materially impair our ability to increase sales and revenue and materially and adversely affect

our margins, which could harm our business and cause our stock price to decline.

Supply chain interruptions as a result

of the Covid-19 pandemic may hinder our ability to fill customer orders in a timely and reliable fashion, resulting in an inability

to grow our sales and customer base.

Following the outbreak of the Covid-19 pandemic

and resulting lock-down orders in the U.S., supply chain disruptions have, from time to time, resulted in the unavailability of

raw ingredients and packaging materials for our products. Although these disruptions have abated recently and have not had a material

effect on our operations to date, future disruptions in the supply of raw materials could negatively impact our ability to timely

fill customer orders and grow our customer base. In event of such supply disruptions, our sales and results of operations could

be materially negatively affected.

We will be required to attract and retain

top quality talent to compete in the marketplace.

We believe our future growth and success will

depend in part on our ability to attract and retain highly skilled managerial, product development, sales and marketing, and finance

personnel. There can be no assurance of success in attracting and retaining such personnel. Shortages in qualified personnel could

limit our ability to increase sales of existing products and services and launch new product and service offerings.

If we fail to retain key personnel and

hire, train and retain qualified employees, we may not be able to compete effectively, which could result in reduced revenue or

increased costs.

Our success is highly dependent on the continued

services of key management and technical personnel. Our management and other employees may voluntarily terminate their employment

at any time upon short notice. The loss of the services of any member of the senior management team or any of the managerial or

technical staff on which we principally rely for expertise on our CBD segment may significantly delay or prevent the achievement

of product development, our growth strategies and other business objectives. Our future success will also depend on our ability

to identify, recruit and retain additional qualified technical and managerial personnel. We operate in several geographic locations

where labor markets are particularly competitive, where demand for personnel with these skills is extremely high and is likely

to remain high. As a result, competition for qualified personnel is intense, particularly in the areas of general management, finance,

engineering and science, and the process of hiring suitably qualified personnel is often lengthy and expensive, and may become

more expensive in the future. If we are unable to hire and retain a sufficient number of qualified employees, our ability to conduct

and expand our business could be seriously reduced.

We may not be able to adequately protect

our intellectual property, which could harm the value of our brand and branded products and adversely affect our business.

We depend in large part on our brand and branded

products and believe that they are very important to our business, as well as on our proprietary hemp infused processes. We rely

on a combination of common law trademark rights, trade secrets, and similar intellectual property rights to protect our brand and

branded products. We do not currently hold any patents for our products and do not have registered trademarks for our brand. The

success of our business depends on our continued ability to use our existing common law trademarks and service marks in order to

increase brand awareness and further develop our branded products in both domestic and international markets. We may not be able

to adequately protect our trademarks and our product formulations, which may result in liability for trademark infringement,

trademark dilution or unfair competition. We may from time to time be required to institute litigation to enforce our trademarks

or other intellectual property rights, or to protect our trade secrets. Such litigation could result in substantial costs and diversion

of resources and could negatively affect our sales, profitability and prospects regardless of whether we are able to successfully

enforce our rights.

FDA regulation could negatively affect

the hemp industry, which would directly affect our financial condition.

The U.S. Food and Drug Administration ("FDA")

may seek expanded regulation of hemp under the Food, Drug and Cosmetics Act of 1938. Additionally, the FDA may issue rules and

regulations including certified good manufacturing practices, or cGMPs, related to the growth, cultivation, harvesting and processing

of hemp. Clinical trials may be needed to verify efficacy and safety. It is also possible that the FDA would require that facilities

where hemp is grown register with the FDA and comply with certain federally prescribed regulations. In the event that some or all

of these regulations are imposed, we do not know what the impact would be on the hemp industry, including what costs, requirements

and possible prohibitions may be enforced. If we are unable to comply with the regulations or registration as prescribed by the

FDA, we may be unable to continue to operate their and our business in its current or planned form or at all.

Changes in the Law and Development

Programs

For the first time since 1937, industrial hemp

has been decriminalized at the federal level and can be grown legally in the United States, but on a limited basis. A landmark

provision passed in the Agricultural Act of 2014 recognizes hemp as distinct from its genetic cousin, marijuana. Federal law now

exempts industrial hemp from U.S. drug laws to allow for crop research by universities, colleges and state agriculture departments.

The new Federal law allows for agricultural programs for industrial hemp “in states that permit the growth or cultivation

of hemp.” However, cannabis remains illegal under federal law, and therefore, strict enforcement of federal laws regarding

cannabis would likely result in our inability and the inability of our customers to execute our respective business plans.

