Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-253395

POWERBRIDGE TECHNOLOGIES CO., LTD.

$30,000,000

Ordinary Shares

On February 23, 2021,

we entered into a certain Sales Agreement, or sales agreement, with A.G.P. / Alliance Global Partners, or A.G.P., relating to our

Ordinary Shares offered by this prospectus. In accordance with the terms of the sales agreement, we may offer and sell Ordinary

Shares having an aggregate offering price of up to $30,000,000 from time to time through A.G.P.

We are a Cayman Islands

exempt company and our affairs are governed by our Fourth Amended and Restated Memorandum and Articles of Association and Companies

Law of the Cayman Islands, which we refer to as the Companies Law below. As of the date hereof, our authorized share capital is

US$500,000 divided into 300,000,000 ordinary shares with a par value of US$0.00166667 per share. Our Ordinary Shares are currently

listed on the Nasdaq Capital Market under the symbol “PBTS.” On February 22, 2021, the last reported sale price of

our Ordinary Shares on the Nasdaq Capital Market was $4.37 per share.

Sales of our Ordinary

Shares, if any, under this prospectus may be made in sales deemed to be “at the market offerings” as defined in Rule

415 promulgated under the Securities Act of 1933, as amended, or the Securities Act. If authorized by us in writing, A.G.P. may

also sell shares of our Ordinary Shares in negotiated transactions at market prices prevailing at the time of sale or at prices

related to such prevailing market prices. A.G.P. is not required to sell any specific number or dollar amount of securities, but

will act as a sales agent using commercially reasonable efforts consistent with its normal trading and sales practices, on mutually

agreed terms between A.G.P. and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

The compensation to A.G.P.

for sales of Ordinary Shares sold pursuant to the sales agreement will be equal to 3.5% of the gross proceeds of any Ordinary Shares

sold under the sales agreement. In connection with the sale of the Ordinary Shares on our behalf, A.G.P. will be deemed to be an

“underwriter” within the meaning of the Securities Act and the compensation of A.G.P. will be deemed to be underwriting

commissions or discounts. We have also agreed to provide indemnification and contribution to A.G.P. with respect to certain liabilities,

including liabilities under the Securities Act or the Exchange Act of 1934, as amended, or the Exchange Act.

Investing in our

Ordinary Shares involves risks. See “Risk Factors” beginning on page 5 of this prospectus, and under similar headings

in the other documents that are incorporated by reference into this prospectus.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

A.G.P.

March 22, 2021

TABLE OF CONTENTS

ABOUT

THIS PROSPECTUS

This prospectus relates

to the offering of our Ordinary Shares. Before buying any of the Ordinary Shares that we are offering, we urge you to carefully

read this prospectus, together with the accompanying base prospectus and the information incorporated by reference as described

under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference”

in this prospectus, and any free writing prospectus or prospectus supplement that we have authorized for use in connection with

this offering. These documents contain important information that you should consider when making your investment decision.

This prospectus describes

the terms of this offering of Ordinary Shares and also adds to and updates information contained in the documents incorporated

by reference into this prospectus. To the extent there is a conflict between the information contained in this prospectus, on the

one hand, and the information contained in any document incorporated by reference into this prospectus that was filed with the

Securities and Exchange Commission, or SEC, before the date of this prospectus, on the other hand, you should rely on the information

in this prospectus. If any statement in one of these documents is inconsistent with a statement in another document having a later

date — for example, a document incorporated by reference into this prospectus — the statement in the document having

the later date modifies or supersedes the earlier statement.

We have not, and the

sales agent has not, authorized anyone to provide you with information different than that contained or incorporated by reference

in this prospectus and any free writing prospectus or prospectus supplement that we have authorized for use in connection with

this offering. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that

others may give you. You should assume that the information appearing in this prospectus, the documents incorporated by reference

herein, and in any free writing prospectus or prospectus supplement that we have authorized for use in connection with this offering

is accurate only as of the date of those respective documents. Our business, financial condition, results of operations and prospects

may have changed since those dates. You should read this prospectus, the documents incorporated by reference herein, and any free

writing prospectus or prospectus supplement that we have authorized for use in connection with this offering in their entirety

before making an investment decision.

