Cara Therapeutics, Inc. (Nasdaq: CARA), a biopharmaceutical company

focused on developing and commercializing new chemical entities

designed to alleviate pruritus by selectively targeting peripheral

kappa opioid receptors (KORs), today announced financial results

and operational highlights for the fourth quarter and full year

ended December 31, 2020.

“During 2020, we made significant advances in

our late-stage clinical pruritus programs, culminating in the

acceptance by the U.S. Food and Drug Administration (FDA) of our

first New Drug Application (NDA) filing for our lead product

candidate, KORSUVA™ (CR845/difelikefalin) Injection for the

treatment of moderate-to-severe pruritus in hemodialysis patients,”

said Derek Chalmers, Ph.D., D.Sc., President and Chief Executive

Officer of Cara Therapeutics. “In addition, we executed a strategic

commercial licensing agreement with Vifor (International) Ltd.

(Vifor) that we believe will provide significant momentum for the

launch and adoption of KORSUVA Injection in the United States, if

approved. Looking forward, we also expect 2021 to be a very

exciting year for our Oral KORSUVA pruritus programs as we report

top-line data for the KARE Phase 2 dose-ranging trial in atopic

dermatitis in the first half of 2021 and initiate our Phase 3

registration trials in stage III-V CKD patients in the second half

of the year.”

Fourth Quarter and Recent

Developments:

KORSUVA Injection: Chronic Kidney

Disease-Associated Pruritus (CKD-aP): Hemodialysis

In February 2021, the FDA accepted the filing of

the NDA for KORSUVA Injection for the treatment of

moderate-to-severe pruritus in hemodialysis patients. If approved,

KORSUVA Injection would be the first treatment for CKD-aP in

dialysis patients. If granted priority review, potential approval

and commercial launch of KORSUVA Injection could take place in the

second half of 2021.

In October 2020, the Company entered into a

license agreement with Vifor under which it granted Vifor an

exclusive license to commercialize KORSUVA Injection for the

treatment of pruritus in hemodialysis patients in the United

States under a Cara 60%, Vifor 40% profit-sharing arrangement.

Under the terms of the agreement, the Company received an upfront

payment of $100.0 million from Vifor and an additional

payment of $50.0 million for the purchase of the

Company’s common stock at a price of $17.0094 per

share.

Upon U.S. regulatory approval of

KORSUVA Injection, the Company will also be eligible to receive an

additional $50.0 million common stock investment at a 20%

premium to the 30-day trailing average price of the Company’s

common stock as of such date. In addition, the Company is eligible

to receive payments of up to $240.0 million upon the

achievement of certain sales-based milestones.

Oral KORSUVA: CKD-aP:

Non-Hemodialysis

In December 2019, the Company announced positive

top-line results from its Phase 2 dose-ranging trial of Oral

KORSUVA for the treatment of pruritus in patients with stage III-V

(moderate-to-severe) CKD. The Company expects to conduct an End of

Phase 2 Meeting with the FDA regarding this indication in the

second quarter of 2021. Following the meeting, the Company intends

to initiate the Phase 3 program in patients with stage III-V CKD in

the second half of 2021.

Oral KORSUVA: Atopic Dermatitis

(AD)

In December 2020, the Company announced that it

has completed full enrollment in the ongoing KARE Phase 2

dose-ranging trial of Oral KORSUVA for the treatment of

moderate-to-severe pruritus in approximately 400 adult AD patients.

The study is evaluating the safety and efficacy of three tablet

strengths (0.25 mg, 0.5 mg and 1.0 mg, twice daily) of Oral KORSUVA

versus placebo for 12 weeks, followed by a four-week active

extension phase.

KARE’s primary efficacy endpoint is change from

baseline in the weekly mean of the daily 24-hour Worst Itch –

Numeric Rating Scale (WI-NRS) score at week 12 of the treatment

period. The key secondary endpoint for KARE is the assessment of

the proportion of patients achieving an improvement from baseline

of ≥4 points with respect to the weekly mean of the daily 24-hour

WI-NRS score at week 12. Itch-related quality of life scores at the

end of week 12 are assessed by the total Skindex-10 and 5-D itch

scales.

