UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 2, 2021

GLOBAL

HEALTHCARE REIT, INC.

(Exact

Name of Registrant as Specified in its Charter)

|

Utah

|

|

0-15415

|

|

87-0340206

|

|

(State

or other jurisdiction

|

|

Commission

|

|

(I.R.S.

Employer

|

|

of

incorporation)

|

|

File

Number

|

|

Identification

number)

|

|

|

6800

N. 79th St., Ste. 200, Niwot, CO 80503

|

|

|

|

(Address

of principal executive offices) (Zip Code)

|

|

|

|

|

|

|

|

Registrant’s

telephone number, including area code: (303) 449-2100

|

|

|

|

|

|

|

|

(Former

name or former address, if changed since last report)

|

|

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each Class

|

|

Trading

Symbol

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

ITEM

2.03

|

CREATION

OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT

|

|

|

|

|

ITEM

7.01

|

REGULATION

FD DISCLOSURE

|

On

March 31, 2021, Global Healthcare REIT, Inc. (Currently in a rebranding effort to Selectis Health, Inc.) (OTC: GBCS) (“Selectis”

or the “Company”) issued a press release today that reported net income for the fourth quarter of 2020 of $1.3 million, or

$0.05 per diluted share, and $2.93 million, or $.11 per diluted share, for the full year 2020. Total revenue increased 202% to $20.93

million for the full year 2020 compared to $6.93 million for 2019.

FOURTH

QUARTER HIGHLIGHTS

|

|

■

|

Record

revenue of $5,626,471 in Q420 versus revenue of $2,051,382 in Q419, a growth rate of 174% year-over-year;

|

|

|

■

|

Net

Income of $1,296,988 in Q420 versus net income (loss) of ($1,049,237) in Q419, a growth rate of 224% year-over-year;

|

|

|

■

|

Earnings

per Share of $.05 per share in Q420 versus net income (loss) of ($.04) per share in Q419, a growth rate of 225% year-over-year;

|

|

|

■

|

Company’s

Board of Directors approved the repurchase for redemption of 104,715 shares of common stock for $26,178 or $0.25 per share in a privately

negotiated transaction. The redemption has been completed and the shares of common stock cancelled;

|

|

|

■

|

Implemented

rebranding to Selectis Health;

|

|

|

■

|

Addition

of new CFO, Brandon Thall;

|

|

|

■

|

Completion

of the 29 Bed Acquisition of Fairland Family Care.

|

YEAR-END

2020 HIGHLIGHTS

|

|

■

|

Record

revenue for the Year-End 2020 of $20,928,698 versus revenues of $6,929,988 in 2019, a growth rate of 202% year-over-year;

|

|

|

■

|

Net

Income of $2,925,820 for the Year-End 2020 versus net income (Loss) of ($891,614) in 2019, a growth rate of 428% year-over-year;

|

|

|

■

|

Earnings

Per Share for the Year-End 2020 of $0.11 per share basic and diluted versus (Loss) of ($0.03) in 2019, a growth rate of 467%.

|

|

|

■

|

Net

increase in cash of $2,985,790 to a cash balance of $3,978,303 including restricted cash for the fourth quarter, a 301% percent increase

from Year-End 2019 of $992,513;

|

|

|

■

|

Court

approved operations transfer agreement to the Company’s wholly owned subsidiary Global Eastman, LLC as the operator of the

Dodge Eastman facility;

|

|

|

■

|

Company

received a line of credit of $500,000 and a construction loan of $750,000 to be used for renovation and capital investment in its

Park Place facility from Southern Bank, both loans carry an interest rate of 4.75% on the principal balance;

|

|

|

■

|

Company’s

Board of Directors approved the repurchase for redemption of 548,146 total shares of common stock for $101,563 or at an average cost

of $0.185 per share in privately negotiated transactions. The redemptions have been completed and the shares of common stock cancelled;

|

|

|

■

|

Purchased

$402,000 of 13% mezzanine debt notes owed by Goodwill Hunting, LLC;

|

|

|

■

|

Purchase

of 86 bed Quapaw Higher Call acquisition.

|

“The

Covid-19 pandemic presented historic headwinds to the healthcare industry and the Company in 2020. During the year, we implemented innumerable

special protocols at our facilities to ensure our residents continued to have access to a higher quality of care. Despite significant

challenges, I am proud to announce that we also delivered excellent financial results highlighted by record revenue and net income in

both the fourth quarter and fiscal 2020 for our stakeholders,” said Lance Baller, CEO of Selectis Health. “For the majority

of 2020, we were able to avoid much of the Covid-19 exposure that many of our competitors experienced. However, in early December, we

did see an significant increase in cases in all our facilities. While conditions have improved, we anticipate a relatively flat first

quarter of 2021. The successful rollout of the Covid-19 vaccines is helping to provide a well-deserved tailwind to our business, and

the healthcare industry in general. We are determined to remain vigilant in our efforts to deliver safe, effective care to our residents.

