|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prospectus Supplement No. 6

(to prospectus dated August 7, 2020)

|

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-240278

|

DIGITAL MEDIA SOLUTIONS, INC.

75,295,024 Shares of Class A Common Stock

4,000,000 Warrants to Purchase Class A Common Stock

This prospectus supplement relates to the prospectus dated August 7, 2020, as supplemented thereafter (the “Prospectus”), related to (i) the issuance by Digital Media Solutions, Inc., a Delaware corporation (“DMS”), of up to 14,000,000 shares of its Class A common stock, par value $0.0001 per share (“Class A Common Stock”), upon exercise of warrants to purchase Class A Common Stock at an exercise price of $11.50 per share (“DMS Warrants”) and (ii) the offer and sale, from time to time, by the selling holders identified in the Prospectus, or their permitted transferees, of (A) up to 61,295,024 shares of Class A Common Stock and (B) up to 4,000,000 DMS Warrants.

This prospectus supplement is being filed to update and supplement the information contained in Prospectus with the information contained in DMS’s Current Report on Form 8-K filed with the Securities and Exchange Commission on February 19, 2021, which is attached to this prospectus supplement.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

The Class A Common Stock and DMS Warrants are traded on the New York Stock Exchange under the symbols “DMS” and “DMS WS,” respectively.

Investing in our securities involves risks. See “Risk Factors” beginning on page 24 of the Prospectus and in any applicable prospectus supplement.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the Prospectus or this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is February 19, 2021.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________________________

FORM 8-K

__________________________________________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): February 19, 2021 (February 13, 2021)

__________________________________________________________________________

Digital Media Solutions, Inc.

(Exact name of Registrant as specified in its charter)

__________________________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-38393

|

98-1399727

|

|

(State of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

4800 140th Avenue N., Suite 101

Clearwater, Florida

|

33762

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(877) 236-8632

(Registrant’s telephone number, including area code)

__________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Class A common stock, $0.0001 par value per share

|

|

DMS

|

|

New York Stock Exchange

|

|

Redeemable warrants to acquire Class A common stock

|

|

DMS WS

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Appointment of Chief Financial Officer

On February 16, 2021, Digital Media Solutions, Inc. (the “Company”) announced the appointment of Vasundara Srenivas as the Company’s Chief Financial Officer, effective March 13, 2021.

Vasundara Srenivas, 46, has over 20 years of financial and accounting leadership experience. Since 2008, Ms. Srenivas has held various financial and accounting positions of increasing seniority, including most recently as the Chief Financial Officer, at Boeing Capital Corporation, a wholly-owned, multi-billion dollar subsidiary of Boeing Company. Previously, Ms. Srenivas served as Corporate Financial Planning and Analysis Leader for Raytheon Austrial P/L from 2004 to 2008. From 1997 to 2004, Ms. Srenivas served as Corporate Accountant for TransACT Communications.

Ms. Srenivas holds a Bachelors of Commerce & Masters of Commerce from Bangalore University and a Master of Business Administration from the University of Canberra.

Pursuant to the terms of an Offer Letter, dated as of February 13, 2021 (the “Srenivas Offer Letter”), by and between the Company and Ms. Srenivas, Ms. Srenivas will receive (1) an annual base salary of $265,000; (2) a pro-rated annual cash incentive bonus based upon criteria established by the Company’s Board of Directors at a target level of 40% of earned base salary, with a guaranteed bonus of $97,167 for 2021; (3) a one-time sign on bonus of $40,000 to assist with relocation costs; (4) an equity grant on July 1, 2021 of $275,000, subject to three-year vesting, consisting of 30% in options and 70% in restricted stock units, subject to the approval of the Compensation Committee; and (5) benefit enrollments paid by the Company.

The Srenivas Offer Letter provides for certain severance benefits upon a termination by the Company without “cause” or for “good reason.” In the event of a termination without “cause” or “good reason” by the Company, Ms. Srenivas would be entitled to (i) continued payment of her respective base salary for twelve (12) months and (ii) payment of the Company’s portion of the premium for healthcare continuation coverage under COBRA at the same level of coverage they were entitled to at the time of termination of employment, subject to the timely election of continuation coverage.

