As filed with the Securities and Exchange Commission on March 22,

2021

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

RETO

ECO-SOLUTIONS, INC.

(Exact name of registrant as specified in

its charter)

Not Applicable

(Translation of Registrant’s Name

into English)

|

British Virgin Islands

|

|

3290

|

|

Not Applicable

|

|

(State or other jurisdiction of

|

|

(Primary Standard Industrial

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Classification Code Number)

|

|

Identification Number)

|

c/o Beijing REIT Technology Development

Co., Ltd.

X-702, 60 Anli Road, Chaoyang District,

Beijing

People’s Republic of China 100101

(+86) 10-64827328– telephone

(Address, including zip code, and telephone

number,

including area code, of principal executive

offices)

Vcorp Agent Services, Inc.

25 Robert Pitt Dr., Suite 204

Monsey, New York 10952

(888) 528-2677

(Name, address, including zip code, and

telephone

number, including area code, of agent for

service)

Copies to:

|

William S. Rosenstadt, Esq.

Mengyi “Jason” Ye, Esq.

Yarona L. Yieh, Esq.

Ortoli Rosenstadt LLP

366 Madison Avenue – 3rd Floor

New York, New York 10017

(212)-588-0022

|

Approximate date of commencement of proposed

sale to public: As soon as practicable after this registration statement becomes effective.

If any securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following

box. ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares

its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B)

of the Securities Act. ☐

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION

STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT

WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF

THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT

TO SAID SECTION 8(A), MAY DETERMINE.

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Amount to be

Registered(1)

|

|

|

Proposed

Maximum

Offering

Price

Per Share(2)

|

|

|

Proposed

Maximum

Aggregate

Offering

Price(2)

|

|

|

Amount of

Registration

Fee

|

|

|

Common shares, par value $0.001 per share (underlying convertible debentures)

|

|

|

4,600,000

|

|

|

$

|

1.81

|

|

|

$

|

8,326,000

|

|

|

$

|

908.37

|

|

|

Total

|

|

|

4,600,000

|

|

|

$

|

1.81

|

|

|

$

|

8,326,000

|

|

|

$

|

908.37

|

|

|

|

(1)

|

Common shares that may be

offered pursuant to this registration statement consist of shares that may be issuable upon conversion of convertible debentures

issued in a private placement on March 1, 2021 and issuable in the future. For purposes of estimating the number of common shares

to be included in this registration statement, we included 4,600,000 shares, representing the maximum number of common shares

issuable upon conversion in full of the outstanding convertible debentures and the maximum amount of interest thereof (utilizing

the Floor Price included in such notes) issued pursuant to that certain Securities Purchase Agreement dated as of March 1, 2021

(without regard to any limitations on conversion). Pursuant to Rule 416 of the Securities Act of 1933, this Registration Statement

includes an indeterminate number of additional shares as may be issuable as a result of share splits or share dividends which

occur during this continuous offering.

|

|

|

(2)

|

The proposed maximum offering

price per share is estimated solely for the purpose of calculating the registration fee for this offering pursuant to Rule 457(c)

under the Securities Act of 1933, as amended (the “Securities Act”), using the closing price of $1.81 by the NASDAQ

Stock Market on March 18, 2021.

|

The information

in this prospectus is not complete and may be changed. These securities may not be resold until the registration statement filed

with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is

not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS

|

SUBJECT TO COMPLETION

DATED March [*], 2021

|

RETO ECO-SOLUTIONS,

INC.

Issuance of up to 4,600,000 Common Shares

Upon the Conversion of Convertible Debentures

This prospectus relates to the offer and

sale, from time to time, of up to 4,600,000 common shares of Reto Eco-Solutions, Inc. (the “Company”, “we”,

“us” and “our”) by the shareholder named in the section of this prospectus entitled “Selling Shareholder”.

The common shares being offered by the selling shareholder may be issued upon the conversion of convertible debentures on March

1, 2021 (and accrued interest thereon) issued pursuant to a securities purchase agreement that we entered into with the selling

shareholder on March 1, 2021 (the “Securities Purchase Agreement”).

We are not selling any common shares in

this offering, and we will not receive any proceeds from the sale of shares by the selling shareholder.

Our common shares

are listed on the Nasdaq Capital Market under the symbol “RETO”. On March 18, 2021, the last reported sale price of

our common shares on the Nasdaq Capital Market was $1.81 per share, and on March 18, 2021, we had 24,135,000 common shares outstanding.

The selling shareholder

may offer all or part of the shares for resale from time to time through public or private transactions, at either prevailing market

prices or at privately negotiated prices.

This prospectus provides

a general description of the securities being offered. You should this prospectus and the registration statement of which it forms

a part before you invest in any securities.

Investing in our

common shares involves substantial risks. See “Risk Factors” beginning on page 6 of this prospectus to read about important

factors you should consider before purchasing common shares.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the

adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2021.

TABLE

OF CONTENTS

You should rely only on the information

contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by or on our

behalf. Neither we, nor the selling shareholder, have authorized any other person to provide you with different or additional information.

Neither we, nor the selling shareholder, take responsibility for, nor can we provide assurance as to the reliability of, any other

information that others may provide. The selling shareholder is not making an offer to sell these securities in any jurisdiction

where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this

prospectus or such other date stated in this prospectus, and our business, financial condition, results of operations and/or prospects

may have changed since those dates.

Except as otherwise

set forth in this prospectus, neither we nor the selling shareholder has taken any action to permit a public offering of these

securities outside the United States or to permit the possession or distribution of this prospectus outside the United States.

Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions

relating to the offering of these securities and the distribution of this prospectus outside the United States.

Conventions Used in this Prospectus

In this prospectus,

unless otherwise specified or the context otherwise requires:

The

terms “we,” “us,” “Company” “our company,” and “our” refers to ReTo

Eco-Solutions, Inc. and its subsidiaries;

|

|

●

|

ReTo Eco-Solutions, Inc. (“ReTo Eco-Solutions”), a British Virgin Islands holding company;

|

|

|

●

|

REIT Holdings (China) Limited (“REIT Holdings”), a Hong Kong limited company and a wholly owned subsidiary of ReTo Eco-Solutions;

|

|

|

●

|

Beijing REIT Technology Development Co., Ltd. (“Beijing REIT”), a China limited company and a wholly owned subsidiary of REIT Holdings;

|

|

|

●

|

Xinyi REIT Ecological Technology Co., Ltd. (“REIT Ecological”), a China limited company and a wholly owned subsidiary of REIT Holdings, and was deregistered on March 27, 2019;

|

|

|

●

|

Beijing REIT Ecological Engineering and Technology Co., Ltd. (“REIT Eco Engineering”), a China limited company and a wholly owned subsidiary of Beijing REIT;

|

|

|

●

|

Langfang Ruirong Mechanical and Electrical Equipment Co., Ltd.(“Ruirong”), a China limited company and a wholly owned subsidiary of Beijing REIT;

