Amended Statement of Beneficial Ownership (3/a)

February 26 2021 - 5:44PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Bettis Carr |

2. Date of Event Requiring Statement (MM/DD/YYYY)

9/4/2018

|

3. Issuer Name and Ticker or Trading Symbol

AUDIOEYE INC [AEYE]

|

|

(Last)

(First)

(Middle)

C/O AUDIOEYE INC, 5210 E. WILLIAMS CIRCLE, SUITE 750 |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

__X__ Director ___X___ 10% Owner

___X___ Officer (give title below) _____ Other (specify below)

Exec Chrmn/Chrmn of the Board / |

|

(Street)

TUCSON, AZ 85711

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

9/4/2018

| 6. Individual or Joint/Group Filing(Check Applicable Line)

_X_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Common Stock | 128180 (1) | D | |

| Common Stock | 27593 (2) | I | J. Carr & Stephanie V. Bettis Revocable Trust, Dated January 1, 2003 (3) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Series A Convertible Preferred Stock | (4) | (4) | Common Stock | 10000 (5) | (6)(7) | I | J. Carr & Stephanie V. Bettis Revocable Trust, Dated January 1, 2003 (3) |

| Explanation of Responses: |

| (1) | The reporting person's Form 3 filed on September 4, 2018, and subsequent Form 4s, inadvertently understated the reporting person's direct holdings by 840 shares. |

| (2) | The reporting person's Form 3 filed on September 4, 2018, and subsequent Form 4s, inadvertently reported certain shares of Series A Convertible Preferred Stock held by the J. Carr & Stephanie V. Bettis Revocable Trust, Dated 1/1/03 (the "Trust") as shares of common stock, overstating the number of shares of common stock held by the Trust by 27,263 shares. |

| (3) | Dr. Bettis is deemed to be a beneficial owner of the J. Carr & Stephanie V. Bettis Revocable Trust, dated January 1, 2003. |

| (4) | The shares of Series A Preferred Stock were immediately convertible upon issuance and do not expire. |

| (5) | The reporting person's Form 3 filed on September 4, 2018, and subsequent Form 4s, inadvertently overstated the number shares of Series A Preferred Stock held by the Trust by 16,801 shares. |

| (6) | Each share of Series A Convertible Preferred Stock of the Issuer ("Series A Preferred Stock") shall be convertible, at any time and from time to time into that number of shares of the Issuer's common stock determined by dividing $10 (the "Stated Value") plus any accrued dividends with respect to such share by the Conversion Price of $4.385, subject to adjustment as described in the Certificate of Designations for the Series A Preferred Stock (the "Series A COD"). |

| (7) | Holders of shares of Series A Preferred Stock are entitled to receive, when, as and if declared by the Board of Directors of the Issuer, cumulative dividends at the annual rate of 5% of the Stated Value per share of Series A Preferred Stock. Such dividends shall accrue on each such share commencing on the date of issue, and shall accrue from day to day, whether or not earned or declared. Subject to the terms of the Series A COD, at any time the Issuer shall be entitled to redeem any or all of the outstanding shares of Series A Preferred Stock at a per share price equal to 125% of the Stated Value plus accumulated dividends, payable in cash. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Bettis Carr

C/O AUDIOEYE INC

5210 E. WILLIAMS CIRCLE, SUITE 750

TUCSON, AZ 85711 | X | X | Exec Chrmn/Chrmn of the Board |

|

Signatures

|

| /s/ James Spolar, Attorney-in-Fact | | 2/26/2021 |

| **Signature of Reporting Person | Date |

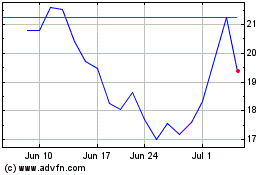

AudioEye (NASDAQ:AEYE)

Historical Stock Chart

From Mar 2024 to Apr 2024

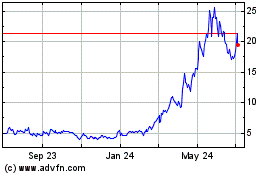

AudioEye (NASDAQ:AEYE)

Historical Stock Chart

From Apr 2023 to Apr 2024