Sands to Sell Las Vegas Properties for $6.25 Billion to Apollo Global, REIT--Update

March 03 2021 - 11:20AM

Dow Jones News

By Dave Sebastian

Las Vegas Sands Corp. agreed to sell its Las Vegas properties to

Apollo Global Management Inc. and a real-estate investment trust

for about $6.25 billion as the casino operator exits the gambling

hub to focus on its core Asia operations.

Sands' sale of the Venetian Resort and its convention center

comes as the Covid-19 pandemic has roiled the casino industry with

temporary shutdowns, reduced travel and limited occupancies. Hopes

for a recovery this year depend on how many tourists and business

travelers will return following the distribution of vaccines.

The casino operator had said in October that it was considering

a sale of the Vegas assets. After the death of founder Sheldon

Adelson in January, Sands executives said the company would

continue to invest in its Singapore and Macau casinos, which

generate most of the company's revenue.

"As we announce the sale of the Venetian Resort, we pay tribute

to Mr. Adelson's legacy while starting a new chapter in this

company's history, " Chief Executive Robert Goldstein said

Wednesday. "Asia remains the backbone of this company, and our

developments in Macau and Singapore are the center of our

attention."

Sands plans to keep its headquarters in Las Vegas, a company

spokesman said. The company has been considering expansion

opportunities in New York and Texas, Sands executives have said,

and it will also explore opportunities in online gambling.

Shares of Sands hit a 52-week high Wednesday and recently rose

1.3% to $65.80. The sale could lead Sands to return some of that

money to shareholders, likely through dividends, which had been

paused since last year, Jefferies analyst David Katz said.

Apollo said it sees the Las Vegas properties as having exposure

to categories positioned for recovery and long-term growth, such as

hospitality, meeting events, gaming and entertainment.

"This investment also underscores our conviction in a strong

recovery for Las Vegas as vaccines usher in a reopening of leisure

and travel in the United States and across the world," Apollo

partner Alex van Hoek said.

Apollo has previously invested in Vegas casinos. In 2008, Apollo

and TPG completed a $30 billion leveraged buyout of Harrah's

Entertainment Inc., which loaded the company with debt on the eve

of Las Vegas's longest and deepest recession. The company renamed

itself Caesars Entertainment Corp. and, in 2015, filed for

bankruptcy protection of its largest unit, which had $18 billion in

debt.

Apollo recently has been increasing its bets on the gambling

industry. The private-equity giant agreed to buy Canadian casino

operator Great Canadian Gaming Corp. in November and eyed U.K.

bookmaker William Hill PLC last year before deciding against making

an offer.

Under the Sands deal, funds tied to Apollo will buy subsidiaries

that hold the operating assets and liabilities of Sands' Las Vegas

business for about $1.05 billion in cash and $1.2 billion in seller

financing in the form of a term loan credit and security agreement,

Sands said. REIT Vici Properties Inc. will buy subsidiaries that

hold the real-estate and real-estate-related assets of the Venetian

for about $4 billion in cash.

The Apollo funds will also enter into a long-term lease pact

with Vici for the properties, the companies said.

The Venetian resort comprises a 35-story hotel tower with some

3,000 suites, a 12-story tower with about 1,000 suites and the

50-story Palazzo Tower, which has about 3,000 suites, according to

its 2019 annual securities filing. The resort has about 225,000

square feet of gambling space, the company said in the filing.

The Sands Expo and Convention Center has about 1.2 million gross

square feet of exhibit and meeting space, the company said. It also

has about 1.1 million square feet of meeting and conference

facility that links the center with the Venetian resort.

The Sands and Mr. Adelson have long been connected with Las

Vegas.

Mr. Adelson launched Computer Dealers Exposition, or Comdex,

which became a hugely successful trade exhibit held in Las Vegas

and other cities. In 1988, needing space for his own exhibition

center in Las Vegas to accommodate growing crowds, he bought the

Sands hotel and casino on the Las Vegas Strip for $110 million,

opening up a new line of business. His bet was that conventions and

trade shows were a surer way to keep rooms filled than a pure focus

on gambling.

He tore down the Sands and built in its place the Venetian

resort, featuring a canal replica with singing gondoliers.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

March 03, 2021 11:05 ET (16:05 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

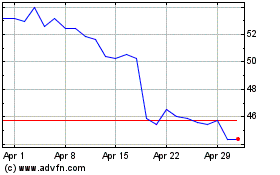

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

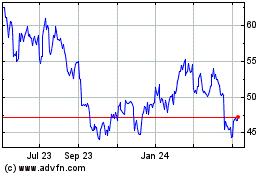

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Apr 2023 to Apr 2024