Even in those jurisdictions in which the manufacture

and use of medical cannabis has been legalized at the state level, the possession, use and cultivation of cannabis all remain violations

of federal law that are punishable by imprisonment, substantial fines and forfeiture. Moreover, individuals and entities may violate

federal law if they intentionally aid and abet another in violating these federal controlled substance laws, or conspire with another

to violate them. The U.S. Supreme Court has ruled in United States v. Oakland Cannabis Buyers' Coop. and Gonzales

v. Raich that it is the federal government that has the right to regulate and criminalize the sale, possession and use

of cannabis, even for medical purposes. We would likely be unable to execute our business plan if the federal government were to

enforce federal law regarding cannabis and applied such laws to low THC containing hemp, or other federal or state laws were to

be extended to our business. For this reason, we continue to believe cannabis legislation and the enforcement of laws should be

considered a significant risk factor to our business. Confusion surrounding the nature of our products, inaccurate or incomplete

testing, farming practices and law enforcement vigilance or lack of education could result in confusion and our products could

be intercepted and our business interrupted, or we could be required to undertake processes that could delay shipments, impede

sales or result in seizures, proper or not, that would be costly to rectify or remove and which could have a material adverse effect

on the business, prospects, results of operations or financial condition of the Company.

In January 2018, the Department of Justice

(the “DOJ”) rescinded certain memoranda, including the so-called “Cole Memo” issued on August 29, 2013

under the Obama Administration, which had characterized enforcement of federal cannabis prohibitions under the CSA to prosecute

those complying with state regulatory systems allowing the use, manufacture and distribution of medical cannabis as an inefficient

use of federal investigative and prosecutorial resources when state regulatory and enforcement efforts are effective with respect

to enumerated federal enforcement priorities under the CSA. The impact of the DOJ's rescission of the Cole Memo and related memoranda

is unclear, but may result in the DOJ increasing its enforcement actions against the state-regulated cannabis industry generally.

Additionally, financial transactions involving

proceeds generated by cannabis-related conduct can form the basis for prosecution under the federal money laundering statutes,

unlicensed money transmitter statutes and the Bank Secrecy Act. The penalties for violation of these laws include imprisonment,

substantial fines and forfeiture. Prior to the DOJ's rescission of the “Cole Memo”, supplemental guidance from the

DOJ issued under the Obama administration directed federal prosecutors to consider the federal enforcement priorities enumerated

in the “Cole Memo” when determining whether to charge institutions or individuals with any of the financial crimes

described above based upon cannabis-related activity. With the rescission of the “Cole Memo,” there is increased uncertainty

and added risk that federal law enforcement authorities could seek to pursue money laundering charges against entities or individuals

engaged in supporting the cannabis industry.

Federal prosecutors have significant discretion

and no assurance can be given that the federal prosecutor in each judicial district where we operate will not choose to strictly

enforce the federal laws governing cannabis production or distribution. Any change in the federal government's enforcement posture

with respect to state-licensed cultivation of cannabis, including the enforcement postures of individual federal prosecutors in

judicial districts where we operate, would result in our inability to execute our business plan, and we would likely suffer significant

losses, which would adversely affect the trading price of our securities. We have not requested or obtained any opinion of counsel

or ruling from any authority to determine if our operations are in compliance with or violate any state or federal laws or whether

we are assisting others to violate a state or federal law. In the event that our operations are deemed to violate any laws or if

we are deemed to be assisting others to violate a state or federal law, any resulting liability could cause us to modify or cease

our operations.

Although we believe the foregoing will be applicable

to business other than hemp-based CBD businesses there is risk that confusion or uncertainty surrounding our products with regulated

cannabis could occur on the state or federal level and impact us. We may have difficulty with establishing banking relationships,

working with investment banks and brokers who would be willing to offer and sell our securities or accept deposits from shareholders,

and auditors willing to certify our financial statements if we are confused with businesses that are in the cannabis business.

Any of these additional factors, should they occur, could also affect our business, prospects, assets or results of operation could

have a material adverse effect on the business, prospects, results of operations or financial condition of the Company.

Our annual and quarterly financial results

are subject to significant fluctuations depending on various factors, many of which are beyond our control, which could adversely

affect our ability to satisfy our debt obligations as they become due.

