Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-239419

|

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated July 2, 2020)

|

|

|

|

|

DIGITAL

ALLY, INC.

3,250,000 Shares of Common

Stock

Prefunded

Common Stock Purchase Warrants to purchase up to 11,050,000 Shares of Common Stock

Common

Stock Purchase Warrants to purchase up to 14,300,000 Shares of Common Stock

Digital Ally, Inc. (the “Company”,

“our”, “we” and “us”) is offering 3,250,000 shares of our common stock (“Shares”),

par value $0.001 per share (“Common Stock”), and common stock purchase warrants to purchase up to an aggregate of

14,300,000 shares of Common Stock (the “Warrants”) (and the shares of Common Stock that are issuable from time

to time upon exercise of the Warrants (the “Warrant Shares”)). We are also offering to purchasers whose purchase of

shares of Common Stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related

parties, beneficially owning more than 4.99% (or, at the election of the holder, 9.99%) of our outstanding shares of Common Stock

immediately following the consummation of this offering, prefunded common stock purchase warrants to purchase up to 11,050,000

shares of Common Stock (the “Pre-Funded Warrants”), in lieu of shares of Common Stock.

The purchase price of each Pre-Funded Warrant

will equal the price per share at which the Shares are being sold to the public in this offering, minus $0.01, and the exercise

price of each Pre-Funded Warrant will be $0.01 per share. Each Pre-Funded Warrant is exercisable for one (1) share of Common Stock.

The Pre-Funded Warrants will be immediately exercisable and may be exercised at any time until all of the Pre-Funded Warrants

are exercised in full. This prospectus supplement also relates to the Warrant Shares and the shares of Common Stock issuable

upon exercise of any Pre-Funded Warrants sold in this offering (the “Pre-Funded Warrant Shares”). Each share of Common

Stock and Pre-Funded Warrant is being sold together with a Warrant to purchase one (1) share of our Common Stock, at an exercise

price of $3.25 per share. The Warrants will be exercisable immediately and will expire five (5) years from the date of issuance.

The shares of Common Stock or Pre-Funded Warrants, and the accompanying Warrants, can only be purchased together in this offering

but will be issued separately and will be immediately separable upon issuance.

We will sell to the investors in this offering

(i) the shares of Common Stock and accompanying Warrants at a combined public offering price of $2.80 per share of Common

Stock and accompanying Warrant and (ii) the Pre-Funded Warrants and accompanying Warrants at a combined public offering price

of $2.79 per Pre-Funded Warrant and accompanying Warrant. We will pay all of the expenses incident to the registration,

offering and sale of such securities under this prospectus supplement and the accompanying base prospectus.

|

|

|

Per

Share and

Accompanying

Warrant

|

|

|

Per

Pre-

Funded

Warrant and

Accompanying

Warrant

|

|

|

Total(1)

|

|

|

Combined public offering

price(2)

|

|

$

|

2.80

|

|

|

$

|

2.79

|

|

|

$

|

39,929,500

|

|

|

Placement agent discounts and commissions(3)

|

|

$

|

0.168

|

|

|

$

|

0.1674

|

|

|

$

|

2,395,770

|

|

|

Proceeds, before expenses, to us

|

|

$

|

2.632

|

|

|

$

|

2.6226

|

|

|

$

|

37,533,730

|

|

|

|

(1)

|

Total

excludes exercise of the Pre-Funded Warrants. Upon exercise of the Pre-Funded Warrants,

gross proceeds received would equal $40,040,000.

|

|

|

|

|

|

|

(2)

|

The

public offering price is $2.799 per share of Common Stock and $0.001 per accompanying Warrant and $2.789 per

Pre-Funded Warrant and $0.001 per accompanying Warrant.

|

|

|

|

|

|

|

(3)

|

The

placement agent will receive a placement agent discount equal to 6.0% of the gross proceeds in this offering. In addition,

we have agreed to reimburse the placement agent for certain expenses. See the section entitled “Plan of Distribution”

beginning on page S-29 of this prospectus supplement for a description of the compensation payable to the placement agent.

|

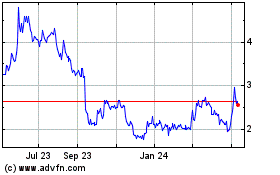

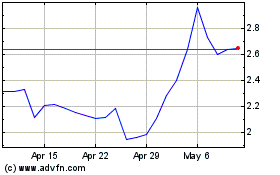

Our

Common Stock is listed on The Nasdaq Capital Market (“Nasdaq”) under the symbol “DGLY.” The last reported

sale price for our Common Stock on Nasdaq on January 26, 2021 was $2.75 per share. There

is no established trading market for the Warrants or the Pre-Funded Warrants, and we do not expect a market to develop. In addition,

we do not intend to apply for the listing of the Warrants or the Pre-Funded Warrants on any national securities exchange or other

trading market. Without an active trading market, the liquidity of the Warrants and the Pre-Funded Warrants will be limited.

As

of the date of this prospectus supplement, we are not subject to the sale limitations described in General Instruction I.B.6 to

Form S-3 because the “public float” (the market value of our Common Stock held by non-affiliates) was greater than

$75,0000,000 on the date on which the accompanying base prospectus forming a part of the registration statement of which this

prospectus supplement and such base prospectus form a part. In the event that any time during the effectiveness of the registration

statement of which this prospectus supplement and accompanying base prospectus forms a part, we become subject to such sale limitations,

as a result of the public float becoming less that $75,000,000 during any applicable 12-month period, we will not sell securities

in a public primary offering with a value exceeding more than one-third of our public float.

