REGISTRATION STATEMENT

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON MARCH 1, 2021

REGISTRATION NO. 333-252943

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3/AMENDMENT NO. 1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

Singlepoint Inc.

|

|

(Exact name of registrant as specified in its charter)

|

Nevada

(State or other jurisdiction of

incorporation or organization)

26-1240905

I.R.S. Employer Identification Number

2999 North 44th Street, Suite 530

Phoenix, AZ 85108

(855) 711-2009

(Address, including zip code, and telephone number, including area code of registrant’s principal executive offices)

William Ralston

President

Singlepoint Inc.

2999 North 44th Street, Suite 530

Phoenix, AZ 85108

(855) 711-2009

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Jeffrey M. Stein, Esq.

JMS Law Group, PLLC

998C Old Country Road, #233

Plainview, New York 11803

Phone: 516-422-6285

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plants, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

Proposed

|

|

|

|

|

|

|

|

|

|

|

maximum

|

|

|

|

|

|

|

|

Amount

|

|

|

aggregate

|

|

|

Amount of

|

|

|

|

|

to be

|

|

|

offering

|

|

|

registration

|

|

|

Title of each class of Securities to be registered

|

|

registered(1)

|

|

|

price

|

|

|

fee(2)

|

|

|

Common stock, par value $0.0001 per share

|

|

|

675,675,676

|

|

|

$

|

.0285

|

|

|

|

—

|

|

|

Total

|

|

|

—

|

|

|

$

|

19,256,756.76

|

|

|

$

|

2,100.91

|

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act, the shares being registered hereunder include such indeterminate number of common shares and preferred shares as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions.

|

|

(2)

|

Calculated pursuant to Rule 457(o) under the Securities Act. The total amount has been previously been paid.

|

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement relating to these securities that has been filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any State where the offer or sale is not permitted.

(Subject to Completion, Dated March 1, 2021)

PROSPECTUS

$19,256,756.76

Singlepoint Inc.

Common Stock

We may from time to time, in one or more offerings at a price of $.0285 per share sell common stock for an aggregate initial offering price of up to $19,256,756.76. This prospectus describes the general manner in which our securities may be offered using this prospectus. Each time we offer and sell securities, we will provide you with a prospectus supplement that will contain specific information about the terms of that offering. Any prospectus supplement may also add, update, or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement as well as the documents incorporated or deemed to be incorporated by reference in this prospectus before you purchase any of the securities offered hereby.

This prospectus may not be used to offer and sell securities unless accompanied by a prospectus supplement.

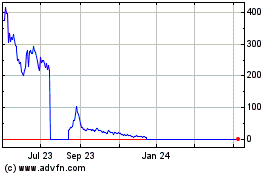

Our common stock is currently traded on the OTC Pink under the symbol “SING.” On February 26, 2021, the last reported sales price for our common stock was $0.0328 per share. The prospectus supplement will contain information, where applicable, as to any other listing of the securities on the OTC Pink or any other securities market or exchange covered by the prospectus supplement.

The securities offered by this prospectus involve a high degree of risk. See “Risk Factors” beginning on page 2, in addition to Risk Factors contained in the applicable prospectus supplement.

Neither the Securities and Exchange Commission nor any State securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We may offer the securities directly or through agents or to or through underwriters or dealers. If any agents or underwriters are involved in the sale of the securities their names, and any applicable purchase price, fee, commission or discount arrangement between or among them, will be set forth, or will be calculable from the information set forth, in an accompanying prospectus supplement. We can sell the securities through agents, underwriters or dealers only with delivery of a prospectus supplement describing the method and terms of the offering of such securities. See “Plan of Distribution.”

This prospectus is dated ___________, 2021

Table of Contents

You should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with information different from that contained or incorporated by reference into this prospectus. If any person does provide you with information that differs from what is contained or incorporated by reference in this prospectus, you should not rely on it. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You should assume that the information contained in this prospectus or any prospectus supplement is accurate only as of the date on the front of the document and that any information contained in any document we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any prospectus supplement or any sale of a security. These documents are not an offer to sell or a solicitation of an offer to buy these securities in any circumstances under which the offer or solicitation is unlawful.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus in one of more offerings up to a total dollar amount of proceeds of $19,256,756.76. This prospectus describes the general manner in which our securities may be offered by this prospectus. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus or in documents incorporated by reference in this prospectus. The prospectus supplement that contains specific information about the terms of the securities being offered may also include a discussion of certain U.S. Federal income tax consequences and any risk factors or other special considerations applicable to those securities. To the extent that any statement that we make in a prospectus supplement is inconsistent with statements made in this prospectus or in documents incorporated by reference in this prospectus, you should rely on the information in the prospectus supplement. You should carefully read both this prospectus and any prospectus supplement together with the additional information described under “Where You Can Find More Information” before buying any securities in this offering.

The terms “Singlepoint” the “Company,” “we,” “our” or “us” in this prospectus refer to Singlepoint Inc., unless the context suggests otherwise.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents and information incorporated by reference in this prospectus include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such forward-looking statements include those that express plans, anticipation, intent, contingency, goals, targets or future development and/or otherwise are not statements of historical fact.

All statements in this prospectus and the documents and information incorporated by reference in this prospectus that are not historical facts are forward-looking statements. We may, in some cases, use terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions or the negative of such items that convey uncertainty of future events or outcomes to identify forward-looking statements.

Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as may be required by applicable law. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

ABOUT SINGLEPOINT INC.

