DoorDash to Show Narrower Annual Loss as Growth Continues

February 25 2021 - 5:59AM

Dow Jones News

By Preetika Rana

DoorDash Inc.'s first results as a public company are expected

to show the food-delivery app growing at a blistering pace while

trimming its yearly loss.

Analysts polled by FactSet expect revenue in 2020 to jump more

than threefold to $2.85 billion from $885 million a year earlier,

as demand for food delivery skyrocketed during widespread

shelter-in-place orders. Fourth-quarter revenue is also expected to

more than triple to $938 million.

Food delivery has been an expensive logistical undertaking,

however. DoorDash turned a surprise profit in last year's second

quarter but has never posted a full-year profit. Analysts expect

the company's 2020 loss to narrow to $318 million from $667 million

a year earlier. But they predict fourth-quarter loss will widen to

$153 million from $134 million in the year-earlier period.

DoorDash made its debut on the stock market in December

alongside home-sharing giant Airbnb Inc., which also reports its

first earnings as a public company on Thursday. Both companies are

scheduled to report their results after market hours. DoorDash's

shares have climbed 73% from their IPO price as of Wednesday's

close. Its more than $56 billion market capitalization makes it is

more valuable than Chipotle Mexican Grill Inc. and Domino's Pizza

Inc. combined.

Consumers are more reliant on food-delivery services than ever

before. DoorDash leapfrogged rivals Uber Technologies Inc.'s Eats

and Grubhub Inc. to command nearly half the U.S. food-delivery

market in mid-October, up from one-third a year earlier. Its

monthly subscribers have more than tripled between January and

September.

Some restaurants are pushing back against the high fees that

food-delivery apps can charge -- up to 30% of an order -- by

driving more orders toward their websites and putting idle staff on

delivery duty. Regulators in cities including New York, San

Francisco and Seattle have stepped in to cap app fees, in an

attempt to rein in costs for restaurants.

Grubhub's fourth-quarter loss widened compared with a year

earlier as these caps hurt its bottom line, among other things.

Uber Eats trimmed its losses in the fourth-quarter.

DoorDash has said it spent millions of dollars to support small

restaurants through grants and free marketing during the pandemic.

It also waived commissions for restaurants with five or fewer

outlets in the initial months of the health crisis.

The company's sales and marketing costs, which include deep

discounts to consumers, rose 34% year over year to $900

million.

Write to Preetika Rana at preetika.rana@wsj.com

(END) Dow Jones Newswires

February 25, 2021 05:44 ET (10:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

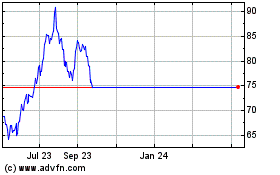

DoorDash (NYSE:DASH)

Historical Stock Chart

From Mar 2024 to Apr 2024

DoorDash (NYSE:DASH)

Historical Stock Chart

From Apr 2023 to Apr 2024