UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the six-month period ended September 30, 2020

CHINA

SXT PHARMACEUTICALS, INC.

(Translation

of registrant’s name into English)

178

Taidong Rd North, Taizhou

Jiangsu,

China

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual

report to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document

that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant

is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the

home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a

press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing

a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENT

This

Current Report contains forward-looking statements. All statements contained in this Current Report other than statements of historical

fact are forward-looking statements. The words “believe,” “may,” “will,” “estimate,”

“continue,” “anticipate,” “intend,” “expect,” “seek” and similar expressions

are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations

and projections about future events and trends that we believe may affect our financial condition, results of operations, business

strategy, short-term and long-term business operations and objectives, and financial needs.

These

forward-looking statements are subject to a number of risks, uncertainties and assumptions, including, but not limited to, the

following: the effects of the COVID-19 outbreak, including its impact on the demand for our products; the duration of the

COVID-19 outbreak and severity of such outbreak in regions where we operate; the pace of recovery following the COVID-19

outbreak; our ability to implement cost containment and business recovery strategies; the adverse effects of the COVID-19

outbreak on our business or the market price of our ordinary shares, the Company’s goals and strategies; the Company’s future

business development; product and service demand and acceptance; changes in technology; economic conditions; reputation and brand;

the impact of competition and pricing; government regulations; fluctuations in general economic and business conditions in China

and assumptions underlying or related to any of the foregoing and other risks contained in reports filed by the Company with the

Securities and Exchange Commission. In light of these risks, uncertainties and assumptions, the future events and trends discussed

in this Current Report may not occur and actual results could differ materially and adversely from those anticipated or implied

in the forward-looking statements.

You

should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the

forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking

statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Except as required

by applicable law, we undertake no duty to update any of these forward-looking statements after the date of this Current Report

or to conform these statements to actual results or revised expectations.

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The

following discussion and analysis of our results of operations and financial condition should be read together with our

unaudited condensed consolidated financial statements and the notes thereto and other financial information, which are

included elsewhere in this Form 6-K. Our unaudited financial statements have been prepared in accordance with U.S. generally

accepted accounting principles (“U.S. GAAP”). In addition, our unaudited financial statements and the financial

information included in this Form 6-K reflect our organizational transactions and have been prepared as if our current

corporate structure had been in place throughout the relevant periods.

This

section contains forward-looking statements. These forward-looking statements are subject to various factors, risks and uncertainties

that could cause actual results to differ materially from those reflected in these forward-looking statements. Further, as a result

of these factors, risks and uncertainties, the forward-looking events may not occur. Relevant factors, risks and uncertainties

include, but are not limited to, those discussed in the section entitled “Business,” “Risk Factors” and

elsewhere in this Form 6-K. Readers are cautioned not to place undue reliance on forward-looking statements, which reflect management’s

beliefs and opinions as of the date of this Form 6-K. We are not obligated to publicly update or revise any forward-looking statements,

whether as a result of new Information, future events or otherwise. See “Special Note Regarding Forward-Looking Statements.”

Key

Factors Affecting Our Results of Operation

Working

capital required to implement our business plan will most likely be provided by funds obtained through offerings of our equity,

debt, debt-linked securities, and/or equity-linked securities, and revenues generated by us. No assurance can be given that we

will have revenues sufficient to support and sustain our operations or that we would be able to obtain equity/debt financing in

the current economic environment. If we do not have sufficient working capital and are unable to generate sufficient revenues

or raise additional funds, we may delay the completion of or significantly reduce the scope of our current business plan; delay

some of our development and clinical or marketing efforts; postpone the hiring of new personnel; or, under certain dire financial

circumstances, substantially curtail or cease our operations.

