UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of

1934

Date of

Report (Date of earliest event reported): February 25,

2021

AMERICAN BIO MEDICA CORPORATION

(Exact

name of registrant as specified in its charter)

|

New

York

|

|

0-28666

|

|

14-1702188

|

|

(State

or other jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer Identification Number)

|

|

122

Smith Road, Kinderhook, NY

|

|

12106

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: 518-758-8158

Not applicable

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see

General Instruction A.2.

below):

☐

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

Trading

Symbol(s)

|

Name

of each exchange on which registered

|

|

Common

|

ABMC

|

OTC

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this

chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

ITEM 1.01.

Entry

into a Material Definitive Agreement

On

February 24, 2021 (the “Closing Date”), American Bio

Medica Corporation (the “Company”) completed a

transaction related to one-year Extension Agreements dated February

14, 2021 (the “Extension Agreement(s)”) with Cherokee

Financial, LLC (“Cherokee”) under which Cherokee

extended the due date of the Company’s credit facilities; a

Loan and Security Agreement with Cherokee ($900,000) and a 2019

Term Loan with Cherokee ($220,000).

Loan

and Security Agreement with Cherokee Financial, LLC

This

facility was a 5 year note executed on February 15, 2015, at a

fixed annual interest rate of 8% plus a 1% annual oversight fee,

interest only and oversight fee paid quarterly with first payment

being made on May 15, 2015, annual principal reduction payment of

$75,000 due each year beginning on February 15, 2016, with a final

balloon payment being due on February 15, 2020 (“Cherokee

LSA”). In February 2020, the Cherokee LSA was extended for

one year (until February 15, 2021) under the same terms and

conditions. The Cherokee LSA is collateralized by a first security

interest in building, land and property.

Under

the terms of this latest extension agreement, the $900,000

(secured) Cherokee LSA was increased to $1,000,000 to include a

$100,000 penalty that was due as a result of the Company being

unable to pay back the principal balance to Cherokee on February

15, 2021. The annual interest rate on the extended Cherokee LSA

will be fixed at 10% plus a 1% annual oversight fee, interest only

and oversight fee paid quarterly with the first payment being due

on May 15, 2021. If the Company doesn’t pay off the principal

on or before February 15, 2022, there will be an 8% delinquent fee

charged. This delinquent fee will only apply to whatever the

principal balance is on February 15, 2022. If the Company pays any

portion (or all) of the principal back, the 8% fee will not be due

on the prepaid amounts. The Company can prepay all of part of the

facility back prior to February 15, 2022 with no

penalty.

Cantone

Research, Inc. will earn a 3% fee on the extended principal of

$900,000 (or $27,000) for their services related to securing the

extension with Cherokee investors. This 3% service fee will be

“rebated” when/if the Company prepays any, or a

portion, of the loan. As an example, if the Company makes a

principal reduction payment of $100,000, only $97,000 in cash will

need to be remitted to Cherokee to have the $100,000 taken off the

principal balance.

2019

Term Loan with Cherokee Financial, LLC

1 year

note at an annual fixed interest rate of 18% paid quarterly in

arrears with first interest payment being made on May 15, 2019 and

a balloon payment being due on February 15, 2020 (the “2019

Cherokee Term Loan”). In February 2020, the 2019 Cherokee

Term Loan was extended for one year (until February 15, 2021) under

the same terms and conditions. A penalty of $20,000 was added to

the principal (of $200,000) on February 15, 2020 in connection with

the extension of the 2019 Cherokee Term Loan, bringing the

principal to $220,000.

Under

the terms of this latest extension agreement, the 2019 Cherokee

Term Loan Cherokee LSA was increased to $240,000 to include a

$20,000 penalty that was due as a result of the Company being

unable to pay back the principal balance to Cherokee on February

15, 2021. The annual interest rate under the 2019 Cherokee Term

Loan will remain fixed at 18% paid quarterly in arrears with first

interest payment with the first payment being due on May 15, 2021.

If the Company doesn’t pay off the principal on or before

February 15, 2022, there will be an 8% delinquent fee charged. This

delinquent fee will only apply to whatever the principal balance is

on February 15, 2022. If the Company pays any portion (or all) of

the principal back, the 8% fee will not be due on the prepaid

amounts. The Company can prepay all of part of the facility back

prior to February 15, 2022 with no penalty.

No

common stock was issued in connection with the

extensions.

The

Company also agreed to pay Cherokee’s legal fees in the

amount of $1,000.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

AMERICAN

BIO MEDICA CORPORATION (Registrant)

|

|

|

|

|

|

|

|

Dated:

March 3, 2021

|

By:

|

/s/

Melissa A. Waterhouse

|

|

|

|

|

Melissa

A. Waterhouse

|

|

|

|

|

Chief

Executive Officer (Principal Executive Officer)

Principal

Financial Officer

|

|

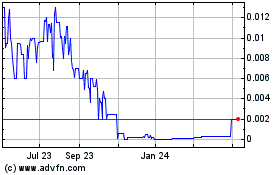

American Bio Medica (CE) (USOTC:ABMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

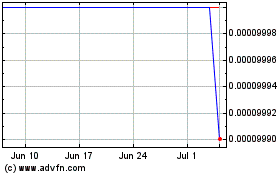

American Bio Medica (CE) (USOTC:ABMC)

Historical Stock Chart

From Apr 2023 to Apr 2024