The foregoing description of the Srenivas Offer Letter does not purport to be complete and is qualified in its entirety by reference to the Srenivas Offer letter, which is attached to this Current Report as Exhibit 10.1 and incorporated herein by reference. Ms. Srenivas and the Company will also enter into an Indemnity Agreement substantially in the form filed as Exhibit 10.8 to the Company’s Current Report on Form 8-K filed with the SEC on July 20, 2020, which is attached to this Current Report as Exhibit 10.2 and incorporated herein by reference.

A copy of the press release announcing the appointment of Ms. Srenivasis is attached as Exhibit 99.1 and incorporated herein by reference.

There are no family relationships between Ms. Srenivas and any director or other executive officer, nor are there any transactions to which the Company was or is a participant and in which Ms. Srenivas has a material interest subject to disclosure under Item 404(a) of Regulation S-K. There are no arrangements or understandings between Ms. Srenivas and any other persons pursuant to which she was selected as an officer.

Departure of Randall Koubek

On February 16, 2021, the Company announced the departure of Randall Koubek, Chief Financial Officer of the Company. Mr. Koubek and the Company mutually decided that Mr. Koubek’s last day of employment would be March 12, 2021.

Upon Mr. Koubek’s departure, the Company and Mr. Koubek will enter into a separation and release agreement. Pursuant to the separation and release agreement, Mr. Koubek will be entitled to a lump sum payment equivalent to twelve months of his base salary and $4,200, representing the cost for three months of COBRA coverage, in lieu of the twelve months of salary continuation and COBRA coverage that had been provided in his offer letter, dated as of October 28, 2018. In addition, the Compensation Committee approved the acceleration of the 8,503 options and 17,500 restricted stock units held by Mr. Koubek following his departure, subject to the separation and release agreement.

Mr. Koubek’s decision to step down was not related to any disagreements with the Company on any matter relating to its operations, policies, practices or any issues regarding financial disclosures, accounting or legal matters.

A copy of the press release announcing the departure of Mr. Koubek is attached as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d). Exhibits

The following exhibits are filed herewith:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

|

|

|

Offer Letter, dated February 13, 2021, by and between Digital Media Solutions, Inc. and Vasundara Srenivas

|

|

|

|

Form of Indemnification Agreement (incorporated by reference to Exhibit 10.8 to Digital Media Solutions, Inc.’s Current Report on Form 8-K/A filed with the SEC on July 20, 2020).

|

|

|

|

Offer Letter, dated October 23, 2018, by and between Digital Media Solutions, LLC and Randall Koubek (incorporated by reference to Exhibit 10.13 to Amendment No. 1 to Digital Media Solutions, Inc.’s Current Report on Form 8-K filed with the SEC on July 20, 2020

|

|

|

|

Press release of Digital Media Solutions, Inc. issued February 16, 2021

|

|

|

|

|

|

104

|

|

Cover Page Interactive File (the cover page tags are embedded within the Inline XBRL document).

|

|

|

|

|

+ Management contract and compensatory plan and arrangement

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 19, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Digital Media Solutions, Inc.

|

|

|

|

|

|

|

|

/s/ Anthony Saldana

|

|

|

Name:

|

Anthony Saldana

|

|

|

Title:

|

General Counsel & Corporate Secretary

|

Digital Media Solutions 4800 140th Ave N

Suite 101

Clearwater, FL 33762

EXHIBIT 10.1+

EXHIBIT 10.1+

Vasundara Srenivas vasundara.srenivas@gmail.com

2/13/2021

Re: Offer of Employment Dear Vasundara,

Digital Media Solutions, Inc., together with its subsidiaries (collectively, the “Company”), is pleased to offer you a full-time exempt position as Chief Financial Officer (CFO), reporting to Joseph Marinucci, Chief Executive Officer (CEO), out of a remote work location but relocating in 2021 to Florida. Your date of hire will be 03/13/2021 (the “Commencement Date”).

