Current Report Filing (8-k)

February 24 2021 - 5:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 22, 2021

Montauk Renewables, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Delaware

|

|

1-39919

|

|

85-3189583

|

|

(State or Other jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

680 Andersen Drive, 5th Floor

Pittsburgh, PA 15220

(Address of Principal Executive Offices) (ZIP Code)

Telephone: (412) 747-8700

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or

Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading Symbol

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $0.01 par value per share

|

|

MNTK

|

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☒

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

In connection with the closing of the initial public offering of the common stock (the “Common Stock”) of Montauk Renewables,

Inc. (the “Company”) and the distribution (the “Distribution”) of the Common Stock to the shareholders of Montauk Holdings Limited, the Company’s parent company prior to the Distribution

(“MNK”), on January 26, 2021, the Company entered into a Loan Agreement and Secured Promissory Note (the “Initial Promissory Note”) with MNK. MNK is currently an affiliate of the Company and all of the

Company’s directors and certain of the Company’s executive officers are also directors and executive officers of MNK. Pursuant to the Initial Promissory Note, the Company advanced a cash loan of $5,000,000 to MNK for MNK to pay its

dividends tax liability arising from the Distribution under the South African Income Tax Act, 1962 (Act No. 58 of 1962), as amended. On February 22, 2021, the Company and MNK entered into an Amended and Restated Promissory Note (the

“Amended Promissory Note”) to increase the principal amount of the loan to a total of $7,000,000, in the aggregate, in accordance with the Company’s obligations set forth in the Transaction Implementation Agreement

entered into by and among the Company, MNK and the other party thereto, dated November 6, 2020, and amended on January 14, 2021. The terms of the Amended Promissory Note are otherwise substantially similar to the Initial Promissory Note.

The Amended Promissory Note will, among other things, (1) allow MNK (as borrower) to pay interest by increasing the outstanding

principal amount of the note or by paying cash to the Company (or both), (2) grant the Company a pledge over 800,000 shares of Common Stock withheld by MNK to satisfy tax obligations arising from the Distribution as security for MNK’s loan

obligations and (3) require MNK to use the proceeds of any sale of such shares to prepay the amounts due to the Company under the Amended Promissory Note.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

|

On February 23, 2021, the Compensation Committee (the

“Compensation Committee”) of the Board of Directors (the “Board”) of the Company determined bonus compensation for the year ended December 31, 2020 (“Fiscal 2020”) for all employees, including

certain named executive officers (“NEOs”) identified for Fiscal 2020 in amendments to the Company’s Registration Statement on Form S-1 (File

No. 333-251312) originally filed on December 11, 2020 (the “Registration Statement”), and reviewed such amounts with the Board. At the time of filing such amendments to the

Registration Statement, the amounts of the bonus awards for Fiscal 2020 had not been determined and were not calculable. This Current Report on Form 8-K updates the amounts for Fiscal 2020 previously reported

in the Registration Statement’s Summary Compensation Table with respect to the “Bonus,” “Nonequity Incentive Plan Compensation,” and “Total” columns included therein. All other compensation for the NEOs previously

reported in the Summary Compensation Table of the Registration Statement is unchanged and is included below to provide complete information regarding such table.

Summary Compensation Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position

|

|

Year

($)

|

|

|

Salary

($)

|

|

|

Bonus

($) (1)

|

|

|

Option

Awards

($) (2)

|

|

|

Nonequity

Incentive Plan

Compensation

($)(3)

|

|

|

All Other

Compensation

($) (4)

|

|

|

Total ($)

|

|

|

Sean F. McClain,

President and Chief

Executive Officer

|

|

|

2020

|

|

|

|

280,123

|

|

|

|

67,328

|

|

|

|

137,000

|

|

|

|

107,200

|

|

|

|

14,337

|

|

|

|

605,988

|

|

|

|

|

|

2019

|

|

|

|

219,477

|

|

|

|

17,664

|

|

|

|

919,000

|

|

|

|

—

|

|

|

|

12,204

|

|

|

|

1,168,345

|

|

|

John Ciroli,

Vice president,

General Counsel and

Secretary

|

|

|

2020

|

|

|

|

98,038

|

|

|

|

31,831

|

|

|

|

394,000

|

|

|

|

25,200

|

|

|

|

3,798

|

|

|

|

552,867

|

|

|

Scott Hill,

Vice President of

Business Development

|

|

|

2020

|

|

|

|

219,577

|

|

|

|

63,291

|

|

|

|

128,000

|

|

|

|

50,400

|

|

|

|

11,476

|

|

|

|

472,744

|

|

|

(1)

|

In the case of Mr. McClain, the 2019 amount, equal to approximately 30% of his eligible target bonus

amount, reflects a discretionary cash bonus paid to him for 2019 performance. The discretionary bonus amounts for 2020 relate to holiday bonuses and additional discretionary bonuses paid to each NEO. The additional discretionary bonus for

Mr. McClain was equal to 25% of his 2020 base compensation, or $67,000. The additional discretionary bonus for Mr. Ciroli was equal to 30% of his prorated 2020 base compensation, or $31,500. The additional discretionary bonus for

Mr. Hill was equal to 30% of his 2020 base compensation, or $63,000.

|

|

(2)

|

Amounts reflect stock options (“Options”) granted to the NEOs. The value of Options included

herein is equal to the aggregate grant date fair value computed in accordance with ASC Topic 718. The 2020 values were calculated using a Black-Scholes pricing model with a volatility indicator of 61% and an annual interest rate of 0.31%. The 2019

value was calculated using a Black-Scholes pricing model with a volatility indicator of 90% and an annual interest rate of between 1.74-1.79%.

|

|

(3)

|

This column includes performance bonus amounts earned for 2020 performance.

|

|

(4)

|

Amounts reflected in this column represent the values of all other compensation awarded to the NEOs in 2020

and, in the case of Mr. McClain, 2019. The 2020 amount reported for Mr. McClain reflects $14,022 in Company contributions under the 401(k) plan and $315 in company-paid life insurance premiums. The amount reported for Mr. Ciroli

reflects $3,603 in Company contributions under the 401(k) plan and $195 in Company-paid life insurance premiums. The amount reported for Mr. Hill reflects $10,993 in Company contributions under the 401(k) plan and $483 in Company-paid life

insurance premiums.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

MONTAUK RENEWABLES, INC.

|

|

|

|

|

|

|

Dated: February 24, 2021

|

|

|

|

By:

|

|

/s/ Kevin A. Van Asdalan

|

|

|

|

|

|

|

|

Name: Kevin A. Van Asdalan

|

|

|

|

|

|

|

|

Title: Chief Financial Officer

|

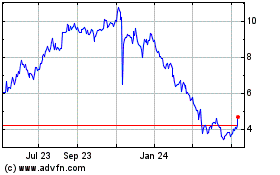

Montauk Renewables (NASDAQ:MNTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

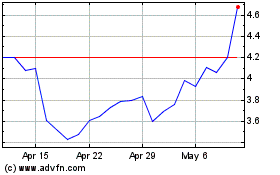

Montauk Renewables (NASDAQ:MNTK)

Historical Stock Chart

From Apr 2023 to Apr 2024