Our

past operating results are not an accurate indication of the lines of business we are principally engaged in currently. Thus,

you should consider our future prospects in light of the risks and uncertainties experienced by early-stage companies in evolving

markets rather than typical companies of our age. Some of these risks and uncertainties relate to our ability to:

|

|

●

|

attract

additional customers and increased spending per customer;

|

|

|

●

|

increase

awareness of our brand and develop customer loyalty;

|

|

|

●

|

respond

to competitive market conditions;

|

|

|

●

|

respond

to changes in our regulatory environment;

|

|

|

●

|

manage

risks associated with intellectual property rights;

|

|

|

●

|

maintain

effective control of our costs and expenses;

|

|

|

●

|

raise

sufficient capital to sustain and expand our business;

|

|

|

●

|

attract,

retain and motivate qualified personnel; and

|

|

|

●

|

upgrade

our technology to support additional research and development of new products.

|

Results

of Operations for the Six Months Ended September 30, 2020 Compared to September 30, 2019

|

|

|

For the six months ended

September 30,

|

|

|

Change

|

|

|

|

|

2020

|

|

|

2019

|

|

|

Amount

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$

|

3,860,501

|

|

|

|

3,215,147

|

|

|

$

|

645,354

|

|

|

|

20

|

%

|

|

Cost of revenues

|

|

|

(1,039,565

|

)

|

|

|

(1,375,762

|

)

|

|

|

336,197

|

|

|

|

(24

|

%)

|

|

Gross profit

|

|

|

2,820,936

|

|

|

|

1,839,385

|

|

|

|

981,551

|

|

|

|

53

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses

|

|

|

(704,558

|

)

|

|

|

(774,253

|

)

|

|

|

69,695

|

|

|

|

(9

|

%)

|

|

General and administrative expenses

|

|

|

(952,568

|

)

|

|

|

(1,285,885

|

)

|

|

|

333,317

|

|

|

|

(26

|

%)

|

|

Total operating expenses

|

|

|

(1,657,126

|

)

|

|

|

(2,060,138

|

)

|

|

|

403,012

|

|

|

|

(20

|

%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) from operations

|

|

|

1,163,810

|

|

|

|

(220,753

|

)

|

|

|

1,384,563

|

|

|

|

>100

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

(442,079

|

)

|

|

|

(2,170,561

|

)

|

|

|

1,728,482

|

|

|

|

(80

|

%)

|

|

Other income, net

|

|

|

894,543

|

|

|

|

38,079

|

|

|

|

856,464

|

|

|

|

>100

|

%

|

|

Total other expenses

|

|

|

452,464

|

|

|

|

(2,132,482

|

)

|

|

|

2,584,946

|

|

|

|

(121

|

%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) before income taxes expense

|

|

|

1,616,274

|

|

|

|

(2,353,235

|

)

|

|

|

3,969,509

|

|

|

|

>100

|

%

|

|

Provision for income taxes

|

|

|

(235,016

|

)

|

|

|

5,166

|

|

|

|

(240,182

|

)

|

|

|

>100

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income

|

|

$

|

1,381,258

|

|

|

|

(2,348,069

|

)

|

|

$

|

3,729,327

|

|

|

|

>100

|

%

|

Revenues

We

generated revenues primarily from manufacture and sales of four types of traditional Chinese medicine pieces (the

“TCMP”) products: Advanced TCMP, Fine TCMP, Regular TCMP, and TCM Homologous Supplements (“TCMHS”)

products. TCMHS is a classification of health-supporting food used traditionally in China as TCM but are also consumed as

food, which has been developed and commercialized in April 2019. As compared with the six months ended September 30, 2020,

our total revenues increased by $645,354, or 20% for the six months ended September 30, 2020. The increase was primarily due

to the increase in sales of Advanced TCMP products and TCMHS products and partly offset by the decrease in the sales of Fine

TCMP products and Regular TCMP products.

