Nextech AR

(OTCQB: NEXCF) Doubling Sales –

Emerging Growth Report

Miami, FL - (March 24, 2021) – EmergingGrowth.com, a

leading independent small cap media portal with an extensive

history of providing unparalleled content for the Emerging Growth

markets and companies, reports on NexTech AR Solutions

(OTCQB: NEXCF).

Get the Full Report on EmergingGrowth.com

NexTech AR Solutions(OTCQB: NEXCF) is a Discount That Won't Last

Forever

Rarely do the markets print a valuation mismatch like what

you're seeing with NEXCF stock

Easily one of the most paradigm-shifting events that have

occurred in the trailing two decades was the advent of e-commerce.

With the innovation of connectivity that the internet engendered,

it was now possible to facilitate multiple transactions that

traditionally occurred face-to-face through online platforms.

Moving forward, NexTech AR

Solutions (OTCQB: NEXCF) stands poised to fill the opportunity

gaps that currently exist in the digitalization ecosystem.

Fundamentally and financially, NexTech AR makes a strong

argument that it's one of the most undervalued investments in the

digital transformation space. Still, groundbreaking companies like

this don't stay under-the-radar for long, which is why you'll want

to consider NEXCF stock now.

According to the Harvard Business Review, augmented reality is

defined as a set of technologies that superimposes digital data and images on the physical

world. This is distinct from virtual reality, where such

systems project images within an artificially manufactured

environment – hence the VR headsets.

By integrating AR platforms with current retail channels,

NexTech AR brings comprehensive product evangelism to the

transactional edge. With the consumers' questions and concerns

answered, they only need to hit the "buy" button.

It's no wonder that according to some expert sources, the

augmented reality industry could hit $72 billion by 2024 and

skyrocket to over $340

billion globally by 2028.

One of the hallmark features of the augmented reality market and

the broader digital transformation movement is that they embody

full-spectrum solutions.

As NexTech AR's management team puts it, we're hurtling toward

an ecosystem where we can:

- Work from home – Due to the disruptive impact of the novel

coronavirus pandemic, millions were forced to operate remotely.

Generally speaking, this baptism under fire has functioned

remarkably well given the circumstances. And as the Wall

Street Journal pointed out, we could see a hybrid

home/office work model, further incentivizing development

of remote connectivity platforms.

- Learn from home – Amid the usual rancor in Washington, a

particular issue has captured the public's attention and that is

student debt forgiveness. This raging debates points to the

ultimate fact that for many households, higher education is

increasingly out of reach. But with its remote education solutions,

NexTech AR can sharply mitigate costs while helping to deliver

quality programs and curriculum safely.

- Shop from home – In 2020, e-commerce sales will bring in $3.914 trillion

globally. Some experts predict that by 2024, this market

will reach $6.3 trillion worldwide. As explained earlier, NexTech's

integrated solutions bring consumer education to the edge of

transaction, fostering significantly improved sales for its

corporate clients.

Get the Full Report on EmergingGrowth.com

As such, NexTech AR has a favorable valuation profile that

should not be ignored. Over the trailing-12-month period, NexTech

has delivered $20.2 million in bookings +233% 2019 $6 million

total. Moreover, the company has a very low float compared to its

rivals, with only 75.2 million shares outstanding and 2.2 million

unexercised warrants.

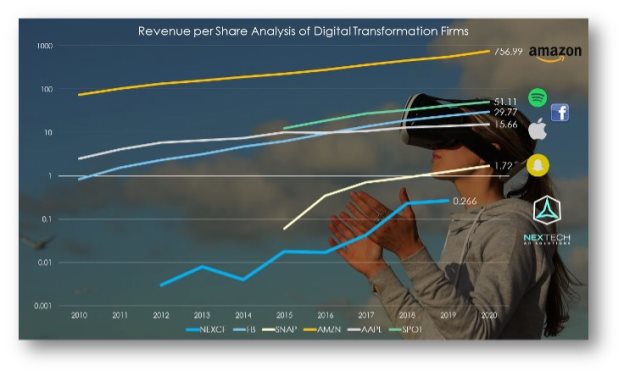

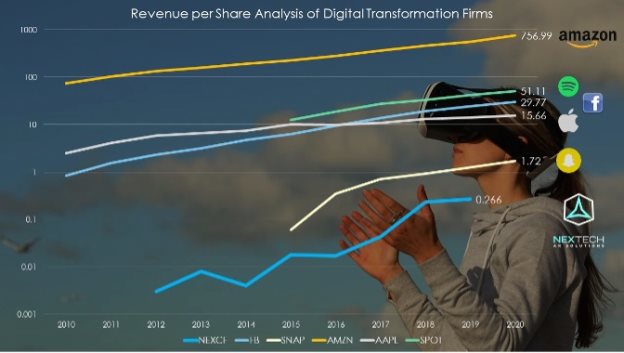

As of the latest data, we're looking at a revenue per share

for NEXCF stock of 0.15, up approximately 67%

from the prior year. To see how this stacks up, consider the

following stats:

