By Xie Yu and Jing Yang

In its path to becoming one of the world's most valuable

startups, Ant Group Co. built a complex financial ecosystem that

captured huge sums of money and kept millions of people in it by

supplying them with credit and managing their investments.

Now, Beijing is forcing the Chinese financial-technology giant

to scale back its activities and dismantle arrangements that have

given Ant a big advantage over its rivals as well as the country's

banks and traditional financial institutions.

This week, the People's Bank of China outlined a five-pronged

rectification plan for Ant, which will fall fully in line with

regulations by applying to become a financial-holding company

overseen by the central bank. Ant, an affiliate of Alibaba Group

Holding Ltd., will be subject to regulations similar to those

governing banks, which will curtail some of its growth

prospects.

Ant's mobile payments and lifestyle app Alipay, which has more

than one billion users in China, has in recent years sought to

generate bigger profits from its customers by directing them toward

other financial services such as online loans and a giant

money-market mutual fund where they can park their money. In the

year to June 2020, Ant reported profit of $5.8 billion on revenue

of $21.5 billion.

Half a billion Chinese citizens used Ant's microlending services

in the year to June 2020, and they had the equivalent of more than

$264 billion in outstanding loans at that point. And at the end of

last year, more than 690 million people -- or close to half of

China's population -- were invested in Ant's flagship money-market

mutual fund, which had $182 billion in assets under management.

The central bank Monday said Ant needs to shrink the giant fund

and reduce its risks. It said Ant also needs to break an

"inappropriate link" between its microlending and payments

services, and curb monopolistic behavior in how it collects,

controls and uses consumer data.

Ant used to aggressively market its virtual credit card service

to Alipay users while they were making purchases. Many of them were

prompted to select Huabei -- which means "Just spend" -- as their

default payment option, and some individuals inadvertently selected

it without realizing they had opted for that.

Ant partnered with banks that supplied most of the credit to

Alipay users, and Ant took a cut of the interest income. The ease

of borrowing from Huabei also led many young Chinese citizens to

borrow money to spend on luxury goods and lifestyles they couldn't

afford.

Following the central bank's directive, Ant will stop pushing

Huabei in this manner.

Regulators don't want Ant to "nudge people into using consumer

credit that they don't need," said Martin Chorzempa, a research

fellow at the Peterson Institute for International Economics,

adding that regulators want other credit-card providers, such as

banks, to operate on an even playing field.

Ant has been benefiting from "cross-pollination across different

lines of business that have positive feedback effects on each

other," said Eswar Prasad, a Cornell University professor and

former head of the International Monetary Fund's China division.

Users' payment histories have also helped Ant develop internal

scoring systems to gauge their creditworthiness, helping to

strengthen Ant's dominance of the financial-services sector, he

said.

Chinese financial regulators are uneasy about the intertwined

nature of Ant's services. "Therefore, it is best to separate the

various businesses and supervise them individually to avoid

cross-selling," said Ma Xiangyun, an analyst with Soochow

Securities.

Ant's giant money-market mutual fund, known as Yu'e Bao -- which

means "leftover treasure" -- was started in 2013. It was the first

of its kind globally: an online-only fund that people could put

money in at any time of the day with a minimum investment of just 1

yuan, equivalent to $0.15.

By early 2018 it had become the world's biggest money-market

mutual fund, with close to $260 billion in assets under management,

effectively keeping the money within Ant's ecosystem and allowing

Ant to earn fees from it.

Financial regulators grew concerned and pressured Ant to shrink

the fund. Ant has given Alipay users other investment options, but

regulators want it to do more.

Monday's directive from the central bank said Ant will have to

reduce the liquidity risks of its investment products and lower the

assets under management of Yu'e Bao. Regulators have long worried

about a situation where the fund's manager can't sell its

underlying assets quickly if many investors pull out at the same

time, which could cause them to incur losses.

"It's a remote problem but real. It is remote until many people

suddenly want their money," said Richard Turrin, a

financial-technology-industry consultant.

Ant was valued at $150 billion in a private fundraising round in

mid-2018, and last fall was on track to go public at a valuation in

excess of $300 billion when its blockbuster initial public

offerings were scuttled by Beijing. Some Ant shareholders in recent

months marked the value of their Ant stakes at prices that implied

a company valuation of $230 billion, according to regulatory

filings.

Broadly, Ant's restructuring plan could serve as a blueprint for

other financial-technology companies in China, said Mr. Prasad. "It

is likely to result in other companies restructuring themselves in

similar fashion before the heavy hand of the regulator falls on

them," he said.

Write to Xie Yu at Yu.Xie@wsj.com and Jing Yang at

Jing.Yang@wsj.com

(END) Dow Jones Newswires

April 13, 2021 09:35 ET (13:35 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

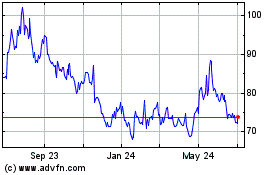

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

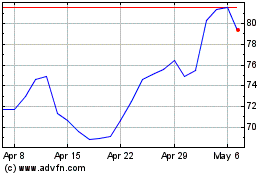

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024