Current Report Filing (8-k)

March 19 2021 - 7:36AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 19, 2021

|

PREMIER PRODUCTS GROUP, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

|

000-51232

|

|

85-3285491

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

file number)

|

|

(I.R.S. Employer

Identification Number)

|

6303 Owensmouth, #1058

Woodland Hills, California 91367

(Address of principal executive offices) (Zip Code)

818-798-1878

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 2459.244a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 2459.244d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 2459.243e-4c))

This Premier Products Group, Inc. (“Registrant”) Report updates the (i) improper issuance by Registrant’s transfer agent of Registrant shares to certain Noteholders of a wholly owned subsidiary in the circumstances outlined below and (ii) efforts taken by Registrant to remedy such issuance of shares.

[Balance of Page Intentionally Left Blank]

UPDATE: IMPROPER TA ISSUANCE OF REGISTRANT’S COMMON

Item 7: Regulation FD (Events Registrant Elects to Disclose)

Item 8: Other Events

Item 2.06: Material Impairment

Item 3.02: Unregistered Sale of Equity Securities

On February 25 and 26, 2021, Registrant issued a Form 8-K and associated Amendment (jointly, the “Current Reports”). The disclosures following are hereby updated:

|

|

·

|

Registrant’s transfer agent (Pacific Stock Transfer Company, hereafter the “TA”) did convert, even after Registrant requested the TA not to do so, a Note of Valley High Mining Company, Registrant’s wholly owned subsidiary (hereafter, “VHMC”) into common stock of Registrant. (For details of the associated Delaware 251(g) reorganization, see Footnote below.)

|

|

|

|

|

|

|

·

|

Very simply, despite the conversion notice by the Noteholders, shares in Registrant should not have been issued. The Noteholders are owed money by VHMC (the predecessor issuer). Registrant does not owe this money. Accordingly, Registrant’s shares should not be issued in satisfaction of VHMC’s liability.

|

|

|

|

|

|

|

·

|

Upon discovering November 3, 2020 such issuance of Registrant’s (the parent’s) common stock based on the subsidiary’s Note, Registrant objected (specifically advising the TA such conversions were taken without Registrant’s authorization). Registrant has taken actions at all times subsequent to remediate the illegal issuance of the parent’s shares. For the reasons outlined in this 8-K and prior Current Reports, Registrant is not the responsible party on its subsidiary’s (VHMC’s) Note.

|

|

|

|

|

|

|

·

|

Indeed, the TA removed the restrictive legend on the Notes and the Registrant’s shares so issued improperly became “free trading”—again without Registrant’s authorization.

|

At all times subsequent, Registrant has worked to retract/reverse the TA’s improper share issuance.

______________________

Footnote: For a detailed description of the reorganization, see Registrant’s Form 8-K filed February 27, 2018. At its simplest, a Delaware 251(g) reorganization involves the creation of two new corporations followed by a merger and a share exchange. The end result is that the corporation which was previously the public company (in this case VHMC) becomes a wholly owned subsidiary which is non-trading while one of the newly formed companies, often referred to as “Holdco” or the successor issuer, becomes the public entity (in this case the Registrant). As a result, all assets and liabilities of the entity which was previously the public entity (the predecessor issuer) remains the entity with all the assets and all the liabilities. The successor issuer, in this case Registrant, unless specifically assumed, has no assets and no liabilities following the reorganization. Therefore, since the liabilities of the predecessor issuer (“VHMC”) are now in a non-trading, wholly owned subsidiary of the successor issuer, VHMC’s debts (again unless specifically assumed) should never be satisfied from the share issuances of the successor issuer (Registrant) as done here. This is why the common stock of Registrant should not have been issued to the VHMC Noteholders despite the conversion notice. The Noteholders are owed money by Valley High (the predecessor issuer). Premier Products Group does not owe this money. Accordingly, its shares should not be issued in satisfaction of Valley High’s liability.

