Beyond Meat Signs Supply Deals With McDonald's, Yum

February 25 2021 - 7:07PM

Dow Jones News

By Jacob Bunge

Beyond Meat Inc. said it struck deals to supply plant-based meat

imitations to McDonald's, KFC and Pizza Hut, a victory in the

company's effort to take meat alternatives into the American dining

mainstream.

Under separate agreements announced Thursday, California-based

Beyond said it would be the preferred supplier for a new

plant-based burger from McDonald's Corp., while helping develop new

plant-based menu items for Yum Brands Inc. chains KFC, Pizza Hut

and Taco Bell.

The deals boost Beyond's prospects as more restaurants resume

in-person dining, after Covid-19 forced shutdowns and restrictions

on eating out over the past year. The pandemic's blow to the

food-service industry hurt Beyond's business, which had been

heavily propelled by restaurants in recent years, and prompted the

company to focus more on supermarket sales.

Beyond reported Thursday a $25.1 million loss for 2020's fourth

quarter, as restaurant orders remained sluggish.

"They are the biggest deals you could possibly put together in

food," said Ethan Brown, Beyond Meat's chief executive and founder,

of the new agreements with McDonald's and Yum.

Beyond, founded in 2009, processes yellow pea protein, canola

oil, potato starch and other ingredients to produce patties and

sausages meant to mimic the taste, appearance and feel of

traditional meat. Along with competitor Impossible Foods Inc., the

companies have pitched their high-tech faux meats as an animal- and

environment-friendly option for consumers that have been more open

to "flexitarian" diets.

Fast-food chains like Burger King, White Castle and Carl's Jr.

have credited meat-free burger patties for bringing in new diners,

boosting overall checks and building buzz. Before the pandemic, the

rapid rollout of plant-based burgers at times had generated

shortages, prompting producers to invest in new manufacturing

plants.

For plant-based food makers like Beyond and Impossible, teaming

up with burger chains has represented a way to take meat-free

products beyond a health-food niche, to be sold in familiar forms

at thousands of restaurant locations across the country.

Beyond's three-year global strategic agreement with McDonald's

includes working with the burger giant on potential chicken, pork

and egg alternatives. McDonald's announced its McPlant products in

November, saying that the chain envisioned a line of plant-based

menu offerings, following an earlier test of Beyond-made

patties.

Yum's partnership with Beyond will focus on creating new menu

items that expand on the companies' earlier introductions, which

included Beyond-made fried chicken tested by KFC in 2019, and

Beyond-made toppings launched in 2020 at Pizza Hut. Mr. Brown said

that Beyond wasn't likely to generate many sales from the new

ventures until the end of 2021.

McDonald's Chief Supply Chain Officer Francesca DeBiase said

partnering with Beyond was an important step in the company's

long-term strategy to develop plant-based menu items. Chris Turner,

Yum's chief financial officer, said his company's tests with

Beyond-developed entrees had good potential to draw younger

consumers to Yum's chains.

Beyond's sales for 2020's fourth quarter increased 3.5% to $102

million, despite its U.S. food service sales dropping 43% from the

same quarter a year ago. The company's quarterly loss came in

bigger than analysts projected and grew from the third quarter of

2019, when Beyond reported a $19 million loss.

Mr. Brown said that the late-2020 surge in Covid-19 infections

added more pressure to Beyond's restaurant sales, and that

prospects now look better as coronavirus cases ease.

Write to Jacob Bunge at jacob.bunge@wsj.com

(END) Dow Jones Newswires

February 25, 2021 18:52 ET (23:52 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

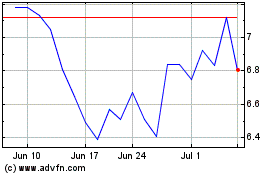

Beyond Meat (NASDAQ:BYND)

Historical Stock Chart

From Mar 2024 to Apr 2024

Beyond Meat (NASDAQ:BYND)

Historical Stock Chart

From Apr 2023 to Apr 2024