Overview

We are a company whose core subsidiaries include operating in the renewable energy market. Our initial renewable focus is on solar and energy (battery) storage with future expansion and growth opportunities in related initiatives like EV charging, solar as a subscription services, and energy efficient or other related appliance that enhance sustainability and a healthier life. We built our portfolio by acquiring undervalued companies, providing a rich, diversified holding base. We specialize in acquisitions of small to mid-sized solar companies. Our subsidiary, Singlepoint Direct Solar LLC (“Direct Solar America”, 51% interest), operating as Direct Solar of America is focused on providing renewable energy and storage solutions to residential consumers and small commercial businesses and growing its national footprint, which has grown to operate in 38 states in U.S. during 2020 alone. Direct Solar America is a solar brokerage company headquartered in Phoenix, Arizona that currently works with homeowners to define the best solar installation provider and financer for their particular need in multiple cities around the United States. We are in the process of divesting ourselves from our non-core subsidiaries.

Recent Developments

In February 2021 we bolstered our solar operations with the acquisition of Energywyze, LLC, a premiere digital and direct marketing firm focused on customer centric lead generation in the solar energy industry, EnergyWyze currently operates its leading consumer site at www.energywyze.com and its solar business site at www.solarcxm.com.

Our principal executive offices are located at 2999 North 44th Street, Suite 530, Phoenix, AZ 85108. Our telephone number is (855) 711-2009. We maintain an Internet website at www.singlepoint.com. The information contained on, connected to or that can be accessed via our website is not part of this prospectus. We have included our website address in this prospectus as an inactive textual reference only and not as an active hyperlink.

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described below and in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, as well as any amendments thereto reflected in subsequent filings with the SEC, each of which are incorporated by reference in this prospectus, and all of the other information in this prospectus, including our financial statements and related notes incorporated by reference herein. If any of these risks is realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the trading price of our common stock could decline and you could lose part or all of your investment. Additional risks and uncertainties that are not yet identified or that we currently believe to be immaterial may also materially harm our business, financial condition, results of operations and prospects and could result in a complete loss of your investment.

Our business, affairs, prospects, assets, financial condition, results of operations and cash flows could be materially and adversely affected by these risks. For more information about our SEC filings, please see “Where You Can Find More Information.”

Risks Related To This Offering and Our Common Stock

Our stock price has been and will likely continue to be volatile and you may not be able to sell shares of common stock at or above the offering price, if at all.

The trading price of our common stock may be highly volatile. The stock market in general and the market for solar companies in particular have experienced volatility that has often been unrelated to the operating performance of particular companies. As a result of this volatility, you may not be able to sell your common stock at or above the purchase price and you may lose some or all of your investment. If the market price of shares of our common stock after this offering does not exceed the offering price, you may not realize any return on your investment in us and may lose some or all of your investment. Broad market and industry factors may negatively affect the market price of our common stock, regardless of our actual operating performance.

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Management will have broad discretion in the application of the net proceeds from this offering, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are being used appropriately. Because of the number and variability of factors that will determine our use of the net proceeds from this offering, the ultimate use may vary substantially from their currently intended use. Our management might not apply our net proceeds in ways that ultimately increase or maintain the value of your investment.

Future sales and issuances of our common stock or rights to purchase common stock could result in additional dilution of the percentage ownership of our stockholders and could cause our stock price to fall.

We expect that significant additional capital may be needed in the future to continue our planned operations. To raise capital, we may sell common stock, convertible securities, or other equity securities in one or more transactions at prices and in a manner we determine from time to time. If we sell common stock, convertible securities, or other equity securities, investors may be materially diluted by subsequent sales. Such sales may also result in material dilution to our existing stockholders, and new investors could gain rights, preferences, and privileges senior to the holders of our common stock, including shares of common stock sold in this offering.

We do not intend to pay dividends on our common stock, so any returns will be limited to the value of our stock.

We have never issued dividends, and currently anticipate that we will retain future earnings for the development, operation, and expansion of our business and do not anticipate declaring or paying any cash dividends for the foreseeable future. In addition, we may enter into agreements that prohibit us from paying cash dividends without prior written consent from our contracting parties, or which other terms prohibiting or limiting the amount of dividends that may be declared or paid on our common stock. Any return to stockholders will therefore be limited to the appreciation of their stock, which may never occur.

Our principal stockholders and management own a significant percentage of our stock and will be able to exert significant influence over matters subject to stockholder approval.

Our executive officers, and directors through their holdings of super voting preferred stock beneficially owned a majority of the voting power of our capital stock. Therefore, even after this offering, these stockholders will have the ability to influence us through this ownership position. These stockholders may be able to determine all matters requiring stockholder approval. For example, these stockholders may be able to control elections of directors, amendments of our organizational documents, or approval of any merger, sale of assets, or other major corporate transaction. This may prevent or discourage unsolicited acquisition proposals or offers for our common stock that you may feel are in your best interest as one of our stockholders.

USE OF PROCEEDS

Unless otherwise indicated in a prospectus supplement, we intend to use the net proceeds from the sale of the securities under this prospectus for general corporate purposes, including general working capital purposes, which may include the repayment of outstanding debt. The amount of proceeds from this offering will depend upon the number of shares of our common stock sold and the market price at which they are sold. There can be no assurance that we will be able to sell any shares under. Therefore, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time.

