Goliath Resources Limited (TSX-V: GOT)

(OTCQB: GOTRF) (Frankfurt: B4IF) (the

“Company” or

“Goliath”) is

pleased to announce the closing of strategic investments made by

Eric Sprott through 2176423 Ontario Ltd. and Crescat Capital

(“

Crescat”) LLC via non-brokered private

placements. Eric Sprott and Crescat now own 8.3% and 9.9% of

Goliath respectively. Gross proceeds of $2,862,025 were raised for

the Company.

A total of 4,189,136 units were issued at a

price of $0.55 for gross proceeds of $2,304,025. Each unit consists

of one common share plus one warrant to purchase an additional

common share at $0.86 for a twenty-four month period and subject to

an accelerator clause. The Company shall have the right to

accelerate the exercise period after the 4 month hold period has

expired and its common shares close at or above $1.50 for a period

of 20 consecutive trading days. If Goliath exercises such right,

the Company will give a 30 day notice to the holders that the

warrants will expire.

A total of 929,999 units were issued at a price

of $0.60 for gross proceeds of $557,999. Each unit consists of one

common share plus one warrant to purchase an additional common

share at $0.95 for a twenty-four month period and subject to an

accelerator clause. The Company shall have the right to accelerate

the exercise period after the 4 month hold period has expired and

its common shares close at or above $1.50 for a period of 20

consecutive trading days. If Goliath exercises such right, the

Company will give a 30 day notice to the holders that the warrants

will expire.

Mr. Sprott, through 2176423 Ontario Ltd., a

corporation that is beneficially owned by him acquired 3,636,364

units at $0.55 each for consideration of approximately $2,000,000.

As a result, Mr. Sprott beneficially owns and controls 3,636,364

common shares and 3,636,364 warrants, representing approximately

8.3% of the issued and outstanding shares of the Company on a

non-diluted basis and approximately 15.3% of the issued and

outstanding common shares on a partially-diluted basis assuming

exercise of the warrants acquired hereunder forming part of the

units. Prior to the current acquisition, Mr. Sprott did not

beneficially own or control any securities of the Company.

A copy of Mr. Sprott’s early warning report with

respect to the foregoing will appear on the company’s profile on

the System for Electronic Document Analysis and Retrieval

(“SEDAR”) at www.sedar.com and may also be

obtained by calling Mr. Sprott’s office at (416) 945-3294 (2176423

Ontario Ltd., 200 Bay Street, Suite 2600, Royal Bank Plaza, South

Tower, Toronto, Ontario M5J 2J1).

The units were acquired by Mr. Sprott for

investment purposes. Mr. Sprott has a long-term view of the

investment and may acquire additional securities of the Company

including on the open market or through private acquisitions or

sell securities of the Company including on the open market or

through private dispositions in the future depending on market

conditions, reformulation of plans and/or other factors that Mr.

Sprott considers relevant from time to time.

Crescat Capital LLC acquired 480,000 units

priced at $0.55 each for consideration of $264,000 as well as

96,667 units priced at $0.60. As a result, Crescat beneficially

owns and controls a total of 4,294,752 common shares and 4,294,752

warrants, representing 9.9% of the issued and outstanding shares of

the Company on a non-diluted basis and approximately 19.6% of the

issued and outstanding common shares on a partially-diluted basis

assuming exercise of its warrants owned. Prior to this placement,

Crescat beneficially owned and controlled 3,718,085 common shares

3,718,085 warrants of the Company.

The Company paid a finder's fee of $40,000 and

72,727 warrants in relation to this placement. This non-brokered

private placement is subject to TSX Venture Exchange approval. All

shares issued pursuant to this offering and any shares issued

pursuant to the exercise of warrants will be subject to a

four-month hold period from the closing date.

Mr. Rosmus, Director and CEO of Goliath

states:

“We are very pleased to have the support of Mr.

Sprott and Crescat Capital as strategic investors in Goliath. Their

investment will enable the Company to help unlock the potential of

its assets over the long term and build shareholder value. This

investment of $2,862,025 and strategic partnership, coupled with

the ongoing institutional support and interest from senior miners,

is a strong endorsement that clearly demonstrates the significant

near-term discovery potential at our 100% controlled properties.

With less than 45M shares issued and outstanding, no debt, and a

strong cash position, we are well positioned to move forward with

the inaugural drilling program at our newly discovered high-grade

gold-silver discovery at the Surebet Zone in the prolific Golden

Triangle.”