- Amazon's RPS is 757 times with 503 million shares

outstanding

- Spotify (NYSE: SPOT) trades at 51-times revenue with 189.6

million shares outstanding

- Facebook (NASDAQ: FB) trades at 29.8-times revenue with 2.4

billion shares outstanding

- Apple (NASDAQ: AAPL) trades at 15.7-times revenue with 16.8

billion shares outstanding

- Snap (NYSE: SNAP) trades at 1.72-times revenue with 1.25

billion shares outstanding

To be fair, you generally want to see a stock trade at some

multiple of revenue – of course, the higher this metric, the more

sales each unit of equity is tied to. However, having this ratio

get too high can turn off many investors, who don't see as much

growth opportunities. For instance, it's hard to imagine Amazon at

757-times revenue expanding much more until it reaches a maturation

point, if it hasn't done so already.

To be fair, you generally want to see a stock trade at some

multiple of revenue – of course, the higher this metric, the more

sales each unit of equity is tied to. However, having this ratio

get too high can turn off many investors, who don't see as much

growth opportunities. For instance, it's hard to imagine Amazon at

757-times revenue expanding much more until it reaches a maturation

point, if it hasn't done so already.

Also, most of these companies have a much broader base of shares

outstanding. Spotify comes the closest to NexTech AR with a little

under 200 million shares outstanding. But because of its meteoric

financial growth, it's possible that SPOT shares are getting

stretched.

For instance, between 2018 and 2019, revenue per share grew by

nearly 26%. But from 2019 to last year, RPS growth slipped to 23%.

Plus, Spotify is a well-known entity, accruing significant investor

interest. At some point, though, growth investors start to look for

much more viable opportunities.

That's why NEXCF stock is particularly exciting. With

a time of writing market cap of only 384 million CAD (approximately

$307.6 million USD), you're really getting into a pure-play AR

investment at a fraction of the valuation of the alpha dogs.

The fact of the matter is that roughly 97%

of Facebook revenue comes from selling advertisements. Even

with Facebook's push toward AR/VR solutions, it's merely a drop in

the bucket for FB stock.

In contrast, NEXCF stock is geared toward everything

AR. Yes, that has its risks – you've got to be aware of that. But

if you believe in the burgeoning AR and digital transformation

market, one that collectively will haul in trillions of dollars,

NexTech represents one of the very few plays where you can accrue a

windfall, not a pittance, from this industry's growth

trajectory.

And on a critical sidenote, NEXCF stock isn't just undervalued

relative to publicly traded companies – or even the AR industry

specifically. Due to the terrible Covid-19 pandemic, millions of

workers have been forced to work from home. Though new coronavirus

cases have declined sharply this year, the Wall Street

Journal reports that a mass

scale return to the office remains in limbo.

Naturally, this means teleconferencing and virtual event

platforms – an area which NexTech also specializes in, offering

unique synergies through its AR innovations – still reigns

supreme.

This has sparked intense competition in the space,

with Hopin being one of the top

competitors to NexTech AR. Recently, Hopin announced that it closed

a $400 million Series C private funding round, which places its

valuation between $5 billion and $6 billion.

Prior to the Series C funding, rumors suggested that Hopin could

go public via a special purpose acquisition company or SPAC.

However, one of the drawbacks regarding SPACs is that their

sponsors typically receive about 20% equity in the eventually

combined entity, which is incredibly dilutive for shareholders.

Therefore, many companies that go the SPAC route eventually fizzle

out.

Now, with significant demand in the private funding space, it's

possible that Hopin will go public via a traditional initial public

offering, with a potential target of 2022 or 2023.

One of the beautiful things about NEXCF stock is that it hasn't yet absorbed

this manic influx of investor dollars. However, it's very possible

that it might. In its recent corporate presentation, management

disclosed that it's awaiting approval for listing NEXCF shares on

the Nasdaq exchange. If that goes

through, there's a great chance that more eyeballs will assess this

opportunity.

When they do, they'll likely key in on the AR industry potential

and the valuation profile of NexTech AR Solutions, auguring well

for NEXCF stock. But you'll want to consider

getting in now before the big wave of buyers do.

Get the Full Report on EmergingGrowth.com

Other Companies in the news and featured on

EmergingGrowth.com

Cytodyn, Inc.

Shares of Cytodyn, Inc. (OTCQB: CYDY) gapped down on March 8th and

have been trending around the $2.40 mark ever

since. The space has been severely beaten

down especially yesterday but Cytodyn held its ground. Look

for a rebound once the sector as a whole

turns positive. Support is currently around $2.00.

Humbl, Inc.

Shares of Humbl, Inc. (OTC Pink: TSNPD) have been upticking since the

announcement of the Aurea Group Ventures investment nearly

30%. That being said, volume is slowing in the stock and

pending market conditions, the shares could stabilize here before

moving higher.

Amarin Corp.

Shares of Amarin Corp. (NASDAQ: AMRN) traded down 7% yesterday with the rest of

the biotech stocks. It has support at around 5.40 but as they

closed on a downtrend, the industry could see some more red

today.