The Company aims to report top-line results from

this trial in the first half of 2021, subject to any delays related

to the ongoing COVID-19 pandemic.

Oral KORSUVA: Chronic Liver

Disease-Associated Pruritus (CLD-aP): Primary Biliary Cholangitis

(PBC)

The Company is currently conducting a Phase 2

trial of Oral KORSUVA for the treatment of pruritus in patients

with hepatic impairment due to PBC. The trial is evaluating the

safety and efficacy of Oral KORSUVA (1.0 mg tablet, twice daily)

versus placebo for 16 weeks. The Company aims to have top-line data

in the second half of 2021, due in part to delays related to the

ongoing COVID-19 pandemic.

Oral KORSUVA: Notalgia Paresthetica

(NP)

In January 2021, the Company initiated a Phase 2

trial of Oral KORSUVA for the treatment of moderate-to-severe

pruritus in patients suffering from NP, a nerve disorder

characterized by chronic pruritus of the upper to middle back.

The Phase 2 multicenter, randomized,

double-blind, placebo-controlled 8-week study is designed to

evaluate the efficacy and safety of Oral KORSUVA for

moderate-to-severe pruritus in approximately 120 subjects with NP.

Subjects will be randomized to receive Oral KORSUVA 2.0 mg twice

daily versus placebo for 8 weeks, followed by a four-week active

extension period. The primary efficacy endpoint is the change from

baseline in the weekly mean of the daily 24-hour WI-NRS score at

Week 8 of the treatment period. Secondary endpoints include change

from baseline in itch-related quality of life scores and a change

from baseline in itch-related sleep disturbance subscale at the end

of Week 8.

COVID-19 Impacts and Business

Operations

Due to the ongoing COVID-19 pandemic and in

accordance with the FDA’s updated guidance for conducting clinical

trials, the Company has implemented numerous clinical and

operational measures to prioritize the health and safety of

patients, employees and study investigators and minimize potential

disruptions to its ongoing clinical studies. Cara is working

closely with its clinical and commercial manufacturing partners to

continue to ensure sufficient supply of KORSUVA is available for

its ongoing and planned clinical trials.

Based on guidelines from the Centers for

Disease Control and Prevention and the State of

Connecticut, all Cara employees continue to work remotely, and

business travel has been restricted.

Expected 2021 Milestones

- Top-line data from the KARE Phase 2

dose-ranging trial of Oral KORSUVA in AD patients in the first half

of 2021.

- End of Phase 2 Meeting with the FDA

in the second quarter of 2021 to enable initiation of a Phase 3

program of Oral KORSUVA in non-hemodialysis CKD-aP patients in the

second half of 2021.

- Potential FDA approval of NDA for

KORSUVA Injection in the second half of 2021.

- Top-line data from the Phase 2

trial of Oral KORSUVA in CLD-aP in the second half of 2021.

- Initiate Phase 3 trial of Oral

KORSUVA for CKD-aP patients in the second half of 2021.

Upcoming Meeting Activities

The Company expects to make presentations at the

following upcoming conferences:

- National Kidney Foundation Spring

Clinical Meeting, April 6-10, 2021

- Needham & Co. Annual Healthcare

Conference, April 12-15, 2021

- American Nephrology Nurses

Association National Symposium, May 2-5, 2021

- Bank of America Merrill Lynch

Healthcare Conference, May 10-13, 2021

Fourth Quarter and Full Year 2020

Financial Results

Cash, cash equivalents and marketable securities

at December 31, 2020 totaled $251.5 million compared to $218.2

million at December 31, 2019. The increase in the balance primarily

resulted from $38.4 million from the sale of common stock in a

license agreement with Vifor, partially offset by $5.5 million of

cash used in operating activities, which includes $111.6 million of

cash received from the Vifor Agreement which was included as

license and milestone fees revenue.

For the fourth quarter of 2020, net income was

$78.9 million, or $1.60 per basic share and $1.59 per diluted

share, compared to a net loss of $28.6 million, or $0.61 per basic

and diluted share, for the same period in 2019.

