By Jared S. Hopkins and Peter Loftus

The blood-clot concerns surrounding Johnson & Johnson's

Covid-19 vaccine pose a new test for the world's biggest

health-products maker.

J&J has faced a number of thorny, headline-grabbing issues

during its 135-year history, from cyanide poisoning of its Tylenol

headache remedy to quality problems with several of the company's

over-the-counter products and cancer concerns about its talcum

powder.

The company's handling of the Tylenol poisoning burnished its

reputation as a high-minded corporate citizen and became a

business-school case study in how companies should handle crises,

while its response to the over-the-counter quality problems hurt

its standing among consumers and the company's consumer-health

business.

U.S. health authorities recommended a pause in the use of the

Covid-19 shot Tuesday, following reports of severe blood clots in

six women who received the shot.

The clots were rare, and regulators are still investigating

whether the vaccine causes the clots.

Yet the issue is forcing the company, a relative newcomer to the

vaccine business, to navigate additional scrutiny over safety of

its shot. However the clot issue is resolved by regulators, the

company will need to respond to concerns held by many in the public

on high alert about vaccine safety.

The company was already working through manufacturing setbacks,

after problems related to the shot's production by a contract

manufacturer.

J&J said Tuesday it is working with health authorities and

medical experts probing the rare blood-clotting issue, and supports

open communication of the information to healthcare professionals

and the public.

Johnson & Johnson, which carries a market cap of $425

billion and notched $82.6 billion in sales last year, is among the

most storied names in healthcare. The company's Band-Aids,

Johnson's Baby products and Listerine mouthwash are staples in many

households.

The New Brunswick, N.J., company's focus has shifted in recent

years from the recognizable consumer products to more advanced --

and lucrative -- prescription drugs and medical devices.

Its arthritis treatment Remicade has been among the world's

biggest-selling drugs, while J&J has introduced new drugs for

various autoimmune conditions, prostate cancer and HIV that have

transformed treatment and helped patients.

Despite its size, J&J has a small presence in the vaccine

market. Its Covid-19 vaccine is the company's only shot cleared for

use in the U.S., although its Ebola vaccine was approved for use by

European regulators last year. Potential vaccines for other

diseases are still in development.

The company said it developed the Covid-19 shot to meet the

challenge presented by the pandemic, not for business purposes, and

is selling its vaccine to government customers on a not-for-profit

basis during the pandemic emergency.

Yet the recommended pause weighed down J&J's stock, with its

shares down nearly 2% early Tuesday afternoon.

Analysts, however, said they didn't expect the clotting issue to

affect J&J's overall business because of its size and

diversity. Analysts said they expect the vaccine's safety concerns

and manufacturing timelines to be discussed next week when the

company reports second-quarter earnings.

The U.S. Food and Drug Administration authorized the J&J

Covid-19 vaccine's use in February, after it was shown to be highly

effective at preventing symptomatic Covid-19.

Health authorities and providers looked forward to the rollout

of the shots. The single-dose shot can be stored at more favorable

temperatures than other vaccines, making it easier to handle at

sites and simplifying vaccination efforts.

The clot issue calls into question the future of the company's

vaccine business, which it began expanding about 10 years ago when

it made a big bet using a new technology called viral vectors.

AstraZeneca PLC's shot uses similar technology as J&J's, and

health regulators have been investigating blood clots involving the

British drugmaker's shot for several weeks.

J&J has faced scrutiny for other products, ranging from

medical devices to its iconic baby powder.

In 1982, J&J weathered a storm involving Tylenol. At the

time, seven people died from taking Extra-Strength Tylenol that

someone had laced with cyanide and placed on store shelves. The

company quickly alerted the public to the deaths and immediately

recalled millions of Tylenol bottles, earning trust among many

consumers.

More than a decade ago, J&J recalled millions of

over-the-counter drugs over quality issues, including Tylenol and

Zyrtec.

Last year, the company said it would stop selling baby powder

made with talc in the U.S. and Canada, a decision that came as the

company faced thousands of lawsuits alleging the talc powder has

harmed women who had used it for years.

J&J has lost trial verdicts and has been ordered to pay

billions of dollars in talc-powder cases, but the company is trying

to reverse such decisions on appeal. The company has said its

talc-containing powder is safe and doesn't cause cancer.

The company is also a defendant in the sprawling litigation

related to the opioids crisis. Johnson & Johnson, which at one

time sold the prescription fentanyl patch Duragesic, and other

companies have been working to broker a deal with state attorneys

general and local municipalities since late 2019.

Write to Jared S. Hopkins at jared.hopkins@wsj.com and Peter

Loftus at peter.loftus@wsj.com

(END) Dow Jones Newswires

April 13, 2021 14:45 ET (18:45 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

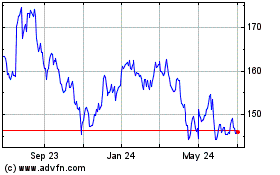

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

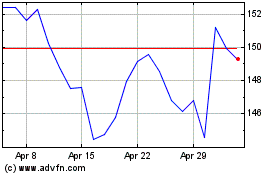

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024