Filed Pursuant to Rule 424(b)(3)

Registration No.

333-251924

PROSPECTUS SUPPLEMENT No. 1

(To Prospectus Dated February 25, 2021)

ATIF HOLDINGS LIMITED

(incorporated in the British Virgin Islands

with limited liability)

4,739,130

Ordinary Shares

This prospectus supplement (this “Prospectus

Supplement”) updates and supplements the prospectus dated February 25, 2021 (the “Prospectus”), which forms a

part of our Registration Statement on Form F-1, as amended (Registration No. 333-251924). This Prospectus Supplement is being filed

to update and supplement the information in the Prospectus with the information contained in our Report on Form 6-K, furnished

with the Securities and Exchange Commission on March 4, 2021 (the “Form 6-K”). Accordingly, we have attached the Form

6-K to this Prospectus Supplement.

The Prospectus and this Prospectus Supplement

relates to relates to the resale of an aggregate of 4,739,130 shares of our ordinary shares that are issuable upon the exercise

of outstanding warrants by the selling shareholders identified herein. These warrants were issued in connection with a private

placement we completed on November 5, 2020. We will not receive any of the proceeds from the sale by the selling shareholders of

the ordinary shares. Upon any exercise of the warrants by payment of cash, however, we will receive the exercise price of the warrants.

This Prospectus Supplement should be read

in conjunction with the Prospectus. If there is any inconsistency between the information in the Prospectus and this Prospectus

Supplement, you should rely on the information in this Prospectus Supplement.

Our ordinary shares are listed on the NASDAQ

Capital Market under the symbol “ATIF.” On March 2, 2021, the last reported sale price of our ordinary share was $1.35

per share.

INVESTING IN OUR SECURITIES INVOLVES

RISKS. YOU SHOULD REVIEW CAREFULLY THE RISKS AND UNCERTAINTIES DESCRIBED UNDER THE HEADING “RISK FACTORS” CONTAINED

ON PAGE 3 OF THE PROSPECTUS AND IN OUR ANNUAL REPORT ON FORM 20-F FOR THE YEAR ENDED JULY 31, 2020, AS WELL AS OUR SUBSEQUENTLY

FILED PERIODIC AND CURRENT REPORTS, WHICH WE FILE WITH THE SECURITIES AND EXCHANGE COMMISSION AND ARE INCORPORATED BY REFERENCE

INTO THIS PROSPECTUS. YOU SHOULD READ THE ENTIRE PROSPECTUS ALONG WITH THE PROSPECTUS SUPPLEMENT CAREFULLY BEFORE YOU MAKE YOUR

INVESTMENT DECISION.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR

COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus Supplement is

March 4, 2021.

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of March, 2021

Commission

File Number: 001-38876

ATIF

HOLDINGS LIMITED

Room

2803,

Dachong

Business Centre, Dachong 1st Road,

Nanshan

District, Shenzhen, China

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

ATIF

Holdings Limited (the “Company”) is furnishing this current report on Form 6-K to report the dismissal of Friedman

LLP (“Friedman”) effective March 3, 2021 and that the Company has appointed ZH CPA, LLC (the “Successor Auditors”)

as successor auditor of the Company effective March 3, 2021 and for the fiscal year ended July 31, 2021.

In connection therewith, the Company provides that:

1.

the dismissal of Friedman and the appointment of the Successor Auditors have been considered

and approved by the Company’s audit committee and board of directors;

2.

The audit report of Friedman on the financial statements of the Company as of and for

the years ended July 31, 2019 and 2020 did not contain any adverse opinion or disclaimer of opinion, nor was it qualified or modified

as to uncertainty, audit scope, or accounting principles, except that the audit report on the financial statements of the Company

for the year ended July 31, 2020 contained an uncertainty about the Company’s ability to continue as a going concern.

3.

There were no disagreements with Friedman on any matter of accounting principles or

practices, financial statement disclosure, or auditing scope or procedures, from the time of Friedman’s engagement up to

the date of dismissal which disagreements that, if not resolved to Friedman’s satisfaction, would have caused Friedman to

make reference in connection with its opinion to the subject matter of the disagreement. None of “reportable events”,

as that term is described in Item 16F(a)(1)(v)(A)-(D) of Form 20-F occurred within the two fiscal years of the Company ended July

31, 2019 and 2020 and subsequently up to the date of dismissal.

The

Company provided Friedman with a copy of this Form 6-K and requested that Friedman provide the Company with a letter addressed

to the Securities and Exchange Commission stating whether it agrees with the above statements. A copy of Friedman’s letter

is furnished as Exhibit 99.1 to this Form 6-K.

During

the Company’s most recent two fiscal years and through the subsequent interim period on or prior to the appointment of the

Successor Auditors, neither the Company nor anyone on its behalf has consulted with the Successor Auditors on either (a) the application

of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be

rendered on the Company’s financial statements, or (b) any matter that was the subject of a disagreement, as that term is

defined in Item 16F(a)(1)(iv) of Form 20-F (and the related instructions thereto) or a reportable event as set forth in Item 16F(a)(1)(v)(A)

through (D) of Form 20-F.