You

should read carefully this prospectus supplement, the accompanying base prospectus and the documents incorporated by reference

into this prospectus supplement and the accompanying base prospectus before you invest.

Our

business and an investment in our shares of Common Stock involve a high degree of risk. See “Risk Factors” beginning

on page S-12 of this prospectus supplement, on page 11 of the accompanying base prospectus and the risk factors described in the

documents incorporated by reference into this prospectus supplement and the accompanying base prospectus for more information.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus supplement and accompanying base prospectus is truthful or complete. Any representation to the contrary

is a criminal offense.

The

Company expects to deliver the shares of Common Stock, the Pre-Funded Warrants and the Warrants to the purchasers on or about

February 1, 2021.

Sole

Placement Agent

KINGSWOOD

CAPITAL MARKETS

division

of Benchmark Investments, Inc.

The

date of this Prospectus Supplement is January 27, 2021

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is in two parts, this prospectus supplement and the accompanying base prospectus, both of which are part of a registration

statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”) using a “shelf”

registration process.

The

two parts of this document include: (1) this prospectus supplement, which describes the specific details regarding this offering

of securities; and (2) the accompanying base prospectus, which provides a general description of the securities that we

may offer, some of which may not apply to this offering. Generally, when we refer to this “prospectus,” we are referring

to both documents combined. If information in this prospectus supplement is inconsistent with the accompanying base prospectus,

you should rely on this prospectus supplement. You should read this prospectus supplement together with the additional information

described below under the heading “Where You Can Find More Information” and “Incorporation of Documents by Reference.”

Any

statement made in this prospectus supplement or in a document incorporated or deemed to be incorporated by reference into this

prospectus supplement will be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that

a statement contained in this prospectus supplement or in any other subsequently filed document that is also incorporated by reference

into this prospectus supplement modifies or supersedes that statement. Any statements so modified or superseded will be deemed

not to constitute a part of this prospectus supplement except as so modified or superseded. In addition, to the extent of any

inconsistencies between the statements in this prospectus supplement and similar statements in any previously filed report incorporated

by reference into this prospectus supplement, the statements in this prospectus supplement will be deemed to modify and supersede

such prior statements.

The

registration statement that contains this prospectus supplement, including the exhibits to the registration statement and the

information incorporated by reference, contains additional information about the securities offered under this prospectus supplement.

That registration statement can be read on the SEC website or at the SEC offices mentioned below under the heading “Where

You Can Find More Information.”

We

are responsible for the information contained and incorporated by reference in this prospectus supplement, the accompanying base

prospectus and any related free writing prospectus that we prepare or authorize. We have not authorized anyone to provide you

with different or additional information, and we take no responsibility for any other information that others may give you. If

you receive any other information, you should not rely on it.

This

prospectus supplement and the accompanying base prospectus do not constitute an offer to sell or the solicitation of an offer

to buy any securities other than the registered securities to which this prospectus supplement relates, nor do this prospectus

supplement and the accompanying base prospectus constitute an offer to sell or the solicitation of an offer to buy securities

in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

You

should not assume that the information in this prospectus supplement and the accompanying base prospectus is accurate at any date

other than the date indicated on the cover page of this prospectus supplement or that any information we have incorporated by

reference is correct on any date subsequent to the date of the document incorporated by reference. Our business, financial condition,

results of operations or prospects may have changed since that date.

You

should not rely on or assume the accuracy of any representation or warranty in any agreement that we have filed in connection

with this offering or that we may otherwise publicly file in the future because any such representation or warranty may be subject

to exceptions and qualifications contained in separate disclosure schedules, may represent the parties’ risk allocation

in the particular transaction, may be qualified by materiality standards that differ from what may be viewed as material for securities

law purposes or may no longer continue to be true as of any given date.

We

are not offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted.

We have not done anything that would permit this offering or possession or distribution of this prospectus supplement and accompanying

base prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside

the United States who come into possession of this prospectus supplement and accompanying base prospectus must inform themselves

about, and observe any restrictions relating to, the offering of the securities as to distribution of the prospectus supplement

and accompanying base prospectus outside of the United States.

Solely

for convenience, our trademarks and tradenames referred to in this prospectus supplement, including the information in the accompanying

base prospectus and the documents incorporated by reference herein and therein, may appear without the ® or ™ symbols,

but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law,

our rights to these trademarks and tradenames.

Information

contained in, and that can be accessed through our website, www.digitalallyinc.com, does not constitute part of this prospectus

supplement, including the information in the accompanying base prospectus and the documents incorporated by reference herein and

therein.

This

prospectus supplement, including the information in the accompanying base prospectus and the documents incorporated by reference

herein and therein, includes market and industry data that has been obtained from third party sources, including industry publications,

as well as industry data prepared by our management on the basis of its knowledge of and experience in the industries in which

we operate (including our management’s estimates and assumptions relating to such industries based on that knowledge). Management’s

knowledge of such industries has been developed through its experience and participation in these industries. While our management

believes the third-party sources referred to in this prospectus supplement, the accompanying base prospectus and such other documents

are reliable, neither we nor our management have independently verified any of the data from such sources referred to in this

prospectus supplement, the accompanying base prospectus and such other documents or ascertained the underlying economic assumptions

relied upon by such sources. Internally prepared and third-party market forecasts, in particular, are estimates only and may be

inaccurate, especially over long periods of time. Furthermore, references in this prospectus supplement, the accompanying base

prospectus and such other documents to any publications, reports, surveys or articles prepared by third parties should not be

construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such

publication, report, survey or article is not incorporated by reference in this prospectus supplement, the accompanying base prospectus

and such other documents.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights certain information about us, this offering and selected information contained or incorporated by reference

in this prospectus supplement and the accompanying base prospectus. This summary is not complete and does not contain all the

information that you should consider before deciding whether to invest in our securities. For a more complete understanding of

Digital Ally, Inc. and this offering, we encourage you to read and consider carefully this entire prospectus supplement, including

the information the accompanying base prospectus and the documents incorporated by reference herein and therein, as well as any

free writing prospectus that we have authorized for use in connection with this offering, including the information set forth

in the section titled “Risk Factors” in this prospectus supplement beginning on page S-12. Unless the context provides

otherwise, all references herein to “Digital Ally”, “the “Company”, “we”, “our”

and “us” refer to Digital Ally, Inc.