DILUTION

If you invest in this offering, your ownership interest will be diluted to the extent of the difference between the public offering price per share of our common stock in this offering and the as adjusted net tangible book value per share of our common stock immediately after this offering. Our net tangible book value as of September 30, 2020 was approximately $($9,393,249.00), or approximately $(0.00) per share of common stock. Net tangible book value per share represents the amount of total tangible assets (total assets less intangible assets) less total liabilities, divided by the number of shares of our common stock outstanding as of September 30, 2020. Dilution in net tangible book value per share to new investors participating in this offering represents the difference between the amount per share paid by purchasers in this offering and the as adjusted net tangible book value per share of our common stock immediately after giving effect to this offering. After giving effect to the assumed sale of 675,675,676 shares of our common stock in the aggregate amount of approximately $19.2 million at an assumed offering price of $ 0.0285 per share, the last reported sale price of our common stock on OTC Pink Market on February 9, 2021, our as adjusted net tangible book value as of September 30, 2020 would have been approximately $9,863,507.77 or approximately $0.0038 per share of common stock. This represents an immediate increase in net tangible book value of $0.009 per share of common stock to our existing stockholders and an immediate dilution in net tangible book value of $0.0247 per share of common stock to investors participating in this offering at the assumed offering price.

The information above and in the foregoing table is based upon 1,943,081,280 shares of our common stock outstanding as of September 30, 2020. The information above and in the foregoing table excludes, as of September 30, 2020:

|

|

•

|

10,000,000 shares of common stock issuable upon the exercise of warrants to purchase common stock at a weighted-average exercise price of $0.10 per share;

|

|

|

•

|

100,000,000 shares of our common stock reserved for future issuance under our Equity Incentive Plan; and

|

|

|

•

|

1,713,201,750 shares of common stock reserved for the future issuance based upon the exercise terms set forth in the respective Certificate of Designations of our Preferred Stock outstanding as of February 9, 2021.

|

In addition, we may choose to raise additional capital in the future through the sale of equity or convertible debt securities due to market conditions or strategic considerations, even if we believe we have sufficient funds for our current or future operating plans.

DESCRIPTION OF COMMON STOCK

General

We are authorized to issue 5,000,000,000 shares of common stock, $0.0001 par value per share.

Holders of the Company’s common stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of common stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of common stock voting for the election of directors can elect all of the directors to our board of directors. Holders of the Company’s common stock representing a majority of the voting power of the Company’s common stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of stockholders. A vote by the holders of a majority of the Company’s outstanding shares is required to effectuate certain fundamental corporate changes such as a liquidation, merger or an amendment to the Company’s articles of incorporation.

Subject to the rights of preferred stockholders (if any), holders of the Company’s common stock are entitled to share in all dividends that the Board of Directors, in its discretion, declares from legally available funds. In the event of a liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the common stock. The Company’s common stock has no pre-emptive rights, no conversion rights, and there are no redemption provisions applicable to the Company’s common stock. All of the issued and outstanding shares of our common stock are duly authorized, validly issued, fully paid and non-assessable. To the extent that additional shares of our common stock are issued, the relative interests of existing stockholders will be diluted.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is West Coast Stock Transfer, Inc.

Listing

Our common stock is currently traded on the OTC Pink under the symbol “SING”.

DESCRIPTION OF PREFERRED STOCK

We are authorized to issue up to 100,000,000 shares of preferred stock, par value $0.0001 per share, from time to time, in one or more series. We have the following outstanding shares of preferred stock as of February 9, 2021:

|

Class

|

|

# Shares Outstanding

|

|

Class A Preferred Stock

|

|

59,000,000

|

|

Class B Preferred Stock

|

|

408

|

|

Class C Preferred Stock

|

|

510

|

*Pursuant to financing documents the Company has agreed to issue up to an additional 500 shares of Class C Preferred Stock under certain circumstances.

We are authorized to issue up to 100,000,000 shares of preferred stock, par value $0.0001 per share, in one or more classes or series within a class as may be determined by our board of directors, who may establish, from time to time, the number of shares to be included in each class or series, may fix the designation, powers, preferences and rights of the shares of each such class or series and any qualifications, limitations or restrictions thereof as shall be stated and expressed in the resolution or resolutions providing for the issuance of such stock adopted from time to time by the board of directors. Any preferred stock so issued by the board of directors may rank senior to the common stock with respect to the payment of dividends or amounts upon liquidation, dissolution or winding up of us, or both or have voting or conversion rights that could adversely affect the voting power or other rights of the holders of common stock. Moreover, under certain circumstances, the issuance of preferred stock or the existence of the unissued preferred stock might tend to discourage or render more difficult a merger or other change of control.

Class A Preferred Stock

We filed a Certificate of Designation with the Secretary of State of Nevada establishing a series of our preferred stock, of which 60,000,000 were designated as “Class A Preferred Stock.” A summary of the Certificate of Designation is set forth below:

Ranking. The Class A Convertible Preferred Stock ranks, as to dividends and upon liquidation, senior and prior to the Common stock of the Company.

Liquidation. In the event of liquidation, dissolution or winding up of the Company, the holders of the Class A Convertible Preferred Stock are entitled, out of the assets of the Company legally available for distribution, to receive, before any payment to the holders of shares of Common Stock or any other class or series of stock ranking junior, and amount per share equal to $1.00.

Voting. Each share of Class A Convertible Preferred Stock entitles the holder thereof to 50 votes on any matters requiring a shareholder vote of the Company.

Conversion. Each share of our Class A Convertible Preferred Stock is convertible into common stock on a one-for-25 basis at the option of the holder.