The

Company intends to use this Form 6-K and the accompanying exhibit to satisfy its reporting obligations under Item 16F(a) of its

Form 20-F for the year ending July 31, 2021 to the extent provided in and permitted by Paragraph 2 of the Instructions to Item

16F of Form 20-F and plans to incorporate Exhibit 99.1 reference into its Form 20-F to the extent necessary to satisfy such reporting

obligations

This

Form 6-K, including all exhibits attached hereto, is hereby incorporated by reference into the Registrant’s Registration

Statements on Form F-3 filed with the Securities and Exchange Commission on June 12, 2020 (Registration file numbers 333-239131),

to be a part thereof from the date on which this report is submitted, to the extent not superseded by documents or reports subsequently

filed or furnished.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

ATIF Holdings Limited

|

|

|

|

|

|

By:

|

/s/

Pishan Chi

|

|

|

|

Pishan

Chi

Chief

Executive Officer

|

|

|

|

|

|

Dated: March 4, 2021

|

|

|

EXHIBIT

INDEX

Exhibit 99.1

March

4, 2021

Securities

and Exchange Commission

100

F Street, N.E.

Washington,

D.C. 20549

|

Re:

|

ATIF

Holdings Limited.

|

|

|

CIK

No: 0001755058

|

Dear

Sir or Madam:

We

have read Form 6-K dated March 4, 2021 of ATIF Holdings Limited. (“Registrant”) and are in agreement with the statements

contained therein as it pertains to our firm.

We

have no basis to agree or disagree with any other statements of the Registrant contained in Form 6-K.

/s/

Friedman LLP

New

York, New York

Exhibit

99.2

ATIF Holdings Limited Announces the Change

of Auditor

Los Angeles, California, March 4, 2021 (GLOBE NEWSWIRE) -- ATIF

Holdings Limited (Nasdaq: ATIF, the “Company”), a holding group providing business and financial consulting in Asia

and North America, today announced the change of auditor from Friedman LLP to ZH

CPA, LLC (“ZH CPA”) as its independent registered public accounting firm for the fiscal year ended July 31,

2021. The Audit Committee and the Board of Directors of the Company approved the appointment of ZH CPA as the Company’s independent

registered public accounting firm for the fiscal year ended July 31, 2021, effective March 3, 2021.

In connection with the change of auditor,

the Company provides that: (a) there were no disagreements between the Company and the former auditors on any matter of accounting

principles or practices, financial statement disclosure or auditing scope or procedure, which disagreement, if not resolved to

the satisfaction of the former accountant, would have caused it to make reference to the subject matter of the disagreement in

connection with its report; and (b) no reportable events as set forth in Item 16F(a)(1)(v)(A) through (D) of Form 20-F have occurred.

About ATIF Holdings Limited

Headquartered in Los Angeles, California,

ATIF Holdings Limited (“ATIF”) is a holding group with asset management, investment holding and online financial information

business and provide business consulting services to small and medium-sized enterprises in Asia and North America. ATIF operates

an internet-based financial information service platform IPOEX.com, which provides prestige membership services including market

information, pre-IPO education, IR media and matchmaking services between SMEs and financing institutions. ATIF’s investment

holding business is to provide going public consulting, M&A consulting and financial consulting services to SMEs. ATIF has

advised several enterprises in China in their plans to become publicly listed in the U.S. ATIF plans to launch securities investment

service and investment advisory in Q1 2021. For more information, please visit https://ir.atifchina.com/.

Forward-Looking Statements

Certain statements made in this release

are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. When used in this press release, the words “estimates,” “projected,”

“expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,”

“seeks,” “may,” “will,” “should,” “future,” “propose” and

variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify

forward-looking statements. These forward-looking statements are not guarantee of future performance, conditions or results,

and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside

the Company’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking

statements. Important factors, among others, are: future financial and operating results, including revenues, income, expenditures,

cash balances and other financial items; ability to manage growth and expansion; current and future economic and political conditions; ability to

compete in an industry with low barriers to entry; ability to continue to operate through our VIE structure; ability to obtain

additional financing in the future to fund capital expenditures; ability to attract new clients and further enhance brand recognition;

ability to hire and retain qualified management personnel and key employees; trends and competition in the financial consulting

services industry; a pandemic or epidemic; and other factors listed in the Company’s annual report on Form 20-F and other documents filed

with the Securities and Exchange Commission. The Company undertakes no obligation to update forward-looking statements to reflect

subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company

believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations

will turn out to be correct, and the Company cautions you that actual results may differ materially from the anticipated results

expressed or implied by the forward-looking statements we make. You should not rely upon forward-looking statements as predictions

of future events. Forward-looking statements represent our management’s beliefs and assumptions only as of the date such

statements are made. These forward-looking statements are made as of the date of this news release.

Media contact:

Anna Huang

+86-139-2726-7157

anna@atifchina.com

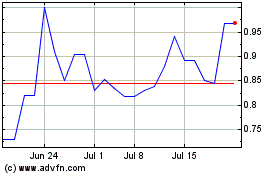

ATIF (NASDAQ:ATIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

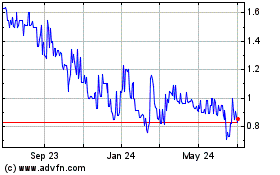

ATIF (NASDAQ:ATIF)

Historical Stock Chart

From Apr 2023 to Apr 2024