Our sales and operating results can vary significantly

from quarter to quarter and year to year depending on various factors, many of which are beyond our control. These factors include:

• Variations

in the timing and volume of our sales

• The

timing of expenditures in anticipation of future sales

• Sales

promotions by us and our competitors

• Changes

in competitive and economic conditions generally

• Foreign

currency exposure

Consequently, our results of operations may

decline quickly and significantly in response to changes in order patterns or rapid decreases in demand for our products. We anticipate

that fluctuations in operating results will continue in the future. The Company's operating results may vary. We may incur net

losses. The Company expects to experience variability in its revenues and net profit. While we intend to implement our business

plan to the fullest extent we can, we may experience net losses. Factors expected to contribute to this variability include, among

other things:

|

|

•

|

The regulatory environment concerning beverage production

|

|

|

•

|

Climate, seasonality and environmental factors

|

|

|

•

|

Consumer demand for the Company’s products

|

|

|

•

|

Competition in products

|

You should further consider, among other factors,

our prospects for success in light of the risks and uncertainties encountered by companies that, like us, are in their early stages. For

example, unanticipated expenses, problems, and technical difficulties may occur and they may result in material delays in the operation

of our business, in particular with respect to our new products. We may not successfully address these risks and uncertainties

or successfully implement our operating strategies. If we fail to do so, it could materially harm our business to the

point of having to cease operations and could impair the value of our common stock to the point investors may lose their entire

investment. These factors, among others, raise substantial doubt about the ability of the Company to continue as a going concern.

We will require additional capital to

finance our operations in the future, but that capital may not be available when it is needed and could be dilutive to existing

stockholders.

We will require additional capital for future

operations. We plan to finance anticipated ongoing expenses and capital requirements with funds generated from the following

sources:

|

|

•

|

Cash provided by operating activities

|

|

|

•

|

Available cash and cash investments

|

|

|

•

|

Capital raised through debt and equity offerings

|

Current conditions in the capital markets are

such that traditional sources of capital may not be available to us when needed or may be available only on unfavorable terms. Our

ability to raise additional capital, if needed, will depend on conditions in the capital markets, economic conditions and a number

of other factors,

many of which are outside our control, and on our financial performance. Accordingly, we cannot assure

you that we will be able to successfully raise additional capital at all or on terms that are acceptable to us. If we

cannot raise additional capital when needed, it may have a material adverse effect on our liquidity, financial condition, results

of operations and prospects. Further, if we raise capital by issuing stock, the holdings of our existing stockholders

will be diluted.

If we raise capital by issuing debt securities,

such debt securities would rank senior to our common stock upon our bankruptcy or liquidation. In addition, we may raise

capital by issuing equity securities that may be senior to our common stock for the purposes of dividend and liquidating distributions,

which may adversely affect the market price of our common stock. Finally, upon bankruptcy or liquidation, holders of

our debt securities and lenders with respect to other borrowings will receive a distribution of our available assets prior to the

holders of our common stock. Additional equity offerings may dilute the holdings of our existing stockholders or reduce

the market price of our common stock, or both.

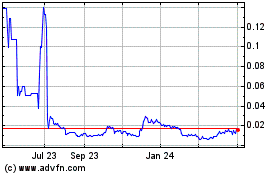

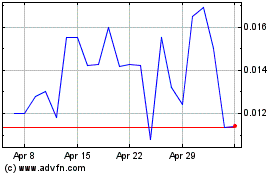

Our stock price has been extremely volatile

and our common stock is not listed on a national stock exchange; as a result, stockholders may not be able to resell their shares

at or above the price paid for them.

The market price of our common stock as has

been extremely volatile and could be subject to significant fluctuations due to changes in sentiment in the market regarding our

operations or business prospects, among other factors. Further, our common stock is not listed on a national stock exchange;

we intend to list the common stock on a national stock exchange once we meet the entry criteria. An active public market

for our common stock currently exists on the OTC Markets (www.otcmarkets.com) but may not be sustained. Therefore, stockholders

may not be able to sell their shares at or above the price they paid for them.

Among the factors

that could affect our stock price are:

|

|

•

|

Industry trends and the business success of our vendors

|

|

|

•

|

Actual or anticipated fluctuations in our quarterly financial and operating results and operating results that vary from the expectations of our management or of securities analysts and investors

|

|

|

•

|

our failure to meet the expectations of the investment community and changes in investment community recommendations or estimates of our future operating results

|

|

|

•

|

Announcements of strategic developments, acquisitions, dispositions, financings, product developments and other materials events by us or our competitors

|

|

|

•

|

Regulatory and legislative developments

|

|

|

•

|

Litigation

|

|

|

•

|

General market conditions

|

|

|

•

|

Other domestic and international macroeconomic factors unrelated to our performance

|

|

|

•

|

Additions or departures of key personnel

|

Sales by our stockholders of a substantial

number of shares of our common stock in the public market could adversely affect the market price of our common stock.

A substantial portion of our total outstanding

shares of common stock may be sold into the market at any time. Some of these shares are owned by executive officers

and directors, and we believe that such holders have no current intention to sell a significant number of shares of our stock.

If all of the major stockholders were to decide to sell large amounts of stock over a short period of time such sales could cause

the market price of our common stock to drop significantly, even if our business is doing well.