Company

Overview

We

produce digital video imaging, storage products and disinfectant and related safety products for use in law enforcement, security

and commercial applications. Our products include, among others: in-car digital video/audio recorders contained in a rear-view

mirror for use in law enforcement and commercial fleets; a system that provides our law enforcement customers with audio/video

surveillance from multiple vantage points and hands-free automatic activation of body-worn cameras and in-car video systems; a

miniature digital video system designed to be worn on an individual’s body; and cloud storage solutions. We have recently

added two new lines of branded products: (1) the ThermoVu™ line, which is a line of self-contained temperature monitoring

stations that provides alerts and controls facility access when an individual’s temperature exceeds a pre-set threshold

and (2) the Shield™ disinfectant and cleanser line, which is for use against viruses and bacteria and which we began offering

to our law enforcement and commercials customers beginning late in the second quarter of 2020. Both product lines are manufactured

by third parties. In addition, we have active research and development programs to adapt our technologies to other applications.

We can integrate electronic, radio, computer, mechanical, and multi-media technologies to create unique solutions to address needs

in a variety of other industries and markets, including mass transit, school bus, taxicab and the military. We sell our products

to law enforcement agencies, private security customers and organizations, and consumer and commercial fleet operators through

direct sales domestically and third-party distributors internationally.

COVID-19

Pandemic

The

consolidated financial statements incorporated by reference into this prospectus supplement and accompanying base prospectus as

well as the description of our business contained herein, unless otherwise indicated, principally reflect the status of our business

and the results of our operations as of September 30, 2020. Since that date, economies throughout the world have continued to

be severely disrupted by the effects of the quarantines, business closures and the reluctance of individuals to leave their homes

as a result of the outbreak of the coronavirus (“COVID-19”). Although we remain open as an “essential business,”

our supply chain has been disrupted and our customers, in particular our commercial customers, have been significantly impacted

which has, in turn, reduced our level of operations and activities. In addition, the capital markets have been disrupted and our

efforts to raise necessary capital will likely be adversely impacted by the outbreak of the virus and we cannot forecast with

any certainty when the disruptions caused by it will cease to impact our business and the results of our operations. In reading

this prospectus supplement and accompanying base prospectus forming a part of this registration statement, including the related

exhibits, the information incorporated by reference herein and therein and our discussion of our ability to continue as a going

concern set forth in our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2020, filed with the SEC on

November 12, 2020, and in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed with the SEC on April

6, 2020 (the “Form 10-K”), and amended in our Annual Report on Form 10-K/A, filed with the SEC on April 29, 2020,

including the notes to the consolidated financial statements contained therein, in each case, consider the additional uncertainties

caused by the outbreak of COVID-19.

Our

Products

We

supply technology-based products utilizing our portable digital video and audio recording capabilities for the law enforcement

and security industries and for the commercial fleet and mass transit markets. We have the ability to integrate electronic, radio,

computer, mechanical, and multi-media technologies to create positive solutions to our customers’ requests. Our products

include: the DVM-800 and DVM-800 Lite, in-car digital video mirror systems for law enforcement; the FirstVU and the FirstVU HD,

body-worn cameras, our patented and revolutionary VuLink product, which integrates our body-worn cameras with our in-car systems

by providing hands-free automatic activation for both law enforcement and commercial markets; the DVM-250 and DVM-250 Plus, a

commercial line of digital video mirrors that serve as “event recorders” for the commercial fleet and mass transit

markets; and FleetVU and VuLink, our cloud-based evidence management systems. We introduced the EVO-HD product in the second quarter

of 2019 and began full-scale deliveries in the third quarter of 2019. The EVO-HD is designed and built on a new and highly advanced

technology platform that we expect to become the platform for a new family of in-car video solution products for the law enforcement

and commercial markets. We believe that the launch of these new products will help to reinvigorate our in-car and body-worn systems

revenues while diversifying and broadening the market for our product offerings. Recently, we launched a new line of branded disinfectant

and related safety products, which will be marketed to our law enforcement and commercial customers. The following describes our

product portfolio:

In-Car

Digital Video Mirror System for Law Enforcement – EVO-HD, DVM-800 and DVM-800 Lite

In-car

video systems for patrol cars are now a necessity and have generally become standard. Current systems are primarily digital based

systems with cameras mounted on the windshield and the recording device generally in the trunk, headliner, dashboard, console

or under the seat of the vehicle. Most manufacturers have already developed and transitioned completely to digital video, and

some have offered full high definition (“HD”) level recordings which is currently state-of-art for the industry.

Our

digital video rear-view mirror unit is a self-contained video recorder, microphone and digital storage system that is integrated

into a rear-view mirror, with a monitor, global positioning system (“GPS”) and 900 megahertz (“MHz”) audio

transceiver. Our system is more compact and unobtrusive than certain of our competitors because it requires no recording equipment

to be located in other parts of the vehicle.

