UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE 13D

Under the Securities Exchange Act of

1934

(Amendment No. )*

Equillium, Inc.

(Name of Issuer)

Common Stock, par value $0.0001 per

share

(Title of Class of Securities)

29446K106

(CUSIP Number)

Decheng Capital Global Life Sciences

Fund IV, L.P.

Ugland House, PO Box 309, Grand Cayman

KY1-1104, Cayman Islands

+1- 345-949-8066

(Name, Address and Telephone Number of

Person

Authorized to Receive Notices and Communications)

February 5, 2021

(Date of Event Which Requires Filing

of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

¨

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom

copies are to be sent.

|

|

*

|

The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

|

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange

Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all

other provisions of the Act (however, see the Notes).

|

1.

|

NAME OF REPORTING PERSONS

Decheng Capital Global Life Sciences Fund

IV, L.P.

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF

A GROUP (SEE INSTRUCTIONS)

(a) ¨

(b) x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

WC

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E):

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

4,271,423(1)

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SOLE DISPOSITIVE POWER

4,271,423(1)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON

4,271,423(1)

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS): ¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW 11:

14.7%(2)

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN

|

|

|

|

|

|

(1) Consists of 3,285,710 shares of the Issuer’s

Common Stock and 985,713 shares of the Issuer’s Common Stock issuable upon exercise of warrants, which are exercisable within

60 days of the date of this filing, held directly by Decheng Capital Global Life Sciences Fund IV, L.P. (“Fund IV”).

Decheng Capital Management IV (Cayman), LLC (“General Partner IV”) is the general partner of Fund IV and Xiangmin

Cui is the managing director of General Partner IV. Fund IV, General Partner IV and Dr. Cui may be deemed to share voting and

dispositive power with respect to the shares held directly by Fund IV.

(2) This percentage is calculated based upon 29,039,512

outstanding shares of Common Stock of the Issuer, as reported in the Issuer’s prospectus supplement filed pursuant to Rule

424(b)(5) with the Securities and Exchange Commission on February 4, 2021.

|

1.

|

NAME OF REPORTING PERSONS

Decheng Capital Management IV (Cayman),

LLC

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF

A GROUP (SEE INSTRUCTIONS)

(a) ¨

(b) x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E):

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

4,271,423(3)

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SOLE DISPOSITIVE POWER

4,271,423(3)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON

4,271,423(3)

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS): ¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW 11:

14.7%(4)

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO

|

|

|

|

|

|

(3) Consists of 3,285,710 shares of the Issuer’s

Common Stock and 985,713 shares of the Issuer’s Common Stock issuable upon exercise of warrants, which are exercisable within

60 days of the date of this filing, held directly by Fund IV. General Partner IV is the general partner of Fund IV and Xiangmin

Cui is the managing director of General Partner IV. Fund IV, General Partner IV and Dr. Cui may be deemed to share voting and

dispositive power with respect to the shares held directly by Fund IV.

(4) This percentage is calculated based upon 29,039,512

outstanding shares of Common Stock of the Issuer, as reported in the Issuer’s prospectus supplement filed pursuant to Rule

424(b)(5) with the Securities and Exchange Commission on February 4, 2021.

|

1.

|

NAME OF REPORTING PERSONS

Decheng Capital Global Healthcare Fund

(Master), LP

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF

A GROUP (SEE INSTRUCTIONS)

(a) ¨

(b) x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

WC

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E):

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

1,461,598(5)

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SOLE DISPOSITIVE POWER

1,461,598(5)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON

1,461,598 (5)

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS): ¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW 11:

5.0%(6)

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN

|

|

|

|

|

|

(5) Consists of 1,161,598 shares of the Issuer’s

Common Stock and 300,000 shares of the Issuer’s Common Stock issuable upon exercise of warrants, which are exercisable within

60 days of the date of this filing, held directly by Decheng Capital Global Global Healthcare Fund (Master), LP (“Public

Fund”). Decheng Capital Global Healthcare GP, LLC (“Public General Partner”) is the general partner of Public

Fund and Xiangmin Cui is the managing director of Public General Partner. Public Fund, Public General Partner and Dr. Cui may

be deemed to share voting and dispositive power with respect to the shares held directly by Public Fund.