Any future litigation could have a material

adverse impact on our results of operations, financial condition and liquidity, particularly since we do not currently have director

and officer insurance. Our lack of D&O insurance may also make it difficult for us to retain and attract talented

and skilled directors and officers. While we have applied for D&O insurance and are working with our insurance brokerage house

to obtain coverage, we are not guaranteed of our ability to do so.

Despite our significant efforts in quality

control and preservation, we will face risks of litigation from customers, employees and others in the ordinary course of business,

which may divert our financial and management resources. Any adverse litigation or publicity may negatively impact our financial

condition and results of operations.

Claims of illness or injury relating to beverage

quality or beverage handling are common in the beverage industry. While we believe our processes and high standards of quality

control will minimize these instances, there is always a risk of occurrence, and so despite our best efforts to regulate quality

control, litigation may occur. In that event, our financial condition, operating results and cash flows could be harmed.

From time to time we may be subject to litigation,

including potential stockholder derivative actions. Risks associated with legal liability are difficult to assess and

quantify, and their existence and magnitude can remain unknown for significant periods of time. To date we have no directors

and officers liability (“D&O”) insurance to cover such risk exposure for our directors and officers. Such

insurance generally pays the expenses (including amounts paid to plaintiffs, fines, and expenses including attorneys’ fees)

of officers and directors who are the subject of a lawsuit as a result of their service to the Company. While we are

actively attempting to obtain such insurance, there can be no assurance that we will be able to do so at reasonable rates or at

all, or in amounts adequate to cover such expenses should such a lawsuit occur. While neither Nevada law nor our articles

of incorporation or bylaws require us to indemnify or advance expenses to our officers and directors involved in such a legal action,

we expect that we would do so to the extent permitted by Nevada law. Without D&O insurance, the amounts we would

pay to indemnify our officers and directors should they be subject to legal action based on their service to the Company could

have a material adverse effect on our financial condition, results of operations and liquidity. Further, our lack of

D&O insurance may make it difficult for us to retain and attract talented and skilled directors and officers, which could adversely

affect our business.

We have only one member of the Board

Directors, which could create a conflict of interests and pose a risk from a corporate governance perspective.

Our Board of Directors consists of one member,

our CEO Vincent Andreula. We do not have outside or independent directors. The lack of independent directors may prevent

the Board from being independent from management in its judgments and decisions and its ability to pursue the Board responsibilities

without undue influence. For example, an independent Board can serve as a check on management, which can limit management

taking unnecessary risks. Furthermore, the lack of independent directors creates the potential for

conflicts between

management and the diligent independent decision making process of the Board. In this regard, our lack of an independent

compensation committee presents the risk that our executive officers on the Board may have influence over his/their personal compensation

and benefits levels that may not be commensurate with our financial performance. Furthermore, our lack of outside directors

deprives our company of the benefits of various viewpoints and experience when confronting the challenges we face. Without

independent directors, it will be difficult for the Board to fulfill its traditional role as overseeing management.

Requirements associated with being a

reporting public company will require significant company resources and management attention.

We are filing this Form 10 registration statement

with the U.S. Securities and Exchange Commission (“SEC”). Once the Form 10 becomes effective, we will be

subject to the reporting requirements of the Exchange Act and the other rules and regulations of the SEC relating to public companies. We

are working with independent legal, accounting and financial advisors to identify those areas in which changes should be made to

our financial and management control systems to manage our growth and our obligations as an SEC reporting company. These

areas include corporate governance, internal control, internal audit, disclosure controls and procedures and financial reporting

and accounting systems. We have made, and will continue to make, changes in these and other areas, including our internal

control over financial reporting. However, we cannot provide assurances that these and other measures we may take will

be sufficient to allow us to satisfy our obligations as an SEC reporting company on a timely basis.

In addition, compliance with reporting and

other requirements applicable to SEC reporting companies will create additional costs for the Company will require the time and

attention of management and will require the hiring of additional personnel and legal, audit and other professionals. We

cannot predict or estimate the amount of the additional costs we may incur, the timing of such costs or the impact that our management’s

attention to these matters will have on our business.

Our management controls a large block

of our common stock that will allow them to control us.

As of April 7, 2021, members of our management

team beneficially own 110,996,444 shares of common stock, or approximately 77.63% of our outstanding common stock and of our voting

power and controls the Company. As a result, management has the ability to control substantially all matters submitted

to our stockholders for approval including:

|

|

•

|

Election of our board of directors;

|

|

|

•

|

Removal of any of our directors;

|

|

|

•

|

Amendment of our articles of incorporation or bylaws; and

|

|

|

•

|

Adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us.

|

In addition, management’s stock ownership

may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could

reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

Any additional investors will own a minority

percentage of our common stock and will have minority voting rights.