Our

in-car digital video rear-view mirror has the following features:

|

|

●

|

wide

angle zoom color camera;

|

|

|

|

|

|

|

●

|

standards-based

video and audio compression and recording;

|

|

|

|

|

|

|

●

|

system

is concealed in the rear-view mirror, replacing factory rear-view mirror;

|

|

|

|

|

|

|

●

|

monitor

in rear-view mirror is invisible when not activated;

|

|

|

|

|

|

|

●

|

easily

installs in any vehicle;

|

|

|

|

|

|

|

●

|

ability

to integrate with body-worn cameras including auto-activation of either system;

|

|

|

|

|

|

|

●

|

archives

audio/video data to the cloud, computers (wirelessly) and to compact flash memory, or file servers;

|

|

|

|

|

|

|

●

|

900

MHz audio transceiver with automatic activation;

|

|

|

|

|

|

|

●

|

marks

exact location of incident with integrated GPS;

|

|

|

|

|

|

|

●

|

playback

using Windows Media Player;

|

|

|

|

|

|

|

●

|

optional

wireless download of stored video evidence;

|

|

|

|

|

|

|

●

|

proprietary

software protects the chain of custody; and

|

|

|

|

|

|

|

●

|

records

to rugged and durable solid-state memory.

|

We

have completed development of a new in-car digital video platform under the name EVO-HD which it launched during the second quarter

of 2019. The EVO-HD is a next generation system that offers a multiple HD in-car camera solution system with built-in patented

VuLink auto-activation technology. The EVO-HD is built on an entirely new and highly advanced technology platform that enables

many new and revolutionary features, including auto activation beyond the car and body camera. No other provider can offer built-in

patented VuLink auto-activation technology.

The

EVO-HD provides law enforcement officers with an easier to use, faster and more advanced system for capturing video evidence and

uploading than similar products sold by the Company’s competitors. Additional features include:

|

|

●

|

a

remote cloud trigger feature that allows dispatchers to remotely start recordings;

|

|

|

|

|

|

|

●

|

simultaneous

audio/video play back;

|

|

|

|

|

|

|

●

|

cloud

connectivity via cell modem, including the planned deployment of the new 5G network;

|

|

|

|

|

|

|

●

|

near

real-time mapping and system health monitoring;

|

|

|

|

|

|

|

●

|

body-camera

connectivity with built-in auto activation technology; and

|

|

|

|

|

|

|

●

|

128

gigabyte internal storage, up to 2 terabyte external solid-state drive storage.

|

The

EVO-HD is designed and built on a new and highly advanced technology platform that will become the platform for a whole new family

of in-car video solution products for the law enforcement. The innovative EVO-HD technology replaces the current in-car mirror-based

systems with a miniaturized system that can be custom-mounted in the vehicle while offering numerous hardware configurations to

meet the varied needs and requirements of its law enforcement customers. The EVO-HD can support up to four HD cameras, with two

cameras having pre-event and evidence capture assurance (“ECA”) capabilities to allow agencies to review entire shifts.

An internal cell modem will allow for connectivity to the VuVault.net cloud, powered by Amazon Web Services (“AWS”)

and real time metadata when in the field.

In-Car

Digital Video “Event Recorder” System – DVM-250 Plus for Commercial Fleets

Digital

Ally provides commercial fleets and commercial fleet managers with the digital video tools that they need to increase driver safety

and track assets in real-time and minimize the company’s

liability risk, all while enabling fleet managers to operate the fleet at an optimal level. We market a product designed to address

these commercial fleet markets with our DVM-250 Plus event recorders that provide all types of commercial fleets with features

and capabilities which are fully-customizable, consistent with their specific application and inherent risks. The DVM-250 Plus

is a rear-view mirror based digital audio and video recording system with many, but not all of, the features of our

DVM-800 law enforcement mirror systems, which we sell at a lower price point. The DVM-250 Plus is designed to capture “events,” such

as wrecks and erratic driving or other abnormal occurrences, for evidentiary or training purposes. The commercial fleet markets

may find our units attractive from both a feature and a cost perspective compared to other providers. We believe that due to our

marketing efforts, commercial fleets are adopting this technology, in particular the ambulance and taxi-cab markets. During

the first quarter of 2021, the Company intends to launch the DVM-250 FLT, which is the basic DVM-250 with a monitor that can be

located outside of the rear-view mirror. The DVM-250 FLT is expected to be attractive to customers in the over-the-road trucking

and similar industries that typically do not have rear view mirrors.

Digital

Ally offers a suite of data management web-based tools to assist fleet managers in the organization, archival, and management

of videos and telematics information. Within the suite, there are powerful mapping and reporting tools that are intended to optimize

efficiency, serve as excellent training tools for teams on safety and ultimately generate a significant return on investment for

the organization.

The

EVO-HD described above will also become the platform for a whole new family of in-car video solution products for the commercial

markets. The innovative EVO-HD technology will replace the current in-car mirror-based systems with a miniaturized system that

can be custom-mounted in the vehicle while offering numerous hardware configurations to meet the varied needs and requirements

of its commercial customers. In its commercial market application, the EVO-HD can support up to four HD cameras, with two cameras

having pre-event and ECA capabilities to allow customers to review entire shifts. An internal cell modem will allow for connectivity

to the FleetVU Manager cloud-based system for commercial fleet tracking and monitoring, powered by AWS and real time metadata

when in the field.