The

following table sets forth the breakdown of revenues by categories for the six months ended September 30, 2020 and 2019 presented:

|

|

|

For the six months ended

September 30,

|

|

|

Change

|

|

|

|

|

2020

|

|

|

2019

|

|

|

Amount

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advanced TCMP

|

|

$

|

1,696,577

|

|

|

|

1,100,405

|

|

|

$

|

596,172

|

|

|

|

54

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fine TCMP

|

|

|

236,414

|

|

|

|

656,397

|

|

|

|

(419,983

|

)

|

|

|

(64

|

%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regular TCMP

|

|

|

818,627

|

|

|

|

1,297,974

|

|

|

|

(479,347

|

)

|

|

|

(37

|

%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TCMHS

|

|

|

1,108,883

|

|

|

|

160,371

|

|

|

|

948,512

|

|

|

|

>100

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenue

|

|

$

|

3,860,501

|

|

|

$

|

3,215,147

|

|

|

$

|

645,354

|

|

|

|

20

|

%

|

Advanced

TCMP

Advanced

TCMP is comprised of nine Directly Oral TCMP products (the “Directly-Oral-TCMP”) and nine After-soaking-oral TCMP

products (the “After-Soaking-Oral-TCMP”). Both Directly Oral TCMP and After-soaking-oral TCMP are new types of advanced

TCMP.

Revenue

from advanced TCMP accounted for 44% and 34% of revenue recognized during the six months ended September 30, 2020 and 2019, respectively.

As compared with the six months ended September 30, 2019, our revenue generated from advanced TCMP increased by $596,172, or 54%

for the six months ended September 30, 2020. The increase was primarily due to the company’s plan to shift from low margin

Regular TCMPs and to focus more on the business of high margin Fine and Advanced TCMPs.

Fine

TCMP

We

currently produce over 15 fine TCMP products for drug stores and hospitals. Our fine TCMP products are manufactured manually

from only high-quality authentic ingredients derived from their region of origin.

Revenue

from fine TCMP accounted for 6% and 20% of revenue recognized during the six months ended September 30, 2020 and 2019. As compared

with the six months ended September 30, 2019, our revenue from generated from fine TCMP decreased by $419,983, or 64% for the

six months ended September 30, 2020. The decrease was primarily attributable to the effect of COVID-19 outbreak in China on the

operation of pharmaceutical stores, which were the main sale channel for fine TCMP products.

Regular

TCMP

We

currently manufacture 430 regular TCMP products listed on China Pharmacopoeia (version 2015) Part I for hospitals and drug

store in treatment of various diseases or serving as dietary supplements.

Revenue

from regular TCMP accounted for 21% and 40% of revenue recognized during the six months ended September 30, 2020 and 2019, respectively.

Revenue from regular TCMP products decreased by $479,347, or 37%, to $818,627 for the six months ended September 30, 2020 from

$1,297,974 for the six months ended September 30, 2019. Decrease in revenue from Regular TCMP products is consistent with the

effect of the effect of COVID-19 outbreak in China and the company’s plan to shift from low margin Regular TCMPs and to

focus more on the business of high margin Fine and Advanced TCMPs.

TCMHS

Solid Beverages

Four

solid beverage products as part of the Company’s TCMHS products were developed and commercially launched in April 2019 and

generated a revenue of $1,108,883 and $160,371 for the six months ended September 30, 2019, respectively, representing an increase

of $948,512.

Gross

Profit

Cost

of revenues primarily include cost of materials, direct labors, overhead, and other related incidental expenses that are directly

attributable to the Company’s principal operations. Total cost of revenue decreased by $ 336,197, or 24%, to $1,039,565

for the six months ended September 30, 2020 from $1,375,762 for the six months ended September 30, 2019. The decrease of cost

of revenues was mainly due to the decrease of the sales of our products.

Gross

profit increased by $ 981,551, or 53%, to $2,820,936 for the six months ended September 30, 2020 from $1,839,385 for the six months

ended September 30, 2019. Gross margin was 73.1% for the six months ended September 30, 2020, compared to 57.2% for the six months

ended September 30, 2019. The increase in gross margin was mainly due to the increase of gross margin of TCMHS products and Regular

TCMP products and offset by the decrease of gross margin of Fine TCMP products.