We are an emerging growth company and,

as a result of the reduced disclosure and governance requirements applicable to emerging growth companies, our common stock may

be less attractive to investors.

We are an emerging growth company, as defined

in the JOBS Act, and we are eligible to take advantage of certain exemptions from various reporting requirements applicable to

other public companies, but not to emerging growth companies, including, but not limited to, a requirement to present only two

years of audited financial statements, an exemption from the auditor attestation requirement of Section 404 of the Sarbanes-Oxley

Act, reduced disclosure about executive compensation arrangements pursuant to the rules applicable to smaller reporting companies

and no requirement to seek non-binding advisory votes on executive compensation or golden parachute arrangements, although some

of these exemptions are available to us as a smaller reporting company (i.e.a company that has: (i) a public float of less than

$250 million; or (ii) less than $100 million in annual revenues and no public float or a public float of less than $700 million).. We

have elected to adopt these reduced disclosure requirements. We cannot predict if investors will find our common stock

less attractive as a result of our taking advantage of these exemptions. If some investors find our common stock less

attractive as a result of our choices, there may be a less active trading market for our common stock and our stock price may be

more volatile.

We do not expect to pay any cash dividends

in the foreseeable future.

We intend to retain our future earnings, if

any, in order to reinvest in the development and growth of our business and, therefore, do not intend to pay dividends on our common

stock for the foreseeable future. Any future determination to pay dividends will be at the discretion of our board of

directors and will depend on our financial condition, results of operations, capital requirements, and such other factors as our

board of directors deems relevant. Accordingly, investors may need to sell their shares of our common stock to realize

a return on their investment, and they may not be able to sell such shares at or above the price paid for them.

We can sell additional shares of

common stock without consulting stockholders and without offering shares to existing stockholders, which would result in dilution

of existing stockholders’ interests in the Company and could depress our stock price.

Our Articles of Incorporation authorize 200,000,000

shares of common stock, of which 142,987,383 are outstanding as of April 7, 2021. Although our Board of Directors

intends to utilize its reasonable business judgment to fulfill its fiduciary obligations to our then existing stockholders in connection

with any future issuance of our capital stock, the future issuance of additional shares of our common stock would cause immediate,

and potentially substantial, dilution to our existing stockholders, which could also have a material effect on the market value

of the shares.

Further, our shares do not have preemptive

rights, which mean we can sell shares of our common stock to other persons without offering purchasers in this offering the right

to purchase their proportionate share of such offered shares. Therefore, any additional sales of stock by us could dilute

an existing stockholder’s ownership interest in our company.

Item 2. Financial Information

MANAGEMENT'S DISCUSSION AND ANALYSIS

Forward Looking Statements

The following discussion and analysis should

be read in conjunction with our financial statements and the related notes thereto. The management's discussion and analysis contain

forward-looking statements, such as statements of our plans, objectives, expectations, and intentions. Any statements that are

not statements of historical fact are forward-looking statements. When used, the words "believe," "plan," "intend,"

"anticipate," "target," "estimate," "expect" and the like, and/or future tense or conditional

constructions ("will," "may," "could," "should," etc.), or similar expressions, identify

certain of these forward-looking statements. These forward-looking statements are subject to risks and uncertainties, including

those under "Risk Factors," which appear in elsewhere in this Registration Statement, that could cause actual results

or events to differ materially from those expressed or implied by the forward-looking statements. Our actual results and the timing

of events could differ materially from those anticipated in these forward-looking statements as a result of several factors. We

do not undertake any obligation to update forward-looking statements to reflect events or circumstances occurring after the date

of this Registration Statement.

Overview

Imperalis Holding Corp. (the “Company”

or “IMHC”), acts as a holding company for its operating subsidiary, CannaCure

Sciences, Inc. (“CannaCure”). Through CannaCure, we are developing of a lineup of personal care products containing

Cannabidiol (CBD). We currently offer CBD-based lotions and oils to the consumer markets. Our products are all-natural, cruelty-free

products that aim to provide an alternative to synthetic personal care products. We hold

two additional subsidiaries whose operations are currently dormant, The Crypto Currency Mining Company, a Wyoming Corporation,

and Dollar Shots Club, Inc., a Nevada corporation.

Impact of COVID-19

The Company has experienced significant disruptions

to its business and operations due to circumstances related to COVID-19, and as a result of delays caused government-imposed quarantines,

office closings and travel restrictions, which affect both the Company’s and its suppliers. Following the outbreak of Covid-19

in the U.S., we experienced a significant decline in customers sales, which has not abated to date. In addition, supply chain disruptions

have, from time to time, resulted in the unavailability of raw ingredients and packaging materials for our products.