Miniature

Body-Worn Digital Video System – FirstVU HD for Law Enforcement and Private Security

This

system is also a derivative of our in-car video systems, but is much smaller and lighter and more rugged and water-resistant to

handle a hostile outdoor environment. These systems can be used in many applications in addition to law enforcement and private

security and are designed specifically to be clipped to an individual’s pocket or other outer clothing. The unit is self-contained

and requires no external battery or storage devices. Current systems offered by competitors are digital based, but generally require

a battery pack and/or storage device to be connected to the camera by wire or other means. We believe that our FirstVU HD product

is more desirable for potential users than our competitors’ offerings because of its video quality, small size, shape and

lightweight characteristics. Our FirstVU HD integrates with our in-car video systems through our patented VuLink system

allowing for automatic activation of both systems.

Auto-activation

and Interconnectivity Between In-Car Video Systems and FirstVU HD Body Worn Camera Products – VuLink for Law Enforcement

Applications

Recognizing

a critical limitation in law enforcement camera technology, we pioneered the development of our VuLink ecosystem that provides

intuitive auto-activation functionality as well as coordination between multiple recording devices. The United States Patent and

Trademark Office (the “USPTO”) has recognized these pioneering efforts by granting us multiple patents with claims

covering numerous features, such as automatically activating an officer’s cameras when the light bar is activated or when

a data-recording device such as a smart weapon is activated. Additionally, the awarded patent claims cover automatic coordination

between multiple recording devices. Prior to this work, officers were forced to manually activate each device while responding

to emergency scenarios, a requirement that both decreased the usefulness of the existing camera systems and diverted officers’

attention during critical moments. Our FirstVU HD integrates with our in-car video systems through our patented VuLink system

allowing for automatic activation of both systems.

This

feature is becoming a standard feature required by many law agencies. Unfortunately, certain of our competitors have chosen to

infringe our patent and develop products that provide the same or similar features as our VuLink system. We filed lawsuits against

two competitors – Axon Enterprises, Inc. (“Axon,” formerly known as Taser International, Inc.) and Enforcement

Video, LLC d/b/a WatchGuard Video (“WatchGuard”) – which challenge Axon’s and WatchGuard’s infringing

products. On May 13, 2019, WatchGuard and the Company resolved the dispute and executed a settlement agreement in the form of

a Release and License Agreement. The litigation has been dismissed as a result of this settlement.

Axon

– On June 17, 2019, the U.S. District Court for the District of Kansas (the “U.S. District Court”)

granted Axon’s motion for summary judgment that Axon did not infringe on the Company’s patent and dismissed the case.

Importantly, the U.S. District Court’s ruling did not find that the Company’s ‘452 Patent was invalid. It also

did not address any other issue, such as whether the Company’s requested damages were appropriate, and it does not impact

the Company’s ability to file additional lawsuits to hold other competitors accountable for patent infringement. This ruling

solely related to an interpretation of the Company’s claims as they relate to Axon and was unrelated to the supplemental

briefing the Company filed on its damages claim and the WatchGuard settlement. Those issues are separate and the U.S. District

Court’s ruling on the motion for summary judgment had nothing to do with the Company’s damages request.

We

filed an opening appeal brief on August 26, 2019 with the U.S. Court of Appeals for the Tenth Circuit (the “Court of Appeals”),

appealing the U.S. District Court’s granting of Axon’s motion for summary judgment. Axon responded by filing a responsive

brief on November 6, 2019 and we then filed a reply brief responding to Axon on November 27, 2019. The Court of Appeals scheduled

oral arguments on our appeal of the U.S. District Court’s summary judgment ruling on April 6, 2020. This appeal was intended

to address the Company’s position that the U.S. District Court incorrectly dismissed our claims against Axon. If the Court

of Appeals overturns the ruling of the U.S. District Court, the case will be remanded to the U.S District Court before a new judge.

On March 12, 2020, the panel of judges for the Court of Appeals issued an order cancelling the oral arguments previously set for

April 6, 2020, having determined that the appeal will be decided solely based on the parties’ briefs. On April 22, 2020,

a three-judge panel of the United States Court of Appeals denied our appeal and affirmed the District Court’s previous decision

to grant Axon summary judgment. On May 22, 2020, we filed a petition for panel rehearing requesting that we be granted a rehearing

of our appeal of the U.S. District Court’s summary judgment ruling. Furthermore, we requested that we be given an opportunity

to make our case through oral argument in front of the three-judge panel of the Court of Appeals, which was also denied. The Company

has abandoned its right to any further appeals.

WatchGuard

– On May 27, 2016, the Company filed suit against WatchGuard alleging patent infringement based on WatchGuard’s

VISTA Wifi and 4RE In-Car product lines. On May 13, 2019, the parties resolved the dispute and executed a settlement agreement

in the form of a Release and License Agreement. The litigation has been dismissed as a result of this settlement. The Release

and License Agreement contains the following key terms:

|

|

●

|

WatchGuard

paid Digital Ally a one-time, lump settlement payment of $6,000,000.

|

|

|

|

|

|

|

●

|

Digital

Ally has granted WatchGuard a perpetual covenant not to sue if WatchGuard’s products

incorporate agreed-upon modified recording functionality. Digital Ally has also granted

WatchGuard a license to the ‘292 Patent and the ‘452 Patent (and related

patents, now existing and yet-to-issue) through December 31, 2023. The parties have agreed

to negotiate in good faith to attempt to resolve any alleged infringement that occurs

after

the license period expires.

|

|

|

|

|

|

|

●

|

The

parties have further agreed to release each other from all claims or liabilities pre-existing the settlement.

|

|

|

|

|

|

|

●

|

As

part of the settlement, the parties agreed that WatchGuard is making no admission that

it has infringed

any

of Digital Ally’s patents.

|

Upon

receipt of the $6,000,000, the parties filed a joint motion to dismiss the lawsuit with the court, which was granted.