Additionally, as we continue to transition our business model and increase our footprint of healthcare facilities, we expect to deliver

stronger financial performance across our entire portfolio in the coming year. We are pleased with the foundation of improved financial

metrics and patient care that we laid for the Company in 2020. We expect to build on these successes in 2021.”

Total

Revenue

For

the year ended December 31, 2020, total revenue increased 202% to $20.93 million, compared to $6.93 million for the comparable period

in 2019. The higher total revenue reflects our focus on our transition to our healthcare business model.

Net

Income

For

the year ended December 31, 2020, net income was $2.93 million, or $0.11 per diluted share, compared to a net loss of $(892 thousand),

or a loss of ($0.03) per diluted share, for the full year 2019.

For

the full year 2020, the Company’s EPS was $0.11 and normalized after-tax margin was 16.1%.

General

and Administrative Expense Ratio

For

the year ended December 31, 2020, the G&A ratio was 2.0% compared to 31.3% in 2019. The full year 2020 normalized G&A ratio was

10.2%. This improvement reflects disciplined cost management and the benefits of scale produced by the Company’s growth.

Balance

Sheet

Cash

and investments at the Company amounted to $4.00 million as of December 31, 2020, compared to $1.02 million as of December 31, 2019.

In

2020, the Company’s Board of Directors approved the repurchase for redemption of 548,146 shares of common stock for $101,563 at

an average cost of $0.1853 per share in privately negotiated transactions. The redemptions have been completed and the shares of common

stock cancelled.

Cash

Flow

Operating

cash flow for the year ended December 31, 2020, amounted to $3.98 million, compared to $992.5 thousand for December 31, 2019, an increase

of 301%. This is primarily due to strong operating results, cash flow timing in 2020, and the net impact of timing differences in governmental

receivables and payables.

Conference

Call

Management

will host a conference call to discuss Selectis Health’s fourth quarter and year-end 2020 results at 11:00 a.m. Eastern Daylight

Time on Thursday, April 1, 2021. The number to call for the interactive teleconference is (877) 407-0789 and the confirmation

number is 13718277. A telephonic replay of the call will be available after 2:00 p.m. Eastern Daylight Time on the same day through

Thursday April 8, 2021., by dialing (844) 512-2921 and entering the confirmation number 13718277.

SUMMARY

OF FOURTH QUARTER AND YEAR-END 2020 RESULTS

GLOBAL

HEALTHCARE REIT, INC.

CONSOLIDATED BALANCE SHEETS

(AUDITED)

|

|

|

December

31, 2020

|

|

|

December

31, 2019

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Property and Equipment, Net

|

|

$

|

38,238,367

|

|

|

$

|

36,394,587

|

|

|

Cash and Cash Equivalents

|

|

|

3,567,437

|

|

|

|

641,215

|

|

|

Restricted Cash

|

|

|

410,866

|

|

|

|

351,298

|

|

|

Accounts Receivable, Net

|

|

|

1,931,569

|

|

|

|

1,188,100

|

|

|

Investments in Debt Securities

|

|

|

24,387

|

|

|

|

24,387

|

|

|

Intangible Assets

|

|

|

-

|

|

|

|

15,258

|

|

|

Goodwill

|

|

|

1,076,908

|

|

|

|

379,479

|

|

|

Prepaid Expenses and

Other

|

|

|

682,949

|

|

|

|

883,839

|

|

|

Total Assets

|

|

$

|

45,932,483

|

|

|

$

|

39,878,163

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY

|

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

Debt, Net of discount of $452,593 and $493,353,

respectively

|

|

$

|

38,129,600

|

|

|

$

|

36,954,184

|

|

|

Debt – Related Parties, Net of discount

of $3,234 and $0, respectively

|

|

|

1,121,766

|

|

|

|

1,025,000

|

|

|

Accounts Payable and Accrued Liabilities

|

|

|

3,196,178

|

|

|

|

1,241,573

|

|

|

Accounts Payable – Related Parties

|

|

|

9,900

|

|

|

|

32,156

|

|

|

Dividends Payable

|

|

|

7,500

|

|

|

|

7,500

|

|

|

Derivative Liability

|

|

|

-

|

|

|

|

-

|

|

|

Lease Security Deposit

|

|

|

251,600

|

|

|

|

251,100

|

|

|

Total Liabilities

|

|

|

42,716,544

|

|

|

|

39,511,513

|

|

|

Commitments and Contingencies

|

|

|

|

|

|

|

|

|

|

Equity

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Preferred Stock:

