Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

February 23 2021 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of February 2021.

Commission File Number: 001-38146

ZK

INTERNATIONAL GROUP CO., LTD.

(Translation

of registrant’s name into English)

c/o Zhejiang Zhengkang Industrial Co.,

Ltd.

No. 678 Dingxiang Road, Binhai Industrial

Park

Economic & Technology Development

Zone

Wenzhou, Zhejiang Province

People’s Republic of China 325025

Tel: +86-577-86852999

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Entry into Material Definitive Agreements in Connection

with a Registered Direct Offering.

On February 22, 2021, ZK International Group Co., Ltd., a British

Virgin Islands company (the “Company”), entered into a securities purchase agreement (the “Purchase Agreement”)

with several accredited investors (the “Investors”) providing for an aggregate investment of $4,599,983.50 by the Investors

for the issuance by the Company to them of (i) 1,295,770 ordinary shares of the Company (the “Shares”); (ii) first

registered investor warrants, with a term of five (5) years exercisable immediately upon issuance, to purchase an aggregate of

up to 1,295,770 ordinary shares (the “First Registered Warrant Shares”) at an exercise price of $4.00 per share, subject

to customary adjustments thereunder (the “First Registered Warrants”); and (iii) second registered investor warrants,

with a term of five (5) years exercisable immediately upon issuance, to purchase an aggregate of up to 1,295,770 ordinary shares

(the “Second Registered Warrant Shares” and collectively with the First Registered Warrant Shares, the “Warrant

Shares”) at an exercise price of $4.50 per share, subject to customary adjustments thereunder (the “Second Registered

Warrants” and collectively with the First Registered Warrants, the “Warrants”). Holders of the Warrants may exercise

them by paying the applicable cash exercise price or, if there is not an effective registration statement for the sale of the Warrant

Shares at the time of exercise, by exercising on a cashless basis pursuant to the formula provided in the Warrants. The Shares,

the Warrants and the Warrant Shares are collectively referred to as the “Securities.”

The Company is registering the Securities

in a registered direct offering (the “Registered Offering”), pursuant to the Securities Act of 1933, as amended (the

“Securities Act”), pursuant to a prospectus supplement to the Company’s currently effective registration statement

on Form F-3 (File No. 333-230860), which was initially filed with the U.S. Securities and Exchange Commission (the “SEC”)

on April 15, 2019, and was declared effective on April 29, 2019 (the “Shelf Registration Statement”). The Company expects

to file the prospectus supplement for the Registered Offering on or about February 23, 2021.

The closing of the Offering is expected

to take place on or about February 24, 2021, subject to the satisfaction of customary closing conditions. The Purchase Agreement

also contains customary representations, warranties and agreements of the Company and the Investors and customary rights and obligations

of the parties thereto. The Investors have previously invested in securities of the Company or otherwise had pre-existing relationships

with the Company; the Company did not engage in general solicitation or advertising with regard to the issuance and sale of the

Securities. The Investors represented that they are accredited investors and purchased the Securities for investment and not with

a view to distribution.

The foregoing description of the Purchase

Agreement, the First Registered Investor Warrants and the Second Registered Investor Warrants, are qualified in their entirety

by reference to the full text of such documents, the forms of which are attached as Exhibits 10.1, 4.1, and 4.2, respectively,

to this report on Form 6-K, and which are incorporated herein in their entirety by reference. The Company will file the opinion

of its BVI counsel, Mourant Ozannes, relating to the legality of the issuance and sale of the Securities as Exhibit 5.1, in a separate

Form 6-K upon the closing of the Offering.

This Form 6-K contains forward-looking

statements. Forward-looking statements include, but are not limited to, statements that express the Company’s intentions,

beliefs, expectations, strategies, predictions or any other statements related to the Company’s future activities, or future

events or conditions. These statements are based on current expectations, estimates and projections about the Company’s business

based, in part, on assumptions made by its management. These statements are not guarantees of future performances and involve risks,

uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from

what is expressed or forecasted in the forward-looking statements due to numerous factors, including those risks discussed in the

Company’s Annual Report on Form 20-F for the year ended September 30, 2020, and in other documents that the Company files

from time to time with the SEC. Any forward-looking statements speak only as of the date on which they are made, and the Company

undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date of this Form

6-K, except as required by law.

The prospectus supplement relating to the

Registered Offering will be available on the SEC’s web site at http://www.sec.gov.

Financial Statements and Exhibits.

Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

Date: February 23, 2021

|

ZK INTERNATIONAL GROUP CO., LTD.

|

|

|

|

|

|

|

By:

|

/s/ Jiancong Huang

|

|

|

Name:

|

Jiancong Huang

|

|

|

Title:

|

Chief Executive Officer and Chairman of the Board

|

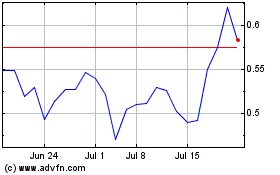

ZK (NASDAQ:ZKIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

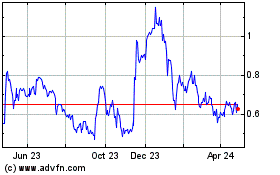

ZK (NASDAQ:ZKIN)

Historical Stock Chart

From Apr 2023 to Apr 2024