Operating

income

Selling

expenses primarily consisted of sales staff payroll and welfare expenses, travelling expenses, advertisement expenses, distribution

expenses. Selling expenses decrease from $774,253 for the six months ended September 30, 2019 to $704,558 for the six months ended

September 30, 2020, representing a decrease of $69,695, or 9%.

General

and administrative expenses primarily consisted of staff payroll and welfare expenses, research and development expenses, entertainment

expenses, travelling expenses, depreciation and amortization expenses for administrative purposes, and office supply expenses.

General and administrative expenses decreased from $ 1,285,885 for the six months ended September 30, 2019 to $952,568 for the

six months ended September 30, 2020, representing a decrease of $333,317, or 26%.

The

decreases in selling expenses and general and administrative expenses were mainly due to the Company’s efforts in cost control.

Operating

income increased $1,384,563 from an operating loss of $220,753 for the six months ended September 30, 2019 to an operating income

of $1,163,810 for the six months ended September 30, 2020.

Income

before income taxes

Interest

income (expenses) for the six months ended September 30, 2020 mainly consists of accretion of finance cost and interest

expense of the issuance and forbearance of Convertible Notes issued on April 16, 2019. For the six months ended September

30, 2020, the company record amortization of issuance cost and debt discount of $184,587 and Convertible Notes interest

expense of $298,145.

Other income (expense) increased $2,584,946 from a loss of $2,132,482

for the six months ended September 30, 2019 to an income of $452,464 for the six months ended September 30, 2020.

Income before income taxes increased $3,969,509 from a loss

of $2,353,235 for the six months ended September 30, 2019 to an income of $1,616,274 for the six months ended September 30, 2020.

Net

income

Income

tax expense represented current and deferred income tax expenses derived from income before taxes generated by Jiangsu

Suxuantang Pharmaceutical Co., Ltd (“Suxuantang”), the variable interest entity of the Company. As compared with the six months ended September 30, 2019, the

income tax expense for the six months ended September 30, 2020 increased by $240,182. Income tax expense for the six months

ended September 30, 2020 consists of current income tax of $143,534 and deferred tax benefit of $91,482.

As a result of the foregoing, net income for the six months

ended September 30, 2020 was $1,381,258, representing an increase of $3,729,327 from net loss of $2,348,069 for the six months

ended September 30, 2019.

Liquidity

and Capital Resources

To date, we have financed our operations primarily through shareholder

capital contributions, shareholder loans, convertible notes, and cash flow from operations. As a result of our total activities,

we had cash and cash equivalents of $10,353,474 and $7,287,032 as of September 30, 2020 and March 31, 2020, respectively. We primarily

hold our excess unrestricted cash in short-term interest-bearing bank accounts at financial institutions. As of September 30, 2020,

we had current liabilities balance of $5,506,455, which the Company expects to repay within 1 year. With the current cash and cash

equivalents and anticipated cash flows from operating activities, we believe that our cash position is sufficient to meet our liquidity

needs for at least the next 12 months.

|

|

|

For the six months ended

September 30,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

|

|

|

|

|

|

|

|

Net Cash Used in Operating Activities

|

|

|

(333,508

|

)

|

|

|

(2,023,834

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net Cash Provided by (Used in) Investing Activities

|

|

|

2,738,048

|

|

|

|

(5,487,867

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net Cash Provided by Financing Activities

|

|

|

274,497

|

|

|

|

6,913,556

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of Exchange Rate Changes on Cash

|

|

|

387,405

|

|

|

|

(369,561

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net increase in cash, cash equivalents and restricted cash

|

|

|

3,066,442

|

|

|

|

(967,706

|

)

|

Cash

Flow in Operating Activities

For the six months ended September 30, 2020 net cash used in

operating activities was $333,508, as compared to net cash used operating activities of $2,023,834 for the six months ended September

30, 2019, representing an increase of $1,690,326. The increase in net cash provided by operating activities primarily resulted

from the change of following accounts:

|

|

a)

|

A net income for the six months ended September 30, 2020 of $1,381,258, compared with a net loss of $2,348,069 for the six months ended September 30, 2019.