(6) This percentage is calculated based upon 29,039,512

outstanding shares of Common Stock of the Issuer, as reported in the Issuer’s prospectus supplement filed pursuant to Rule

424(b)(5) with the Securities and Exchange Commission on February 4, 2021.

|

1.

|

NAME OF REPORTING PERSONS

Decheng Capital Global Healthcare GP, LLC

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF

A GROUP (SEE INSTRUCTIONS)

(a) ¨

(b) x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E):

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

1,461,598(7)

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SOLE DISPOSITIVE POWER

1,461,598(7)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON

1,461,598(7)

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS): ¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW 11:

5.0%(8)

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO

|

|

|

|

|

|

(7) Consists of 1,161,598 shares of the Issuer’s

Common Stock and 300,000 shares of the Issuer’s Common Stock issuable upon exercise of warrants, which are exercisable within

60 days of the date of this filing, held directly by Public Fund. Public General Partner is the general partner of Public Fund

and Xiangmin Cui is the managing director of Public General Partner. Public Fund, Public General Partner and Dr. Cui may be deemed

to share voting and dispositive power with respect to the shares held directly by Public Fund.

(8) This percentage is calculated based upon 29,039,512

outstanding shares of Common Stock of the Issuer, as reported in the Issuer’s prospectus supplement filed pursuant to Rule

424(b)(5) with the Securities and Exchange Commission on February 4, 2021.

|

1.

|

NAME OF REPORTING PERSONS

Xiangmin Cui

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF

A GROUP (SEE INSTRUCTIONS)

(a) ¨

(b) x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF

|

|

5.

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E):

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

5,733,021(9)

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SOLE DISPOSITIVE POWER

5,733,021(9)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON

5,733,021(9)

|

|

12

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS): ¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW 11:

19.7%(10)

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN

|

|

|

|

|

|

(9) Consists of 3,285,710 shares of the Issuer’s

Common Stock and 985,713 shares of the Issuer’s Common Stock issuable upon exercise of warrants, which are exercisable within

60 days of the date of this filing, held directly by Fund IV and Public Fund. General Partner IV is the general partner of Fund

IV and Xiangmin Cui is the managing director of General Partner IV. Public General Partner is the general partner of Public Fund

and Xiangmin Cui is the managing director of Public General Partner. Fund IV, General Partner IV, Public Fund, Public General

Partner and Dr. Cui may be deemed to share voting and dispositive power with respect to the shares held directly by Fund IV and

Public Fund.

(10) This percentage is calculated based upon 29,039,512

outstanding shares of Common Stock of the Issuer, as reported in the Issuer’s prospectus supplement filed pursuant to Rule

424(b)(5) with the Securities and Exchange Commission on February 4, 2021.

|

Item 1.

|

Security and Issuer.

|

The class of equity securities to which

this Schedule 13D relates is common stock, par value $0.0001 per share (“Common Stock”) of Equillium, Inc., a

Delaware corporation (the “Issuer”). The principal executive offices of the Issuer are located at 2223 Avenida de la

Playa, Suite 105, La Jolla, CA.

|

Item 2.

|

Identity and Background.

|

|

|

(a)

|

This Schedule 13D is filed by (i) Decheng Capital Global Life Sciences Fund IV, L.P. (“Fund IV”), a Cayman

Islands exempted limited partnership, (ii) Decheng Capital Management IV (Cayman), LLC (“General Partner IV”),

a Cayman Islands limited liability company (iii) Decheng Capital Global Healthcare Fund (Master), LP (“Public Fund”),

a Cayman Islands exempted limited partnership, (iv) Decheng Capital Global Healthcare GP, LLC (“Public General Partner”),

a Cayman Islands limited liability company and (v) Xiangmin Cui (“Dr. Cui”) (collectively, the “Reporting