Class B Preferred Stock

In December 2020 we filed a Certificate of Designation with the Secretary of State of Nevada establishing a new series of our preferred stock, of which 1,500 were designated as “Class B Preferred Stock.” A summary of the Certificate of Designation is set forth below:

Redemption. The Company has the right to redeem the Class B Preferred Stock, in accordance with the following schedule:

|

|

i.

|

If all of the Class B Preferred Stock are redeemed within ninety (90) calendar days from the issuance date thereof, the Company shall have the right to redeem the Class B Preferred Stock upon three (3) business days’ of written notice at a price equal to one hundred and fifteen percent (115%) of the Stated Value together with any accrued but unpaid dividends;

|

|

|

ii.

|

If all of the Class B Preferred Stock are redeemed after ninety (90) calendar days and within one hundred twenty (120) calendar days from the issuance date thereof, the Company shall have the right to redeem the Class B Preferred Stock upon three (3) business days of written notice at a price equal to one hundred and twenty percent (120%) of the Stated Value together with any accrued but unpaid dividends; and

|

|

|

|

|

|

|

iii.

|

If all of the Class B Preferred Stock are redeemed after one hundred and twenty (120) calendar days and within one hundred eighty (180) calendar days from the issuance date thereof, the Company shall have the right to redeem the Class B Preferred Stock upon three (3) business days of written notice at a price equal to one hundred and twenty five percent (125%) of the Stated Value together with any accrued but unpaid dividends.

|

|

|

|

|

|

|

iv.

|

The Company shall redeem the Class B Preferred Stock on the date that is One (1) Calendar year from the issuance at an amount equaling the sum of the Stated Value and all accrued but unpaid dividends and all other amounts due pursuant to the Certificate of Designation.

|

Dividend. The Company shall pay a dividend of eight percent (8%) per annum on the Class B Preferred Stock. Dividends shall be paid quarterly, and at the Company’s discretion, in cash or Class B Preferred Stock calculated at the purchase price.

Stated Value. The Stated Value of the Class B Preferred Stock is $1,200 per share.

Conversion. Each share of the Class B Preferred Stock is convertible, at any time and from time to time from and after the issuance at the option of the Holder thereof, into that number of shares of Common Stock (subject to Beneficial Ownership Limitations) determined by dividing the Stated Value of such share of Preferred Stock by $0.00244.

Miscellaneous. From the date of issuance until the date when the Holder no longer holds any shares of Class B Preferred Stock, upon any issuance by the Company or any of its Subsidiaries of Common Stock or Common Stock Equivalents for cash consideration, Indebtedness or a combination of units thereof (a “Subsequent Financing”), the Holder may elect, in its sole discretion, to exchange (in lieu of conversion), if applicable, all or some of the shares of Class B Preferred Stock then held for any securities or units issued in a Subsequent Financing on a $1.00 for $1.00 basis. Additionally, if in such Subsequent Financing there are any contractual provisions or side letters that provide terms more favorable in the aggregate discount to the investors than the terms provided for hereunder, then the Company shall specifically notify the Holder of such additional or more favorable terms and such terms, at Holder’s option, shall become a part of the transaction documents with the Holder. If at any time the Company sells any Common Stock Equivalents or rights to purchase stock, warrants, securities or other property pro rata to the record holders of any class of shares of Common Stock (the “Purchase Rights”), then the Holder will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which the Holder could have acquired if the Holder had held the number of shares of Common Stock acquirable upon complete conversion of such Holder’s Preferred Stock (without regard to any limitations on exercise hereof, including without limitation, the Beneficial Ownership Limitation) immediately before the date on which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the grant, issue or sale of such Purchase Rights (provided, however, to the extent that the Holder’s right to participate in any such Purchase Right would result in the Holder exceeding the Beneficial Ownership Limitation, then the Holder shall not be entitled to participate in such Purchase Right to such extent (or beneficial ownership of such shares of Common Stock as a result of such Purchase Right to such extent) and such Purchase Right to such extent shall be held in abeyance for the Holder until such time, if ever, as its right thereto would not result in the Holder exceeding the Beneficial Ownership Limitation). Notwithstanding the foregoing, the holders of the Preferred Stock shall not be entitled to such rights relating to the spin-off of non-core assets of the Company, even if the holders of common stock of the Company are entitled to such dividend. Upon a Subsequent Financing, a Holder of at least one hundred (100) shares of Class B Preferred Stock shall have the right to participate in up to an amount of the Subsequent Financing equal to 100% of the Subsequent Financing on the same terms, conditions and price provided for in the Subsequent Financing. If at any time on or after the issuance date of the Class B Preferred Stock, the Company proposes to file any Registration Statement with respect to any offering of equity securities, or securities or other obligations exercisable or exchangeable for, or convertible into, equity securities, by the Company for its own account or for shareholders of the Company for their account (or by the Company and by shareholders of the Company), other than a Registration Statement in connection with a merger or acquisition, then the Company shall offer to the Holders the opportunity to register the sale of such number of Preferred Stock as such Holders may request in writing.

Class C Preferred Stock

In January 2021 we filed a Certificate of Designation with the Secretary of State of Nevada establishing a new series of our preferred stock, of which 1,500 were designated as “Class C Preferred Stock.” A summary of the Certificate of Designation is set forth below (all capitalized terms not otherwise defined herein shall have that definition assigned to it as per the Certificate of Designation for the Class C Preferred Stock).

