In addition, B. Riley Financial exchanged $35

million of its existing Tranche A term loan for senior notes

Net proceeds to be used to substantially pay

down debt and invest in clean energy growth initiatives

Babcock & Wilcox Enterprises, Inc. ("B&W" or the

"Company") (NYSE: BW) announced that on February 12, 2021 it closed

an underwritten public offering of 29,487,180 shares of common

stock, which included 3,846,154 shares issued in connection with

the underwriter’s option to purchase additional shares, at a price

to the public of $5.85 per share, for gross proceeds of

approximately $172.5 million. The Company also announced that on

February 12, 2021 it closed an underwritten public offering of

$125.0 million aggregate principal amount of 8.125% senior notes

due 2026, which included $5 million aggregate principal amount of

senior notes issued in connection with the underwriters’ option to

purchase senior notes. Gross proceeds for both offerings are

exclusive of underwriting discounts and commissions and estimated

offering expenses payable by the Company.

B&W and the senior notes both received a rating of BB+ from

Egan-Jones Ratings Company, an independent, unaffiliated rating

agency. The notes are expected to begin trading on NYSE under the

symbol “BWSN” as early as February 17, 2021.

In addition to the public offering, B. Riley Financial, Inc

exchanged $35 million of its existing Tranche A term loan for $35

million principal amount of senior notes in a concurrent private

offering, and the interest rate on the remaining Tranche A term

loan balance has been reduced to an interest rate of 6.625%,

compared to its current rate of 12%.

The two offerings resulted in net proceeds of approximately $283

million after deducting underwriting discounts and commissions, but

before expenses. The Company expects to use the net proceeds of

this offering to support clean energy growth initiatives and to pay

down its revolving credit facility by approximately $167 million

while permanently reducing the facility size by approximately $94

million.

“We expect the proceeds derived from this raise to significantly

reduce our secured debt and future cash interest payments, de-lever

our balance sheet, support expansion of our clean energy

technologies portfolio, and provide a strong foundation to pursue

our more than $5 billion 3-year pipeline of identified

opportunities on top of our strong, high-margin parts and services

business,” said Kenneth Young, B&W’s Chairman and CEO. “Looking

forward, we remain focused on growing our Renewable and

Environmental segments, including deploying our waste-to-energy and

carbon capture technologies to help meet critical climate goals, as

the next-generation B&W powers the global energy and

environmental transformation.”

B. Riley Securities, Inc., acted as the lead book-running

manager for the common stock offering. D.A. Davidson & Co. and

Janney Montgomery Scott LLC acted as joint book-running managers

for the common stock offering. Lake Street Capital Markets, LLC and

National Securities Corporation acted as co-managers for the common

stock offering.

B. Riley Securities, Inc. acted as lead book-running manager for

the senior notes offering. D.A. Davidson & Co., Janney

Montgomery Scott LLC, Ladenburg Thalmann & Co. Inc., and

National Securities Corporation acted as joint book-running

managers for the senior notes offering. Aegis Capital Corp.,

Boenning & Scattergood, Inc., Huntington Securities, Inc. and

Kingswood Capital Markets, division of Benchmark Investments, Inc.

acted as co-managers for the senior notes offering.

The common stock and senior notes were offered under the

Company's shelf registration statement on Form S-3, which was

declared effective by the Securities and Exchange Commission

("SEC") on February 13, 2020. The offerings were made only by means

of a prospectus supplement and accompanying base prospectus. Copies

of the prospectus supplement and the accompanying base prospectus

for the offering may be obtained on the SEC's website at

www.sec.gov, or by contacting B. Riley Securities by telephone at

(703) 312-9580, or by email at prospectuses@brileyfin.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

sale or solicitation would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

Forward-Looking Statements

Statements in this press release that are not descriptions of

historical facts are forward-looking statements that are based on

management's current expectations and assumptions and are subject

to risks and uncertainties. If such risks or uncertainties

materialize or such assumptions prove incorrect, our business,

operating results, financial condition and stock price could be

materially negatively affected. You should not place undue reliance

on such forward-looking statements, which are based on the

information currently available to us and speak only as of the date

of this press release. Such forward looking statements include, but

are not limited to, statements regarding the Company's public

offerings of common stock and senior notes, B. Riley Financial’s

exchange of a portion of its existing Tranche A term loan for $35

million of senior notes, the revolving credit facility to be

permanently reduced by 75% of the senior note value, exclusive of

the value of the B. Riley Financial term loan exchange, the

interest on remaining Tranche A term loan to be significantly

reduced, and the pursuit of more than $5 billion 3-year pipeline of

identified opportunities. Factors that could cause such actual

results to differ materially from those contemplated or implied by

such forward-looking statements include, without limitation, the

risks associated with the unpredictable and ongoing impact of the

COVID-19 pandemic and other risks described from time to time in

the Company's periodic filings with the SEC, including, without

limitation, the risks described in the Company's Annual Report on

Form 10-K for the year ended December 31, 2019 and Quarterly

Reports on Form 10-Q for the quarters ended March 31, 2020, June

30, 2020 and September 30, 2020 under the captions "Risk Factors"

and "Management's Discussion and Analysis of Financial Condition

and Results of Operations" (as applicable). These factors should be

considered carefully, and B&W Enterprises cautions not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this release, and undertakes no obligation

to update or revise any forward-looking statement, except to the

extent required by applicable law.

About Babcock & Wilcox Enterprises

Headquartered in Akron, Ohio, Babcock & Wilcox Enterprises

is a global leader in energy and environmental technologies and

services for the power and industrial markets.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210216005370/en/

Investor Contact: Megan Wilson Vice President, Corporate

Development & Investor Relations Babcock & Wilcox

Enterprises 704.625.4944 | investors@babcock.com

Media Contact: Ryan Cornell Public Relations Babcock

& Wilcox Enterprises 330.860.1345 | rscornell@babcock.com

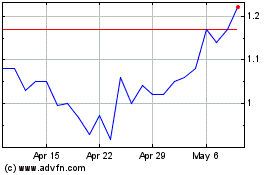

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Mar 2024 to Apr 2024

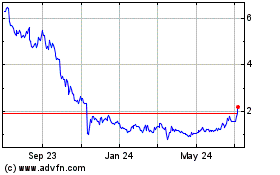

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Apr 2023 to Apr 2024