Revenues: Total revenue was $112.1 million for

the fourth quarter of 2020, compared to $4.5 million during the

same period of 2019. Total revenue primarily consisted of:

-

$112.1 million of license and milestone fees revenue during the

fourth quarter of 2020, of which $111.6 million related to the

license agreement with Vifor and $0.5 million related to the

license agreement with Vifor Fresenius Medical Care Renal Pharma

Ltd. (VFMCRP). The Company recognized $4.5 million of license and

milestone fees revenue during the fourth quarter of 2019, which

related to the license agreement with VFMCRP.

Research and Development (R&D) Expenses:

R&D expenses were $27.1 million in the fourth quarter of 2020

compared to $29.9 million in the same period of 2019. The lower

R&D expenses in 2020 were principally due to a net decrease in

costs associated with clinical trials and travel and related costs,

partially offset by a $2.5 million milestone payment made in

connection with the license agreement with Enteris Biopharma, Inc.

(Enteris), increases in payroll and related costs, and increases in

stock compensation expense.

General and Administrative (G&A) Expenses:

G&A expenses were $6.7 million in the fourth quarter of 2020

compared to $4.6 million in the same period of 2019. The

higher G&A expenses in 2020 were principally due to increases

in payroll and related costs, commercial costs, and insurance

costs.

Other Income, net: Other income, net was $0.4

million in the fourth quarter of 2020 compared to $1.2 million in

the same period of 2019. The decrease in other income, net was

primarily due to a decrease in net accretion income and a decrease

in interest income resulting from a lower yield on our portfolio of

investments in the 2020 period.

For the full year ended December 31, 2020, net

income was $8.4 million, or $0.18 per basic and diluted share

compared to a net loss of $106.4 million, or $2.49 per basic and

diluted share, for the full year ended December 31, 2019.

Revenues: Total revenue was $135.1 million for

the full year ended December 31, 2020 compared to $19.9 million for

the full year ended December 31, 2019. Total revenue primarily

consisted of:

- $134.4 million of license and

milestone fees revenue for the year ended December 31, 2020, of

which $111.6 million related to the license agreement with Vifor,

$22.3 million related to the license agreement with VFMCRP, and

$0.6 million related to the achievement of a milestone related to

its license agreement with Chong Kun Dang Pharmaceutical Corp. The

Company also recognized $19.7 million of license and milestone fees

revenue for the year ended December 31, 2019, which related to the

license agreement with VFMCRP.

- Approximately $643,000 and $140,000

of revenue from the sales of clinical compound during the years

ended December 31, 2020 and 2019, respectively, in connection with

the sale of clinical compound to VFMCRP and Maruishi Pharmaceutical

Co. Ltd.

Research and Development (R&D) Expenses:

R&D expenses were $107.9 million for the full year ended

December 31, 2020 compared to $113.8 million for the full year

ended December 31, 2019. The lower R&D expenses in 2020 were

principally due to a net decrease in clinical trial costs and

related consultant costs, lower payments made to Enteris during the

year ended December 2020, and a decrease in travel and related

costs, partially offset by increases in stock compensation expense,

payroll and related costs, and cost of clinical compound sales.

General and Administrative (G&A) Expenses:

G&A expenses were $21.8 million for the full year ended

December 31, 2020 compared to $17.7 million for the full year ended

December 31, 2019. The increase in 2020 was primarily due to

increases in commercial costs, insurance costs, payroll and related

costs, and accounting fees, partially offset by decreases in

consultants’ costs and stock compensation expense.

Other Income, net: Other income, net was $2.3

million for the full year ended December 31, 2020 compared to $4.5

million for the full year ended December 31, 2019. The decrease in

2020 was primarily due to a decrease in net accretion income and a

decrease in interest income resulting from a lower yield on our

lower average balance of our portfolio of investments in the 2020

period, partially offset by a realized gain of approximately $0.3

million from the sale of our available-for-sale marketable

securities in the 2020 period.

Financial Guidance

Based on timing expectations and projected costs

for current clinical development plans, Cara expects that its

existing unrestricted cash and cash equivalents and

available-for-sale marketable securities as of December 31, 2020

will be sufficient to fund its currently anticipated operating

expenses and capital expenditures into 2023, without giving effect

to any potential milestone payments or potential product revenue

under existing collaborations.