Should you accept this offer, your compensation will be structured such that your base pay is

$265,000 annually less applicable payroll deductions and withholdings. You will be paid in accordance with the Company’s customary payroll schedule then-currently in effect. Currently, Company salaries are paid on the 15th and the last working day of every month, except in the event that such a day falls on a weekend or holiday, in which case, you will be paid on the business day prior to such weekend or holiday. Payment of your salary is conditional on your compliance with all of the terms and obligations of your employment with the Company. This position carries an annual short-term performance incentive (STI), the terms of which for 2021 are outlined as an Addendum to this offer letter. Payment of your salary and STI is conditional on your performance associated with the terms and obligations of your employment with the Company. Additionally, we are providing you with a one-time sign-on bonus of $40,000 less applicable payroll deductions and withholdings to support your upcoming relocation to Florida.

If this position carries a performance incentive, it will be outlined upon employment in a separate signed document. Payment of your salary, and incentive is conditional on your compliance with all of the terms and obligations of your employment with the Company.

Digital Media Solutions has adopted a remote work office model. Employees will not be required to commute to a physical office location. Upon employment, employees will sign a ‘Telecommute Agreement’ electronically.

Digital Media Solutions 4800 140th Ave N

Suite 101

Clearwater, FL 33762

DMS is publicly traded and grants Restricted Stock Units (RSUs) and Stock Options as part of the Company’s equity compensation program. Employees will be eligible for issuance of RSUs and stock options after 90-days of successful employment. Your offering will be based on the level of your role as it relates to DMS RSU/Option Plan Tiers. RSU and option grant awards will be processed and issued on a quarterly basis through our equity portal. In that regard, we will recommend to the Compensation Committee that you be granted a one-time equity Award, in accordance with our 2020 Equity Incentive Plan, with an aggregate Award value of $275,000. The Award shall consist of two components: (a) Restricted Stock Units (RSUs) and (b) the remaining of the aggregate Award value to be granted in the form of a non-qualified stock option to purchase shares of the Company’s stock (Options), and will be revisited annually. Upon processing, you will receive plan details and award documentation.

As a full-time exempt employee, you will not accrue vacation time but rather work with your manager to coordinate and approve any paid time off. Paid time off is provided when an employee (a) schedules and takes vacation in a manner that ensures that all department and Company needs are met; (b) the employee maintains satisfactory performance and productivity levels; and (c) the employee has his or her manager’s prior approval to take such time off. You will accrue sick hours calculated on actual hours worked, with a maximum accrual balance of 80 sick hours. Accruals will start upon your commencement date.

You will also be eligible to participate in our customary employee benefits, including health and related insurance, and 401(k) retirement benefits, all subject to participation requirements and provided in accordance with normal Company policies. Your position falls under the ‘Executive Tier’ meaning your benefit enrollments will be paid by the company, excluding voluntary benefits, which includes accident, additional long-term disability, additional Life AD&D, and legal services. You will not incur a waiting period for enrolling in benefits, and your enrollments will be effective immediately upon your hire date. You should note that the Company may modify or terminate benefits, from time to time, as it deems necessary or appropriate.

As a condition of your employment, you will be required to abide by the Company’s general policies and rules of conduct as modified from time to time including standard provisions concerning your confidentiality and non-solicitation obligations to the Company, and all of the Company policies set out in the employee handbook. If you have not already done so, please disclose to the Company any and all conflicting employment restrictions and/or agreements relating to your prior employment that may affect your eligibility to be employed by the Company or limit the manner in which you may be employed, such as prior employment,

Digital Media Solutions 4800 140th Ave N

Suite 101

Clearwater, FL 33762

compensation, non-competition or confidentiality agreements. Please note the Company may modify job titles, salaries, work location and benefits, from time to time, as it deems necessary.