We are offering to

sell, and are seeking offers to buy, the shares only in jurisdictions where such offers and sales are permitted. The distribution

of this prospectus and the offering of the shares in certain jurisdictions or to certain persons within such jurisdictions may

be restricted by law. Persons outside the United States who come into possession of this prospectus must inform themselves about

and observe any restrictions relating to the offering of the shares and the distribution of this prospectus outside the United

States. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an

offer to buy, any securities offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person

to make such an offer or solicitation.

We own or have rights

to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus

may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners.

Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended

to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service

marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols,

but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law,

our rights or the right of the applicable licensor to these trademarks, service marks and trade names.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including

the documents that we incorporate by reference, contain forward-looking statements within the meaning of Section 27A of the Securities

Act and Section 21E of the Exchange Act of 1934, as amended (the “Exchange Act”), which represent our expectations

or beliefs concerning future events. Forward-looking statements include statements that are predictive in nature, which depend

upon or refer to future events or conditions, and/or which include words such as “believes,” “plans,” “intends,”

“anticipates,” “estimates,” “expects,” “may,” “will” or similar expressions.

In addition, any statements concerning future financial performance, ongoing strategies or prospects, and possible future actions,

which may be provided by our management, are also forward-looking statements. Forward-looking statements are based on current expectations

and projections about future events and are subject to risks, uncertainties, and assumptions about our company, economic and market

factors, and the industry in which we do business, among other things. These statements are not guarantees of future performance,

and we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future

events, or otherwise, except as required by law. Actual events and results may differ materially from those expressed or forecasted

in forward-looking statements due to a number of factors. Factors that could cause our actual performance, future results and actions

to differ materially from any forward-looking statements include, but are not limited to, those discussed under the heading “Risk

Factors” in any of our filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act. The forward-looking

statements in this prospectus, the applicable prospectus supplement or any amendments thereto and the information incorporated

by reference in this prospectus represent our views as of the date such statements are made. These forward-looking statements should

not be relied upon as representing our views as of any date subsequent to the date such statements are made.

PROSPECTUS

SUMMARY

The following summary is qualified in

its entirety by, and should be read together with, the more detailed information and financial statements and related notes thereto

appearing elsewhere or incorporated by reference in this prospectus. Before you decide to invest in our securities, you should

read the entire prospectus carefully, including the risk factors and the financial statements and related notes included or incorporated

by reference in this prospectus.

Unless otherwise indicated or unless

the context requires otherwise, this prospectus includes the accounts of Powerbridge Technologies Co., Ltd., a Cayman Islands company

and its wholly-owned subsidiaries, collectively referred to as “we”, “us”, “Powerbridge” or

the “Company”.

Overview

We are a provider of

software application and technology solutions and services to corporate and government customers primarily located in China. We

introduced global trade software applications when we launched our operations in 1997 with a vision to make global trade operations

easier for our customers. Since our inception, we have continued to innovate by developing technologies that enable us to successfully

deliver a series of solutions and services that address the evolving and changing needs of our corporate and government customers.

Our mission is to make global trade easier by empowering all players in the ecosystem.

With the rapid growth

of advertisement and media industrial in recent years, we believe that there is a substantial market opportunity to operate an

out-of-home digital display advertising and media technology platform in the Greater Bay Area of China. We also see the potential

to further expand our business into such industry, which could be supported by the success of our own Big Data platforms/products.

As a result, we started to implement our plan to build a network of digital display and operate an advertisement platform since

October 2020 by using our Big Data platform and services.

Our customers

are corporate and government organizations engaged in global trade. Our corporate customers are import and export companies, manufacturers

engaged in international trade, as well as logistics and other service providers. Our government customers include customs and

other government agencies that oversee the flow of goods and services across borders, as well as government authorities and organizations

that manage and operate free trade and bonded trade zones, ports and terminals, and other international trade facilities.

Global trade involves

complicated and cumbersome processing, manual handling of voluminous documents, extended and complex cross-organization workflows

as well as a great number of business and government players in the global trade ecosystem. Our customers are facing increasing

challenges as the world’s trade ecosystems continue to grow in size and complexity. Costs associated with global trade, such

as logistics performance, border control and international connectivity remain high. Potential savings from more collaborative

and efficient trade processes could reduce the costs of global trade significantly. The need for greater efficiency and cost savings

are driving the transformative shift for participants in global trade to become more connected and collaborative.

Our comprehensive and

robust solutions and services include Powerbridge System Solutions and Powerbridge SaaS Services with

more than 50 solutions and services deployable on premise and in the cloud. Leveraging our deep domain knowledge and strong industry

experience, we provide a series of differentiated and robust solutions and services that address the mission critical needs of

our corporate and government customers, enabling them to handle and simplify the complexities of global trade operations, logistics

and compliance.