|

|

|

|

|

|

|

|

|

|

Series A - No Dividends, $2.00 Stated Value,

Non-Voting; 2,000,000 Shares Authorized, 200,500 Shares Issued and Outstanding

|

|

|

401,000

|

|

|

|

401,000

|

|

|

Series D - 8% Cumulative, Convertible, $1.00

Stated Value, Non-Voting; 1,000,000 Shares Authorized, 375,000 Shares Issued and Outstanding

|

|

|

375,000

|

|

|

|

375,000

|

|

|

Common Stock - $0.05 Par Value; 50,000,000

Shares Authorized, 26,866,379 and 27,441,040 Shares Issued and Outstanding at June 30, 2020 and December 31, 2019, respectively

|

|

|

1,343,319

|

|

|

|

1,372,052

|

|

|

Prepaid Stock Compensation

|

|

|

-

|

|

|

|

-

|

|

|

Additional Paid-In Capital

|

|

|

10,331,065

|

|

|

|

10,385,417

|

|

|

Accumulated Deficit

|

|

|

(9,036,400

|

)

|

|

|

(11,962,220

|

)

|

|

Total Global Healthcare REIT, Inc. Stockholders’

Equity

|

|

|

3,413,984

|

|

|

|

571,249

|

|

|

Noncontrolling Interests

|

|

|

(198,045

|

)

|

|

|

(204,599

|

)

|

|

Total Equity

|

|

|

3,215,939

|

|

|

|

366,650

|

|

|

Total Liabilities and Equity

|

|

$

|

45,932,483

|

|

|

$

|

39,878,163

|

|

GLOBAL

HEALTHCARE REIT, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(AUDITED)

|

|

|

Twelve Months

Ended

|

|

|

Three Months

Ended

|

|

|

|

|

December

31,

|

|

|

December

31,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

2020

|

|

|

2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental Revenue

|

|

$

|

2,112,459

|

|

|

$

|

3,267,644

|

|

|

$

|

483,555

|

|

|

$

|

478,424

|

|

|

Healthcare Revenue

|

|

|

18,816,239

|

|

|

|

3,662,344

|

|

|

|

5,142,916

|

|

|

|

1,572,958

|

|

|

Total Revenue

|

|

|

20,928,698

|

|

|

|

6,929,988

|

|

|

|

5,626,471

|

|

|

|

2,051,382

|

|

|

Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and Administrative

|

|

|

2,088,722

|

|

|

|

1,298,593

|

|

|

|

365,569

|

|

|

|

407,562

|

|

|

Property Taxes, Insurance and Other Operating

|

|

|

13,384,322

|

|

|

|

2,760,227

|

|

|

|

4,626,520

|

|

|

|

1,163,392

|

|

|

Provision for Bad Debt

|

|

|

292,529

|

|

|

|

155,833

|

|

|

|

62,730

|

|

|

|

155,833

|

|

|

Acquisition Costs

|

|

|

207,899

|

|

|

|

62,882

|

|

|

|

(2,047

|

)

|

|

|

56,111

|

|

|

Depreciation

|

|

|

1,580,300

|

|

|

|

1,351,810

|

|

|

|

405,401

|

|

|

|

381,976

|

|

|

Total Expenses

|

|

|

17,553,772

|

|

|

|

5,629,345

|

|

|

|

5,458,173

|

|

|

|

2,164,874

|

|

|

Income

(Loss) from Operations

|

|

|

3,374,926

|

|

|

|

1,300,643

|

|

|

|

168,298

|

|

|

|

(113,492

|

)

|

|

Other (Income) Expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on Warrant Liability

|

|

|

-

|

|

|

|

(2,785

|

)

|

|

|

-

|

|

|

|

-

|

|

|

(Gain) Loss on Extinguishment of Debt

|

|

|

(1,727,349

|

)

|

|

|

-

|

|

|

|

(1,646,949

|

)

|

|

|

-

|

|

|

(Gain) Loss on Sale of Investments

|

|

|

-

|

|

|

|

(1,069

|

)

|

|

|

-

|

|

|

|

-

|

|

|

Gain on Proceeds from Insurance Claim

|

|

|

-

|

|

|

|

(158,161

|

)

|

|

|

-

|

|

|

|

165,857

|

|

|

Loss on Write-Off of Note Receivable

|

|

|

-

|

|

|

|

250,000

|

|

|

|

-

|

|

|

|

250,000

|

|

|

Interest Income

|

|

|

(465

|

)

|

|

|

(56,012

|

)

|

|

|

-

|

|

|

|

(29,764

|

)

|

|

Interest Expense

|

|

|

2,140,366

|

|

|

|

2,136,701

|

|

|

|

507,364

|

|

|

|

541,338

|

|

|

Total Other (Income)