|

|

|

b)

|

Change in Prepayments, receivables and other current assets was $263,108 net cash outflow for the six months ended September 30, 2020. For the six months ended September 30, 2019, change in Prepayments, receivables and other current assets was $1,140,076 net cash outflow, which led to $876,968 decrease in net cash outflow from operating activities.

|

And offset by the change of following accounts:

|

|

a)

|

Change in accounts receivable was $1,548,400 net cash outflow for the six months ended September 30, 2020. For the six months ended September 30, 2019, change in accounts receivable was $664,341 net cash outflow, which led to $884,059 increase in net cash outflow from operating activities.

|

|

|

b)

|

Change in accounts payable and accruals was $645,852 net cash outflow for the six months ended September 30, 2020. For the six months ended September 30, 2019, change in accounts payable and accruals was $389,515 net cash inflow, which led to $1,035,367 increase in net cash outflow from operating activities.

|

Cash

Flow in Investing Activities

We

had net cash provided by investing activities of $2,738,048, for the six months ended September 30, 2020, which primarily consisted

of purchase of property and equipment of $4,931, capital expenditure in construction in process of $114,286, and a collection

of receivables from Huangshan Panjie Investment Management Co., Ltd. of $2,857,265.

We

had net cash used in investing activities of $5,487,867, for the six months ended September 30, 2019, which primarily consisted

of purchase of property and equipment of $123,543, capital expenditure in construction in process of $250,178, loan receivable

from RH Holdings Management (HK) Limited of $1,500,000, and a receivable from Huangshan Panjie Investment Management Co., Ltd.

of $3,614,146.

Cash

Flow in Financing Activities

For the six months ended September 30,

2020, the net cash provided by financing activities was $274,497, which was primarily attributable to repayment of principal and

interest of Convertible Notes of $26,378, amounts received from related parties of $323,080 and payment of the bank borrowings

of $22,205.

For

the six months ended September 30, 2019, the net cash provided by financing activities was $6,913,556, which was primarily attributable

to net proceeds from the convertible notes of $8,358,950 (gross proceeds of $10,000,000 and debt issuance cost of $1,641,050),

repayment of principal and interest of Convertible Notes of $869,565, repayment of amounts due to related parties of $610,204,

and net proceeds from bank borrowings of $34,375.

The

Convertible Notes

PIPE

Transaction

On

April 16, 2019, the company entered into a Securities Purchase Agreement with certain unaffiliated institutional investors

relating to a private placement by the company of (1) Senior Convertible Notes (the “Convertible Notes”) in the

aggregate principal amount of $15 million, consisting of (i) a Series A Note in the principal amount of $ 10 million , and

(ii) a Series B Note in the principal amount of $ 5 million and (2) warrants (the “Warrants”) to purchase such

amount of shares of the company’s ordinary shares equal to 50% of the shares issuable upon conversion of the Notes,

exercisable for a period of five years at an initial exercise price of $8.38, for consideration consisting of (i) a cash

payment of $10,000,000, and (ii) a secured promissory note payable by the Investors to the Company in the principal amount of

$5 million. All amounts outstanding under the Notes were mature and due and payable on or before October 2,

2020.

Material

Terms of the Convertible Notes:

|

|

●

|

The

aggregate principal amount of the Series A Notes is $10,000,000 and the Series B Notes is $5,000,000. All of the aggregate principal

amount of the Series B Notes will constitute Restricted Principal. If an Investor prepays any amount under such Investor’s

Investor Note, an equal amount of the Restricted Principal becomes unrestricted principal under such Investor’s Series B

Note. The amount raised by the Company upon closing of the PIPE transaction was $10,000,000 from Series A Notes.

|

|

|

●

|

The

expiration date of Notes and warrant shall be October 2, 2020 and May 2, 2023 respectively. The aggregate redemption amount of

the Notes shall be redeemed in installments on or before the expiration date.