We provide Powerbridge

System Solutions to our corporate and government customers engaged in global trade, including businesses and manufacturers

across a broad range of industries, government agencies and regulatory authorities, as well as global trade logistics and other

service providers. Powerbridge System Solutions enable our customers to streamline their trade operations, trade logistics

and regulatory compliance, consisting of Trade Enterprise Solutions and Trade Compliance Solutions which have been

in service since our first introduction twenty years ago and Import & Export Loan and Insurance Processing which have

recently been introduced to a selected group of customers.

We began offering our

Powerbridge SaaS Services (software-as-a-service) in 2016 and are continually developing and expanding our SaaS services

that provide our corporate and government customers with significant benefits, including better use of resources, a lower cost

of operations, easier document handling, faster processing time as well as higher logistics and compliance connectivity and efficiency.

Powerbridge SaaS Services include Logistics Service Cloud and Trade Zone Operations Cloud which are in service,

and Inward Processed Manufacturing Cloud, Cross-Border eCommerce Cloud and Import & Export Loan and Insurance Processing

Service Cloud which are in development.

We have begun offering

our cloud-based Powerbridge BaaS Services (blockchain-as-a-service) with designated use case for limited government

customers since June 2019 and we have not generated any revenue from it. We continue developing our BaaS Services for

market commercialization. Blockchain technology is emerging as a major disruptive force across many industries including those

involved in global trade. We believe that blockchain technology could allow our customers to conduct business in more synchronized

and collaborative ways to substantially increase operational efficiency and reduce trade costs across the global trade supply chain. Powerbridge

BaaS Service includes Compliance Blockchain Services and Supply Chain Blockchain Services.

Our solutions and services

are built from our multiple proprietary technology platforms which are developed based on industry leading open source infrastructure

technologies. Our technology platforms include Powerbridge System Platform and Powerbridge SaaS Platform,

which are designed for high-performance reliability, flexibility and scalability, allowing us to expand our solutions and services

rapidly and efficiently to consistently address the needs of our corporate and government customers. Our Powerbridge BaaS

Platform is in development and our BaaS services will be built on top of our Powerbridge Blockchain Platform that

is designed to provide high scalability and performance characteristics, consisting of multiple technology engines that support

the various business component models specific for trade transaction, trade logistics and regulatory compliance in global trade.

We intend to continue

leveraging our industry expertise and product knowledge with the best use of emerging and disruptive technologies such as big data,

artificial intelligence and Internet of Things to enhance our core technology capabilities and continually increase the scope of

our solutions and services to our customers.

Expansion Into Out-Of-Home Advertising

and Media

Since October 2020,

we started to implement our plan to build a network of digital display such as LCD screens and operate an advertisement platform

in Shenzhen initially, and then expand to the Greater Bay Area of China. We believe that there is a substantial market opportunity

to operate an out-of-home digital display advertising and media technology platform in the Greater Bay Area of China. We will focus

on display advertising in various high traffic advertising locations such as residential and office buildings, commercial parking

garages, and elevators in residential and office buildings.

We closed on a $50

million Note financing on October 27, 2020, which is in addition to the $17.5 million raised on August 24, 2020 in a private placement

of ordinary shares, par value $0.00166667. The funds raised are being used as prepayment for acquiring the right to operate and

publish advertisements at certain advertising space, as an efficient way of accelerating the Company’s entrance into the

out-of-home digital display advertising and media business.

On September 25, 2020,

Shenzhen Honghao Internet Technology Co. Ltd. (“Honghao”), a wholly-owned subsidiary of the Company, entered into a

leasing agreement (the “Original Leasing Agreement”) with Shenzhen Kezhi Technology Co., Ltd., a company incorporated

under the PRC laws (“Kezhi”), pursuant to which, Kezhi agreed to transfer the right to operate and publish advertisements

at certain advertising space it leases or controls in certain shopping centers in Shenzhen, Guangdong, to Honghao. No less than

75% of the advertising space as provided in the Original Leasing Agreement shall be delivered within 6 months and the remainder

shall be delivered within 12 months following the date of the Original Leasing Agreement. The Original Leasing Agreement became

effective on October 1, 2020 and shall expire on September 30, 2032.