We

believe that the outcome of the Axon lawsuit will largely define the competitive landscape for the body-worn and in-car video

market for the foreseeable future. We expect that our VuLink product and its related patents will be recognized as the revolutionary

and pioneering invention by the U.S. courts.

VuVault.net

and FleetVU Manager

VuVault.net

is a cost-effective, fully expandable, law enforcement cloud storage solution powered by AWS that provides redundant and security-enhanced

storage of all uploaded videos that comply with the United States Federal Bureau of Investigation’s Criminal Justice Information

Services Division requirements.

FleetVU

Manager is our web-based software for commercial fleet tracking and monitoring that features and manages video captured by our

video event data recorders of incidents requiring attention, such as accidents. This software solution features our cloud-based

web portal that utilizes many of the features of our VuVault.net law-enforcement cloud-based storage solution.

Disinfectant

Line and Related Safety Products

On

June 2, 2020, the Company announced that it was launching its branded ThermoVu™ product line. ThermoVu is a non-contact

temperature-measuring instrument that measures temperature through the wrist. ThermoVu has optional features such as facial recognition

to improve facility security by restricting access based on temperature and/or facial recognition parameters. ThermoVu provides

an instant pass/fail audible tone with its temperature display and controls access to facilities based on such results. The Company

believes this product can be applied in schools, office buildings, subway stations, airports and other public venues.

On

June 2, 2020, the Company also announced the launch of its branded Shield™ Disinfectant/Sanitizer and several related products

to fulfill demand by current customers and others for a disinfectant and sanitizer that is less harsh than many of the traditional

products now widely distributed. The Shield™ product line contains a cleaner with no harsh chemicals or fumes. Hypochlorous

acid (“HOCL”), the active ingredient of the Company’s Shield products, falls under category IV of the United

States Environmental Protection Agency’s (“EPA”) toxicity categories, the least toxic category. Cleaning crews

are not required to wear personal protective equipment when applying and reapplying HOCL. The Shield™ Disinfectant/Sanitizer

has been listed on the EPA’s List N: Disinfectants for Use Against SARS-CoV-2, the virus that causes COVID-19.

The

Company is also distributing other personal protective equipment (“PPE”) such as nitrile gloves and masks which is

used by many different customers who wish to reduce transmission of SARS-CoV-2, the virus that causes COVID-19, and other viruses.

The Company is purchasing such PPE from international vendors on a wholesale basis.

Other

Products

During

the last year, we focused our research and development efforts to meet the varying needs of our customers, enhance our existing

products and commence development of new products and product categories. Our research and development efforts are intended to

maintain and enhance our competitiveness in the market niche we have carved out, as well as positioning us to compete in diverse

markets outside of law enforcement. In December 2019, the Company announced a partnership with Pivot International for design

and manufacture of a new and innovative Breathalyzer Device utilizing the Company’s recently issued patent. With this new

technology, when an officer is conducting a field sobriety test and the breathalyzer is activated, the digital video recording

device will automatically start a recording, later embedding the meta-data captured onto the recorded video. The ‘732 Patent

was granted by the U.S. Patent Office in August 2019 and is an expansion of Digital Ally’s patented VuLink automatic activation

technology.

Corporate

Information

We

were incorporated in Nevada on December 13, 2000 as Vegas Petra, Inc. From that date until November 30, 2004, when we entered

into a Plan of Merger with Digital Ally, Inc., a Nevada corporation, which was formerly known as Trophy Tech Corporation (the

“Acquired Company”), we had not conducted any operations and were a closely-held company. In conjunction with the

merger, we were renamed Digital Ally, Inc.

The

Acquired Company, which was incorporated on May 16, 2003, engaged in the design, development, marketing and sale of bow hunting-related

products. Its principal product was a digital video recording system for use in the bow hunting industry. It changed its business

plan in 2004 to adapt its digital video recording system for use in the law enforcement and security markets. We began shipments

of our in-car digital video rear view mirrors in March 2006.

On

January 2, 2008, we commenced trading on Nasdaq under the symbol “DGLY.” We conduct our business from 15612 College

Boulevard, Lenexa, Kansas 66219. Our website address is www.digitalallyinc.com. Information contained on our website does

not form part of this prospectus supplement and accompanying base prospectus and is intended for informational purposes only.

Recent

Developments

Advancement

of Funds

In

October 2020, the Company advanced a total of $500,000 to American Rebel Holdings, Inc. (“AREB”) under two separate

secured promissory notes. The CEO, President and Chairman of AREB is the brother of the Company’s CEO, President and Chairman.

Such notes bear interest at 8%, mature on April 21, 2021 and are secured by substantially all tangible and intangible assets

of AREB. The Company also received warrants to purchase 2,500,000 shares of AREB common stock at an exercise price of $0.10 per

share.

Promissory

Note Under the Paycheck Protection Program

On

April 4, 2020, the Company entered into a promissory

note which provides for a loan in the amount of $1,418,900 (the “PPP Loan”) pursuant to the Paycheck Protection Program

under the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”).

The PPP Loan has a two-year term and bears interest at a rate of 0.98% per annum. Monthly principal and interest payments are

deferred for six months after the date of disbursement. The PPP Loan may be prepaid at any time prior to maturity with no prepayment

penalties. The promissory note contains events of default and other provisions customary for a loan of this type. The Paycheck

Protection Program provides that the PPP Loan may be partially or wholly forgiven if the funds are used for certain qualifying

expenses as described in the CARES Act. The Company used the majority of the PPP Loan amount for qualifying expenses and

applied for forgiveness of the loan in accordance with the terms of the CARES Act.

