Statement of Ownership (sc 13g)

February 08 2021 - 6:00AM

Edgar (US Regulatory)

|

|

SECURITIES AND EXCHANGE

COMMISSION

|

|

|

|

Washington, D.C. 20549

|

|

SCHEDULE 13G

(Rule 13d-102)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(b), (c) AND (d) AND AMENDMENTS THERETO FILED

PURSUANT TO § 240.13d-2

UNDER THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )*

Fangdd Network Group Ltd.

(Name of Issuer)

Class A ordinary shares, $0.0000001 par value per share

(Title of Class of Securities)

30712L 109**

(CUSIP Number)

December 31, 2020

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to designate the rule pursuant to which this Schedule is filed:

|

o

|

Rule 13d-1(b)

|

|

o

|

Rule 13d-1(c)

|

|

x

|

Rule 13d-1(d)

|

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

** CUSIP number 30712L 109 has been assigned to the American depositary shares (“ADSs”) of the issuer, which are quoted on The Nasdaq Global Market under the symbol “DUO.” Each ADS represents 25 Class A ordinary shares of the issuer. No CUSIP has been assigned to the Issuer’s Class A ordinary shares.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

Name of Reporting Person

FANGDD DECENT INTERNATIONAL LTD.

|

|

2

|

Check the Appropriate Box if a Member of a Group

(a) o

(b) o

|

|

3

|

SEC Use Only

|

|

4

|

Citizenship or Place of Organization

British Virgin Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

5

|

Sole Voting Power

102,102,318 (1)

|

|

6

|

Shared Voting Power

0

|

|

7

|

Sole Dispositive Power

102,102,318 (1)

|

|

8

|

Shared Dispositive Power

0

|

|

9

|

Aggregate Amount Beneficially Owned by Each Reporting Person

102,102,318 (1)

|

|

10

|

Check if the Aggregate Amount in Row (9) Excludes Certain Shares o

|

|

11

|

Percent of Class Represented by Amount in Row 9

5.1% (2)

|

|

12

|

Type of Reporting Person

CO

|

|

|

|

|

|

(1) Represents (i) 18 Class A ordinary shares and (ii) 4,084,092 American depositary receipts (“ADRs”), representing 102,102,300 Class A ordinary shares, held by FANGDD DECENT INTERNATIONAL LTD.

(2) Calculation is based on a total of 1,996,169,104 ordinary shares (being the sum of 1,376,231,046 Class A ordinary shares and 619,938,058 Class B ordinary shares) of the Issuer as a single class as of March 31, 2020 as reported in the Issuer’s 20-F filing filed with the Securities and Exchange Commission on April 15, 2020. The Class B ordinary shares are treated as converted into Class A ordinary shares only for the purpose of calculating the percentage ownership of the Reporting Persons.

2

|

1

|

Name of Reporting Person

Liqing Zeng

|

|

2

|

Check the Appropriate Box if a Member of a Group

(a) o

(b) o

|

|

3

|

SEC Use Only

|

|

4

|

Citizenship or Place of Organization

Hong Kong

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

5

|

Sole Voting Power

138,698,218 (3)

|

|

6

|

Shared Voting Power

0

|

|

7

|

Sole Dispositive Power

138,698,218 (3)

|

|

8

|

Shared Dispositive Power

0

|

|

9

|

Aggregate Amount Beneficially Owned by Each Reporting Person

138,698,218 (3)

|

|

10

|

Check if the Aggregate Amount in Row (9) Excludes Certain Shares o

|

|

11

|

Percent of Class Represented by Amount in Row 9

6.9% (4)

|

|

12

|

Type of Reporting Person

IN

|

|

|

|

|

|

(3) Represents (i) 18 Class A ordinary shares and 4,084,092 ADRs, representing 102,102,300 Class A ordinary shares, held by FANGDD DECENT INTERNATIONAL LTD., and (ii) 1,463,836 ADRs, representing 36,595,900 Class A ordinary shares, held by an affiliate of FANGDD DECENT INTERNATIONAL LTD ultimately controlled by Mr. Liqing Zeng. FANGDD DECENT INTERNATIONAL LTD. is controlled by Best Vision International Ltd. Best Vision International Ltd. is controlled by Best Vision Trust, managed by Cantrust (Far East) Limited as the trustee. Mr. Liqing Zeng is the settlor of Best Vision Trust, and Mr. Zeng and his family members are the trust’s beneficiaries. Under the terms of this trust, Mr. Zeng has the power to direct the trustee with respect to the retention or disposal of, and the exercise of any voting and other rights attached to, the share held by FANGDD DECENT INTERNATIONAL LTD.

(4) Calculation is based on a total of 1,996,169,104 ordinary shares (being the sum of 1,376,231,046 Class A ordinary shares and 619,938,058 Class B ordinary shares) of the Issuer as a single class as of March 31, 2020 as reported in the Issuer’s 20-F filing filed with the Securities and Exchange Commission on April 15, 2020. The Class B ordinary shares are treated as converted into Class A ordinary shares only for the purpose of calculating the percentage ownership of the Reporting Persons.