|

|

|

●

|

Nanjing Dingxuan Environment Protection Technology Development Co., Ltd. (“Dingxuan”), a China limited company and a wholly owned subsidiary of Beijing REIT;

|

|

|

●

|

REIT Technology Development (America), Inc.(“REIT US”), a California corporation and a wholly owned subsidiary of Beijing REIT;

|

|

|

●

|

REIT MingSheng Environment Protection Construction Materials (Changjiang) Co., Ltd. (“REIT Changjiang”), a China limited company and 84.32% owned by Beijing REIT and 15.68% owned by REIT Holdings;

|

|

|

●

|

Hainan REIT Construction Project Co., Ltd. (“REIT Construction”), a China limited company and a wholly owned subsidiary of REIT Changjiang;

|

|

|

●

|

Horgos Ta-REIT Environment Technology Co., Ltd. (“Horgos Ta-REIT”), a China limited company and a wholly owned subsidiary of REIT Eco Engineering, and was deregistered on May 15, 2019;

|

|

|

●

|

REIT Xinyi New Material Co., Ltd (“REIT Xinyi”), a China limited company and a 70% owned subsidiary of Beijing REIT;

|

|

|

●

|

REIT Q GREEN Machines Private Limited (“REIT India”), an India limited company and a 51% owned subsidiary of Beijing REIT;

|

|

|

●

|

REIT Ecological Technology Co., Ltd. (“REIT Yancheng”), a China limited company and a wholly owned subsidiary of REIT Holdings;

|

|

|

|

|

|

|

●

|

Lingqiu REIT Dongtian Ecological Technology Co., Ltd. (“REIT Lingqiu”), a China limited company, 51% equity interest of which was owned by REIT Eco Engineering and then transferred to Pengqing Zhi on November 4, 2019;

|

|

|

|

|

|

|

●

|

Datong Ruisheng Environment Protection Engineering Co., Ltd. (“Datong Ruisheng”), a China limited company and a wholly owned subsidiary of REIT Eco Engineering;

|

|

|

|

|

|

|

●

|

Yunnan Litu Technology Development Co., Ltd. (“Yunnan Litu”), a China limited company, 55% equity interest of which was owned by REIT Yancheng and then transferred to Dali Zhongrong Ruitu Environmental Protection Engineering Co., Ltd., Jiangsu Xinchun Biological Technology Co., Ltd., and Yonglan Li on July 13, 2020;

|

|

|

|

|

|

|

●

|

Yangbi Litu Ecological Technology Co., Ltd. (“Yangbi Litu”), a China limited company, with 55% of its equity interest owned by REIT Yancheng and 45% of its equity interest owned by Yunnan Litu;

|

|

|

|

|

|

|

●

|

China Operating Companies or China Operating Company refer to, collectively or individually, as the case may be, to Beijing REIT, REIT Ecological, REIT Eco Engineering, Ruirong, Dingxuan, REIT Changjiang, REIT Construction, , REIT Xinyi, and REIT Yancheng.

|

|

|

●

|

“shares” and “common shares” refer to our common shares, $0.001 par value per share;

|

|

|

●

|

“China” and “PRC” refer to the People’s Republic of China,

excluding, for the purposes of this annual report only, Macau, Taiwan and Hong Kong;

|

|

|

●

|

“BVI Act” means the BVI Business Companies Act 2004;

and

|

|

|

●

|

all references to “RMB,” and “Renminbi” are to the legal currency of China, and all references to “USD,” and “U.S. Dollars” are to the legal currency of the United States.

|

For the sake of clarity, this prospectus follows the English

naming convention of first name followed by last name, regardless of whether an individual’s name is Chinese or English.

For example, the name of our chief executive officer will be presented as “Hengfang Li”, even though, in Chinese, his

name would be presented as “Li Hengfang”.

PROSPECTUS SUMMARY

This

summary highlights selected information contained elsewhere, or incorporated by reference, in this prospectus. Because this is

only a summary, it does not contain all the information that may be important to you. You should read the entire prospectus carefully,

especially “Risk Factors” and “Operating and Financial Review and Prospects” in the following documents

which we incorporate by reference:

|

|

●

|

our Annual Report on Form 20-F for the fiscal year ended December 31, 2019, filed with the SEC on October 30, 2020 (the “2019 Annual Report”)

|

|

|

|

|

|

|

●

|

our interim financial report on Form 6-K for the six months ended June 30, 2020, filed with the SEC on December 22, 2020 (the “2019 Annual Report”)

|

and our consolidated

financial statements and related notes and other information incorporated by reference in this prospectus, before deciding to invest

in our common shares.

Our Company

We are a manufacturer and distributor of

eco-friendly construction materials (aggregates, bricks, pavers and tiles), made from mining waste (iron tailings) and fly-ash,

as well as equipment used for the production of these eco-friendly construction materials. In addition, we provide consultation,

design, project implementation and construction of urban ecological environments. We also provide parts, engineering support, consulting,

technical advice and service, and other project-related solutions for our manufacturing equipment and environmental protection

projects.

We believe our products are eco-friendly,

as they contain approximately 70% of reclaimed fly-ash and iron tailings in place of traditional cement. The use of reclaimed fly-ash

and iron tailings assists in the protection of the environment by saving space in landfills and fly-ash ponds used for the disposal

of these materials, and assisting in the remediation and reclamation of abandoned or closed mining sites. In addition, our eco-friendly

construction materials consume less energy during manufacturing than other traditional building materials. We believe our eco-friendly

construction materials, with their characteristics, including superior water permeability, and competitive prices, are in greater

demand than traditional materials as governments and others increase their focus on reducing the environmental impact of their

activities.

Presently, our clients are located throughout

mainland China, and internationally in Canada, the United States, Mongolia, the Middle East, India, North Africa and Brazil. We

seek to establish long-term relationships with our clients by producing and delivering high-quality products and equipment and

then providing technical support and consulting after equipment is delivered and projects are completed. We engage in marketing

and sales through integrated marketing, services marketing and Internet marketing. We are actively pursuing additional markets

for our products, equipment and projects, internationally in the Philippines, Laos, Morocco, Tunisia, Cuba, Kenya, Maldives, Argentina,

Mexico and Malaysia and in additional provinces of China.

Beijing REIT was founded in 1999 by our

Chief Executive Officer, Hengfang Li. Mr. Li has approximately 20 years of experience in the construction materials and construction

materials manufacturing equipment industries. Our principal office is located in Beijing, China. As of October, 2020, we employed

47 people on a full-time basis. We have 5 employees in management, 5 employees in sales and marketing, 5 employees in research

and development, 7 employees in manufacturing and installation and 17 employees in administration.

We are able to provide a full spectrum of

products and services, from producing eco-friendly construction materials and manufacturing equipment used to produce construction

materials, to project installation. We utilize our research and development efforts to differentiate us from our competitors. For

example, we released our first fully automatic block production line in 1999, and have made advances in our technology, such as

intelligent automatic systems, which allows us to access our customers’ equipment remotely to troubleshoot problems. Some

of our competitors do not have automatic production lines.