On

December 10, 2020, the Company received notification from First-Citizens Bank & Trust Company (“First-Citizens”)

of partial forgiveness of the PPP Loan that it had obtained under the U.S. Small Business Administration (“SBA”) Paycheck

Protection Program in the amount of $1,418,900 after the Company previously applied for forgiveness of the PPP Loan. The amount

of forgiveness remitted to First-Citizens by the SBA was $1,418,900, which was reduced by a $10,000 Economic Injury Disaster Loan

advance that the Company received and which is the remaining balance of the PPP Loan.

Salaries

Payable and Option Awards Granted to Executive Officers in 2021

On

January 7, 2021, the Compensation Committee of the Company’s

board of directors (the “Committee”) set the annual base salaries of Stanton E. Ross, the Company’s President

and Chief Executive Officer, and Thomas J. Heckman, the Company’s Chief Financial Officer, Treasurer and Secretary, at $250,000

and $230,000, respectively for 2021. The Committee determined that Mr. Ross will be eligible for bonuses of up to a total of $250,000

in 2021 and Mr. Heckman will be eligible for bonuses of up to a total of $230,000 in 2021 based on each person’s performance

during the year. The Committee will review each executive officer’s performance on a periodic basis during 2021 and determine

what, if any, portion of the bonus he has earned and will be paid as of such point.

The

Committee also awarded Mr. Ross 300,000 shares of restricted Common Stock and Mr. Heckman 150,000 shares of restricted Common

Stock, effective January 7, 2021. Half of such shares awarded will vest for each person on January 6, 2022 and the other half

will vest on January 6, 2023, provided that such person remains an officer on such dates.

January

14, 2021 Registered Direct Offering

On

January 14, 2021, pursuant a securities purchase agreement

with two investors, we closed a registered direct offering of (i) 2,800,000

shares of Common Stock; (ii) pre-funded warrants to purchase up to 7,200,000 shares of Common Stock at an exercise price of $0.01

per share; and (iii) common stock purchase warrants to purchase up to an aggregate of 10,000,000 shares of Common Stock, which

are exercisable for a period of five years after issuance at an initial exercise price $3.25 per share, subject to certain adjustments,

as provided in such warrants. Such shares of Common Stock or pre-funded warrants, and the accompanying warrants, were only purchasable

together, but were issued separately and were immediately separable upon issuance. Each share of Common Stock and accompanying

warrant in such offering was offered at a combined offering price of $3.095 per share and accompanying warrant, and each pre-funded

warrant and accompanying warrant in such offering was offered at a combined offering price of $3.085 per pre-funded warrant and

accompanying warrant.

We

received gross proceeds of approximately $30,950,000, before deducting discounts, commissions

and other offering expenses, which we intend to use for working capital, product development, order fulfillment and for general

corporate purposes. The exclusive placement agent for this offering of Common Stock, Kingswood Capital Markets, division

of Benchmark Investments, Inc. (“Kingswood”), also acted as the exclusive placement agent in connection with such

offering pursuant to a placement agency agreement, dated January 11, 2021. We agreed to pay Kingswood a fee equal to 6% of the

aggregate purchase price paid by investors placed by Kingswood and certain expenses. Such

shares, pre-funded warrants, and warrants, as well as the shares of Common Stock underlying such pre-funded warrants and warrants,

were registered under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to a prospectus supplement

to our currently effective shelf registration statement, which was initially filed with the SEC on June 25, 2020,

and was declared effective on July 2, 2020, and the related base prospectus included in such registration statement, as supplemented

by the prospectus supplement, dated January 11, 2021.

THE

OFFERING

|

Shares

of Common Stock Offered

|

|

We

are offering 3,250,000 shares of Common Stock.

|

|

|

|

|

|

Pre-Funded

Warrants offered by us

|

|

We

are also offering Pre-Funded Warrants to purchase up to 11,050,000 shares of Common Stock to purchasers whose purchase

of shares of Common Stock in this offering would otherwise result in any such purchaser, together with its affiliates and

certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding

Common Stock immediately following the consummation of this offering, the opportunity to purchase, if any such purchaser so

chooses, Pre-Funded Warrants, in lieu of shares of Common Stock that would otherwise result in such purchaser’s beneficial

ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Common Stock. Each Pre-Funded Warrant

will be exercisable for one share of Common Stock. The combined purchase price of each Pre-Funded Warrant with accompanying

Warrant will be equal to the combined purchase price at which each share of Common Stock and accompanying Warrant are sold

to the public in this offering, minus $0.01, and the exercise price of each Pre-Funded Warrant will be $0.01 per share. This

offering also relates to the shares of Common Stock issuable upon exercise of any Pre-Funded Warrant sold in this offering.