About Crescat Capital LLC

Crescat is a global macro asset management firm

headquartered in Denver, Colorado. Crescat’s mission is to grow and

protect wealth over the long term by deploying tactical investment

themes based on proprietary value-driven equity and macro models.

Crescat’s goal is industry leading absolute and risk-adjusted

returns over complete business cycles with low correlation to

common benchmarks. Crescat’s investment process involves a mix of

asset classes and strategies to assist with each client’s unique

needs and objectives and includes Global Macro, Long/Short, Large

Cap and Precious Metals funds.

Crescat is advised by its technical consultant

Dr. Quinton Hennigh on investments in gold and silver resource

companies. Dr. Hennigh became an economic geologist after obtaining

his PhD in Geology/Geochemistry from the Colorado School of Mines.

He has more than 30 years of exploration experience with major gold

mining firms that include Homestake Mining, Newcrest Mining and

Newmont Mining. Recently, Dr. Hennigh founded Novo Resources Corp

and serving as Chairman. Among his notable project involvements are

First Mining Gold’s Springpole gold deposit in Ontario, Kirkland

Lake Gold’s acquisition of the Fosterville gold mine in Australia,

the Rattlesnake Hills gold deposit in Wyoming, and Lion One’s

Tuvatu gold project on Fiji, among many others.

About Goliath Resources

Limited

Goliath Resources Limited is an explorer of

precious metals projects in the prolific Golden Triangle of

northwestern British Columbia and Abitibi Greenstone Belt of

Quebec. All of its projects are in world class geological settings

and geopolitical safe jurisdictions amenable to mining in

Canada.

For more information please

contact:

Goliath Resources Limited Mr. Roger

Rosmus President and Chief Executive Officer Tel:

+1-416-488-2887 x222 roger@goliathresources.com

www.goliathresourcesltd.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange), nor the OTCQB Venture Market

accepts responsibility for the adequacy or accuracy of this

release.

Certain statements contained in this press

release constitute forward-looking information. These statements

relate to future events or future performance. The use of any of

the words "could", "intend", "expect", "believe", "will",

"projected", "estimated" and similar expressions and statements

relating to matters that are not historical facts are intended to

identify forward-looking information and are based on Goliath’s

current belief or assumptions as to the outcome and timing of such

future events. Actual future results may differ materially. In

particular, this release contains forward-looking information

relating to, among other things, the ability of Company to complete

the financings and its ability to build value for its shareholders

as it develops its mining properties. Various assumptions or

factors are typically applied in drawing conclusions or making the

forecasts or projections set out in forward-looking information.

Those assumptions and factors are based on information currently

available to Goliath. Although such statements are based on

management's reasonable assumptions, there can be no assurance that

the proposed transactions will occur, or that if the proposed

transactions do occur, will be completed on the terms described

above.

The forward-looking information contained in

this release is made as of the date hereof and Goliath is not

obligated to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise,

except as required by applicable securities laws. Because of the

risks, uncertainties and assumptions contained herein, investors

should not place undue reliance on forward-looking information. The

foregoing statements expressly qualify any forward-looking

information contained herein.

This announcement does not constitute an offer,

invitation, or recommendation to subscribe for or purchase any

securities and neither this announcement nor anything contained in

it shall form the basis of any contract or commitment. In

particular, this announcement does not constitute an offer to sell,

or a solicitation of an offer to buy, securities in the United

States, or in any other jurisdiction in which such an offer would

be illegal.

The securities referred to herein have not been

and will not be will not be registered under the United States

Securities Act of 1933, as amended (the “U.S. Securities Act”), or

any state securities laws and may not be offered or sold within the

United States or to or for the account or benefit of a U.S. person

(as defined in Regulation S under the U.S. Securities Act) unless

registered under the U.S. Securities Act and applicable state

securities laws or an exemption from such registration is

available.

NOT FOR DISSEMINATION IN THE UNITED

STATES OR FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES AND DOES NOT

CONSTITUTE AN OFFER OF THE SECURITIES DESCRIBED

HEREIN.

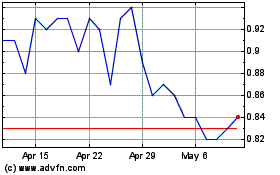

Goliath Resources (TSXV:GOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

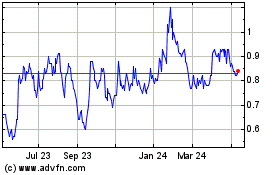

Goliath Resources (TSXV:GOT)

Historical Stock Chart

From Apr 2023 to Apr 2024