Those ongoing remedial actions include the following:

|

|

·

|

On November 3, 2020, Registrant emailed the TA to not convert the VHMC Notes since VHMC’s Notes were not assumed by Registrant in the reorganization and, accordingly, VHMC’s Notes are neither Registrant’s Notes (and/or liability). Such November email included a detailed explanation of Holding Company Reorganization Section 251(g) under the Delaware General Corporation Law. (As to that authority, see the Footnote above and the February 27, 2018 Form 8-K re the Delaware 251(g) Reorganization, the latter herein incorporated by reference.)

|

|

|

|

|

|

|

·

|

Registrant issued its prior Current Reports in February as to this unauthorized issuance of shares conveying the then current status of these issues and committed to update such Current Reports…which it is here being done. Note as well that the prior Current Reports had a detailed 6 bullet “background” discussion (which is hereby incorporated by reference to the foregoing February Current Reports)—and which concluded: “…[a]ccordingly, Registrant’s shares should not be issued in satisfaction of VHMC’s liability….”

|

|

|

|

|

|

|

·

|

By letter dated February 22, 2021, Registrant instructed the TA to reverse the 78,530,130 share reservation involved in the Note conversion and, as of this date, the TA has NOT done so. In fact, the TA responded in a February 23, 2021 email acknowledging, among other matters, that it (i) will not issue further Registrant shares to VHMC Noteholders and (ii) had issued Registrant’s common shares to VHMC Noteholders. (A copy of the associated TA correspondence--to and from—was attached as Exhibit 10.1 to the 8-K filed February 25, 2021—which, again, is hereby incorporated by reference.)

|

|

|

|

|

|

|

·

|

In addition, management has written a February 24, 2021 demand letter to all VHMC Noteholders who received the shares in the wrong entity (in other words, the Registrant) seeking return of Registrant’s common so issued. (A copy of that letter to the individual Noteholders is attached as Exhibit 10.2 to the 8-K filed February 25, 2020

|

|

|

|

|

|

|

·

|

As of the date of this Form 8-K, Registrant believes the following information regarding the VHMC Noteholders and wrongly converted Registrant common shares to be true:

|

|

|

·

|

Noteholder 1: 21,468,620 Registrant common shares in the aggregate have been issued. Based on two Schedules 13G filed, all of such shares were issued, Noteholder 1 currently is not on Registrant’s shareholder list and perhaps such Registrant’s shares have been sold.

|

|

|

|

|

|

|

·

|

Noteholder 2: 12,127,129 Registrant common shares have been issued relative to a VHMC Note originated January 2018, Noteholder 2 currently is not on Registrant’s shareholder list and perhaps such Registrant’s shares have been sold.

|

|

|

|

|

|

|

·

|

Noteholder 3: 12,127,129 Registrant common shares have been issued relative to a VHMC Note originated January 2018, Noteholder 3 currently is not on Registrant’s shareholder list, and perhaps such Registrant’s shares have been sold.

|

|

|

|

|

|

|

·

|

Noteholder 4: 16,089,429 Registrant common shares have been issued relative to a VHMC Note originated January 2018, Noteholder 4 currently is on Registrant’s share-holder list and we presume such Registrant’s shares have not been sold.

|

|

|

|

|

|

|

·

|

Noteholder 5: 2,500,000 Registrant common shares have been issued relative to a VHMC Note originated October 2017, Noteholder 5 currently is on Registrant’s share-holder list and we presume such Registrant’s shares have not been sold.

|

|

|

|

|

|

|

·

|

Noteholder 6: 5,000,000 Registrant common shares have been issued relative to a pre- 251(g) debt conversion, Noteholder 6 currently is not on Registrant’s shareholder list, and perhaps such Registrant’s shares have been sold.

|

|

|

·

|

Noteholder 7: 5,000,000 of Registrant common shares were placed on STOP by the Registrant on December 2, 2020, Noteholder 7 currently is on Registrant’s shareholder list and we presume such Registrant’s shares have not been sold.

|

|

|

|

|

|

|

·

|

Noteholder 8: 3,750,000 Registrant common shares have been issued relative to a VHMC Note originated, Noteholder 8 currently is on Registrant’s shareholder list and we presume such Registrant’s shares have not been sold.

|

|

|

·

|

Management and/or its counsel is in continuing discussions with the TA and the affected Noteholders.