You recognize and understand that, in performing your duties and obligations for the Company and in consideration of the compensation you are eligible for hereunder, you will be expected to act with the business interests of the Company and not in any manner which would be detrimental to any of them. You therefore agree that from the Commencement Date and for six

(6)months after termination of your employment, without the prior written consent of the Company, you will not accept employment with, engage in any undertaking or have any financial interest in any person or entity with its principal place of business located within the United States which, in any way, competes with the Company in performance marketing. Further, you will not enter into any business relationship or interfere with the Company’s relationships with current or prospective suppliers, customers, investors, or business partners known or disclosed to you during the course of your employment with the Company. Notwithstanding the foregoing, nothing shall prevent you from owning a passive investment in securities listed on a public stock exchange or quotation system in the United States or Canada, so long as those securities do not represent more than 1% of the issued securities of any such class.

Your employment relationship with the Company will be at-will. Therefore, you may terminate your employment with the Company at any time and for any reason whatsoever, simply by notifying the Company. Similarly, subject to the immediately following paragraph, the Company is free to conclude its employment relationship with you at any time, with or without cause, and with or without notice. Your acceptance of the offer does not create a contract of employment between the Company and you for any specified term.

If your employment is terminated by the Company without Cause, or if you terminate your employment for Good Reason, you will be entitled to receive during the twelve-month period beginning on the date of such termination (the “Severance Payment Period”), your base salary, payable periodically in equal amounts at the same intervals as if the employment period had not ended. During the Severance Payment Period, subject to applicable law and your timely election of continuation coverage under Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”), the Company will continue payment of the Company’s portion of premium costs for healthcare continuation coverage under COBRA at the same level of coverage that you were a participant prior to such termination of employment, subject to the terms and conditions of the applicable plans and policies as may be in effect at the time of your termination. Cause shall mean: (i) your violation of the Company’s current documented policies; (ii) your failure to

Digital Media Solutions 4800 140th Ave N

Suite 101

Clearwater, FL 33762

substantially perform your duties under this Agreement; (iii) your failure to reasonably cooperate with any lawful investigation undertaken by the Company; (iv) your gross negligence or breach of fiduciary duty; (v) (A) your conviction under any local, state or federal statute which makes the performance of your duties impracticable or impossible, (B) your arrest for any criminal offense against the Company or its personnel, affiliates, or customers, or (C) your arrest for any other felony criminal offense which in the view of the Company may harm the reputation of the Company or any of its affiliates; (vi) your misconduct, gross incompetence or conduct incompatible with your duties hereunder, or prejudicial to the Company’s business; or (vii) your gross insubordination or willful disobedience to the lawful directions of management of the Company, provided in the case of clauses (vi) or (vii) that you have been given written notice thereof and have failed to correct such conduct forthwith.

For purposes of this Agreement, “Good Reason” shall mean that you have complied with the “Good Reason Process” (hereinafter defined) following the occurrence of any of the following “Good Reasons”: (i) a material diminution in your responsibilities, authority or duties; (ii) a requirement that you relocate to a new geographic location outside of Florida in order to provide services to the Company, except for required travel for the Company’s business; (iii) a material breach of this Agreement by the Company; or (iv) any diminution in your Base Salary except for across-the-board salary reductions based on the Company’s financial performance applied equally, as a percentage of Base Salary, to all or substantially all senior management employees of the Company. “Good Reason Process” shall mean that (i) you discover and reasonably determine in good faith that a “Good Reason” condition has occurred; (ii) you notify the Company in writing of the first occurrence of the Good Reason condition within 60 days of your discovery thereof; (iii) you cooperate in good faith with the Company’s efforts, for a period not less than 30 days following such notice (the “Cure Period”), to remedy the condition; (iv) notwithstanding such efforts, the Good Reason condition continues to exist; and (v) you terminate your employment within 60 days after the end of the Cure Period. If the Company cures the Good Reason condition during the Cure Period, Good Reason shall be deemed not to have occurred.

The Company reserves the right to conduct background investigations and/or reference checks on all of its potential employees. Therefore, this offer is contingent upon a clearance of such a background investigation and/or reference check(s), if any.

As required by law, you will be required to provide the Company documentary evidence of your identity and eligibility for employment in the United States. Such documentation must be provided to the Company within three (3) business days of your Commencement Date.

