Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

April 13 2021 - 8:44AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF

1934

For the month of April 2021

Commission File Number 001-33060

DANAOS CORPORATION

(Translation of registrant’s name into English)

Danaos Corporation

c/o Danaos Shipping Co. Ltd.

14 Akti Kondyli

185 45 Piraeus

Greece

Attention: Secretary

011 030 210 419 6480

(Address of principal executive office)

Indicate by check mark whether the

registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): o

Closing of Debt Refinancing

On April 12, 2021 (the “Closing Date”),

Danaos Corporation (“Danaos” or the “Company”) consummated its previously announced refinancing of a substantial

majority of its outstanding senior secured indebtedness (the “Refinancing”). On the Closing Date, the Company used the proceeds

from a new $815 million senior secured credit facility with Citibank N.A. and National Westminster

Bank plc, entered into on April 1, 2021 (the “New Senior Secured Credit Facility”),

a $135 million sale leaseback agreement (the “New Leaseback Agreement”) with Oriental Fleet International Company Limited,

an affiliate of COSCO Shipping Lease Co., Ltd., with respect to five vessels and the net proceeds, which were released from escrow, of

the Company’s February 2021 offering of 8.500% Senior Secured Notes due 2028, to refinance all of the outstanding indebtedness,

which aggregated $1.3 billion as of December 31, 2020, under the following senior secured credit facilities: (1) The Royal Bank of Scotland

$475.5 million facility, (2) HSH Nordbank-Aegean Baltic Bank-Piraeus Bank $382.5 million facility, (3) Citibank $114 million

Facility, (4) Citibank $123.9 million facility, (5) Citibank $120 million facility, (6) Citibank-Eurobank $37.6 million

facility, (7) Club Facility $206.2 million, (8) Credit Suisse $171.8 million facility and (9) Sinosure-Cexim-Citibank-ABN Amro

$203.4 million facility. The Refinancing, including the New Senior Secured Credit Facility and New Leaseback Agreement, were effected

on the terms described in additional detail in the Company’s Annual Report on Form 20-F filed with the SEC on March 4, 2021.

In connection with the Refinancing, the Company’s

Amended and Restated Management Agreement and the Amended and Restated Restrictive Covenant Agreement were amended and restated to eliminate

references to the refinanced credit facilities and provisions related to arrangements with lenders under those credit facilities, which

amended and restated agreements are furnished as exhibits to this report.

Listing of Notes

The Company’s 8.500% Senior Notes due 2028

have been approved for listing on the Official List of The International Stock Exchange and were admitting to trading thereon as of April

7, 2021.

*****

Forward-Looking Statements

Matters

discussed in this report may constitute forward-looking statements within the meaning of the safe harbor provisions of

Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking

statements reflect the current views of Danaos Corporation (including subsidiaries unless indicated or the context requires

otherwise, the “Company,” “we,” “us,” and “our”) with respect to future events and

financial performance and may include statements concerning our operations, cash flows, financial position, including with respect

to vessel and other asset values, plans, objectives, goals, strategies, future events, performance or business prospects, changes

and trends in our business and the markets in which we operate, and underlying assumptions and other statements, which are other

than statements of historical facts. The forward-looking statements in this release are based upon various assumptions. Although we

believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant

uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure you that

we will achieve or accomplish these expectations, beliefs or projections. Important factors that, in our view, could cause actual

results to differ materially from those discussed in the forward-looking statements include the impact of the novel coronavirus 2019

(COVID-19) pandemic and efforts throughout the world to contain its spread, including effects on global economic activity, demand

for seaborne transportation of containerized cargo, the ability and willingness of charterers

to fulfill their obligations to us, charter rates for containerships, shipyards performing scrubber installations,

drydocking and repairs, changing vessel crews and availability of financing, the effects of the refinancing transaction,

Danaos’ ability to achieve the expected benefits of its refinancing transactions and comply with the terms of its credit

facilities entered into in connection with the such refinancing, the strength of world economies and currencies, general market

conditions, including changes in charter hire rates and vessel values, charter counterparty performance, changes in demand that may

affect attitudes of time charterers to scheduled and unscheduled drydocking, changes in our operating expenses, including bunker

prices, dry-docking and insurance costs, ability to obtain financing and comply with covenants in our financing arrangements,

actions taken by regulatory authorities, potential liability from pending or future litigation, domestic and international political

conditions, potential disruption of shipping routes due to accidents and political events or acts by terrorists.

Risks and uncertainties

are further described in reports filed by us with the U.S. Securities and Exchange Commission.

The forward-looking statements

and information contained in this announcement are made as of the date hereof and the Company undertakes no obligation to update publicly

or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so

required by applicable securities laws.

*****

This report on Form 6-K, other than Exhibit 99.4, is hereby incorporated

by reference into the Company’s (i) Registration Statement on Form F-3 (Reg. No. 333-237284) filed with the SEC on March 19, 2020, (ii) Registration Statements on Form F-3 (Reg. No. 333-230106) and (Reg. No. 333-226096)

filed with the SEC on March 6, 2019, (iii) Registration Statement on Form F-3 (Reg. No. 333-174494) filed with the SEC on May 25, 2011, (iv) Registration Statement on Form F-3 (Reg. No. 333-147099), the related prospectus supplements

filed with the SEC on December 17, 2007, January 16, 2009 and March 27, 2009, (v) Registration Statement on Form S-8 (Reg. No. 333-233128) filed with the SEC on August 8, 2019 and the reoffer prospectus, dated August 8, 2019, contained

therein and (vi) Registration Statement on Form F-3 (Reg. No. 333-169101) filed with the SEC on October 8, 2010.

EXHIBIT INDEX

|

99.1

|

|

Facility Agreement for $815 million Loan Facility, dated April 1, 2021, between Danaos Corporation, as borrower, certain of its subsidiaries as guarantors, and Citibank N.A. and National Westminster Bank plc

|

|

99.2

|

|

Amended and Restated Management Agreement, dated as of April 1, 2021, between Danaos Corporation and Danaos Shipping Company Limited

|

|

99.3

|

|

Amended and Restated Restrictive Covenant Agreement, dated as of April 1, 2021, among Danaos Corporation, Dr. John Coustas and Danaos Investment Limited as the Trustee for the 883 Trust

|

|

99.4

|

|

Danaos Corporation Press Release dated April 12, 2021

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: April 13, 2021

|

|

DANAOS CORPORATION

|

|

|

|

|

|

|

By:

|

/s/ Evangelos Chatzis

|

|

|

Name:

|

Evangelos Chatzis

|

|

|

Title:

|

Chief Financial Officer

|

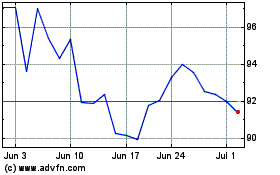

Danaos (NYSE:DAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

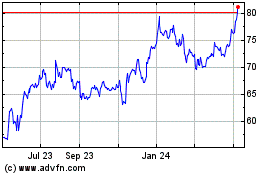

Danaos (NYSE:DAC)

Historical Stock Chart

From Apr 2023 to Apr 2024