Due to China’s recent emphasis on

environmental protection, we believe there is a unique opportunity to grow our company, which we expect will be driven by demand

for our eco-friendly construction materials, equipment used to produce these materials and project construction expertise. We believe

our technological know-how, production capacity, reputation and services offered will enable us to seize this opportunity.

We have received several industry awards

and been asked to participate in several industry activities. Notable awards and activities include:

|

|

●

|

Beijing REIT’s fully automatic solid waste disposal production line became recommended equipment of Liaoning Provincial Wall Material Industry Association in 2007;

|

|

|

●

|

Beijing REIT’s brick production equipment was appraised as “China Famous Brand” by China Construction and Material Industrial Mechanic Standards Committee in 2007;

|

|

|

●

|

Beijing REIT’s concrete brick equipment was authenticated by the European Union CE (European conformity);

|

|

|

●

|

REIT Holdings became a member of the China Resource Reuse Association Wall Material Innovation Committee in 2010;

|

|

|

●

|

Beijing REIT was recognized as a National High-Tech Enterprise and became a “Gazelle Enterprise” in Beijing Zhongguancun Technology Park;

|

|

|

●

|

Beijing REIT was recognized as a National High-Tech Enterprise in 2011;

|

|

|

●

|

Beijing REIT was awarded the “Most Valuable Brand Award” by China Building Materials and Mechanic Industry Association in 2011;

|

|

|

●

|

Beijing REIT was appraised as “AAAA Enterprise” by the Electric Mechanics Association in 2012;

|

|

|

●

|

Beijing REIT became a member of China Association of Urban Environmental Sanitation in 2013; and

|

|

|

●

|

ISO 9001:2000 Authentication (certification based upon quality and consistency).

|

In addition,

our Chief Executive Officer, Hengfang Li, was named one of the “One Hundred Outstanding People of China” in 2005 by

China Celebrity Association. Mr. Li was recognized as one of the “Influential People of Fly-Ash Industry” in 2006 by

fenmeihui.org. Mr. Li was awarded as “Leader of Building Materials and Machinery Enterprises of the National 11 th 5-Year

Plan” in 2011 by China Building Material Machinery Association. In addition, Mr. Li and our chief technology officer, Mr.

Zhizhong Hu were recognized as “Advanced People of National Reuse Technology” in 2011 by China Association of Circular

Economy. We believe our industry awards, reflect widespread recognition of our stature and success in our industry as well as the

quality of our service and products.

Recent Developments

Securities Purchase Agreement

On

March 1, 2021, the Company entered into a securities purchase agreement (the “Agreement”) with an accredited investor

(the “Debenture Holder”) to place a Convertible Debenture (the “Debenture”) with a maturity date of twelve

months after the issuance thereof in the aggregate principal amount of up to $2,300,000 (the “Transaction”), provided

that in case of an event of default, the Debenture may become at the Debenture Holder’s election immediately due and payable.

In addition, the Company paid to an affiliate of the Debenture Holder a fee equal to 3.5% of the amount of the Debenture and a

one-time due diligence and structuring fee of $10,000 at the closing.

The

Debenture Holder may convert the Debenture in its sole discretion to Company’s common shares at any time at the lower

of $2.50 or 95% of the average of the two lowest daily VWAPs during the ten consecutive trading days immediately preceding

the conversion date or other date of determination, provided that the conversion price may not be less than $0.50 (the “Floor Price”). The

Debenture Holder may not convert any portion of a Debenture if such conversion would result in the Debenture Holder

beneficially owning more than 4.99% of Company’s then issued and common shares, provided that such limitation may be

waived by the Debenture Holder with 65 days’ notice. Any time after the issuance of a Debenture that the daily VWAP is

less than the Floor Price for a period of 10 consecutive trading days (each such occurrence, a “Triggering

Event”) and only for so long as such conditions exist after a Triggering Event, the Company shall make monthly payments

beginning on the 30th day after the date of the Triggering Event. Each monthly payment shall be in an amount

equal to the sum of (i) the principal amount outstanding as of the date of the Triggering Event divided by the number of such

monthly payments until maturity, (ii) a redemption premium of 20% of such principal amount and (iii) accrued and unpaid

interest hereunder as of each payment date.

Change of Independent Accounting Firm

On March 15, 2021,

the “Company dismissed its independent registered public accounting firm, Friedman LLP (“Friedman”). The report

of Friedman on the financial statements of the Company for the fiscal years ended December 31, 2019 and 2018, and the related statements

of operations and comprehensive income (loss), changes in shareholders’ equity (deficit), and cash flows for the fiscal years

ended December 31, 2019 and 2018 did not contain an adverse opinion or disclaimer of opinion and were not qualified or modified

as to uncertainty, audit scope or accounting principles, except that the audit report on the financial statements of the Company

for the year ended December 31, 2019 contained an uncertainty about the Company’s ability to continue as a going concern.

The decision to change the independent registered public accounting firm was recommended and approved by the Audit Committee of

the Company. From the time of Friedman’s engagement up to March 15, 2021, the date of dismissal, (a) there were no disagreements

with Friedman on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure,

which disagreements, if not resolved to the satisfaction of Friedman, would have caused it to make reference thereto in its reports

on the financial statements for such years and (b) there were no “reportable events” as described in Item 304(a)(1)(v)

of Regulation S-K. On March 15, 2021, the Audit Committee approved the appointment of YCM CPA Inc. (“YCM”) as its new

independent registered public accounting firm to audit and review the Company’s financial statements. During the two most

recent fiscal years ended December 31, 2020 and December 31, 2019 and any subsequent interim periods through the date hereof prior

to the engagement of Friedman, neither the Company, nor someone on its behalf, has consulted YCM regarding either i) the application

of accounting principles to a specified transaction, either completed or proposed or the type of audit opinion that might be rendered

on the Company’s consolidated financial statements, and either a written report was provided to the Company or oral advice

was provided that the new independent registered public accounting firm concluded was an important factor considered by the Company

in reaching a decision as to the accounting, auditing or financial reporting issue; or ii) any matter that was either the subject

of a disagreement as defined in paragraph 304(a)(1)(iv) of Regulation S-K or a reportable event as described in paragraph 304(a)(1)(v)

of Regulation S-K.

Regain Nasdaq compliance

As previously

reported, on September 4, 2020, the Company received a letter from the Listings Qualifications Department of The Nasdaq

Capital Market (“Nasdaq”) notifying the Company that the minimum closing bid price per share for its common

shares was below $1.00 for a period of 30 consecutive business days and that the Company did not meet the minimum bid price

requirement set forth in Nasdaq Listing Rule 5550(a)(2). The Company was provided

with 180 days, or until April 19, 2021, to regain compliance with

the Rule. As a result of the Company’s common shares closing with a bid price of at least $1.00

for 18 consecutive days from February 4 through March 2, 2021, on March 3, 2021, Nasdaq notified the Company that

it has regained compliance with Listing Rule 5550(a)(2) and the matter is now closed.