The Company has the right to redeem the Class C Preferred Stock, in accordance with the following schedule:

|

|

i.

|

If all of the Class C Preferred Stock are redeemed within ninety (90) calendar days from the issuance date thereof, the Company shall have the right to redeem the Class C Preferred Stock upon three (3) business days’ of written notice at a price equal to one hundred and fifteen percent (115%) of the Stated Value together with any accrued but unpaid dividends;

|

|

|

|

|

|

|

ii.

|

If all of the Class C Preferred Stock are redeemed after ninety (90) calendar days and within one hundred twenty (120) calendar days from the issuance date thereof, the Company shall have the right to redeem the Class C Preferred Stock upon three (3) business days of written notice at a price equal to one hundred and twenty percent (120%) of the Stated Value together with any accrued but unpaid dividends; and

|

|

|

|

|

|

|

iii.

|

If all of the Class C Preferred Stock are redeemed after one hundred and twenty (120) calendar days and within one hundred eighty (180) calendar days from the issuance date thereof, the Company shall have the right to redeem the Class C Preferred Stock upon three (3) business days of written notice at a price equal to one hundred and twenty five percent (125%) of the Stated Value together with any accrued but unpaid dividends.

|

|

|

|

|

|

|

iv.

|

The Company shall redeem the Class C Preferred Stock on the date that is One (1) Calendar year from the issuance at an amount equaling the sum of the Stated Value and all accrued but unpaid dividends and all other amounts due pursuant to the Certificate of Designation.

|

The Company shall pay a dividend of three percent (3%) per annum on the Class C Preferred Stock. Dividends shall be paid quarterly, and at the Company’s discretion, in cash or Class C Preferred Stock calculated at the purchase price. The Stated Value of the Class C Preferred Stock is $1,200 per share.

The Class C Preferred Stock will vote together with the common stock on an as-converted basis subject to the Beneficial Ownership Limitations (as set forth in the Certificate of Designation).

Each share of the Class C Preferred Stock is convertible, at any time and from time to time from and after the issuance at the option of the Holder thereof, into that number of shares of Common Stock (subject to Beneficial Ownership Limitations) determined by dividing the Stated Value of such share by the lesser of (i) (a) $.0163 (a fixed price equaling ninety percent (90%) of the average daily volume weighted average price (“VWAP”) for the Company’s common stock for the five (5) trading days preceding the execution of definitive agreements); and (b) where applicable, a fixed price equaling ninety percent (90%) of the average daily VWAP for the five (5) trading days following a reverse split.

From the date of issuance until the date when the Holder no longer holds any shares of Class C Preferred Stock, upon any issuance by the Company or any of its Subsidiaries of Common Stock or Common Stock Equivalents for cash consideration, Indebtedness or a combination of units thereof (a “Subsequent Financing”), the Holder may elect, in its sole discretion, to exchange (in lieu of conversion), if applicable, all or some of the shares of Class C Preferred Stock then held for any securities or units issued in a Subsequent Financing on a $1.00 for $1.00 basis. Additionally, if in such Subsequent Financing there are any contractual provisions or side letters that provide terms more favorable in the aggregate discount to the investors than the terms provided for hereunder, then the Company shall specifically notify the Holder of such additional or more favorable terms and such terms, at Holder’s option, shall become a part of the transaction documents with the Holder.

If at any time the Company sells any Common Stock Equivalents or rights to purchase stock, warrants, securities or other property pro rata to the record holders of any class of shares of Common Stock (the “Purchase Rights”), then the Holder will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which the Holder could have acquired if the Holder had held the number of shares of Common Stock acquirable upon complete conversion of such Holder’s Preferred Stock (without regard to any limitations on exercise hereof, including without limitation, the Beneficial Ownership Limitation) immediately before the date on which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the grant, issue or sale of such Purchase Rights (provided, however, to the extent that the Holder’s right to participate in any such Purchase Right would result in the Holder exceeding the Beneficial Ownership Limitation, then the Holder shall not be entitled to participate in such Purchase Right to such extent (or beneficial ownership of such shares of Common Stock as a result of such Purchase Right to such extent) and such Purchase Right to such extent shall be held in abeyance for the Holder until such time, if ever, as its right thereto would not result in the Holder exceeding the Beneficial Ownership Limitation). Notwithstanding the foregoing, the holders of the Preferred Stock shall not be entitled to such rights relating to the spin-off of non-core assets of the Company, even if the holders of common stock of the Company are entitled to such dividend. Upon a Subsequent Financing, a Holder of at least one hundred (100) shares of Class C Preferred Stock shall have the right to participate in up to an amount of the Subsequent Financing equal to 100% of the Subsequent Financing on the same terms, conditions and price provided for in the Subsequent Financing.

If at any time on or after the issuance date of the Class C Preferred Stock, the Company proposes to file any Registration Statement with respect to any offering of equity securities, or securities or other obligations exercisable or exchangeable for, or convertible into, equity securities, by the Company for its own account or for shareholders of the Company for their account (or by the Company and by shareholders of the Company), other than a Registration Statement in connection with a merger or acquisition, then the Company shall offer to the Holders the opportunity to register the sale of such number of Preferred Stock as such Holders may request in writing.

Warrants

In October 2017, the Company issued warrants to purchase an aggregate of 10,000,000 shares of common stock at an exercise price of $.10 per share for a period of five years, subject to adjustment.

PLAN OF DISTRIBUTION

We may sell the securities offered through this prospectus (i) to or through underwriters or dealers, (ii) directly to purchasers, including our affiliates, (iii) through agents, or (iv) through a combination of any these methods. . The prospectus supplement will include the following information:

|

|

●

|

the terms of the offering;

|

|

|

●

|

the names of any underwriters or agents;

|

|

|

●

|

the name or names of any managing underwriter or underwriters;

|

|

|

●

|

the purchase price of the securities;

|

|

|

●

|

any over-allotment options under which underwriters may purchase additional securities from us;

|

|

|

●

|

the net proceeds from the sale of the securities;

|

|

|

●

|

any delayed delivery arrangements;

|

|

|

●

|

any underwriting discounts, commissions and other items constituting underwriters’ compensation;

|

|

|

●

|

any discounts or concessions allowed or reallowed or paid to dealers;

|

|

|

●

|

any commissions paid to agents; and

|

|

|

●

|

any securities exchange or market on which the securities may be listed.