Expense

|

|

|

412,552

|

|

|

|

2,168,674

|

|

|

|

(1,139,585

|

)

|

|

|

927,431

|

|

|

Net Income (Loss)

|

|

|

2,962,374

|

|

|

|

(868,031

|

)

|

|

|

1,307,883

|

|

|

|

(1,040,923

|

)

|

|

Net Loss Attributable

to Noncontrolling Interests

|

|

|

(6,554

|

)

|

|

|

6,417

|

|

|

|

(3,395

|

)

|

|

|

(814

|

)

|

|

Net Income (Loss) Attributable

to Global Healthcare REIT, Inc.

|

|

|

2,955,820

|

|

|

|

(861,614

|

)

|

|

|

1,304,488

|

|

|

|

(1,041,737

|

)

|

|

Series D Preferred Dividends

|

|

|

(30,000

|

)

|

|

|

(30,000

|

)

|

|

|

(7,500

|

)

|

|

|

(7,500

|

)

|

|

Net Income (Loss) Attributable

to Common Stockholders

|

|

$

|

2,925,820

|

|

|

$

|

(891,614

|

)

|

|

$

|

1,296,988

|

|

|

$

|

(1,049,237

|

)

|

|

Per Share Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) per Share

Attributable to Common Stockholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

0.11

|

|

|

$

|

(0.03

|

)

|

|

$

|

0.05

|

|

|

$

|

(0.04

|

)

|

|

Diluted

|

|

$

|

0.11

|

|

|

$

|

(0.03

|

)

|

|

$

|

0.05

|

|

|

$

|

(0.04

|

)

|

|

Weighted Average Common Shares Outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

27,247,531

|

|

|

|

27,282,385

|

|

|

|

26,916,460

|

|

|

|

27,441,040

|

|

|

Diluted

|

|

|

27,630,031

|

|

|

|

27,282,385

|

|

|

|

27,298,960

|

|

|

|

27,441,040

|

|

Forward

Looking Statements

This

earnings release and the Company’s accompanying oral remarks contain forward-looking statements regarding its 2021 guidance, as

well as its plans, expectations, and the Company’s expectations regarding future developments. Actual results could differ materially

due to numerous known and unknown risks as well as uncertainties. These risks and uncertainties are discussed under the headings “Forward-Looking

Statements,” and “Risk Factors,” in the Company’s Annual Report on Form 10-K for the year ended December 31,

2019, and also in its Quarterly Reports on Form 10-Q for the periods ended March 31, 2020, June 30, 2020, and September 30, 2020, which

are on file with the SEC. Additional information will also be set forth in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2020.

These

reports can be accessed under the investor relations tab of the Company’s website or on the SEC’s website at sec.gov . Given

these risks and uncertainties, the Company can give no assurances that its forward-looking statements will prove to be accurate, or that

any other results or developments projected or contemplated by its forward-looking statements will in fact occur, and the Company cautions

investors not to place undue reliance on these statements. All forward-looking statements in this release represent the Company’s

judgment as of the date of this release, except as otherwise required by law, the Company disclaims any obligation to update any forward-looking

statement to conform the statement to actual results or changes in its expectations.

The

information in this Current Report on Form 8-K furnished pursuant to Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to liability under that section, and they shall not be deemed incorporated by reference in any filing under the Securities Act of 1933,

as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. By filing this Current

Report on Form 8-K and furnishing this information pursuant to Item 7.01, the Company makes no admission as to the materiality of any

information in this Current Report on Form 8-K, including Exhibit 99.1, that is required to be disclosed solely by Regulation FD.

ITEM

9.01: EXHIBITS

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

|

|

Global

Healthcare REIT, Inc.

(Registrant)

|

|

|

|

|

Dated:

March 31, 2021

|

/s/

Christopher R. Barker

|

|

|

Christopher

R. Barker, President and COO

|

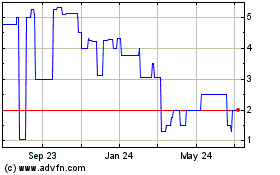

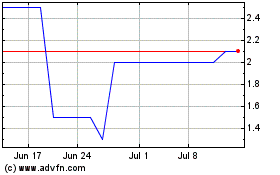

Selectis Health (PK) (USOTC:GBCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Selectis Health (PK) (USOTC:GBCS)

Historical Stock Chart

From Apr 2023 to Apr 2024