Conference Call

Cara management will host a conference call

today at 4:30 p.m. ET to discuss fourth quarter and full year 2020

financial results and provide a business update.

To participate in the conference call, please

dial (855) 445-2816 (domestic) or (484) 756-4300 (international)

and refer to conference ID 6676157. A live webcast of the call can

be accessed under "Events and Presentations" in the News &

Investors section of the Company's website at

www.CaraTherapeutics.com.

An archived webcast recording will be available

on the Cara website beginning approximately two hours after the

call.

About Cara Therapeutics

Cara Therapeutics is a clinical-stage biopharmaceutical company

focused on developing and commercializing new chemical entities

designed to alleviate pruritus by selectively targeting peripheral

KORs. Cara is developing a novel and proprietary class of product

candidates, led by KORSUVA (CR845/difelikefalin), a first-in-class

KOR agonist that targets KORs located in the peripheral nervous

system and on immune cells. In the Company’s KALMTM-1 and KALM-2

Phase 3 trials and two Phase 2 trials, KORSUVA Injection has

demonstrated statistically significant reductions in itch intensity

and concomitant improvement in pruritus-related quality of life

measures in hemodialysis patients with moderate-to-severe CKD-aP.

Cara has successfully completed its Phase 2 trial of Oral KORSUVA

for the treatment of pruritus in patients with CKD and is currently

conducting Phase 2 trials of Oral KORSUVA in AD, PBC and NP

patients with moderate-to-severe pruritus.

The FDA has accepted the NDA filing for KORSUVA Injection for

the treatment of moderate-to-severe pruritus in hemodialysis

patients and conditionally accepted KORSUVA as the trade name for

difelikefalin injection. CR845/difelikefalin is an investigational

drug product and its safety and efficacy have not been fully

evaluated by any regulatory authority.

Forward-looking Statements

Statements contained in this press release

regarding matters that are not historical facts are

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. Examples of these

forward-looking statements include statements concerning the

expected timing of the enrollment and data readouts from the

Company’s ongoing clinical trials, the potential results of ongoing

clinical trials, timing of future regulatory and development

milestones for the Company’s product candidates and potential

commercialization of KORSUVA Injection for CKD-aP, the expected

timeline for conducting meetings with the FDA concerning the

Company’s product candidates, the potential for the Company’s

product candidates to be alternatives in the therapeutic areas

investigated, the Company’s expected cash reach, and the potential

impact of COVID-19 on the Company’s clinical development and

regulatory timelines and plans. Because such statements are subject

to risks and uncertainties, actual results may differ materially

from those expressed or implied by such forward-looking

statements. Risks are described more fully in Cara

Therapeutics’ filings with the Securities and Exchange Commission,

including the “Risk Factors” section of the Company’s most recent

Annual Report on Form 10-K and its other documents subsequently

filed with or furnished to the Securities and Exchange

Commission. All forward-looking statements contained in this

press release speak only as of the date on which they were

made. Cara Therapeutics undertakes no obligation to update

such statements to reflect events that occur or circumstances that

exist after the date on which they were made.

Financial tables follow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CARA

THERAPEUTICS, INC. |

|

|

| STATEMENTS

OF OPERATIONS |

|

|

| (amounts in

thousands, except share and per share data) |

|

|

| (unaudited) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

|

|

2020 |

|

2019 |

|

2020 |

|

2019 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

| |

License and

milestone fees |

|

$ |

112,062 |

|

|

$ |

4,511 |

|

|

$ |

134,439 |

|

|

$ |

19,746 |

|

| |

Clinical

compound revenue |

|

|

27 |

|

|

- |

|

|

|

643 |

|

|

140 |

|

|

Total revenue |

|

|

112,089 |

|

|

4,511 |

|

|

|

135,082 |

|

|

19,886 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Research and

development |

|

|

27,140 |

|

|

29,864 |

|

|

|

107,851 |

|

|

113,820 |

|

| |

General and

administrative |

|

|

6,659 |

|

|

4,617 |

|

|

|

21,846 |

|

|

17,745 |

|

|

Total operating expenses |

|

|

33,799 |

|

|

34,481 |

|

|

|

129,697 |

|

|

131,565 |

|

|

Operating income (loss) |

|

|

78,290 |

|

|

(29,970 |

) |

|

|

5,385 |

|

|

(111,679 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income, net |

|

|

364 |

|

|

1,193 |

|

|

|

2,334 |

|

|

4,490 |

|

|

Income (loss) before benefit from income taxes |

|

78,654 |

|

|

(28,777 |

) |

|

|

7,719 |

|

|

(107,189 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Benefit from income taxes |