Corporate Information

We are a British Virgin Islands business company and conduct

business in China through subsidiaries in China. The principal executive offices of our main operations are located at Building

X-702, 60 Anli Road, Chaoyang District, Beijing, People’s Republic of China 100101. Our telephone number at this address

is (+86) 10-64827328. Our registered office in the British Virgin Islands is at the offices of Vistra (BVI) Limited at Vistra Corporate

Services Centre, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin Islands. Our agent for service of process in the United States

is Vcorp Agent Services, Inc. located at 25 Robert Pitt Dr., Suite 204, Monsey, New York 10952. Our corporate website

is www.retoeco.com.

Implications of Being an Emerging Growth Company

We qualify as and elect

to be an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012, or the JOBS Act.

An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally

to public companies. These provisions include, but not limited to:

|

|

●

|

Reduced disclosure about

the emerging growth company’s executive compensation arrangements in our periodic reports, proxy statements and registration

statements; and

|

|

|

●

|

an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002.

|

We may take advantage of these provisions for up to five years

or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have

more than $1.0 billion in annual revenue, have more than $700 million in market value of our common shares held by non-affiliates

or issue more than $1.0 billion of non-convertible debt over a three-year period. Except for our consolidated balance sheets, which

we include for the fiscal years ended December 31, 2017, 2018 and 2019, we have decided to include three years of audited

financial statements and three years of related management’s discussion and analysis of financial condition and results of

operations disclosure.

Implication of Being a Foreign Private Issuer

We are a foreign private

issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

|

|

●

|

we are not required to provide as many Exchange Act reports or provide periodic and current reports as frequently, as a domestic public company;

|

|

|

●

|

for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies;

|

|

|

●

|

we are not required to provide the same level of disclosure on certain issues, such as executive compensation;

|

|

|

●

|

we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information;

|

|

|

●

|

we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and

|

|

|

●

|

we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction.

|

The Offering

|

Common shares offered by selling shareholder

|

|

Up to 4,600,000 common shares

|

|

|

|

|

|

Voting rights

|

|

One vote per common share

|

|

|

|

|

|

Selling shareholder

|

|

YA II PN, Ltd. See “Selling Shareholder”

|

|

|

|

|

|

Common shares outstanding

|

|

24,135,000 common shares

|

|

|

|

|

|

Common shares outstanding after the offering

|

|

Up to 28,735,000 common shares

|

|

|

|

|

|

Nasdaq Capital Market symbol

|

|

RETO

|

|

|

|

|

|

Discount

|

|

The Convertible Debentures are convertible by the selling shareholder upon issuance. The conversion price will be lower of $2.50 or 95% of the average of the two lowest daily VWAPs during the ten consecutive trading days immediately preceding the conversion date or other date of determination, provided that the conversion price may not be less than $0.50.

|

|

|

|

|

|

Amortization Payment:

|

|

If, any time after the issuance of the Convertible Debenture, the daily VWAP is less than $0.50 for a period of 10 consecutive trading days (each such occurrence, a “Triggering Event”) and only for so long as such conditions exist after a Triggering Event, the Company shall make monthly payments beginning on the 30th day after the date of the Triggering Event. Each monthly payment shall be in an amount equal to the sum of (i) the principal amount outstanding as of the date of the Triggering Event divided by the number of such monthly payments until maturity, (ii) a redemption premium of 20% of such principal amount and (iii) accrued and unpaid interest hereunder as of each payment date.

|

|

Interest Rate:

|

|

The rate of interest on the Convertible Debentures will be 5% per annum, and may be increased to 15% upon an event of default that remains uncured under the Convertible Debentures.

|

|

|

|

|

|

Use of Proceeds

|

|

We will not receive any proceeds from the sale of shares by the selling shareholder. As of the date hereof, we received $2,300,000 from the sale of a Convertible Debenture to the selling shareholder under the Securities Purchase Agreement (prior to accounting for due diligence and structuring fees of $10,000 and commitment of $80,500). These proceeds will be used for general corporate and working capital or other purposes that our Board of Directors deems to be in our best interest. As of the date of this prospectus, we cannot specify with certainty the particular use for the net proceeds we may receive. Accordingly, we will retain broad discretion over the use of these proceeds, if any.

|

|

|

|

|

|

Risk Factors

|

|

The investment of our common shares involve substantial risks. See “Risk Factors” in this prospectus and under “Item 3. Key Information—D. Risk factors” in the 2019 Annual Report, incorporated by reference herein, and other information included or incorporated by reference in this prospectus for a discussion of factors you should carefully consider before investing in our common shares.

|

|

|

|

|

|

Dividend policy

|

|

We have never paid or declared any cash dividends on our shares, and we do not anticipate paying any cash dividends on our common shares in the foreseeable future. See “Dividend Policy.”

|

RISK FACTORS

You should carefully consider the risks

incorporated by reference in this prospectus before making an investment decision. You should also consider the matters described

below and in “Risk Factors” in “Item 3. Key Information—D. Risk factors” in the 2019 Annual Report,

and all of the information included or incorporated by reference in this prospectus before deciding whether to purchase our common

shares. Our business, financial condition and results of operations could be materially and adversely affected by any of these

risks or uncertainties. In that case, the trading price of our common shares could decline, and you may lose all or part of your

investment. The risks also include forward-looking statements and our actual results may differ substantially from those discussed

in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements.”

We do not currently have sufficient funds to repay our

outstanding notes.

On

December 31, 2020, we had approximately $9,745,098 outstanding loans and interest due and only $897,281 of cash or cash equivalents

on hand. As of such date, we were not in a position to repay the principal and interest on our outstanding loans. The funds we

receive from the additional sales of convertible debentures will be less than the amounts that will become due on them. If the

selling shareholder does not elect to convert the Convertible Debentures, we will not have sufficient funds to repay the principal

and interest due on such notes, and we will be forced to raise additional funds (which, if possible, may not be on acceptable terms),

sell assets (which may not be possible) or cease operations.

The conversion of the Convertible

Debentures or future sales of our common shares may further dilute the common shares and adversely impact the price of our common

shares.

As of March 22, 2021,

our transfer agent had recorded approximately 18,346,714 of our common shares as unrestricted and freely tradable. Upon the

effectiveness of the registration statement of which this prospectus forms a part, up to an additional 4,600,000 shares (approximately

18.92% of our issued and outstanding shares on the date hereof) will be unrestricted and freely tradeable. If the holders of our

free trading shares wanted to make a profit on their investment (or if they wish to sell for a loss), there might not be enough

purchasers to maintain the market price of our common shares on the date of such sales. Any such sales, or the fear of such sales,

could substantially decrease the market price of our common shares and the value of your investment.

