Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

February 05 2021 - 10:01AM

Edgar (US Regulatory)

Filed pursuant to Rule 424(b)(3)

Registration No. 333-249831

PROSPECTUS SUPPLEMENT NO. 3

(to prospectus dated November 16, 2020)

Summit Midstream Partners, LP

2,306,972 Common Units

Representing Limited Partner Interests

This prospectus supplement is being filed to update and supplement information contained in the prospectus dated November 16, 2020 (the “prospectus”), relating to up to 2,306,972 common units representing limited partner interests in Summit Midstream Partners, LP (34,604,581 common units prior to the Partnership’s 1-for-15 reverse unit split on its common units, effective after the market closed on November 9, 2020) to be offered on a secondary basis by the selling unitholders named in the prospectus, with information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission on February 5, 2021, which is set forth below.

This prospectus supplement updates and supplements the information in the prospectus and is not complete without, and may not be delivered or utilized except in combination with, the prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the prospectus and if there is any inconsistency between the information in the prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Investing in our securities involves a high degree of risk. Limited partnerships are inherently different from corporations. You should review carefully the risk factors described under “Risk Factors” beginning on page 9 of the prospectus for a discussion of important risks you should consider before you make an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if the prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is February 5, 2021.

1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 1, 2021

Summit Midstream Partners, LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-35666

|

|

45-5200503

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

910 Louisiana Street, Suite 4200

Houston, TX 77002

(Address of principal executive office) (Zip Code)

(Registrants’ telephone number, including area code): (832) 413-4770

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Securities Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Units

|

SMLP

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

2

Item 1.01 Entry into a Material Definitive Agreement.

On February 1, 2021, Summit Permian Transmission, LLC (“Permian Transmission”), a wholly owned subsidiary of Summit Midstream Partners, LP (NYSE: SMLP) (the “Partnership”), entered into a commitment letter with three leading commercial banks pursuant to which the banks have committed to provide up to $175.0 million in credit and term loan facilities to finance the development of Permian Transmission’s Double E Pipeline Project. Pursuant to the commitment letter, the lenders have committed to provide senior secured credit facilities consisting of a $160.0 million delayed draw term loan facility and a $15.0 million working capital facility (collectively, the “Credit Facilities”). The Credit Facilities are expected to be non-recourse to the Partnership and mature seven years after the date of the initial borrowing. The commitments are subject to certain conditions, including execution of definitive documentation and other customary conditions for facilities of this type. Permian Transmission will pay customary fees and expenses in connection with obtaining the commitment letter and the related commitments. The Partnership expects to close and fund the Credit Facilities in the first quarter of 2021 and will post a $15.0 million letter of credit under its existing $1.1 billion revolving credit facility held by its wholly-owned subsidiary, Summit Midstream Holdings, LLC.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Summit Midstream Partners, LP

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

By:

|

Summit Midstream GP, LLC (its general partner)

|

|

|

|

|

|

Dated:

|

February 5, 2021

|

/s/ Marc D. Stratton

|

|

|

|

Marc D. Stratton, Executive Vice President and Chief Financial Officer

|

3

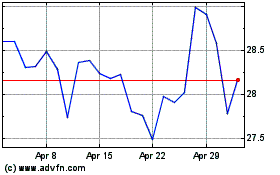

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

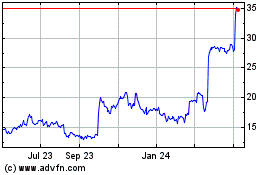

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Apr 2023 to Apr 2024