|

Sale Through Underwriters or Dealers

Only underwriters named in the prospectus supplement are underwriters of the securities offered by the prospectus supplement. If underwriters are used in the sale, the underwriters will acquire the securities for their own account, including through underwriting, purchase, security lending or repurchase agreements with us. The underwriters may resell the securities from time to time in one or more transactions, including negotiated transactions. Underwriters may sell the securities in order to facilitate transactions in any of our other securities (described in this prospectus or otherwise), including other public or private transactions and short sales. Underwriters may offer securities to the public either through underwriting syndicates represented by one or more managing underwriters or directly by one or more firms acting as underwriters. Unless otherwise indicated in the prospectus supplement, the obligations of the underwriters to purchase the securities will be subject to certain conditions, and the underwriters will be obligated to purchase all the offered securities if they purchase any of them. The underwriters may change from time to time any initial public offering price and any discounts or concessions allowed or reallowed or paid to dealers.

If dealers are used in the sale of securities offered through this prospectus, we will sell the securities to them as principals. They may then resell those securities to the public at varying prices determined by the dealers at the time of resale. The prospectus supplement will include the names of the dealers and the terms of the transaction.

Direct Sales and Sales Through Agents

We may sell the securities offered through this prospectus directly. In this case, no underwriters or agents would be involved. Such securities may also be sold through agents designated from time to time. The prospectus supplement will name any agent involved in the offer or sale of the offered securities and will describe any commissions payable to the agent. Unless otherwise indicated in the prospectus supplement, any agent will agree to use its reasonable best efforts to solicit purchases for the period of its appointment.

We may sell the securities directly to institutional investors or others who may be deemed to be underwriters within the meaning of the Securities Act with respect to any sale of those securities. The terms of any such sales will be described in the prospectus supplement.

Delayed Delivery Contracts

If the prospectus supplement indicates, we may authorize agents, underwriters or dealers to solicit offers from certain types of institutions to purchase securities at the public offering price under delayed delivery contracts. These contracts would provide for payment and delivery on a specified date in the future. The contracts would be subject only to those conditions described in the prospectus supplement. The applicable prospectus supplement will describe the commission payable for solicitation of those contracts.

Continuous Offering Program

Without limiting the generality of the foregoing, we may enter into a continuous offering program equity distribution agreement with a broker-dealer, under which we may offer and sell shares of our common stock from time to time through a broker-dealer as our sales agent. If we enter into such a program, sales of the shares of common stock, if any, will be made by means of ordinary brokers’ transactions on the OTC Pink or other market on which are shares may then trade at market prices, block transactions and such other transactions as agreed upon by us and the broker-dealer. Under the terms of such a program, we also may sell shares of common stock to the broker-dealer, as principal for its own account at a price agreed upon at the time of sale. If we sell shares of common stock to such broker-dealer as principal, we will enter into a separate terms agreement with such broker-dealer, and we will describe this agreement in a separate prospectus supplement or pricing supplement.

Market Making, Stabilization and Other Transactions

Unless the applicable prospectus supplement states otherwise, other than our common stock, all securities we offer under this prospectus will be a new issue and will have no established trading market. We may elect to list offered securities on an exchange or in the over-the-counter market. Any underwriters that we use in the sale of offered securities may make a market in such securities, but may discontinue such market making at any time without notice. Therefore, we cannot assure you that the securities will have a liquid trading market.

Any underwriter may also engage in stabilizing transactions, syndicate covering transactions and penalty bids in accordance with Rule 104 under the Securities Exchange Act. Stabilizing transactions involve bids to purchase the underlying security in the open market for the purpose of pegging, fixing or maintaining the price of the securities. Syndicate covering transactions involve purchases of the securities in the open market after the distribution has been completed in order to cover syndicate short positions.

Penalty bids permit the underwriters to reclaim a selling concession from a syndicate member when the securities originally sold by the syndicate member are purchased in a syndicate covering transaction to cover syndicate short positions. Stabilizing transactions, syndicate covering transactions and penalty bids may cause the price of the securities to be higher than it would be in the absence of the transactions. The underwriters may, if they commence these transactions, discontinue them at any time.

General Information

Agents, underwriters, and dealers may be entitled, under agreements entered into with us, to indemnification by us against certain liabilities, including liabilities under the Securities Act. Our agents, underwriters, and dealers, or their affiliates, may be customers of, engage in transactions with or perform services for us, in the ordinary course of business.

LEGAL MATTERS

The validity of the issuance of the securities offered by this prospectus will be passed upon for us by JMS Law Group, PLLC, Plainview, New York.

EXPERTS

The financial statements of Singlepoint Inc. as of and for the years ended December 31, 2019 and December 31, 2018 appearing in Singlepoint Inc.’s Annual Report on Form 10-K for the year ended December 31, 2019, have been audited by Turner, Stone & Company, L.L.P, as set forth in its report thereon, included therein, and incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and special reports, along with other information with the SEC. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov.