We have a limited trading history.

On November 28, 2017,

our common shares began trading on the Nasdaq Capital Market. Prior to that, there was no public market for our common shares.

Our trading history might never improve in terms of price or volume. We cannot guarantee that our common shares will remain quoted

on the Nasdaq Capital Market.

MARKET

AND INDUSTRY DATA

This prospectus and

the documents incorporated by reference herein contain industry, market and competitive position data that are based on industry

publications and studies conducted by third parties as well as our own internal estimates and research. These industry publications

and third-party studies generally state that the information that they contain has been obtained from sources believed to be reliable,

although they do not guarantee the accuracy or completeness of such information.

CAUTIONARY NOTE

REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions

for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”),

and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other

than statements of historical facts contained in this prospectus, including, without limitation, statements regarding our future

results of operations and financial position, business strategy, transformation, strategic priorities and future progress, are

forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may

cause our actual results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by the forward-looking statements.

In

some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,”

“expect,” “plan,” “anticipate,” “could,” “intend,” “project,”

“believe,” “estimate” or “predict” “or the negative of these terms or other similar expressions.

The forward-looking statements in this prospectus are only predictions. We have based these forward-looking statements largely

on our current expectations and projections about future events and financial trends that we believe may affect our business, financial

condition and results of operations. These forward-looking statements speak only as of the date of this prospectus and are subject

to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements,

including the factors described in the sections entitled “Risk Factors” and/or “Operating and Financial Review

and Prospects” in the 2019 Annual Report incorporated by reference herein. Because forward-looking statements are inherently

subject to risks and uncertainties, you should not rely on these forward-looking statements as predictions of future events. Except

as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether

as a result of any new information, future events, changed circumstances or otherwise.

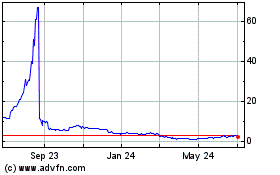

MARKET PRICE AND TRADING HISTORY

Our common shares are listed on the Nasdaq

Capital Market under the symbol “RETO”. The following table sets forth, for the periods indicated, the high and low

bid prices of our common shares on the Nasdaq Capital Market.

|

|

|

High

|

|

|

Low

|

|

|

Fiscal Year Ended December 31, 2021

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

3.66

|

|

|

$

|

0.67

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended December 31, 2019

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

1.65

|

|

|

$

|

0.30

|

|

|

Second Quarter

|

|

$

|

1.68

|

|

|

$

|

0.41

|

|

|

Third Quarter

|

|

$

|

1.92

|

|

|

$

|

0.42

|

|

|

Fourth Quarter

|

|

$

|

0.87

|

|

|

$

|

0.47

|

|

The last reported sales price for our common shares on the Nasdaq

Capital Market as of March 18, 2021, was $1.81 per share. As of March 18, 2021, we had 24,135,000 shares of

$0.001 par value common shares issued and outstanding. Our Transfer Agent is Vstock Transfer LLC, 18 Lafayette Pl, Woodmere,

NY 11598.

USE

OF PROCEEDS

We will not receive any proceeds from the sale of shares by

the selling shareholder. As of the date hereof, we received $2,300,000 from the sale of a Convertible Debenture to the selling

shareholder under the Securities Purchase Agreement (prior to accounting for the one-time due diligence and structuring fees of

$10,000 and a fee equal to 3.5% of the amount of each Convertible Debenture at each closing). These proceeds will be used for general

corporate and working capital or other purposes that our Board of Directors deems to be in our best interest. As of the date

of this prospectus, we cannot specify with certainty the particular use for the net proceeds we may receive. Accordingly,

we will retain broad discretion over the use of these proceeds, if any.

Amount of Proceeds

from Sale of Convertible Debentures

Upon the effectiveness

of the registration statement of which this prospectus forms a part, we will have sold an aggregate of $2,300,000 of Convertible

Debentures. In connection with those sales, we will have paid $80,500 in commitment fees to the selling shareholder as well as

a due diligence fee of $10,000 for net proceeds of $2,209,500. We may be required to make additional payments to the selling shareholder.

The following table set out the payments we have made and may have to make in connection with the sale of $2,300,000 of Convertible

Debentures.

|

Commitment Fee (1)

|

|

$

|

80,500

|

|

|

Interest Payments (2)

|

|

$

|

115,000

|

|

|

Due Diligence Fee

|

|

$

|

10,000

|

|

|

Redemption Premium (3)

|

|

$

|

460,000

|

|

|

Total:

|

|

$

|

665,500

|

|

|

|

(1)

|

We

pay the selling shareholder a commitment fee of 3.5% of the principal amount of the Convertible Debenture.

|

|

|

(2)

|

Each Convertible Debenture

matures one year from its issuance and bears interest at a rate of 5% per annum.

|

|

|

(3)

|

We are required to pay

a redemption premium in two circumstances. If we redeem the Convertible Debentures prior to the maturity, we must pay a redemption

fee equal to 20% of the principal amount being redeemed thereafter. Alternatively, we are required to make monthly payments after

the issuance of a Debenture if the daily VWAP is less than $0.50 for a period of ten consecutive trading days (the “Triggering

Date”). Each monthly payment shall be in an amount equal to the sum of (i) the principal amount outstanding as of

the Triggering Date divided by the number of such monthly payments until maturity, (ii)

a redemption premium of 20% of such principal amount and (iii) accrued and unpaid interest hereunder as of each payment date.

The maximum value of both redemption premiums is $460,000.

|

We have not made, and do not need to make, any payments to any

affiliate of the selling shareholder, or any person with whom the selling shareholder has a contractual relationship.

The

following sets forth upon the issuance of $2,300,000 of Convertible Debentures, the gross proceeds paid or payable to us in connection

with our issuance of the Convertible Debentures, all payments that have been made or that may be required to be made by us in connection

with the issuance of the Convertible Debentures, our resulting net proceeds and the combined total possible profit to be realized

as a result of any conversion discounts regarding the common shares underlying the Convertible Debentures.

|

Gross proceeds to the Company

|

|

$

|

2,300,000

|

|

|

|

|

|

|

|

|

All payments that have been made or that may be required to be made by the Company to the selling shareholder in the first year of the Convertible Debentures

|

|

$

|

665,500

|

|

|

|

|

|

|

|

|

Net proceeds to the Company if we make all such payments to the selling shareholder

|

|

$

|

1,634,500

|

|

|

|

|

|

|

|

|

All payments that have been made or that may be required to be made by the Company to the selling shareholder in the first year of the Convertible Debentures as a percentage of net proceeds

|

|

|

40.72

|

%

|

SELLING

SHAREHOLDER

The common shares

being offered by the selling shareholder are those issuable to the selling shareholder upon conversion of the Convertible Debentures.

We are registering the common shares in order to permit the selling shareholder to offer the shares for resale from time to time.