Honghao agreed to pay

an aggregate rent of RMB150 million (approximately $22 million) within 3 months of the date of the Original Leasing Agreement.

Additionally, Honghao agreed to pay RMB10 million (approximately $1.67 million) as security deposit within 3 business days after

the date of the Original Leasing Agreement. Kezhi agreed to pledge certain Hainan Huanghua pear furniture it owns and currently

valued for RMB150 million (the “Collateral”) as guarantee for the rent payment made by Honghao pursuant to a separate

guarantee agreement to be agreed upon by and between Honghao and Kezhi. The parties agreed the Collateral shall be pledged for

the entire term of the lease and in the event the value of the Collateral is determined less than RMB150 million anytime during

the term of the guaranty, Kezhi shall provide additional collateral within three months of such determination to make sure that

aggregate value of the Collateral maintains at RMB150 million.

On November 20, 2020,

Honghao and Kezhi entered into a supplemental agreement to the Leasing Agreement (the “Supplemental Agreement”, together

with the Original Leasing Agreement, the “Leasing Agreement”), pursuant to which, Kezhi agreed to transfer the right

to operate and publish advertisements at certain additional advertising space it leased or controls in several urban villages in

Shenzhen, Guangdong, to Honghao.

Given that there was

no transfer of the right to operate and publish advertisements between October 1, 2020, the effective date of the Original Leasing

Agreement, and the date of the Supplemental Agreement, both parties agreed to change the effective date of the Original Leasing

Agreement from October 1, 2020 to January 1, 2021, which shall expire on December 31, 2040.

Honghao and Kezhi also

agreed to increase the rent from RMB150 million (approximately $22 million) to RMB 470 million (approximately $71 million) as consideration

for all the advertising space, the payment of which shall be made within 3 months of the date of the Supplemental Agreement. Accordingly,

Kezhi agreed to increase the value of the original collateral as provided in the Original Leasing Agreement from RMB150 million

to RMB 470 million. Additionally, both parties agreed to change the original payment schedule of the security deposit in an amount

of RMB10 million (approximately $1.67 million) as set forth in the Original Leasing Agreement from 3 business days after the date

of the Original Leasing Agreement to 3 business days after the date of the Supplemental Agreement.

Additionally, the Supplemental

Agreement provided the advertising space delivery schedule with at least 50% of the total advertising space to be delivered by

December 31, 2021 and the remainder to be delivered by December 31, 2022 (the “Delivery Schedule”). In the event Kezhi

fails to deliver the advertising space according to the Delivery Schedule, Honghao shall have the right to terminate the Leasing

Agreement and have the rent returned in full as well as demand damages due to Kezhi’s default. Furthermore, both parties

agreed that Honghao shall not be liable for any disputes, conflicts or lawsuits arising between Kezhi and any third party concerning

the advertising space provided thereof (the “Third Party Disputes”). In the event Kezhi is unable to continue to perform

all or part of its obligations under the Leasing Agreement due to third party disputes, Kezhi shall manage to locate similar replacement

of advertising space for Honghao within one month. The parties also agreed on the parties’ obligations to seek regulatory

approval to publish the advertisements, safe operation of the advertisement space, force majeure and other matters

customary to lease agreement of such nature.

As of the date of this

prospectus, we have not started the management of digital displays and have not generated any revenue under the outdoor advertising

business. We plan to initiate our outdoor advertising business in the second quarter of 2021, and expect to manage a network of

30,000 digital displays such as LCD screens as well as operate an advertisement platform in Guangdong province, China. We are partnered

with Kezhi, an advertising company in Shenzhen, to install and provide maintenance service for the digital displays while we will

operate the advertisement system by using our Big Data platform. We expect to generate our revenue from the monthly advertisement

fees charged to the advertisers. Supported by our Big Data platform, we are able to identify the most popular advertisements at

a given time and location. With such analysis result, we can help our customers to identify the place and time which attract the

most attention to their advertisements.

The following diagram

illustrates our current corporate structure:

As of the date of this

prospectus, Ningbo Powerbridge Pet Products Cross-border E-commerce Service Co., Ltd is dormant and has no operation.

Corporate Information

Our principal executive

office is located at 1st Floor, Building D2, Southern Software Park, Tangjia Bay, Zhuhai, Guangdong 519080, China. Our telephone

number is +86-756-339-5666. We maintain a website at www.powerbridge.com that contains information about our Company, though no

information contained on our website is part of this prospectus.