|

|

|

|

|

|

|

·

|

Registrant, via an email date March 14, 2021, has advised counsel for the Noteholder that the shares improperly acquired should be returned to the TA for cancellation and, if not, at minimum, the Noteholder(s) who hold or held more than 5% of the common shares through this improper conversion should file a “beneficial shareholder report” required under Section 13 of the Securities Exchange Act of 1934 (the “‘34Act”).

|

|

|

|

|

|

|

·

|

In response, one Noteholder (Noteholder 1 and the “Reporting Noteholder”):

|

|

|

·

|

Filed a Schedule 13G Report as of December 17, 2020 pursuant to Section 13(g) relating to 15,468,820 shares of Registrant’s shares. Registrant does not have sufficient facts to agree with (i) the specifics of the Schedule 13G, noting that it is not clear that the Reporting Noteholder qualifies (must be a bank, a B-D or other “institutional investor” for use of the “short form” Schedule 13G) and (ii) the number of shares issued by the TA (21,468,620) to the Reporting Noteholder is well short of the 15,468,820 the Noteholder Reports as of its December 17, 2020 Report Date.

|

|

|

|

|

|

|

·

|

Even more confusing is that on or about March 11, the Noteholder filed an Amendment to the Schedule 13G arguing it was correcting a “typographical error,” instead advising that the Noteholder owned 0 shares (not the 15,468,820 or the TA reports respectively of 21,468,820).

|

|

|

|

|

|

|

·

|

Noteholder 1 also have 78,531,380 common shares on reserve with the Transfer Agent. Registrant sent numerous emails to Transfer Agent to cancel the common shares from reserve, but as of report date, the Registrant have been unsuccessful.

|

|

|

·

|

To date, none of Noteholders has agreed to return the shares as requested and counsel for the several parties continues to be in communication.

|

|

|

|

|

|

|

·

|

It continues to be management’s belief the free trading shares affected Registrant’s stock over the last 60 days. Moreover, management is in the process of contacting the brokers who currently may have remaining improperly issued Registrant common shares to stop selling and contacting the VHMC Noteholders to return such improperly issued stock immediately. Management reiterates that it will report more details of counsel’s finding as relevant information becomes available.

|

|

|

|

|

|

|

·

|

Management also recognizes that the shares improperly issued--if allowed to stand--were dilutive in character (and therefore could require particulars as to Item 2.06, “Material Impairment”) and, even though not “sales” as defined, constituted the unregistered issuance of securities (Item 3.02). Registrant seeks to have cancelled those improperly issued shares and are working to so accomplish.

|

|

|

|

|

|

|

·

|

Registrant, through its management and counsel, will take all judicious, cost-effective remedial means to protect the interests of Registrant and its shareholders. All courses of action are on the table. We will have more to report on such remedial actions as events dictate.

|

While future events may impact Registrant’s disclosures, please be advised that (as things stand today and as a result of our efforts due to reconciling records and verifying third party reports, 50,722,878 common shares have been presumably sold into the open market and 27,339,429 of Registrant’s common shares are currently on Registrant’s shareholder’s list. Accordingly, man-agement of Registrant believes there that a cumulative 78,062,307 of Registrant’s common shares have been issued improperly by the TA to VHMC Noteholders. We are working to get those improperly issued common shares of Registrant reconciled, returned, cancelled and/or sales proceeds remitted to Registrant. If we are successful in reversing this improper share issuance, the number of Registrant common shares would be the same before and after the improper issuance of Registrant’s common to VHMC Noteholders. If we are not successful in the return of Registrant shares, their cancellation or the return of any sales proceeds from the improperly issued shares (as events dictate), disclosures so addressing will be the subject of a future Form 8-K.

SIGNATURES

In accordance with the requirements of the ‘34 Act, the Registrant caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

PREMIER PRODUCTS GROUP, INC.

|

|

|

|

|

|

|

|

Date: March 19, 2021

|

By:

|

/s/ Tony Hicks

|

|

|

|

|

Tony Hicks

|

|

|

|

|

Chairman of the Board and CEO

|

|

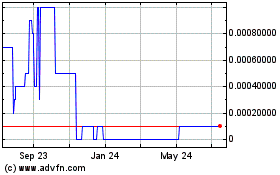

Premier Products (CE) (USOTC:PMPG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Premier Products (CE) (USOTC:PMPG)

Historical Stock Chart

From Apr 2023 to Apr 2024