Amended Current Report Filing (8-k/a)

February 23 2021 - 5:17PM

Edgar (US Regulatory)

0001739566

false

0001739566

2020-12-14

2020-12-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): December 14, 2020

Utz Brands, Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

001-38686

|

|

85-2751850

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

900 High Street

Hanover,

PA 17331

(Address of principal executive offices,

including zip code)

Registrant’s telephone number, including

area code: (717) 637-6644

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

Class A Common Stock, par value $0.0001 per share

|

|

UTZ

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Introductory Note

On December 14, 2020, Utz Brands, Inc.,

a Delaware corporation (the “Company” or “Utz”) filed a Current Report on Form 8-K (the “Form 8-K”)

in connection with the closing, on December 14, 2020 (the “Closing Date”), of the

previously announced transaction pursuant to which Utz caused its subsidiaries to complete the acquisition (the “Acquisition”)

contemplated by that certain Stock Purchase Agreement, dated November 11, 2020 by and among Utz Quality Foods, LLC, a Delaware

limited liability company (“UQF”), Heron Holding Corporation, a Delaware corporation (“Heron”), Truco

Holdco Inc. (“Holdco”), and Truco Holdings LLC (“Seller”). Pursuant to the Stock Purchase Agreement, on

the Closing Date, Heron purchased from Seller all of the issued and outstanding shares of common stock of Holdco. In addition,

UQF purchased from OTB Acquisition, LLC (“IP Seller”) certain IP assets under an Asset Purchase Agreement, dated November 11,

2020, among UQF, Seller and IP Seller (together with the Acquisition, the “Transactions”). At the closing of the Transactions,

UQF and Heron paid the aggregate cash purchase price of approximately $404.0 million to the Truco Seller, including payments of

approximately $3.0 million for cash on hand at Truco at the closing of the Transactions, less estimated working capital adjustments,

subject to customary post-closing adjustments, and approximately $79.0 million to the IP Seller.

This Current Report on Form 8-K/A

is being filed to amend the Form 8-K to provide the financial statements and pro forma financial information described below,

in accordance with the requirements of Item 9.01 of Form 8-K. The pro forma financial information included in this Form 8-K/A

has been presented for informational purposes only, as required by Form 8-K. It does not purport to represent the actual results

of operations that the Company and Holdco would have achieved had the Transactions been consummated prior to the periods presented

in the pro forma financial information and is not intended to project the future results of operations that the combined company

may achieve after the Transactions. Except as described in this Form 8-K/A, all other information in the Current Report on

Form 8-K filed on December 14, 2020 remains unchanged.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements of business acquired

The audited consolidated balance sheet of Holdco as of December 31,

2019, and the audited consolidated statements of income, stockholder’s equity and cash flows for the year ended December 31,

2019, and related notes are included as Exhibit 99.1 to this Current Report on Form 8-K/A.

The unaudited condensed consolidated balance sheet of Holdco

as of September 30, 2020 and the unaudited condensed consolidated statements of income, stockholder’s equity and

cash flows for the nine months ended September 30, 2020, and related notes are included as Exhibit 99.2 to this Current

Report on Form 8-K/A.

(b) Pro Forma Financial Information

The unaudited pro forma condensed combined

balance sheet of the Company as of September 27, 2020 and unaudited pro forma condensed combined statements of operations

for the thirty-nine weeks ended September 27, 2020, and the year ended December 31, 2019, are included as Exhibit 99.3

to this Current Report on Form 8-K/A.

(d) Exhibits

Exhibit

No.

|

|

Description

|

|

23.1*

|

|

Consent of RSM US LLP, independent auditors for Truco Holdco Inc. and Subsidiaries.

|

|

99.1*

|

|

Audited consolidated balance sheet of Truco Holdco Inc. and Subsidiaries, as of December 31, 2019, and audited consolidated statements of income, stockholder’s equity and cash flows for the year ended December 31, 2019 and related notes.

|

|

99.2*

|

|

Unaudited condensed consolidated balance sheet of Truco Holdco Inc. and Subsidiaries, as of September 30, 2020 and unaudited condensed consolidated statements of income, stockholder’s equity and cash flows for the nine months ended September 30, 2020, and related notes.

|

|

99.3*

|

|

Unaudited pro forma condensed combined balance sheet of Utz Brands, Inc. as of September 27, 2020 and unaudited pro forma condensed combined statements of operations for the thirty-nine weeks ended September 27, 2020, and the year ended December 31, 2019.

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

* Filed herewith.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: February 23, 2021

|

Utz Brands, Inc.

|

|

|

|

|

|

By:

|

/s/ Cary Devore

|

|

|

|

Cary Devore

|

|

|

|

Chief Financial Officer

|

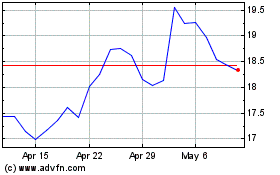

Utz Brands (NYSE:UTZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Utz Brands (NYSE:UTZ)

Historical Stock Chart

From Apr 2023 to Apr 2024