Persons”).

|

|

|

(b)

|

The address of the principal place of business of the Reporting Persons is Ugland House, PO Box 309, Grand Cayman, KY1-1104,

Cayman Islands.

|

|

|

(c)

|

The principal business of both Fund IV and Public Fund is the venture capital investment

business. The principal business of General Partner IV is acting as general partner of Fund IV. The principal business of

Public General Partner is acting as general partner of Public Fund. The principal occupation of Dr. Cui is serving as

the managing director of General Partner IV and Public General Partner.

|

|

|

(d)

|

During the last five years, none of the Reporting Persons has been convicted in any criminal proceeding (excluding traffic

violations or similar misdemeanors).

|

|

|

(e)

|

During the last five years, none of the Reporting Persons have been a party to a civil proceeding of a judicial or administrative

body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining

future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation

with respect to such laws.

|

|

|

(f)

|

Fund IV and Public Fund are each a Cayman Islands exempted limited partnership, General Partner IV and Public General Partner

is a Cayman Islands limited liability company and Dr. Cui is a citizen of the United States.

|

|

Item 3.

|

Source and Amount of Funds or Other Consideration.

|

Pursuant to the terms of that certain Securities Purchase Agreement

by and among the Issuer, Fund IV, and Public Fund (collectively, the “Investors”), dated February 3, 2021 (the

“Securities Purchase Agreement”), the Investors purchased in a private placement 4,285,710 units representing (i) 4,285,710

shares of the Company’s common stock, par value $0.0001 per share (“Common Stock”), and (ii) warrants to

purchase an additional 1,285,713 shares of Common Stock for $7.00 per unit (each unit consisting of one share of Common Stock and

a warrant to purchase 0.3 of a share of Common Stock) (the “Financing”). The Financing closed on February 5, 2021.

The aggregate purchase price of the Shares and the Warrants acquired by the Investors was $29,999,970.00.

The funds used by Fund IV and Public Fund to acquire the securities

described above were obtained from working capital contributed by their partners and members.

|

Item 4.

|

Purpose of Transaction.

|

Fund IV and Public Fund each agreed to purchase the Shares and

the Warrants described herein for investment purposes with the aim of increasing the value of the Issuer and its investment in

the Issuer. In connection with the Financing, and as a condition thereof, Dr. Yu (Katherine) Xu, Ph.D. joined the Board on

February 3, 2021 as an appointee of the Investors. As a director of the Issuer, Dr. Yu may have influence over the corporate

activities of the Issuer, including activities which may relate to the transactions described in clauses (a) through (j) set

forth below in this Item 4.

Except as set forth herein and except that the Reporting Persons

or any of their affiliates may, from time to time or at any time, subject to market conditions and other factors, purchase additional

shares of Common Stock of the Issuer in the open market, in privately negotiated transactions or otherwise, or sell at any time

all or a portion of the common stock of the Issuer now owned or hereafter acquired by them in the open market, in privately negotiated

transactions or otherwise, as of the date of this Schedule 13D, none of the Reporting Persons has any present plans which relate

to or would result in:

|

|

(a)

|

The acquisition by any person of additional securities of the Issuer, or the disposition of securities of the Issuer;

|

|

|

(b)

|

An extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its

subsidiaries;

|

|

|

(c)

|

A sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries;

|

|

|

(d)

|

Any change in the present board of directors or management of the Issuer, including any plans or proposals to change the number

or term of directors or to fill any existing vacancies on the board;

|

|

|

(e)

|

Any material change in the present capitalization or dividend policy of the Issuer;

|

|

|

(f)

|

Any other material change in the Issuer's business or corporate structure including but not limited to, if the Issuer is a

registered closed-end investment company, any plans or proposals to make any changes in its investment policy for which a vote

is required by Section 13 of the Investment Company Act of 1940;

|

|

|

(g)

|

Changes in the Issuer's charter, bylaws or instruments corresponding thereto or other actions which may impede the acquisition

of control of the Issuer by any person;

|

|

|

(h)

|

Causing a class of securities of the Issuer to be delisted from a national securities exchange or to cease to be authorized

to be quoted in an inter-dealer quotation system of a registered national securities association;

|

|

|

(i)

|

A class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of

the Act; or

|

|

|

(j)

|

Any action similar to any of those enumerated above.

