AB InBev 4Q Net Profit Leaps on Lower Finance Costs; Sees Better 2021 Earnings

February 25 2021 - 1:58AM

Dow Jones News

By Ian Walker

Anheuser-Busch InBev SA on Thursday reported a rise in

fourth-quarter net profit as it booked much lower finance

costs--beating market forecasts--and said that it expects to report

improved earnings for 2021 compared with 2020.

The world's largest brewer--with brands such as Budweiser,

Stella Artois and Corona--said own-beer volumes rose 1.8% in the

fourth quarter on an organic basis. North America fell 0.7%, South

America rose 11.4% and Asia Pacific fell 3.1%.

For the quarter, AB InBev made a net profit of $2.27 billion,

compared with $114 million a year earlier and a consensus of $2.63

billion, taken from FactSet and based on four analysts'

forecasts.

Normalized earnings before interest, taxes, depreciation and

amortization--one of the company's preferred metrics, which strips

out exceptional and other one-off items--was $5.07 billion,

compared with $5.34 billion a year earlier and a consensus of $4.70

billion, taken from FactSet and based on five analysts'

forecasts.

Revenue for the quarter was $12.77 billion, down from $13.33

billion, and compared with forecasts of $12.65 billion taken from

FactSet and based on nine analysts' estimates. On an organic basis,

revenue was up 4.5%, the company said.

The board has declared a dividend of 50 European cents (60.85

U.S. cents).

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

February 25, 2021 01:43 ET (06:43 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

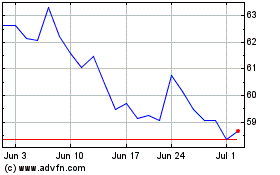

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

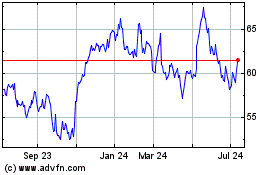

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Apr 2023 to Apr 2024