This prospectus is part of a registration statement that we have filed with the SEC. Certain information in the registration statement has been omitted from this prospectus in accordance with SEC rules and regulations. For more detail about us and any securities that may be offered by this prospectus, you may examine the registration statement on Form S-3 and the exhibits filed with it at the locations listed in the previous paragraph. Please be aware that statements in this prospectus referring to a contract or other document are summaries and you should refer to the exhibits that are part of the registration statement for a copy of the contract or document.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

This prospectus is part of a registration statement filed with the SEC. The SEC allows us to “incorporate by reference” into this prospectus the information that we file with them, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. The following documents are incorporated by reference and made a part of this prospectus:

|

|

●

|

our Annual Report on Form 10-K for the year ended December 31, 2019 filed with the SEC on March 31, 2020;

|

|

|

●

|

our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2020 filed with the SEC on May 20, 2020;

|

|

|

●

|

our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2020 filed with the SEC on August 14, 2020;

|

|

|

●

|

our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2020 filed with the SEC on November 16, 2020;

|

|

|

●

|

our Current Reports on Form 8-K filed with the SEC on January 7, 2020, January 17, 2020, February 4, 2020, February 24, 2020, March 9, 2020, March 13, 2020, April 23, 2020, July 23, 2020, July 28, 2020, October 2, 2020, October 15, 2020(2), October 30, 2020, December 23, 2020, January 19, 2021, January 29, 2021, February 1, 2021 and February 25, 2021; and

|

|

|

●

|

the description of our common stock contained in our Registration Statement on Form 8-A filed with the SEC on September 19, 2008, including any amendment or report filed for the purpose of updating such description.

|

|

|

|

|

|

|

●

|

all future documents filed by us with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, including all filings made after the date of the filing of this prospectus, prior to the termination of the offering of the underlying securities; provided, however, that we are not incorporating by reference any additional documents or information furnished and not filed with the SEC.

|

Nothing in this prospectus shall be deemed to incorporate information furnished but not filed with the SEC (including without limitation, information furnished under Item 2.02 or Item 7.01 of Form 8-K, and any exhibits relating to such information).

Upon request, either orally or in writing, we will provide, without charge, to each person, including any beneficial owner, to whom a copy of this prospectus is delivered, a copy of the documents incorporated by reference into this prospectus but not delivered with the prospectus. You may request a copy of these filings, and any exhibits we have specifically incorporated by reference as an exhibit in this prospectus, at no cost by writing us at the following address: Singlepoint Inc. 2999 North 44th Street, Suite 530 Phoenix, Arizona 85018.

You should rely only on the information incorporated by reference or provided in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus or in the documents incorporated by reference is accurate as of any date other than the date on the front of this prospectus or those documents.

Singlepoint Inc.

$19,256,756.76

Common Stock

Prospectus

, 2021

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the costs and expenses payable by the Registrant in connection with this offering, other than underwriting commissions and discounts, all of which are estimated except for the SEC registration fee.

|

SEC registration fee

|

|

$

|

5,455**

|

|

|

Printing

|

|

|

*

|

|

|

Legal fees and expenses

|

|

$

|

*

|

|

|

Accounting fees and expenses

|

|

$

|

*

|

|

|

Trustees’ Fees and Expenses

|

|

|

*

|

|

|

Warrant Agent Fees and Expenses

|

|

|

*

|

|

|

Miscellaneous

|

|

|

*

|

|

|

Total

|

|

$

|

*

|

|

|

*

|

These fees are calculated based on the securities offered and the number of issuances and accordingly cannot be estimated at this time. The applicable prospectus supplement will set forth the estimated amount of expenses of any offering of securities.

|

|

*

|

Amended fee of $2,100.91 due, the amount listed was previously paid by the Registrant.

|

Item 15. Indemnification of Directors and Officers.

Neither our Articles of Incorporation nor Bylaws prevent us from indemnifying our officers, directors and agents to the extent permitted under the Nevada Revised Statute (“NRS”). NRS Section 78.7502 provides that a corporation shall indemnify any director, officer, employee or agent of a corporation against expenses, including attorneys’ fees, actually and reasonably incurred by him in connection with any defense to the extent that a director, officer, employee or agent of a corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding referred to in Section 78.7502(1) or 78.7502(2), or in defense of any claim, issue or matter therein.

NRS 78.7502(1) provides that a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in the right of the corporation, by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with the action, suit or proceeding if he: (a) is not liable pursuant to NRS 78.138; or (b) acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful.

NRS Section 78.7502(2) provides that a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses, including amounts paid in settlement and attorneys’ fees actually and reasonably incurred by him in connection with the defense or settlement of the action or suit if he: (a) is not liable pursuant to NRS 78.138; or (b) acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation. Indemnification may not be made for any claim, issue or matter as to which such a person has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals there from, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court in which the action or suit was brought or other court of competent jurisdiction determines upon application that in view of all the circumstances of the case, the person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper.

NRS Section 78.747 provides that except as otherwise provided by specific statute, no director or officer of a corporation is individually liable for a debt or liability of the corporation, unless the director or officer acts as the alter ego of the corporation. The court as a matter of law must determine the question of whether a director or officer acts as the alter ego of a corporation.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us pursuant to the foregoing provisions, we have been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public policy as expressed hereby in the Securities Act and we will be governed by the final adjudication of such issue.

Item 16. Exhibits.