Except for the ownership of the Convertible Debentures and entry into the Securities Purchase Agreement, the selling shareholder

has not had any material relationship with us within the past three years.

The table below

lists the selling shareholder and other information regarding the beneficial ownership (as determined under Section 13(d) of the

Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder) of the common shares held by the selling

shareholder. The second column lists the number of common shares beneficially owned by the selling shareholder as of December 18,

2019, assuming conversion of the Convertible Debentures but not taking account of any limitations on conversion and exercise set

forth therein.

The third column

lists the common shares being offered by this prospectus by the selling shareholder and does not take in account any limitations

on conversion of the Convertible Debentures set forth therein.

The fourth column

assumes the sale of all of the shares offered by the selling shareholder pursuant to this prospectus.

Under the terms

of the Convertible Debentures and the Securities Purchase Agreement, the selling shareholder may not convert the Convertible Debentures

and we may not exercise the puts under the Securities Purchase Agreement to the extent (but only to the extent) such selling shareholder

or any of its affiliates would beneficially own a number of common shares which would exceed 4.99% of the total common shares issued

and outstanding as of the execution date of the Securities Purchase Agreement. The number of shares in the second column reflects

these limitations. The selling shareholder may sell all, some or none of its shares in this offering. See “Plan

of Distribution”.

|

Name of Selling Shareholder

|

|

Number of

Common

Shares

Owned

Prior to

Offering

|

|

|

Maximum

Number of

Common

Shares to

be Sold

Pursuant

to this

Prospectus (2)

|

|

|

Number of

Common

Shares

Owned

After

Offering

|

|

|

Number of

Common

Shares that

May Be

Sold in

This Offering As A

Percentage of

Currently

Outstanding

Shares (3)

|

|

|

Percentage of

Common

Shares

Owned

After the

Offering (4)

|

|

|

YA II PN, LTD. (1)

|

|

|

0

|

|

|

|

4,600,000

|

|

|

|

0

|

|

|

|

18.92

|

%

|

|

|

0

|

%

|

|

|

(1)

|

YA II PN, Ltd. (“YA”)

is the investor under the Securities Purchase Agreement. Yorkville Advisors Global, LP (“Yorkville LP”) is YA II PN,

Ltd.’s. investment manager and Yorkville Advisors Global II, LLC (“Yorkville LLC”) is the General Partner of

Yorkville LP. All investment decisions for YA are made by Yorkville LLC’s President and Managing Member, Mr. Mark Angelo.

The address of YA is 1012 Springfield Avenue, Mountainside, NJ 07092, Attention: Mark Angelo, Portfolio Manager.

|

|

|

(2)

|

Includes common shares underlying

the Convertible Debentures that may held by the selling shareholder that are covered by this prospectus, including any such securities

that, due to contractual restrictions, may not be exercisable if such conversion or put would result in beneficial ownership greater

than 4.99%.

|

|

|

(3)

|

Assumes that the total number of our issued and outstanding common

shares remains unchanged at 24,135,000 prior to the issuance of the common shares underlying the Convertible Debentures.

If all of the shares are sold pursuant to this offering and the total number of our issued and outstanding common shares otherwise

remains unchanged at 24,135,000, such shares sold in this offering shall equal approximately 18.92% of the then issued outstanding

common shares.

|

|

|

(4)

|

Assumes that the selling

shareholder sells all of the common shares underlying the Convertible Debentures offered pursuant to this prospectus.

|

Additional Selling Shareholder Information

|

Number of Shares outstanding prior to the Convertible Debentures transaction held by persons other than the selling shareholder, affiliates of the Company, and affiliates of the selling shareholder

|

|

|

24,135,000

|

|

|

Number of Shares registered for resale by the selling shareholder or affiliates of the selling shareholder in prior registration statements

|

|

|

0

|

|

|

Number of Shares registered for resale by the selling shareholder or affiliates of the selling shareholder that continue to be held by the selling shareholder or affiliates of the selling shareholder

|

|

|

0

|

|

|

Number of Shares that have been sold in registered resale transactions by the selling shareholder or affiliates of the selling shareholder

|

|

|

0

|

|

|

Number of Shares registered for resale on behalf of the selling shareholder or affiliates of the selling shareholder in the current transaction

|

|

|

4,600,000

|

|

DIVIDEND POLICY

We have never declared or paid any cash

dividends on our common shares. We anticipate that we will retain any earnings to support operations and to finance the growth

and development of our business. Therefore, we do not expect to pay cash dividends in the foreseeable future. Any future determination

relating to our dividend policy will be made at the discretion of our board of directors and will depend on a number of factors,

including future earnings, capital requirements, financial conditions and future prospects and other factors the board of directors

may deem relevant.

Under British Virgin Islands law, we may

only pay a dividend if our directors are satisfied, on reasonable grounds, that, immediately after the dividend is paid, the value

of our assets will exceed our liabilities and we will be able to pay our debts as they fall due.

If we determine to pay dividends on any

of our common shares in the future, as a holding company, we will be dependent on receipt of funds from Beijing REIT, REIT Ecological

and REIT Yancheng. Current Chinese regulations permit our China Operating Companies to pay dividends to REIT Holdings only out

of their accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. Further, two

loans governing part of the current debts incurred by Beijing REIT and REIT Changjiang have restrictions on their abilities to

pay dividends, and any future financing arrangements may impose such restrictions as well. In addition, each of our subsidiaries

in China is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such

reserve reaches 50% of its registered capital. Our China Operating Companies are also required to further set aside a portion of

its after-tax profits to fund the employee welfare fund, although the amount to be set aside, if any, is determined at the discretion

of its board of directors. Although the statutory reserves can be used, among other ways, to increase the registered capital and

eliminate future losses in excess of retained earnings of the respective companies, the reserve funds are not distributable as

cash dividends except in the event of liquidation. Our subsidiaries in China are required to set aside statutory reserves and have

done so.

In addition, pursuant to the China Enterprise

Income Tax Law (“EIT Law”) and its implementation rules, dividends generated after January 1, 2008 and distributed

to us by Beijing REIT, REIT Ecological and REIT Yancheng are subject to withholding tax at a rate of 10% unless otherwise exempted

or reduced according to treaties or arrangements between the Chinese central government and governments of other countries or regions

where the non-Chinese-resident enterprises are incorporated.

Under existing Chinese foreign exchange

regulations, payments of current account items, including profit distributions, interest payments and trade and service-related

foreign exchange transactions, can be made in foreign currencies without prior approval of the State Administration of Foreign

Exchange, or SAFE, by complying with certain procedural requirements. Specifically, under the existing exchange restrictions, without

prior approval of SAFE, cash generated from the operations in China may be used to pay dividends to our company.

DESCRIPTION OF COMMON SHARES

We were incorporated as a BVI business company

under the BVI Act in the British Virgin Islands on August 7, 2015 under the name “ReTo Eco-Solutions, Inc.” and with

company number 1885527. As of the date of this prospectus, we are authorized to issue up to 200,000,000 common shares of $0.001

par value per share.