|

|

|

●

|

The

interest rate on the Convertible Notes is eight percent (8%) per annum. In the event of default, the Interest Rate shall be increased

to eighteen percent (18%) per annum.

|

|

|

●

|

The

initial fixed conversion price will be $8.38 per share, subject to reduction and adjustment for stock splits, stock dividends,

and similar events.

|

|

|

●

|

During

an Event of Default Redemption Right Period the Investor may convert all, or any part of, the Conversion Amount into Ordinary

Shares at the Alternate Conversion Price.

|

|

|

●

|

The

Alternate Conversion Price is the lowest of (i) the applicable Conversion Price as in effect on the applicable Conversion Date

of the applicable Alternate Conversion, (ii) 80% of the volume-weighted average price (“VWAP”) of the Ordinary Shares

as of the Trading Day immediately preceding the delivery or deemed delivery of the applicable Conversion Notice, (iii) 80% of

the VWAP of the Ordinary Shares as of the Trading Day of the delivery or deemed delivery of the applicable Conversion Notice and

(iv) 80% of the price computed as the quotient of (I) the sum of the VWAP of the Ordinary Shares for each of the three (3) Trading

Days with the lowest VWAP of the Ordinary Shares during the fifteen (15) consecutive Trading Day period ending and including the

Trading Day immediately preceding the delivery or deemed delivery of the applicable Conversion Notice, divided by (II) three (3)

(such period, the “Alternate Conversion Measuring Period”).

|

|

|

●

|

The

aggregate number of Series A and Series B warrant shares to be converted on expiration is 596,658 and 298,330 shares respectively.

|

Entry

into Forbearance Agreements in Connection with the Event of Default Redemption Notices

On

July 23 and 29, 2019, the company received from the investors an Event of Default Redemption Notice claimed that the company failed

to timely make the instalment payment and elected to effect the redemption of $14,318,462.62 comprising in aggregate the entire

principal amount, accrued and unpaid Interest. In addition, demand for the company to purchase the Series A Warrant issued for

the Event of Default Black Scholes Value of not less than $1,208,384.07 was made.

On

December 13, 2019, after negotiation with the Investors, the company entered into certain Forbearance and Amendment Agreements

with each Investor and agreed to redeem the Series A Notes for an aggregate redemption price of $10,939,410 in installments as

set forth in the Forbearance Agreement. Concurrently with the execution of the Forbearance Agreement, the Investors and the Company

have entered into the Lock-Up Agreements, Leak-Out Agreements and Mutual Releases.

Material

Terms of the Agreements

Upon

the execution of the Forbearance Agreements, the Investor shall net all Restricted Principal (as defined in Series B Note)

outstanding under the Series B Note against the amounts outstanding under the Investor Note, after which the Investor Note,

the Series B Note and the Series B Warrant shall no longer remain outstanding.

The

Investors agreed, among other things, to the following:

|

|

●

|

to

forbear from (i) taking any action to enforce their Redemption Notice with respect to certain existing defaults, and (ii) issuing

any new demand for redemption of the Series A Note on the basis of certain additional defaults that the aggregate daily dollar

trading volume of the Company’s ordinary shares does not exceed $1,500,000, and that the volume weighted average price of

the Company’s ordinary shares on any two trading days during the thirty trading day period immediately preceding such date

of determination fails to exceed $2.14;

|

|

|

●

|

not

to exercise the Series A Warrant during the Forbearance Period;

|

|

|

●

|

to

return the original share certificate representing the Pre-Delivered Shares to the Company for cancellation upon the Company’s

payment of the full Forbearance Redemption Amounts;

|

|

|

●

|

to

execute and deliver to the Company certain lock-up agreements with respect to the Pre-Delivered Shares, certain mutual release

and to execute and deliver to the Company the Leak-Out Agreement;

|

|

|

●

|

not

to make any hedge, swap or other agreement that transfers, in whole or in part, any of the economic consequences of ownership

of the Pre-Delivered Shares;

|

|

|

●

|

to

not sell, dispose or otherwise transfer, directly or any Ordinary Shares issued if such sale exceed 20% of the daily composite

trading volume of the Ordinary Shares.