EXHIBIT INDEX

|

4.1

|

|

Form of Stock Purchase Agreement.***

|

|

|

|

|

|

5.1

|

|

Opinion of JMS Law Group, PLLC

|

|

|

|

|

|

10.2

|

|

Securities Financing Agreement between Singlepoint Inc. and Chicago Venture Partners, LP dated October 6, 2017 (including warrant to purchase 5,000,000 shares of common stock of Singlepoint Inc.).*

|

|

|

|

|

|

10.3

|

|

Securities Financing Agreement between Singlepoint Inc. and UAHC Ventures LLC dated October 6, 2017 (including warrant to purchase 5,000,000 shares of common stock of Singlepoint Inc.).*

|

|

|

|

|

|

10.4

|

|

Stock Financing Agreement between Singlepoint Inc., and Jiffy Auto Glass dated October 11, 2017.*

|

|

|

|

|

|

10.5

|

|

Stock Financing Agreement between Singlepoint Inc. and ShieldSaver LLC dated January 16, 2018.*

|

|

|

|

|

|

10.6

|

|

Employment Agreement between Singlepoint Inc. and Gregory Lambrecht dated May 30, 2018.*

|

|

|

|

|

|

10.7

|

|

Employment Agreement between Singlepoint Inc. and William Ralston dated May 30, 2018.*

|

|

|

|

|

|

10.8

|

|

Securities Purchase Agreement between Singlepoint Inc. and Iliad Research and Trading, L.P. dated as of November 5, 2018. (including the following documents attached as exhibits thereto: (i) Secured Convertible Promissory Note, (ii) Investor Notes #1-9, and (iii) Security Agreement). (filed as an Exhibit to Company’s Form 8-K filed with SEC on November 15, 2018, and incorporated herein by reference)

|

|

|

|

|

|

10.9

|

|

Asset Purchase Agreement dated as of February 22, 2019 between Singlepoint Inc., Direct Solar LLC, and AI Live Transfers LLC. (filed as an Exhibit to Company’s Form 8-K filed with SEC on February 26, 2019, and incorporated herein by reference)

|

|

10.10

|

|

Purchase Agreement between Singlepoint Inc., Elite Foundation Inc. and Easy Street Services Company dated June 18, 2019. (filed as an Exhibit to Company’s Form 8-K filed with SEC on June 27, 2019, and incorporated herein by reference)

|

|

|

|

|

|

10.11

|

|

Employment Agreement between Singlepoint Inc. and Corey Lambrecht dated January 17, 2020. (filed as an Exhibit to Company’s Form 8-K filed with SEC on January 17, 2020, and incorporated herein by reference)

|

|

|

|

|

|

10.12

|

|

Singlepoint Inc. 2019 Equity Incentive Plan. (filed as an Exhibit to Company’s Form 8-K filed with SEC on February 4, 2020, and incorporated herein by reference)

|

|

|

|

|

|

10.13

|

|

Securities Purchase Agreement between Singlepoint Inc. and GS Capital, LLC Partners, LLC dated as of March 6, 2020 (including the $1,440,000 principal amount of 10% Convertible Redeemable Note). (filed as an Exhibit to Company’s Form 8-K filed with SEC on March 13, 2020, and incorporated herein by reference)

|

|

|

|

|

|

10.14

|

|

Equity Financing Agreement between Singlepoint Inc. and GHS Investments LLC dated as of April 21, 2020. (filed as an Exhibit to Company’s Form 8-K filed with SEC on April 23, 2020, and incorporated herein by reference)

|

|

|

|

|

|

10.15

|

|

Registration Rights Agreement between Singlepoint Inc. and GHS Investments LLC dated as of April 21, 2020. (filed as an Exhibit to Company’s Form 8-K filed with SEC on April 23, 2020, and incorporated herein by reference)

|

|

|

|

|

|

23.1

|

|

Consent of Turner, Stone & Company, L.L.P

|

|

|

|

|

|

23.2

|

|

Consent of JMS Law Group, PLLC (contained in Exhibit 5.1)

|

* filed as an Exhibit to the Company’s Registration Statement on Form 10, filed with the SEC on June 15, 2018 and incorporated herein by reference.

** filed as an Exhibit to Company’s Form S-1 filed with SEC on June 12, 2020, and incorporated herein by reference.

*** to be filed by amendment or by a Current Report on Form 8-K and incorporated by reference herein.

Item 17. Undertakings

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement.

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, Paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the registration statement is on Form S-3 or Form F-3 and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3)shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date;

(5) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(6) That for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(7) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

(8) That, for purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act of 1933 shall be deemed to be part of this registration statement as of the time it was declared effective;

(9) That, for the purpose of determining any liability under the Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; and

(10) To file an application for the purpose of determining the eligibility of the trustee to act under subsection (a) of Section 310 of the Trust Indenture Act of 1939 in accordance with the rules and regulations prescribed by the Securities and Exchange Commission under Section 305(b)(2) of the Trust Indenture Act of 1939.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Phoenix, State of Arizona, on March 1, 2021.

|

|

Singlepoint Inc.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Gregory P. Lambrecht

|

|

|

|

|

Gregory P. Lambrecht

Chief Executive Officer,

Chairman of the Board of Directors

(Principal Executive Officer)

|

|

Each person whose signature appears below constitutes and appoints Gregory P. Lambrecht, as his true and lawful attorney in fact and agent, with full powers of substitution and re-substitution, for him and in his name, place and stead, in any and all capacities, to sign any or all amendments (including post effective amendments) to the Registration Statement, and to sign any registration statement for the same offering covered by this Registration Statement that is to be effective upon filing pursuant to Rule 462(b) under the Securities Act of 1933, as amended, and all post effective amendments thereto, and to file the same, with all exhibits thereto, and all documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent, each acting alone, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, each acting alone, or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed below by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Gregory P. Lambrecht

|

|

Chief Executive Officer, and Chairman of the Board (Principal Executive Officer)

|

|

March 1, 2021

|

|

Gregory P. Lambrecht

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Corey Lambrecht

|

|

Chief Financial Officer (Principal Accounting Officer)

|

|

March 1, 2021

|

|

Corey Lambrecht

|

|

|

|

|

|

|

|

|

|

|

|

/s/ William Ralston

|

|

President, Director

|

|

March 1, 2021

|

|

William Ralston

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Eric Lofdahl

|

|

Director