The following are summaries of the material

provisions of our Memorandum and Articles of Association that will be in force at the time of the closing of this offering and

the BVI Act, insofar as they relate to the material terms of our common shares. Copies of our Memorandum and Articles of Association

are filed as exhibits to the registration statement of which this prospectus is a part.

Common Shares

General

All of our issued common shares are fully

paid and non-assessable. Each shareholder is entitled, on request, to a certificate for that shareholder’s shares. Our shareholders

who are non-residents of the British Virgin Islands may freely hold and vote their common shares. At the completion of this offering,

there will be 22,340,000 common shares issued and outstanding. If the underwriters exercise in full their option to purchase additional

common shares from us, at the completion of this offering, there would be 22,760,000 common shares issued and outstanding.

Listing

We have received approval to list our common

shares on the NASDAQ Capital Market under the symbol “RETO” provided that we pay the balance of our entry fee and show

that we will have 300 round-lot shareholders prior to our first day of trading. We cannot guarantee that we will be successful

in listing the common shares; however, we will not complete this offering unless we are so listed.

Transfer Agent and Registrar

The transfer agent and registrar for the

common shares is Vstock Transfer, LLC, 18 Lafayette Place, Woodmere, New York 11598.

Distributions

The holders of our common shares are entitled to such dividends

as may be declared by our board of directors, subject to the BVI Act and our Memorandum and Articles of Association.

Voting rights

Any action required or permitted to be taken by the shareholders

must be effected at a duly called meeting of the shareholders entitled to vote on such action or by a resolution in writing. At

each general meeting, each shareholder who is present in person or by proxy (or, in the case of a shareholder being a corporation,

by its duly authorized representative) will have one vote for each common share which such shareholder holds. Cumulative voting

is not a concept that is accepted as a common practice in the British Virgin Islands, and we have made no provisions in our Memorandum

or Articles of Association to allow cumulative voting for elections of directors.

Directors

Our directors are not required to hold a share as a qualification

for office. With regards to conflicts of interest, any director who is interested in a transaction into which we have entered or

will enter may vote on a matter relating to that transaction as long as he or she has disclosed the interest to each other director.

Meetings of shareholders

Any director may convene a meeting of the

shareholders at any time and in any manner or place which he or she considers necessary or desirable. The director convening a

meeting must give at least seven days’ notice of the meeting to those persons whose names appear as shareholders in our register

of shareholders on the date of the notice and are entitled to vote at the meeting and also to the other directors. Our board of

directors shall call a special meeting upon the written request of shareholders holding at least 30% of our outstanding voting

shares. A meeting of shareholders held in contravention of the requirement to give notice is valid if shareholders holding at least

90 percent of the total voting rights on all the matters to be considered at the meeting have waived notice of the meeting and,

for this purpose, the presence of a shareholder at the meeting shall constitute waiver in relation to all the shares which that

shareholder holds.

At any meeting of shareholders, a quorum

will be present if there are shareholders present in person or by proxy representing not less than on 1/3 of the issued common

shares entitled to vote on the resolutions to be considered at the meeting. Such quorum may be represented by only a single shareholder

or proxy. If no quorum is present within two hours of the start time of the meeting, the meeting shall be dissolved if it was requested

by shareholders. In any other case, the meeting shall be adjourned to the next business day, and if shareholders representing not

less than one-third of the votes of the common shares or each class of shares entitled to vote on the matters to be considered

at the meeting are present within one hour of the start time of the adjourned meeting, a quorum will be present. No business may

be transacted at any general meeting unless a quorum is present at the commencement of business. If present, the chairman of our

board of directors shall preside as the chairman at any meeting of the shareholders.

A corporation that is a shareholder shall

be deemed for the purposes of our Memorandum and Articles of Association to be present in person if represented by its duly authorized

representative. This duly authorized representative shall be entitled to exercise the same powers on behalf of the corporation

which he represents as that corporation could exercise if it were our individual shareholder.

Protection of minority shareholders

We would normally expect British Virgin

Islands courts to follow English case law precedents, which permit a minority shareholder to commence a representative action,

or derivative action in our name, to challenge (1) an act which is ultra vires or illegal, (2) an act which constitutes a fraud

against the minority by parties in control of us, (3) an act which constitutes an infringement of the individual rights of a shareholder,

such as the right to vote and pre-emptive rights and (4) an irregularity in the passing of a resolution which requires the consent

of a certain majority of the shareholders.

Pre-emptive rights

There are no pre-emptive rights applicable

to the issue by us of new common shares under either British Virgin Islands law or our Memorandum and Articles of Association.

Transfer of common shares

Subject to the restrictions in our Memorandum

and Articles of Association, the lock-up agreements with the representative of the underwriters described in “Shares Eligible

for Future Sale—Lock-Up Agreements” and applicable securities laws, any of our shareholders may transfer all or any

of his or her common shares by written instrument of transfer signed by the transferor and containing the name and address of the

transferee, which must be sent us for registration. Our board of directors may resolve by resolution to refuse or delay the registration

of the transfer of any common share. If our board of directors resolves to refuse or delay any transfer of any common share, it

shall specify the reasons for such refusal or delay in the resolution. Our directors may not resolve or refuse or delay the transfer

of a common share unless the person transferring the shares has failed to pay any amount due in respect of any of that common share.

Liquidation

If we are wound up and the assets available

for distribution among our shareholders are more than sufficient to repay all amounts paid to us on account of the issue of shares

immediately prior to the winding up, the excess shall be distributable pari passu among those shareholders in

proportion to the amount paid up immediately prior to the winding up on the shares held by them, respectively. If we are wound

up and the assets available for distribution among the shareholders as such are insufficient to repay the whole of the amounts

paid to us on account of the issue of shares, those assets shall be distributed so that, to the greatest extent possible, the losses

shall be borne by the shareholders in proportion to the amounts paid up immediately prior to the winding up on the shares held

by them, respectively. If we are wound up, the liquidator appointed by us may, in accordance with the BVI Act, divide among our

shareholders in specie or kind the whole or any part of our assets (whether they shall consist of property of the same kind or

not) and may, for such purpose, set such value as the liquidator deems fair upon any property to be divided and may determine how

such division shall be carried out as between the shareholders or different classes of shareholders.

Calls on common shares and forfeiture

of common shares

Our board of directors may from time to

time make calls upon shareholders for any amounts unpaid on their common shares in a notice served to such shareholders at least

fourteen days prior to the date of payment specified in that notice. Common shares that have been subject to a notice of call and

remain unpaid are subject to forfeiture.

Redemption of common shares

Subject to the provisions of the BVI

Act, we may issue shares on terms that they are subject to redemption, at our option or at the option of the holders, on such

terms and in such manner as may be determined by our Memorandum and Articles of Association and subject to any applicable

requirements imposed from time to time by the BVI Act, the SEC, the NASDAQ Capital Market, or by any recognized stock

exchange on which our securities are listed.

