China Recycling Energy Corporation Enters a Securities Purchase Agreement of An Approximately $38 million Private Placement O...

February 25 2021 - 9:00AM

China Recycling Energy Corporation (NASDAQ: CREG) ("CREG" or the

“Company"), an industrial waste-to-energy solution provider in

China, announced today that it entered into certain securities

purchase agreements with several non-U.S. investors on February 23,

2021, to purchase approximately $38.3 million worth of its common

stock priced at $11.522 per share (the “Purchase Price”) in a

private placement offering (the “Offering”) pursuant to Section

4(a)(2) and/or Regulation S of the Securities Act of 1933, as

amended.

Under the terms of the securities purchase

agreements, the Company has agreed to sell approximately 3,220,000

shares of the Company’s common stock (the “Shares”). Mr. Guohua Ku,

the Company’s Chairman and Chief Executive Officer agreed to

participate in the Offering and to purchase 1,000,000 shares of the

total 3,220,000 Shares. The Purchase Price represents approximately

an 8.6% premium of the closing price of the Company’s stock on

February 22, 2021.

The Shares have not been registered under the

Securities Act or applicable securities laws of any state or

country and therefore the Shares cannot be sold, pledged, assigned

or otherwise disposed of unless they are subsequently registered

under the Securities Act and applicable state securities laws or

exemptions from such registration requirements are available.

Within 180 days from the effective date of this Agreement, the

Company agreed to use its best efforts to file a registration

statement on Form S-1 or Form S-3 or on such other form promulgated

by the SEC for which the Company then qualifies for the

registration of the Shares for their resale by the investors.

“I am pleased to participate in

this Offering, providing a strong indication of my belief in the

long-term potential of the Company,” commented Mr. Guohua Ku,

Chairman and CEO of CREG. “My personal

investment demonstrates that I am in this for the long haul

and further aligns my interests with those of our

shareholders.”

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of, these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of such

state or jurisdiction.

About China Recycling Energy Corp.

China Recycling Energy Corporation (Nasdaq:

CREG) ("CREG" or "the Company") is based in Xi'an, China and

provides environmentally friendly waste-to-energy technologies to

recycle industrial byproducts for steel mills, cement factories and

coke plants in China. The byproducts include heat, steam, pressure,

and exhaust, which we use to generate large amounts of lower-cost

electricity and reduce the need for outside electrical sources. The

Chinese government has adopted policies to encourage the use of

recycling technologies to optimize resource allocation and reduce

pollution. Currently, recycled energy represents only an estimated

1% of total energy consumption. The recycled energy resource market

is viewed as a fast-growing market due to intensified environmental

concerns and rising energy costs as Chinese economy continues to

expand. The Company’s management and engineering teams have over 20

years of experience in industrial energy recovery in China. For

more information about CREG, please

visit http://creg-cn.investorroom.com.

Safe Harbor Statement

This press release may contain certain

"forward-looking statements" relating to the business of CREG and

its subsidiary companies. All statements, other than statements of

historical fact included herein are "forward-looking statements."

These forward-looking statements are often identified by the use of

forward-looking terminology such as "believes," "expects" or

similar expressions, involve known and unknown risks and

uncertainties. Although the Company believes that the expectations

reflected in these forward-looking statements are reasonable, they

do involve assumptions, risks and uncertainties, and these

expectations may prove to be incorrect. Investors should not place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release. The Company's actual

results could differ materially from those anticipated in these

forward-looking statements as a result of a variety of factors,

including, but not limited to, the risks and uncertainties

associated with market conditions and the satisfaction of customary

closing conditions relating to the registered direct offering and

those discussed in the Company's annual and periodic reports that

are filed with the Securities and Exchange Commission and available

on its website at http://www.sec.gov. All forward-looking

statements attributable to the Company or persons acting on its

behalf are expressly qualified in their entirety by these factors.

Other than as required under the securities laws, the Company does

not assume a duty to update these forward-looking statements.

Investor Relations Inquiries:Vivian

Chenvivianchen@irimpact.com

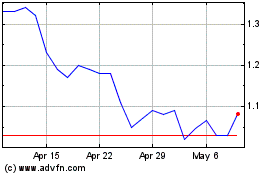

Smart Power (NASDAQ:CREG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Smart Power (NASDAQ:CREG)

Historical Stock Chart

From Apr 2023 to Apr 2024