|

|

255 |

|

|

166 |

|

|

|

691 |

|

|

816 |

|

|

Net income (loss) |

|

$ |

78,909 |

|

|

$ |

(28,611 |

) |

|

$ |

8,410 |

|

|

$ |

(106,373 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.60 |

|

|

$ |

(0.61 |

) |

|

$ |

0.18 |

|

|

$ |

(2.49 |

) |

|

Diluted |

|

$ |

1.59 |

|

|

$ |

(0.61 |

) |

|

$ |

0.18 |

|

|

$ |

(2.49 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

49,228,774 |

|

|

46,691,009 |

|

|

|

47,413,250 |

|

|

42,669,333 |

|

|

Diluted |

|

|

49,701,864 |

|

|

46,691,009 |

|

|

|

47,915,030 |

|

|

42,669,333 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

| CARA

THERAPEUTICS, INC. |

| BALANCE

SHEETS |

| (in thousands) |

| (unaudited) |

| |

|

|

|

| |

December 31, |

| |

2020 |

|

2019 |

|

Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

31,683 |

|

|

$ |

18,305 |

|

|

Marketable securities |

|

149,242 |

|

|

|

136,701 |

|

|

Income tax receivable |

|

1,507 |

|

|

|

816 |

|

|

Other receivables |

|

557 |

|

|

|

971 |

|

|

Prepaid expenses |

|

12,076 |

|

|

|

8,863 |

|

|

Total current assets |

|

195,065 |

|

|

|

165,656 |

|

|

Operating lease right-of-use assets |

|

4,279 |

|

|

|

3,036 |

|

|

Marketable securities, non-current |

|

70,565 |

|

|

|

63,159 |

|

|

Property and equipment, net |

|

840 |

|

|

|

700 |

|

|

Restricted cash |

|

408 |

|

|

|

408 |

|

|

Total assets |

$ |

271,157 |

|

|

$ |

232,959 |

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable and accrued expenses |

$ |

16,881 |

|

|

$ |

19,665 |

|

|

Operating lease liabilities, current |

|

1,602 |

|

|

|

967 |

|

|

Current portion of deferred revenue |

|

- |

|

|

|

22,262 |

|

|

Total current liabilities |

|

18,483 |

|

|

|

42,894 |

|

|

|

|

|

|

|

Operating lease liabilities, non-current |

|

3,673 |

|

|

|

3,352 |

|

|

|

|

|

|

|

Commitments and contingencies |

|

- |

|

|

|

- |

|

| |

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

|

| Preferred

stock |

|

- |

|

|

|

- |

|

| Common

stock |

|

50 |

|

|

|

47 |

|

| Additional

paid-in capital |

|

641,195 |

|

|

|

587,223 |

|

| Accumulated

deficit |

|

(392,317 |

) |

|

|

(400,727 |

) |

| Accumulated

other comprehensive income |

|

73 |

|

|

|

170 |

|

| Total

stockholders’ equity |

|

249,001 |

|

|

|

186,713 |

|

| Total

liabilities and stockholders’ equity |

$ |

271,157 |

|

|

$ |

232,959 |

|

| |

|

|

|

INVESTOR CONTACT:Janhavi MohiteStern Investor

Relations, Inc.212-362-1200 Janhavi.Mohite@sternir.com

MEDIA CONTACT:Claire LaCagnina6

Degrees315-765-1462 clacagnina@6degreespr.com

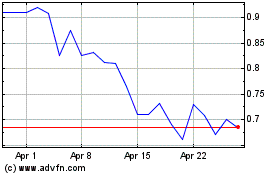

Cara Therapeutics (NASDAQ:CARA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cara Therapeutics (NASDAQ:CARA)

Historical Stock Chart

From Apr 2023 to Apr 2024