|

In

consideration for the above, the Company agreed to the followings:

|

|

●

|

the

Company shall (I) pay to each Investor $500,000 on or prior to December 16, 2019, and (II) commencing on January 24th 2020, redeem

the Series A Notes for an aggregate redemption price of $10,939,410;

|

|

|

●

|

if

the Company fails to pay any New Installment Amount within 5 days of the applicable New Installment Date, the Investor may convert

the applicable New Installment Amount as an Alternate Conversion and the Leak-Out Agreement being disregarded for such conversions;

|

|

|

●

|

the

Company agreed to adjust the exercise price of the Series A Warrant from $8.38 to $2.50;

|

|

|

●

|

the

Company shall cause all restrictive legends on the Pre-Delivered Shares to be removed and delivery of un-legended Pre-Delivery

Shares into the Investor’s custodian’s account pursuant to the DWAC instructions set forth therein.

|

According to the Forbearance Agreements, the Company issued

and delivered 4,000,000 un-legended Pre-Delivery Shares into the investor’s custodian’s account as collateral in December

2019. The Company has made full payment of the forbearance redemption amounts in accordance with the Forbearance Agreements to

the investors. Upon full payment, each investor returned 2,000,000 Ordinary Shares to the Company, which served as security for

the Company’s obligations owed to the investors. To date, the Convertible Notes were fully converted to the Company’s

shares, and the Company has cancelled the 4,000,000 Ordinary Shares by November 2, 2020.

Please

refer to Note 11 of our Condensed Consolidated Financial Statements included in this Form 6-K for details of accounting of

the Convertible Notes.

Off-Balance

Sheet Arrangements

On

April 23, 2019, the Company entered into a financial guarantee agreement with Jiangsu Changjiang Commercial Bank to be the guarantor

of Taizhou Jiutian Pharmaceutical Co. Ltd.’s bank borrowing of $441,852 (equivalent of RMB 3,000,000) for one-year period.

On May 8, 2019 the Company entered a financial guarantee agreement with Bank of Nanjing to be the guarantor of Taizhou Jiutian

Pharmaceutical Co. Ltd.’s borrowing of $515,494 (equivalent of RMB 3,500,000) for a one-year period. The Company is obliged

to pay on behalf the related party the principal, interest, penalty and other expenses if Taizhou Jiutian Pharmaceutical Co. Ltd.

defaults in payment. The Company did not charge financial guarantee fees over Taizhou Jiutian Pharmaceutical Co. Ltd.

On

April 23, 2020, the Company signed a financial guarantee agreement with Jiangsu Changjiang Commercial Bank for Taizhou Jiutian

Pharmaceutical Co. Ltd. in borrowing of $427,124 (equivalent of RMB 2,900,000) for one-year period. On May 18, 2020 the Company

signed a financial guarantee agreement with Bank of Nanjing for Taizhou Jiutian Pharmaceutical Co. Ltd. in borrowing of $500,766

(equivalent of RMB 3,400,000) for a one-year period. The Company is obliged to pay on behalf the related party the principal,

interest, penalty and other expenses if Taizhou Jiutian Pharmaceutical Co. Ltd. defaults in payment.

The

Company had the following operating lease commitment as of September 30, 2020:

|

Office Rental

|

|

For the year ended

September 30,

|

|

|

2021

|

|

$

|

73,701

|

|

|

2022

|

|

|

73,701

|

|

|

2023

|

|

|

73,701

|

|

|

2024

|

|

|

73,701

|

|

|

2025

|

|

|

73,701

|

|

|

Thereafter

|

|

|

165,827

|

|

|

Total

|

|

$

|

534,332

|

|

Except

for the guarantee and commitment listed above, the Company does not have any other off-balance sheet arrangements that have or

are reasonably likely to have a current or future effect on its financial condition, revenues or expenses, results of operations,

liquidity, capital expenditures or capital resources that are material to investors.