Digital Media Solutions 4800 140th Ave N

Suite 101

Clearwater, FL 33762

To ensure the rapid and economical resolution of disputes that may arise in connection with your employment, you and the Company agree that any and all disputes, claims, or causes of action, in law or equity, arising from or relating to the enforcement, breach, performance, or interpretation of this offer, the terms or conditions of your employment, or involving any other employee, officer, director, client, vendor, business partner, agent or professional representative, or occurring on Company property, shall be resolved under the laws of the State of Florida, by way of mediation administered by the American Arbitration Association (“AAA”) under its Commercial Mediation Procedures. Prior to mediation, the parties agree to use their reasonable efforts to settle any dispute by negotiating in good faith to reach a solution satisfactory to all parties. If they do not reach a solution within sixty (60) days, then, upon written notice by either party, the parties agree to attempt to resolve the dispute by mediation as set forth herein. If mediation is unsuccessful, the parties agree to have such dispute settled by, and consent to the process of, arbitration, under the laws of the State of Florida, administered by the AAA in accordance with its Commercial Arbitration Rules in lieu of litigation, with judgment on the award rendered by one arbitrator entered in any court having jurisdiction and the parties irrevocably waive their right to litigate. The location of the negotiation, mediation or arbitration shall be in Pinellas or Hillsborough County, Florida, under the laws of the State of Florida, and each party shall assume their own costs, including attorneys’ fees.

This letter forms the complete and exclusive statement of the terms of the offer of employment with the Company. The parties agree it is entered into without reliance on any promise or representation, written or oral, other than those expressly contained herein, and this letter entirely supersedes and replaces any and all prior or contemporaneous promises or representations, whether oral or written. This letter can only be modified in a written agreement signed by you and a duly authorized representative of the Company.

We look forward to working with you. If you have any questions or concerns regarding this offer letter, please contact Colleen Liguori, EVP of People Operations & HR of the Company at cliguori@dmsgroup.com

To accept this offer, please sign and date this letter in the space provided below and return a signed copy to us to the email provided. This offer of employment will terminate if it is not accepted, signed and returned by 02/18/2021.

Digital Media Solutions 4800 140th Ave N

Suite 101

Clearwater, FL 33762

Sincerely,

Colleen Liguori, MHRM, SPHR EVP People & HR Operations Digital Media Solutions, INC.

By electronically signing and dating this offer letter, I, Vasundara Srenivas, accept this job offer.

/s/ Vasundara Srenivas 2/15/2021

Vasundara Srenivas Date

Digital Media Solutions 4800 140th Ave N

Suite 101

Clearwater, FL 33762

Short-Term Incentive Agreement Addendum (STI)

For 2021, your STI will be a prorated portion of the 2021 STI, based on the period from February 10, 2021 through December 31, 2021.

Your 2021 STI plan will be structured as follows:

Total Potential Incentive of not less than $97,167. This represents eligibility for an annual bonus of 40% of your base salary with a pro-ration for 11-months of employment.

Categories for Completion:

a.Personal performance of Meeting Expectations or Higher on your annual performance review which occurs in October 2021.

b.Company performance.

VS

EXHIBIT 99.1

Former Boeing Capital Corporation CFO To Be Appointed To DMS CFO In March

Vasundara Srenivas Adds Significant Public Market Expertise To Support Growth Of Digital Media Solutions

Clearwater, FL - February 15, 2021 - Digital Media Solutions, Inc. (NYSE: DMS), a leading provider of technology-enabled digital performance advertising solutions connecting consumers and advertisers within insurance and other top verticals, today announces the appointment of Vasundara Srenivas, CPA, as CFO. In this role, Srenivas will lead the company’s global finance and accounting teams. Srenivas will report to DMS CEO, Joe Marinucci, with a March 13th start date.