|

|

Item 5.

|

Interest in Securities of the Issuer.

|

|

|

(a)

|

As of the date hereof, Fund IV is the record owner of 4,271,423

shares of Common Stock, including 985,713 shares of Common Stock issuable within 60 days of the date of this filing upon the exercise

of Warrants. Fund IV is controlled by General Partner IV and Dr. Cui. As of the date hereof, Public Fund is the record owner

of 1,461,598 shares of Common Stock, including 300,000 shares of Common Stock issuable within 60 days of the date of this filing

upon the exercise of Warrants. Public Fund is controlled by Public General Partner and Dr. Cui. As such, each of the Reporting

Persons may be deemed to share voting and dispositive power over the shares held by Fund IV and Public Fund. As such, General Partner

IV, Public General Partner and Dr. Cui may be deemed to beneficially own the shares held directly by Fund IV and Public Fund.

|

|

|

|

Number of Shares of Common Stock

|

|

|

|

|

Power to Vote or Direct

the Vote

|

|

|

Power to Dispose or Direct

the Disposition

|

|

|

Reporting Person

|

|

Sole

|

|

|

Shared

|

|

|

Sole

|

|

|

Shared

|

|

|

Decheng Capital Global Life Sciences Fund IV, L.P

|

|

|

0

|

|

|

|

4,271,423

|

|

|

|

0

|

|

|

|

4,271,423

|

|

|

Decheng Capital Management IV (Cayman), LLC

|

|

|

0

|

|

|

|

4,271,423

|

|

|

|

0

|

|

|

|

4,271,423

|

|

|

Decheng Capital Global Global Healthcare Fund (Master), LP

|

|

|

0

|

|

|

|

1,461,598

|

|

|

|

0

|

|

|

|

1,461,598

|

|

|

Decheng Capital Global Healthcare GP, LLC

|

|

|

0

|

|

|

|

1,461,598

|

|

|

|

0

|

|

|

|

1,461,598

|

|

Xiangmin Cui

|

|

|

0

|

|

|

|

5,733,021

|

|

|

|

0

|

|

|

|

5,733,021

|

|

|

|

(c)

|

The information provided and incorporated by reference in Item 3 is hereby incorporated by reference. There were no other transactions

in the Common Stock by the Reporting Persons in the 60 days prior to the date of the event which requires the filing of this Schedule

13D.

|

|

|

(d)

|

No other person is known by the Reporting Persons to have the right to receive or the power to direct the receipt of dividends

from, or the proceeds from the sale of, the Common Stock beneficially owned by the Reporting Persons.

|

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

|

Warrants

In the Financing, the Investors received

Warrants to purchase an aggregate of 1,285,713 shares of Common Stock at an exercise price of $14.00 per share, subject to adjustments

as provided under the terms of the Warrants. The Warrants are exercisable at any time and expire on February 5, 2026. The

foregoing description of the Warrants is qualified in its entirety by reference to the form of Warrant, which is filed as an exhibit

to this Schedule and is incorporated by reference herein.

Board

Under the Securities Purchase Agreement,

the Investors are entitled to nominate one member of the Issuer’s Board (the “Decheng Director”), and the Issuer

will take all necessary actions to nominate such director at each meeting of stockholders where such nominee is up for re-election.