Gamestop Corp.

Gamestop Corp (NYSE: GME) saw a decline of 20% in the aftermarket

yesterday after announcing earnings. This stock has room to

fall to $86, and then has support around $38.50 which wold break

the 200 EMA.

Keep an eye on Nextech AR Solutions (OTCQB: NEXCF). The CEO purchased shares 5

times in 2020, and once already in 2021. This could be the

next short squeeze and Zacks

Investment Research Valuation of Nextech AR (OTCQB: NEXCF) $8.60

per share.

About Nextech AR

Nextech is one of the leaders in the rapidly

growing Augmented

Reality market estimated to grow from USD $10.7B in 2019 and

projected to reach USD $72.7B by 2024 according to Markets &

Markets Research; it is expected to grow at a CAGR of 46.6% from

2019 to 2024.

The company is pursuing four

verticals:

Virtual Experience Platform (VXP): An advanced

Augmented Reality and Video Learning Experience Platform for

Events, is a SaaS video platform that integrates Interactive Video,

Artificial Intelligence and Augmented Reality in one secure

platform to allow enterprises the ability to create the world's

most engaging virtual event management and learning experiences.

Automated closed captions and translations to over 64 languages.

According to Grandview

Research the global virtual events market in 2020 is $90B and

expected to reach more than $400B by 2027, growing at a 23%

CAGR. With Nextech's VXP platform having augmented

reality, AI, end-to-end encryption, and built-in language

translation for 64 languages, the company is well positioned to

rapidly take market share as the growth accelerates globally.

ARitize™ For eCommerce: The company launched its

SaaS platform for webAR in eCommerce early in 2019. Nextech has a

'full funnel' end-to-end eCommerce solution for the AR industry

including its Aritize360 app for 3D product capture, 3D/AR ads, its

ARitize white label app, its 'Try it On' technology for online

apparel, 3D and 360-degree product views, and 'one click buy'.

ARitize™ 3D/AR Advertising Platform: Launched in Q1

2020 the ad platform will be the industry's first end-to-end

solution whereby the company will leverage its 3D asset creation

into 3D/AR ads. In 2019, according to IDC, global advertising spend

will be about $725 billion.

ARitize™ Hollywood Studios: The studio is in development

producing immersive content using 360 video, and augmented reality

as the primary display platform.

Certain information contained herein may constitute

"forward-looking information" under Canadian securities

legislation. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as, "will

be", "looking forward" or variations of such words and phrases or

statements that certain actions, events, or results "will" occur.

Forward-looking statements regarding the Company increasing

investors awareness are based on the Company's estimates and are

subject to known and unknown risks, uncertainties and other factors

that may cause the actual results, levels of activity, performance,

or achievements of Nextech to be materially different from those

expressed or implied by such forward-looking statements or

forward-looking information, including capital expenditures and

other costs. There can be no assurance that such

statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking statements and forward-looking information. Nextech

will not update any forward-looking statements or forward-looking

information that are incorporated by reference herein, except as

required by applicable securities laws.

About EmergingGrowth.com

Through its evolution, EmergingGrowth.com found a niche in

identifying companies that can be overlooked by the markets. We

look for strong management, innovation, strategy, execution, and

the overall potential for long- term growth. Aside from being a

trusted resource for the Emerging Growth info-seekers, we are well

known for discovering undervalued companies and bringing them to

the attention of the investment community. Through our parent

Company, we also have the ability to facilitate road shows to

present your products and services to the most influential

investment banks in the space.

All information contained herein as well as on

the EmergingGrowth.com website

is obtained from sources believed to be reliable but not guaranteed

to be accurate or all-inclusive. All material is for informational

purposes only, is not the opinion of EmergingGrowth.com and

should not be construed as an offer or solicitation to buy or sell

securities. The information includes certain forward-looking

statements, which may be affected by unforeseen circumstances and /

or certain risks. This report is not

without bias. EmergingGrowth.com has

motivation by means of either self-marketing

or EmergingGrowth.com has been

compensated by or for a company or companies discussed in this

article. EmergingGrowth.com is

compensated two thousand five hundred dollars per month in exchange

for posting press releases and other content

on EmergingGrowth.com beginning

January 19, 2021 and EmergingGrowth.com has also

been compensated additionally for the production and distribution

of a media campaign. EmergingGrowth.com may receive additional

compensation for Nextech AR Solutions and full details of which can

be found here: https://emerginggrowth.com/27286-32336/. EmergingGrowth.com will not

advise if and when its relationship with this company will

end. You can easily lose money

investing in highly speculative small cap stocks like the ones

mentioned within. Please consult an investment professional before

investing in anything viewed within.

When EmergingGrowth.com is

long shares it will sell those shares.

In addition, please make sure you read and understand the Terms of

Use, Privacy Policy and the Disclosure posted on

the EmergingGrowth.com website.

CONTACT:

Company: EmergingGrowth.com - http://www.EmergingGrowth.com

Contact Email: info@EmergingGrowth.com

SOURCE: EmergingGrowth.com