The Offering

|

Ordinary Shares offered by us:

|

|

Ordinary Shares having an aggregate offering price of up to $30,000,000.

|

|

|

|

|

|

Manner of offering:

|

|

“At the market offering” that may be made from time to time through our sales agent, A.G.P. See “Plan of Distribution” on page 7.

|

|

|

|

|

|

Use of proceeds:

|

|

We intend to use the net proceeds, if any, from this offering, for working capital and general corporate purposes. See “Use of Proceeds” on page 6.

|

|

|

|

|

|

Risk Factors:

|

|

Investing in our Ordinary Shares involves significant risks. See “Risk Factors” beginning on page 5 of this prospectus and other information included or incorporated by reference into this prospectus for a discussion of factors you should carefully consider before investing in our securities.

|

|

|

|

|

|

NASDAQ Capital Market trading symbol:

|

|

PBTS

|

RISK FACTORS

An investment in our

Ordinary Share involves significant risks. You should carefully consider the risk factors contained in any prospectus supplement

and in our filings with the SEC, as well as all of the information contained in this prospectus and the related exhibits, any prospectus

supplement or amendments thereto, and the documents incorporated by reference herein or therein, before you decide to invest in

our Ordinary Shares. Our business, prospects, financial condition and results of operations may be materially and adversely affected

as a result of any of such risks. The value of our Ordinary Shares could decline as a result of any of these risks. You could lose

all or part of your investment in our Ordinary Shares. Some of our statements in sections entitled “Risk Factors”

are forward-looking statements. The risks and uncertainties that we have described are not the only ones that we face. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business, prospects,

financial condition and results of operations.

In addition to the

risk factors referenced above, as described in our most recent annual report on Form 20-F, we want to disclose the additional risk

factors below.

Risks Relating to this Offering

We may allocate the net proceeds

from this offering in ways that you or other shareholders may not approve.

We currently intend

to use the net proceeds of this offering, if any, for working capital and general corporate purposes, which may include capital

expenditures, research and development expenditures, regulatory affairs expenditures, clinical trial expenditures, acquisitions

of new technologies and investments, and the financing of possible acquisitions or business expansions. This expected use of the

net proceeds from this offering represents our intentions based upon our current plans and business conditions. The amounts and

timing of our actual expenditures may vary significantly depending on numerous factors, including the progress of our development

efforts, the status of and results from our newly developed outdoor advertisements business, and any unforeseen cash needs. Because

the number and variability of factors that will determine our use of the proceeds from this offering, their ultimate use may vary

substantially from their currently intended use. As a result, our management will retain broad discretion over the allocation of

the net proceeds from this offering and could spend the proceeds in ways that do not necessarily improve our operating results

or enhance the value of our Ordinary Shares. See “Use of Proceeds.”

USE

OF PROCEEDS

We currently intend

to use the net proceeds from this offering, if any, for working capital and general corporate purposes.

The timing and amount

of our actual expenditures will be based on many factors, including cash flows from operations and the anticipated growth of our

business. As of the date of this prospectus, we cannot specify with certainty all of the particular uses for the net proceeds to

us from this offering. As a result, our management will have broad discretion regarding the timing and application of the net proceeds

from this offering.

MARKET PRICE OF OUR ORDINARY SHARES

Our Ordinary Share

is presently listed on The NASDAQ Capital Market under the symbol “PBTS”. On February 22, 2021, the last reported sale

price of our Ordinary Share was $4.37.

DIVIDEND

POLICY

We have never declared

or paid cash dividends on our capital stock. We currently intend to retain our future earnings, if any, for use in our business

and therefore do not anticipate paying cash dividends in the foreseeable future. Payment of future dividends, if any, will be at

the discretion of our board of directors after taking into account various factors, including our financial condition, operating

results, current and anticipated cash needs and plans for expansion.

PLAN

OF DISTRIBUTION

We have entered into

the sales agreement with A.G.P. under which we may issue and sell Ordinary Shares from time to time up to $30,000,000 to or through

A.G.P., acting as our sales agent. The sales of our Ordinary Shares, if any, under this prospectus supplement will be made at market

prices by any method deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the Securities Act,

including sales made directly on The NASDAQ Capital Market, on any other existing trading market for our Ordinary Shares or to

or through a market maker.