Results of Operations

For the years ended December 31, 2020 and December 31, 2019

Revenue and Gross Profit

Revenue and gross profit for the year

ended December 31, 2020 was $29, compared to revenue and gross profit of $805 during the year ended December 31, 2019, representing

a decrease of $776 or 96%. Revenues were derived from the sale of our CannaCure products, with sales decreasing in 2020 following

the outbreak of the Covid-19 pandemic.

Operating Expenses

Operating expenses for the year ended December

31, 2020 were $11,781, compared to operating expenses of $47,530 during the year ended December 31, 2019, representing a decrease

of $35,659 or 75%. The decrease is primarily attributable to a decrease in general and administrative expenses resulting from start-up

costs for the CannaCure business in 2019 which did not recur in 2020. General and administrative expenses were $6,069 for the year

ended December 31, 2020, compared to $37,892 for the year ended December 31, 2019, representing a decrease of $31,823 or 84%. Rent

was $5,712 for the year ended December 31, 2020, compared to $9,638 for the year ended December 31, 2019, representing an increase

of $3,926 or 41%.

Other Income (Expense)

For the year ended December 31, 2020, interest

expense was $42,583, compared to an expense of $35,417 for the year ended December 31, 2019, representing an increase of $7,166

or 20%. Interest income was $23 for the year ended December 31, 2020, compared to $51 for the year ended December 31, 2019. In

2020, we recorded $10,000 in other income a result of a one-time debt forgiveness.

During the year ended December 31, 2019, we

recorded a one-time loss of $82,034 for the disposal of assets, relating to the impairment of cryptocurrency mining equipment used

in our cryptocurrency mining business.

Net Loss

We realized a net loss of $46,278 for the year

ended December 31, 2020, compared to a net loss of $170,484 for the year ended December 31, 2019 representing a decrease in net

loss of $124,206 or 73%.

Liquidity and Capital Resources

As of December 31, 2020, we had cash and cash

equivalents of $29,006 and inventory of $10,926, for total current assets of $39,932. Our total current liabilities as of December

31, 2020 were $101,863, consisting of convertible notes payable in the principal amount of $78,000, a loan payable to our CEO of

$14,785, and accrued expenses of $9,078. Our working capital deficit as of December 31, 2020 was $61,931. Subsequent to the reporting

period, an outstanding note payable in the principal amount of $40,000, together with accrued interest thereon, was converted to

a total 9,284,445 shares of common stock.

Net cash used in operating activities for

the year ended December 31, 2020 was $(11,729), compared to net cash used in operating activities of $(54,623) for the year ended

December 31, 2019. Net cash used in investing activities for the year ended December 31, 2020 was ($850), compared to net cash

used in investing activities of ($1,473) for the year ended December 31, 2019. For the year ended December 31, 2020, net cash

used in financing activities was ($19,215), compared to net cash provided by financing activities of $48,803 during the fiscal

year ended December 31, 2019.

Historically, we have

funded our operations through sales of equity, debt issuances and officer loans. We have no commitment from any investment banker

or other traditional funding sources and, while we have had discussions with various potential funding sources, we have no definitive

agreement with any third party to provide us with financing, either debt or equity, and there can be no assurances that we will

be able to raise additional funds, or if we are successful, on favorable terms. The failure to obtain the financing necessary to

allow us to continue to implement our business plan will have a significant negative impact on our anticipated results of operations.

Going Concern

The accompanying consolidated financial statements

have been prepared assuming we will continue as a going concern, which contemplates realization of assets and the satisfaction

of liabilities in the normal course of business for the twelve-month period following the date of these financial statements. On

a consolidated basis, we have incurred significant operating losses since inception. Because we do not expect that existing operational

cash flow will be sufficient to fund presently anticipated operations, this raises substantial doubt about our ability to continue

as a going concern. Therefore, we will need to raise additional funds and are currently exploring sources of financing. Historically,

we have raised capital through private offerings of debt and equity and officer loans to finance working capital needs. There can

be no assurances that we will be able to continue to raise additional capital through the sale of common stock or other securities

or obtain short-term loans.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

CRITICAL ACCOUNTING POLICIES

AND ESTIMATES

Impairment of Long-lived Assets

The Company analyzes its long-lived

assets for potential impairment. Impairment losses are recorded on long-lived assets when indicators of impairment are present

and undiscounted cash flows estimated to be held and used are adjusted to their estimated fair value, less estimated selling expenses.

As of December 31, 2019, the Company recognized $82,034 impairment loss on its crypto-currency mining equipment and intangibles.

Recent Accounting Pronouncements

The Company does not expect any recent issued

accounting pronouncements to have a material impact on its financial condition, results of operations or cash flows.