Inflation

We

do not believe our business and operations have been materially affected by inflation.

Related

Parties and Material Related Party Transactions

Please

refer to Note 15 of our Condensed Consolidated Financial Statements included in this Form 6-K for details of related parties

and material related party transactions.

Critical

Accounting Policies

Please

refer to Note 2 of our Condensed Consolidated Financial Statements included in Form 6-K or details of our critical accounting

policies.

Recent

Development

Private Placement

On November 24, 2020, China SXT Pharmaceuticals,

Inc. (the “Company”) entered into certain securities purchase agreement (the “SPA”) with

Xing Yuan, a non-affiliate non-U.S. person (the “Investor”), pursuant to which Mr. Yuan agreed to purchase

12,000,000 ordinary shares (the “Shares”) of the Company, par value $0.001 per share (the “Ordinary

Shares”) at a per share purchase price of $0.60. The gross proceeds of this transaction are $7,200,000.

On

the same date, Mr. Yuan also entered into certain voting agreement (the “Voting Agreement”) with Mr. Feng Zhou,

who beneficially owns 8,500,000 Ordinary Shares, representing approximately 13.68% of the total voting power as of the date of

this report. According to the Voting Agreement, Mr. Yuan irrevocably grants a power of attorney to, and entrust Mr. Zhou, for

the maximum period of time permitted by law, with all of Mr. Yuan’s voting rights as a shareholder of the Company, including

without limitation, in connection with the election of directors and approval of all corporate transactions which requires the

approval of the Company’s shareholders.

In

connection with this private placement and the recent resignation of the board member, Mr. Tulin Lu, the board of directors of

the Company appointed Mr. Yuan as a director to fill in the vacancy created by the resignation of Mr. Lu effective upon closing

of the offering contemplated by the SPA, provided that, Mr. Yuan will cease to be a member of the board once he holds less than

1,200,000 Ordinary Shares.

As of date of this report, this private placement has not been

closed as the Investor has not delivered the purchase price yet.

Settlement Agreement with the Placement

Agent

By November 2, 2020, the Series A Notes

issued on May 2, 2019 in connection with the private placement have been fully converted. FT Global Capital, Inc. (“FT Global”),

the placement agent for such private placement demanded that additional warrant should be issued to Mr. Jian Ke, the president

of FT Global according to certain placement agency agreement entered by and between the Company and it on May 2, 2019. After friendly

negotiation, the Company and FT Global agreed to settle this claim and signed certain settlement agreement on January 18, 2021.

Pursuant to such settlement agreement, the Company issued a new warrant to Mr. Ke for purchase of 1,000,000 Ordinary Shares on

the same terms and conditions as the warrants issued to Mr. Ke on May 2, 2019.

The forms of the settlement agreement and

the new warrant are filed as Exhibits 4.1 and 4.2 to this Current Report on Form 6-K and such documents are incorporated herein

by reference. The foregoing is only a brief description of the material terms of the settlement agreement and the warrant,

and does not purport to be a complete description of the rights and obligations of the parties thereunder and is qualified in its

entirety by reference to such exhibits.

Financial

Statements and Exhibits.

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

CHINA

SXT PHARMACEUTICAL, INC.

|

|

|

|

|

|

|

By:

|

/s/ Feng Zhou

|

|

|

|

Feng

Zhou

|

|

|

|

Chief

Executive Officer

|

Date:

January 28, 2021

12

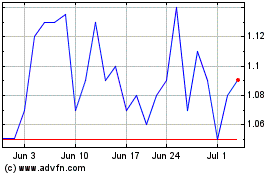

China SXT Pharmaceuticals (NASDAQ:SXTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

China SXT Pharmaceuticals (NASDAQ:SXTC)

Historical Stock Chart

From Apr 2023 to Apr 2024