3

|

Item 1(a).

|

Name of Issuer:

Fangdd Network Group Ltd. (the “Issuer”)

|

|

Item 1(b).

|

Address of Issuer’s Principal Executive Offices:

18/F, Unit B2, Kexing Science Park, 15 Keyuan Road, Technology Park, Nanshan District, Shenzhen, People’s Republic of China

|

|

Item 2(a).

|

Name of Person Filing:

(i) FANGDD DECENT INTERNATIONAL LTD., and

(ii) Liqing Zeng

(collectively, the “Reporting Persons”).

|

|

Item 2(b).

|

Address of Principal Business Office or, if none, Residence:

The addresses of the Reporting Persons are:

(i) FANGDD DECENT INTERNATIONAL LTD.

P.O. Box 957, Offshore Incorporations Centre, Road Town, Tortola, British Virgin Islands

(ii) Liqing Zeng

Flat A 32/F, Luna Sky, Cullinan 1,1 Austin Road West, Tsim Sha Tsui Kowloon, Hongkong

|

|

Item 2(c)

|

Citizenship:

(i) FANGDD DECENT INTERNATIONAL LTD. - British Virgin Islands

(ii) Liqing Zeng — Hong Kong

|

|

Item 2(d).

|

Title of Class of Securities:

Class A ordinary shares, par value US$0.0000001 per share, of the Issuer

The Issuer’s ordinary shares consist of Class A ordinary shares and Class B ordinary shares. Each Class A ordinary share is entitled to one vote and each Class B ordinary share is entitled to ten votes, on all matters submitted to shareholders for vote. Class B ordinary shares are convertible at any time by the holder thereof into Class A ordinary shares on a one-for-one basis. Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances.

|

|

Item 2(e).

|

CUSIP Number:

30712L 109

This CUSIP number applies to the American depositary shares of the Issuer, each representing 25 Class A ordinary shares of the Issuer. No CUSIP has been assigned to the Issuer’s Class A ordinary shares.

|

|

Item 3.

|

If this statement is filed pursuant to §§ 240.13d-1(b), or 240.13d-2(b) or (c), check whether the persons filing is a:

|

|

|

Not applicable

|

4

|

Reporting Person

|

|

Amount

beneficially

owned:

|

|

Percent

of class(1):

|

|

Percent of

aggregate

voting

power(2):

|

|

Sole power

to vote

or direct

the vote:

|

|

Shared

power

to vote or

to direct

the vote:

|

|

Sole power to

dispose or to

direct the

disposition

of:

|

|

Shared

power

to dispose or

to direct the

disposition of:

|

|

|

FANGDD DECENT INTERNATIONAL LTD.

|

|

102,102,318

|

|

5.1

|

%

|

1.3

|

%

|

102,102,318

|

|

0

|

|

102,102,318

|

|

0

|

|

|

Liqing Zeng

|

|

138,698,218

|

|

6.9

|

%

|

1.8

|

%

|

138,698,218

|

|

0

|

|

138,698,218

|

|

0

|

|

(1) The percentage of class of securities beneficially owned by each Reporting Person is based on a total of 1,996,169,104 ordinary shares (being the sum of 1,376,231,046 Class A ordinary shares and 619,938,058 Class B ordinary shares) of the Issuer as a single class as of March 31, 2020 as reported in the Issuer’s 20-F filing filed with the Securities and Exchange Commission on April 15, 2020. Class B ordinary shares are convertible at any time by the holder thereof into Class A ordinary shares on a one-for-one basis. Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances. The Class B ordinary shares are treated as converted into Class A ordinary shares only for the purpose of calculating the percentage ownership of the Reporting Persons.

(2) The percentage of voting power is calculated by dividing the voting power beneficially owned by each Reporting Person by the voting power of all of the Issuer’s Class A ordinary shares and Class B ordinary shares as a single class. Each Class A ordinary share is entitled to one vote and each Class B ordinary share is entitled to ten votes, on all matters submitted to them for vote.

|

Item 5.

|

Ownership of Five Percent or Less of a Class:

|

|

|

Not applicable

|

|

|

|

Item 6.

|

Ownership of More than Five Percent on Behalf of Another Person:

|

|

|

Not applicable

|

|

|

|

Item 7.

|

Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on By the Parent Holding Company or Controlling Person:

|

|

|

Not applicable

|

|

|

|

Item 8.

|

Identification and Classification of Members of the Group:

|

|

|

Not applicable

|

|

|

|

Item 9.

|

Notice of Dissolution of Group:

|

|

|

Not applicable

|

|

|

|

|

Item 10.

|

Certifications:

|

|

|

Not applicable

|

5

LIST OF EXHIBITS

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Joint Filing Agreement

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 5, 2021

|

|

FANGDD DECENT INTERNATIONAL LTD.

|

|

|

|

|

|

|

By:

|

/s/ Liqing Zeng

|

|

|

Name:

|

Liqing Zeng

|

|

|

Title:

|

Authorized Signatory

|

|

|

|

|

|

|

|

|

|

|

Liqing Zeng

|

|

|

|

|

|

|

/s/ Liqing Zeng

|

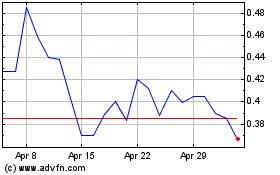

FangDD Network (NASDAQ:DUO)

Historical Stock Chart

From Mar 2024 to Apr 2024

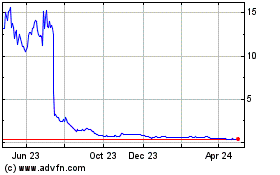

FangDD Network (NASDAQ:DUO)

Historical Stock Chart

From Apr 2023 to Apr 2024