Item 3. Properties.

We do not own any real property. Our facility for compounding

and bottling our products is provided by our CEO, Vincent Andreula, for rent of $476 per month on a month-to-month.

Item 4. Security Ownership of Certain Beneficial Owners and Management.

The following table lists, as of April 7,

2021, the number of shares of common stock beneficially owned by (i) each person, entity or group (as that term is used in

Section 13(d)(3) of the Securities Exchange Act of 1934) known to the Company to be the beneficial owner of more than 5% of

the outstanding common stock; (ii) each of our directors; (iii) each of our named executive officers and (iv) all executive

officers and directors as a group. Information relating to beneficial ownership of common stock by our principal stockholders

and management is based upon information furnished by each person using "beneficial ownership" concepts under the

rules of the SEC. Under these rules, a person is deemed to be a beneficial owner of a security if that person directly or

indirectly has or shares voting power, which includes the power to vote or direct the voting of the security, or investment

power, which includes the power to dispose or direct the disposition of the security. The person is also deemed to be a

beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the

SEC rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to

be a beneficial owner of securities as to which he or she may not have any pecuniary interest. Except as noted below, each person has sole voting and investment

power with respect to the shares beneficially owned and each stockholder's address is c/o Imperalis Holding Corp., 30 N Gould Street,

Suite 11023, Sheridan, Wyoming 82801.

The percentages below are calculated

based on 142,987,383 shares of common stock issued and outstanding as of April 7,, 2021.

|

Title of Class

|

|

Number of Shares of Common Stock

|

|

Percentage

|

|

Vincent Andreula

|

|

|

80,996,444

|

|

|

|

56.65%

|

|

Michael Andreula

|

|

|

15,000,000

|

|

|

|

10.49%

|

|

Kristie Andreula

|

|

|

15,000,000

|

|

|

|

10.49%

|

|

Total All Executive Officers and Directors

|

|

|

110,996,444

|

|

|

|

77.63%

|

|

Other 5% Shareholders

|

|

|

None

|

|

|

|

|

Item 5. Directors and Executive

Officers.

The following table sets forth information

regarding our current directors and executive officers:

|

Name

|

|

Age

|

|

Position

|

|

Vincent Andreula

|

|

43

|

|

Chief Executive Officer, Chief Financial Officer, sole Director President

|

|

Michael Andreula

|

|

39

|

|

Chief Marketing Officer

|

|

Kristie Andreula

|

|

40

|

|

Research and Development Officer

|

The business background and certain other information

about our directors and executive officers, as well our key employee, is set forth below:

Vincent Andreula, our CEO, CFO, and

sole Director, joined the Company on December 28, 2017. Mr. Andreula is an entrepreneur who has owned five businesses prior to

starting CannaCure Sciences. From May of 2014 to December of 2017, Mr. Andreula was with Spencer Edwards. He formerly served as

a Vice President at Capital One; a Fortune 500 company.

Michael Andreula, our Chief Marketing

Officer, joined the Company in April of 2019. Mr. Andreula and his wife, Kristie Andreula, started ReBoot Camp Retreats in 2011,

taking small groups of clients and gym members out of their stressful, unhealthy lives in the city and into 7-10 day immersive

trips to Italy, Costa Rica, Paris, and Mexico. These retreats offer twice-per-day training by Mike and Kristie, healing body

work and nutritional counseling. They also run the Body Transformation Experiment locally, helping people struggling with

their weight to understand their body’s response to carbohydrates and hunger, resulting in some incredible transformations.

At the same time, Michael acts as Head Trainer for CKO Kickboxing, a company he started with in 1999. At CKO Kickboxing, he instructs

group kickboxing classes and serves as Franchise Trainer for new locations. At this point, Michael has taught over 20,000

hours of kickboxing classes, produced over 500 hours of online instruction videos, and hosts a podcast where he talks with some

of the most innovative people in the health and wellness industry, including Gary Taubes, Steve Maxwell and Wim Hof. Mr. Andreula

holds a degree in Systems Applications and Products from Scranton University.

Kristie Andreula, our head of Research

and Development, joined the Company in April of 2019.

Ms. Andreula holds a degree in Biology with

a concentration in Health Science from SUNY Brockport.

Term of Office

Our directors are appointed

for a one-year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance

with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Family Relationships

Michael Andreula, our Chief Marketing

Officer, is the brother of our CEO and sole director, Vincent Andreula. Kristie Andreula, our head of R&D, and Michael Andreula

are spouses.