The initial Decheng Director is Dr. Yu. The foregoing description of the board representation rights contained in the Securities

Purchase Agreement is intended as a summary only and is qualified in its entirety by reference to the Securities Purchase Agreement,

which is filed as an exhibit to this Schedule 13D and incorporated herein.

|

Item 7.

|

Material to Be Filed as Exhibits.

|

|

|

A.

|

Purchase Agreement, dated February 3, 2021, by and among the Company and the Purchasers, (Incorporated by reference to

Exhibit 10.1 to the Issuer’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on February 3,

2021).

|

|

|

B.

|

Form of Warrant (Incorporated by reference to Exhibit 4.1 to the Issuer’s Current Report on Form 8-K,

filed with the Securities and Exchange Commission on February 3, 2021).

|

|

|

C.

|

Agreement regarding filing of joint Schedule 13D.

|

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement

is true, complete and correct.

Dated: February 15, 2021

Decheng Capital Global Life Sciences

Fund IV, L.P.

By its General Partner

Decheng Capital Management IV (Cayman),

LLC

|

By:

|

/s/ Xiangmin Cui

|

|

|

Name:

|

Xiangmin Cui

|

|

|

Title:

|

Managing Director

|

|

Decheng Capital Management IV (Cayman), LLC

|

By:

|

/s/ Xiangmin Cui

|

|

|

Name:

|

Xiangmin Cui

|

|

|

Title:

|

Managing Director

|

|

Decheng Capital Global Global Healthcare

Fund (Master), LP

By its General Partner

Decheng Capital Global Healthcare GP, LLC

|

By:

|

/s/ Xiangmin Cui

|

|

|

Name:

|

Xiangmin Cui

|

|

|

Title:

|

Managing Director

|

|

Decheng Capital Global Healthcare GP, LLC

|

By:

|

/s/ Xiangmin Cui

|

|

|

Name:

|

Xiangmin Cui

|

|

|

Title:

|

Managing Director

|

|

Xiangmin Cui

The

original statement shall be signed by each person on whose behalf the statement is filed or his authorized representative. If the

statement is signed on behalf of a person by his authorized representative (other than an executive officer or general partner

of the filing person), evidence of the representative’s authority to sign on behalf of such person shall be filed with the

statement: provided, however, that a power of attorney for this purpose which is already on file with the Commission may be incorporated

by reference. The name and any title of each person who signs the statement shall be typed or printed beneath his signature.

Attention: - Intentional misstatements

or omissions of fact

constitute Federal criminal violations (See 18 U.S.C. 1001)

EXHIBIT C

JOINT FILING AGREEMENT

Pursuant to Rule 13d-1(k)(1) promulgated

pursuant to the Securities Exchange Act of 1934, as amended, the undersigned agree that the attached Schedule 13D is being filed

on behalf of each of the undersigned.

Dated: February 15, 2019

Decheng Capital Global Life Sciences

Fund IV, L.P.

By its General Partner

Decheng Capital Management IV (Cayman),

LLC

|

By:

|

/s/ Xiangmin Cui

|

|

|

Name:

|

Xiangmin Cui

|

|

|

Title:

|

Managing Director

|

|

Decheng Capital Management IV (Cayman), LLC

|

By:

|

/s/ Xiangmin Cui

|

|

|

Name:

|

Xiangmin Cui

|

|

|

Title:

|

Managing Director

|

|

Decheng Capital Global Global Healthcare

Fund (Master), LP

By its General Partner

Decheng Capital Global Healthcare GP, LLC

|

By:

|

/s/ Xiangmin Cui

|

|

|

Name:

|

Xiangmin Cui

|

|

|

Title:

|

Managing Director

|

|

Decheng Capital Global Healthcare GP, LLC

|

By:

|

/s/ Xiangmin Cui

|

|

|

Name:

|

Xiangmin Cui

|

|

|

Title:

|

Managing Director

|

|

Xiangmin Cui

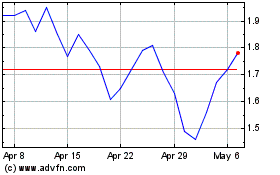

Equillium (NASDAQ:EQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Equillium (NASDAQ:EQ)

Historical Stock Chart

From Apr 2023 to Apr 2024