Aviva PLC 2020 Pretax Profit Falls on Lower Investment Income

March 04 2021 - 3:11AM

Dow Jones News

By Ian Walker

Aviva PLC on Thursday reported a 32% fall in pretax profit for

2020 after booking lower investment income and said it expects to

be able to make substantial returns to shareholders after a number

of disposals over the year.

The FTSE 100-listed insurer made an IFRS pretax profit for the

year ended Dec. 31 of 2.61 billion pounds ($3.64 billion) compared

with GBP3.82 billion for 2019. Gross written premiums fell to

GBP29.02 billion from GBP29.71 billion.

Adjusted operating profit--one of the company's preferred

metrics, which strips out exceptional and other one-off items--fell

to GBP3.16 billion from GBP3.18 billion for 2019.

It ended the year with a Solvency II ratio--a measure of capital

strength--of 202% compared with 195% at Sept. 30 and 206% at Dec.

31, 2019. Its solvency II capital surplus stood at GBP13.0 billion,

up from GBP11.8 billion at Sept. 30.

The insurer declared a final dividend of 14.0 pence a share,

taking the total payout to 21.0 pence. It had guided for a final

dividend for the year of 14.0 pence a share and said it expects to

grow future dividends by low to mid-single digits over time. No

final dividend was paid for 2019 due to the coronavirus pandemic,

but a second interim dividend of 6 pence a share was paid during

the third quarter of 2020.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

March 04, 2021 02:56 ET (07:56 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

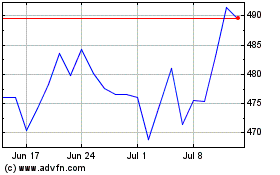

Aviva (LSE:AV.)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aviva (LSE:AV.)

Historical Stock Chart

From Apr 2023 to Apr 2024