Involvement in Certain Legal Proceedings

To the best of our knowledge, during the past

ten years, none of the following occurred with respect to a present or former director, executive officer, or employee: (1) any

bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at

the time of the bankruptcy or within two years; (2) any conviction in a criminal proceeding or being subject to a pending criminal

proceeding (excluding traffic violations and other minor offenses); (3) being subject to any order, judgment or decree, not subsequently

reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending

or otherwise limiting his or her involvement in any type of business, securities or banking activities; and (4) being found by

a court of competent jurisdiction (in a civil action), the SEC or the Commodities Futures Trading Commission to have violated a

federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

Committees of the Board

Until further determination by the board,

the full board of directors will undertake the duties of the Audit Committee, Compensation Committee, and Nominating Committee.

Audit Committee

We do not have a separately designated standing

audit committee. The entire Board of Directors performs the functions of an audit committee, but no written charter governs the

actions of the Board when performing the functions of what would generally be performed by an audit committee. The Board approves

the selection of our independent accountants and meets and interacts with the independent accountants to discuss issues related

to financial reporting. In addition, the Board reviews the scope and results of the audit with the independent accountants, reviews

with management and the independent accountants our annual operating results, considers the adequacy of our internal accounting

procedures and considers other auditing and accounting matters including fees to be paid to the independent auditor and the performance

of the independent auditor. Our Board of Directors, which performs the functions of an audit committee, does not have a member

who would qualify as an “audit committee financial expert” within the definition of Item 407(d)(5)(ii) of Regulation

S-K. We believe that, at our current size and stage of development, the addition of a special audit committee financial expert

to the Board is not necessary.

Nomination Committee

Our Board of Directors does not

maintain a nominating committee. As a result, no written charter governs the director nomination process. Our size and the size

of our Board, at this time, do not require a separate nominating committee.

When evaluating director nominees,

our directors consider the following factors:

|

|

•

|

The appropriate size of our Board of Directors;

|

|

|

•

|

Our needs with respect to the particular talents and experience of our directors;

|

|

|

•

|

The knowledge, skills and experience of nominees, including experience in finance, administration or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board;

|

|

|

•

|

Experience in political affairs;

|

|

|

•

|

Experience with accounting rules and practices; and

|

|

|

•

|

The desire to balance the benefit of continuity with the periodic injection of the fresh perspective provided by new Board members.

|

Our goal is to assemble a Board

that brings together a variety of perspectives and skills derived from high quality business and professional experience. In doing

so, the Board will also consider candidates with appropriate non-business backgrounds.

Other than the foregoing, there

are no stated minimum criteria for director nominees, although the Board may also consider such other factors as it may deem are

in our best interests as well as our stockholders. In addition, the Board identifies nominees by first evaluating the current members

of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to our business

and who are willing to continue in service are considered for re-nomination. If any member of the Board does not wish to continue

in service or if the Board decides not to re-nominate a member for re-election, the Board then identifies the desired skills and

experience of a new nominee in light of the criteria above. Current members of the Board are polled for suggestions as to individuals

meeting the criteria described above. The Board may also engage in research to identify qualified individuals. To date, we have

not engaged third parties to identify or evaluate or assist in identifying potential nominees, although we reserve the right in

the future to retain a third party search firm, if necessary. The Board does not typically consider shareholder nominees because

it believes that its current nomination process is sufficient to identify directors who serve our best interests.

Code of Ethics

We currently have not adopted a

code of ethics for the Board or executives.

Compliance with Section 16(a) of the Exchange Act

Section 16(a) of the Exchange Act, as amended, will require

our executive officers and directors and persons who own more than 10% of a registered class of our equity securities to file with

the Securities and Exchange Commission initial statements of beneficial ownership, reports of changes in ownership and annual reports

concerning their ownership of our common stock and other equity securities, on Form 3, 4 and 5 respectively. Executive officers,

directors and greater than 10% shareholders are required by the Securities and Exchange Commission regulations to furnish our company

with copies of all Section 16(a) reports they file.

Code of Ethics

The Company has not adopted a code of ethics to apply

to its principal executive officer, principal financial officer, principal accounting officer and controller, or persons performing

similar functions.

Item 6. Executive Compensation.

Summary Compensation Table

The following table sets forth the

compensation earned by Executive Officers during the last two fiscal years:

SUMMARY COMPENSATION TABLE

|

Name and Principal Position

|

|

Year

|

|

Salary

|

|

Bonus

|

|

Stock Awards

|

|

Option Awards

|

|

Non-Equity Incentive Plan Compensation

|

|

Non-Qualified Deferred Compensation Earnings

|

|

All Other Compensation

|

|

Total

|

|

|

|

|

|

($)

|

|

($)

|

|

($)

|

|

($)

|

|

($)

|

|

($)

|

|

($)

|

|

($)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vincent Andreula, CEO, CFO

|

|

2020

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

2019

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|