Each time that we wish

to issue and sell Ordinary Shares under the sales agreement, we will provide A.G.P. with a placement notice describing the amount

of shares to be sold, the time period during which sales are requested to be made, any limitation on the amount of Ordinary Shares

that may be sold in any single day, any minimum price below which sales may not be made or any minimum price requested for sales

in a given time period and any other instructions relevant to such requested sales. Upon receipt of a placement notice, A.G.P.,

acting as our sales agent, will use commercially reasonable efforts, consistent with its normal trading and sales practices and

applicable state and federal laws, rules and regulations and the rules of The NASDAQ Capital Market, to sell shares of our Ordinary

Shares under the terms and subject to the conditions of the placement notice and the sales agreement. We or A.G.P. may suspend

the offering of Ordinary Shares pursuant to a placement notice upon notice and subject to other conditions.

Settlement for sales

of Ordinary Shares, unless the parties agree otherwise, will occur on the second trading day following the date on which any sales

are made in return for payment of the net proceeds to us. There are no arrangements to place any of the proceeds of this offering

in an escrow, trust or similar account. Sales of our Ordinary Shares as contemplated in this prospectus supplement will be settled

through the facilities of The Depository Trust Company or by such other means as we and A.G.P. may agree upon.

We will pay A.G.P.

commissions for its services in acting as our sales agent in the sale of our Ordinary Shares pursuant to the sales agreement. A.G.P.

will be entitled to compensation at a fixed commission rate of 3.5% of the gross proceeds from the sale of our Ordinary Shares

on our behalf pursuant to the sales agreement. We have also agreed to reimburse A.G.P. for its reasonable and documented out-of-pocket

expenses (including legal fees and expenses) in an amount not to exceed $45,000 for implementation and up to an additional $8,000

per fiscal year for maintenance.

We estimate that the

total expenses for this offering, excluding compensation payable to A.G.P. and certain expenses reimbursable to A.G.P. under the

terms of the sales agreement, will be approximately $30,000,000. The remaining sales proceeds, after deducting any expenses

payable by us and any transaction fees imposed by any governmental, regulatory, or self-regulatory organization in connection with

the sales, will equal our net proceeds for the sale of such Ordinary Shares.

Because there are no

minimum sale requirements as a condition to this offering, the actual total public offering price, commissions and net proceeds

to us, if any, are not determinable at this time. The actual dollar amount and number of Ordinary Shares we sell through this prospectus

supplement will be dependent, among other things, on market conditions and our capital raising requirements.

We will report at least

quarterly the number of Ordinary Shares sold through A.G.P. under the sales agreement, the net proceeds to us and the compensation

paid by us to A.G.P. in connection with the sales of Ordinary Shares under the sales agreement.

In connection with

the sale of Ordinary Shares on our behalf, A.G.P. will be deemed to be an “underwriter” within the meaning of the Securities

Act, and the compensation of A.G.P. will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification

and contribution to A.G.P. against certain civil liabilities, including liabilities under the Securities Act.

A.G.P. will not engage

in any market making activities involving our Ordinary Shares while the offering is ongoing under this prospectus supplement if

such activity would be prohibited under Regulation M or other anti-manipulation rules under the Securities Act. As our sales

agent, A.G.P. will not engage in any transactions that stabilizes our Ordinary Shares.

The offering pursuant

to the sales agreement will terminate upon the earlier of (i) the sale of all Ordinary Shares subject to the sales agreement and

(ii) termination of the sales agreement as permitted therein. We may terminate the sales agreement in our sole discretion at any

time by giving 10 days’ prior notice to A.G.P. A.G.P. may terminate the sales agreement under the circumstances specified

in the sales agreement and in its sole discretion at any time by giving 10 days’ prior notice to us.

A.G.P. and/or its affiliates

have provided, and may in the future provide, various investment banking and other financial services for us, for which services

they have received and may in the future receive customary fees.

This prospectus supplement

in electronic format may be made available on a website maintained by A.G.P., and A.G.P. may distribute this prospectus supplement

electronically.

LEGAL

MATTERS

The validity of the

Ordinary Shares offered by this prospectus will be passed upon by Hunter Taubman Fischer and Li LLC, New York, New York. A.G.P.

/ Alliance Global Partners is being represented in connection with this offering by Schiff Hardin LLP.

EXPERTS

Our audited consolidated

financial statements as of December 31, 2019 and 2018 are incorporated by reference in this prospectus and any prospectus supplement,

which form a part of the registration statement, have been audited by Friedman LLP, independent registered public accountants,

to the extent and for the periods set forth in their report incorporated by reference herein, and in reliance on such report given

upon the authority of said firm as experts in auditing and accounting.