Modifications of rights

All or any of the special rights attached

to any class of shares may, subject to the provisions of the BVI Act, be amended only pursuant to a resolution passed at a meeting

by the holders of not less than fifty percent of the issued shares in that class.

Changes in the number of shares we

are authorized to issue and those in issue

We may from time to time by resolution of

our board of directors:

|

|

●

|

amend our Memorandum of Association to increase or decrease the maximum number of shares we are authorized to issue;

|

|

|

●

|

subject to our Memorandum of Association and the BVI Act, divide our authorized and issued shares into a larger number of shares; and

|

|

|

●

|

subject to our Memorandum of Association, combine our authorized and issued shares into a smaller number of shares.

|

Untraceable shareholders

Our Memorandum and Articles of Association do

not entitle us to sell the shares of a shareholder who is untraceable.

Inspection of books and records

Under British Virgin Islands Law, holders

of our common shares are entitled, upon giving written notice to us, to inspect (i) our Memorandum and Articles of Association

(our charter), (ii) our register of shareholders, (iii) our register of directors and (iv) minutes of meetings and resolutions

of members (shareholders), and to make copies of, and take extracts from, these documents and records. However, our directors can

refuse access if they are satisfied that to allow such access would be contrary to our interests. See “Where You Can Find

More Information.”

Rights of non-resident or foreign

shareholders

There are no limitations imposed by our

Memorandum or Articles of Association (together, our charter) on the rights of non-resident or foreign shareholders to hold or

exercise voting rights on our shares. In addition, there are no provisions in our Memorandum or Articles of Association governing

the ownership threshold above which shareholder ownership must be disclosed.

Issuance of additional common shares

Our Memorandum and Articles of Association (our charter) authorizes

our board of directors to issue additional common shares from authorized but unissued shares, to the extent available, from time

to time, to such persons, for such consideration and on such terms as our board of directors shall determine.

DIFFERENCES IN CORPORATE LAW

The BVI Act and the laws of the British

Virgin Islands affecting British Virgin Islands companies like us and our shareholders differ from laws applicable to U.S. corporations

and their shareholders. Set forth below is a summary of the significant differences between the provisions of the laws of the British

Virgin Islands applicable to us and, for illustrative purposes only, the Delaware General Corporation Law (the “DGCL”),

which governs companies incorporated in the state of Delaware.

Mergers and similar arrangements

Under the laws of the British Virgin Islands,

two or more companies may merge or consolidate in accordance with Section 170 of the BVI Act. A merger means the merging of two

or more constituent companies into one of the constituent companies and a consolidation means the uniting of two or more constituent

companies into a new company. In order to merge or consolidate, the directors of each constituent company must approve a written

plan of merger or consolidation, which must be authorized by a resolution of shareholders.

While a director may vote on the plan of

merger or consolidation even if he has a financial interest in the plan, the interested director must disclose the interest to

all other directors of the company promptly upon becoming aware of the fact that he is interested in a transaction entered into

or to be entered into by the company.

A transaction entered into by our company

in respect of which a director is interested (including a merger or consolidation) is voidable by our company unless the director’s

interest was (a) disclosed to the board in accordance with the BVI Act prior to the our company’s entry into the transaction

or (b) the transaction is (i) between the director and our company and (ii) entered into in the ordinary course of our company’s

business and on usual terms and conditions.

Notwithstanding the above, a transaction

entered into by our company is not voidable if the material facts of the interest of the director are known to by the shareholders

entitled to vote at a meeting of the shareholders and the transaction is approved or ratified by a resolution of the shareholders

or our company received fair value for the transaction.

Shareholders not otherwise entitled to vote

on the merger or consolidation may still acquire the right to vote if the plan of merger or consolidation contains any provision

that, if proposed as an amendment to the Memorandum or Articles of Association, would entitle them to vote as a class or series

on the proposed amendment. In any event, all shareholders must be given a copy of the plan of merger or consolidation irrespective

of whether they are entitled to vote at the meeting to approve the plan of merger or consolidation.

The shareholders of the constituent companies

are not required to receive shares of the surviving or consolidated company but may receive debt obligations or other securities

of the surviving or consolidated company, other assets, or a combination thereof. Further, some or all of the shares of a class

or series may be converted into a kind of asset while the other shares of the same class or series may receive a different kind

of asset. As such, not all the shares of a class or series must receive the same kind of consideration.

After the plan of merger or consolidation

has been approved by the directors and authorized by a resolution of the shareholders, articles of merger or consolidation are

executed by each company and filed with the Registrar of Corporate Affairs in the British Virgin Islands.

A shareholder may dissent from a mandatory

redemption of his shares, an arrangement (if permitted by the court), a merger (unless the shareholder was a shareholder of the

surviving company prior to the merger and continues to hold the same or similar shares after the merger) or a consolidation. A

shareholder properly exercising his dissent rights is entitled to a cash payment equal to the fair value of his shares.

A shareholder dissenting from a merger or

consolidation must object in writing to the merger or consolidation before the vote by the shareholders on the merger or consolidation,

unless notice of the meeting was not given to the shareholder. If the merger or consolidation is approved by the shareholders,

the company must give notice of this fact to each shareholder within twenty days who gave written objection. These shareholders

then have twenty days to give to the company their written election in the form specified by the BVI Act to dissent from the merger

or consolidation, provided that, in the case of a merger, the twenty days starts when the plan of merger is delivered to the shareholder.

Upon giving notice of his election to dissent,

a shareholder ceases to have any shareholder rights except the right to be paid the fair value of his shares. As such, the merger

or consolidation may proceed in the ordinary course notwithstanding his dissent.

Within seven days of the later of the delivery of the notice

of election to dissent and the effective date of the merger or consolidation, the company must make a written offer to each dissenting

shareholder to purchase his shares at a specified price per share that the company determines to be the fair value of the shares.

The company and the shareholder then have thirty days to agree upon the price. If the company and a shareholder fail to agree on

the price within the thirty days, then the company and the shareholder shall, within twenty days immediately following the expiration

of the thirty-day period, each designate an appraiser and these two appraisers shall designate a third appraiser. These three appraisers

shall fix the fair value of the shares as of the close of business on the day prior to the shareholders’ approval of the

transaction without taking into account any change in value as a result of the transaction.

Under Delaware law each corporation’s

board of directors must approve a merger agreement. The merger agreement must state, among other terms, the terms of the merger

and method of carrying out the merger. This agreement must then be approved by the majority vote of the outstanding shares entitled

to vote at an annual or special meeting of each corporation, and no class vote is required unless provided in the certificate of

incorporation. Delaware permits an agreement of merger to contain a provision allowing the agreement to be terminated by the board

of directors of either corporation, notwithstanding approval of the agreement by the stockholders or shareholders of all or any