For more than a decade, Srenivas held executive-level positions at Boeing, supporting both corporate and divisional finance. A transformational leader, Srenivas’s expertise includes strategic direction, GAAP/IFRS accounting, SEC reporting, M&A and financial operations. Srenivas’s roles at Boeing included CFO of Boeing Australia and Boeing Defense Australia, senior roles in corporate finance transformation and enterprise finance and, from 2017 through 2020, CFO of Boeing Capital Corporation (BCC), a wholly-owned, multi-billion dollar subsidiary of Boeing responsible for arranging, structuring and providing financing for Boeing’s products.

“Vasundara’s passion, ambition and intellectual curiosity are immediately apparent,” noted Marinucci. “Her experience managing financial portfolios for one of the largest publicly traded companies in the U.S. will level up the finance team at DMS. Likewise, Vasundara’s deep M&A experience, her financial compliance background and her public company expertise will be tapped as DMS continues to grow organically and with strategic acquisitions that accelerate our organic growth.”

Srenivas earned her MBA at the University of Canberra in Australia, and she successfully completed the Advanced Management Program at Harvard Business School. Srenivas was recognized as CPA Australia’s Top 40 Under 40 Young Business Leader and awarded the National Asian Pacific American Corporate Achievement Award in Washington, DC. Srenivas is in the process of relocating to Tampa Bay, where the company is headquartered.

Current CFO Randy Koubek joined DMS in December 2018 and led the team through the rigorous process of becoming a public company in July 2020 via a SPAC IPO. He is leaving to pursue other opportunities. “The entire DMS team is grateful to Randy for his dedication and hard work navigating the finance team through multiple acquisitions and our IPO process during his tenure,” noted Marinucci. “Like the rest of DMS, Randy understands everything is possible when you believe it is. I wish Randy the best as he transitions to his next opportunity.”

Last month, DMS announced the appointment of Tony Saldana to General Counsel and EVP of Compliance and Thomas Bock to EVP of Corporate Development and Investor Relations, and earlier this month, DMS announced the acquisition of Aimtell/PushPros. The addition of the Aimtell/PushPros technology and AI infrastructure within the DMS proprietary advertising technology stack enhances the ability of both companies to connect consumers and advertisers with relevant ads delivered to the right people at the right times.

DMS fourth quarter and full-year fiscal 2020 earnings will be released before the stock market opens on Friday, February 26, 2021, and the company will hold a conference call, led by Marinucci and Koubek, to discuss results at 8:30 a.m. (Eastern Time) that day.

About Digital Media Solutions

Digital Media Solutions, Inc. (NYSE: DMS) is a leading provider of technology-enabled digital performance advertising solutions connecting consumers and advertisers within auto, home, health and life insurance plus a long list of top consumer verticals. The DMS first-party data asset, proprietary advertising technology, significant proprietary media distribution and data-driven processes help digital advertising clients de-risk their advertising spend while scaling their customer bases. Learn more at https://digitalmediasolutions.com.

Safe Harbor Statement

This press release includes “forward-looking statements'' within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. DMS’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, DMS’s expectations with respect to its future performance, its ability to implement its strategy and its ability to successfully integrate Aimtell/PushPros. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside DMS’s control and are difficult to predict. Factors that may cause such differences include risks and uncertainties indicated from time to time in DMS’s amended registration statement, filed on August 6, 2020, including those under “Risk Factors”, and in DMS’s other filings with the SEC. There may be additional risks that we consider immaterial or which are unknown, as it is not possible to predict or identify all such risks. DMS cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. DMS does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

Contact:

Media Contact

Melissa Ledesma

(201) 290-2696

Mledesma@dmsgroup.com

Investor Contact:

Thomas Bock

(704) 412-8892

tbock@dmsgroup.com

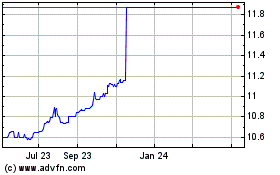

Leo Holdings Corp II (NYSE:LHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

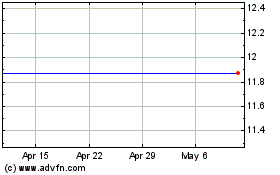

Leo Holdings Corp II (NYSE:LHC)

Historical Stock Chart

From Apr 2023 to Apr 2024