WHERE

YOU CAN FIND MORE INFORMATION

This prospectus is

part of the registration statement on Form F-3 we filed with the Securities and Exchange Commission, or SEC, under the Securities

Act, and does not contain all the information set forth in the registration statement. Whenever a reference is made in this prospectus

to any of our contracts, agreements or other documents, the reference may not be complete, and you should refer to the exhibits

that are a part of the registration statement or the exhibits to the reports or other documents incorporated by reference into

this prospectus for a copy of such contract, agreement or other document. You may inspect a copy of the registration statement,

including the exhibits and schedules, without charge, at the SEC’s public reference room mentioned below, or obtain a copy from

the SEC upon payment of the fees prescribed by the SEC.

We file annual, quarterly

and current reports, proxy statements and other information with the SEC. You may read, without charge, and copy the documents

we file at the SEC’s public reference rooms in Washington, D.C. at 100 F Street, NE, Washington, DC 20549. You can request

copies of these documents by writing to the SEC and paying a fee for the copying cost. Please call the SEC at 1-800-SEC-0330 for

further information on the public reference rooms. Our SEC filings are also available to the public at no cost from the SEC’s

website at http://www.sec.gov.

INCORPORATION

OF DOCUMENTS BY REFERENCE

We incorporate by reference

the filed documents listed below, except as superseded, supplemented or modified by this prospectus, and any future filings we

will make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (unless otherwise noted, the SEC file number

for each of the documents listed below is 001- 38851):

|

|

●

|

Annual Report on Form

20-F for the year ended December 31, 2019, filed on June 24, 2020;

|

|

|

|

|

|

|

●

|

The Form 6-K filed

on March 3, 2021, February 23, 2021, February

9, 2021, December

10, 2020, December

3, 2020, November

25, 2020, November

6, 2020, October

6, 2020, September

30, 2020, September

8, 2020, August

28, 2020, July

28, 2020, and July

2, 2020;

|

|

|

|

|

|

|

●

|

The registration statement and final prospectus for the Company’s initial public offering, filed on April 2, 2019; and

|

|

|

|

|

|

|

●

|

Our Registration Statement on Form 8-A, filed with the SEC on March 27, 2019, including any amendments or reports filed for the purpose of updating the description of our Ordinary Shares therein.

|

We also incorporate

by reference into this prospectus additional documents (other than current reports furnished under Item 2.02 or Item 7.01 of Form

8-K and exhibits on such form that are related to such items) that we may file with the SEC under Sections 13(a), 13(c), 14 or

15(d) of the Exchange Act prior to the completion or termination of the offering, including all such documents we may file with

the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement, but

excluding any information deemed furnished and not filed with the SEC. Any statements contained in a previously filed document

incorporated by reference into this prospectus is deemed to be modified or superseded for purposes of this prospectus to the extent

that a statement contained in this prospectus, or in a subsequently filed document also incorporated by reference herein, modifies

or supersedes that statement.

This prospectus may

contain information that updates, modifies or is contrary to information in one or more of the documents incorporated by reference

in this prospectus. You should rely only on the information incorporated by reference or provided in this prospectus. We have not

authorized anyone else to provide you with different information. You should not assume that the information in this prospectus

is accurate as of any date other than the date of this prospectus, or the date of the documents incorporated by reference in this

prospectus.

We will provide to

each person, including any beneficial owner, to whom this prospectus is delivered, upon written or oral request, at no cost to

the requester, a copy of any and all of the information that is incorporated by reference in this prospectus.

You may request, and

we will provide you with, a copy of these filings, at no cost, by contacting us at:

1st Floor, Building D2, Southern Software

Park

Tangjia Bay, Zhuhai, Guangdong 519080, China

Tel: +86-756-339-5666

POWERBRIDGE TECHNOLOGIES CO., LTD.

$30,000,000

Ordinary Shares

PROSPECTUS

A.G.P.

March 22, 2021

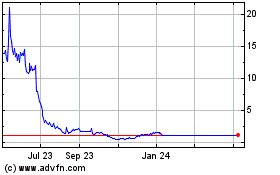

Powerbridge Technologies (NASDAQ:PBTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Powerbridge Technologies (NASDAQ:PBTS)

Historical Stock Chart

From Apr 2023 to Apr 2024