The Pre-Funded Warrants will be exercisable immediately and may be exercised at any time until all of the Pre-Funded Warrants

are exercised in full.

|

|

|

|

|

|

Warrants

offered by us

|

|

We

are also offering Warrants to purchase up to an aggregate of 14,300,000 shares of Common Stock. Each share of Common

Stock and each Pre-Funded Warrant is being sold together with a Warrant to purchase one (1) share of Common Stock. Warrants

will be exercisable at an exercise price of $3.25 per share for each share of Common Stock issuable, will be exercisable immediately

upon issuance by paying the aggregate exercise price for the Warrants being exercised and, in the event there is, at any time,

no effective registration statement registering the Warrant Shares, or the prospectus contained therein is not available for

the issuance of the Warrant Shares, then the Warrants may also be exercised on a cashless basis for a net number of shares,

as provided in the formula in the Warrant. In either case, the Warrants will expire on the fifth anniversary of their original

issuance date. This offering also relates to the shares of Common Stock issuable upon exercise of the Warrants.

|

|

|

|

|

|

Common

Stock outstanding before this offering (1)

|

|

37,284,709

shares of Common

Stock, as of January 27, 2021.

|

|

|

|

|

|

Common

Stock to be outstanding after this offering (1)

|

|

40,534,709

shares, assuming no exercise

of any of the Pre-Funded Warrants or Warrants issued in this offering.

|

|

|

|

|

|

Use

of proceeds

|

|

We

estimate that the net proceeds from this offering will be approximately $37,447,100, excluding any exercise of the

Pre-Funded Warrants or Warrants, and after deducting the placement agent discounts and commissions and estimated offering

expenses payable by us. We intend to use the net proceeds from this offering for working capital, product development, potential

acquisitions, order fulfillment and for general corporate purposes. See “Use of Proceeds” on page S-21 of

this prospectus supplement.

|

|

|

|

|

|

Risk

factors

|

|

Investing

in our securities involves a high degree of risk. You should read the “Risk Factors” section on page S-12 of this

prospectus supplement for a discussion of factors to consider before deciding to invest in the securities offered hereby.

|

|

|

|

|

|

Nasdaq

symbol and trading

|

|

Our

Common Stock is listed on Nasdaq under the symbol “DGLY”. There is no established trading market for the Warrants

or the Pre-Funded Warrants, and we do not expect a trading market for such securities to develop. We do not intend to list

the Warrants or the Pre-Funded Warrants on any securities exchange or other trading market. Without a trading market, the

liquidity of the Warrants or the Pre-Funded Warrants will be extremely limited.

|

Except

as otherwise indicated herein, the number of shares of Common Stock to be outstanding immediately after this offering is based

on 37,284,709 shares of our Common Stock outstanding as of January 27, 2021, and:

|

|

●

|

excludes up to 838,313

shares of our Common Stock issuable upon exercise of outstanding options with a weighted average exercise price of $3.20 per

share as of January 27, 2021;

|

|

|

|

|

|

|

●

|

includes 704,000

shares of our Common Stock subject to forfeiture pursuant to outstanding non-vested restricted stock grants as of January

27, 2021;

|

|

|

|

|

|

|

●

|

excludes 613,846

shares of our Common Stock as of January 27, 2021 reserved for future issuance pursuant to our existing stock incentive

plans;

|

|

|

|

|

|

|

●

|

excludes up to 12,508,598

shares of our Common Stock issuable upon exercise of warrants outstanding as of January 27, 2021 having a weighted

average exercise price of $3.34 per share;

|

|

|

|

|

|

|

●

|

includes

63,518 shares of our Common Stock held as treasury stock as of January 27, 2021;

|

|

|

|

|

|

|

●

|

excludes

up to 11,050,000 shares of our Common Stock issuable pursuant to the exercise of the

Pre-Funded Warrants; and

|

|

|

|

|

|

|

●

|

excludes up to 14,300,000

shares of our Common Stock issuable pursuant to the exercise of the Warrants.

|

RISK

FACTORS

Investing

in in our securities involves a high degree of risk. You should carefully consider and evaluate all of the information contained

in this prospectus supplement, the accompanying base prospectus and in the documents that we incorporate by reference into this

prospectus supplement and the accompanying base prospectus deciding to invest in our securities. In particular, you should carefully

consider and evaluate the risks and uncertainties described under the heading “Risk Factors” in this prospectus supplement.

Any of the risks and uncertainties set forth in this prospectus supplement, the accompanying base prospectus and in the documents

that we incorporate by reference herein and therein, as updated by annual, quarterly and other reports and documents that we file

with the SEC and incorporate by reference into this prospectus supplement could materially and adversely affect our business,

results of operations and financial condition, which in turn could materially and adversely affect the value of our securities.

The risks described in this prospectus supplement, the accompanying base prospectus and in the documents that we incorporate by

reference herein and therein are not the only ones facing us. Additional risks not currently known to us or that we currently

deem immaterial may also adversely affect us. As a result, you could lose all or part of your investment.

Risks

Related to this Offering of Securities

Our

insiders and affiliated parties beneficially own a significant portion of our Common Stock.

As

of the date of this prospectus supplement, our executive officers, directors, and affiliated parties beneficially own approximately

8.8% of our Common Stock, including options vested or to vest within sixty (60) days. As a result, our executive officers,

directors and affiliated parties will have significant influence to:

|

|

●

|

elect

or defeat the election of our directors;

|

|

|

|

|

|

|

●

|

amend

or prevent amendment of our articles of incorporation or bylaws;

|

|

|

|

|

|

|

●

|

effect

or prevent a merger, sale of assets, change of control or other corporate transaction; and

|

|

|

|

|

|

|

●

|

affect

the outcome of any other matter submitted to the stockholders for vote.

|

In

addition, any sale of a significant amount of our Common Stock held by our directors and executive officers, or the possibility

of such sales, could adversely affect the market price of our Common Stock. Management’s stock ownership may discourage

a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our

stock price or prevent our stockholders from realizing any gains from our Common Stock. Furthermore, the interests of this concentration

of ownership may not always coincide with our interests or the interests of other stockholders. Accordingly, these stockholders

could cause us to enter into transactions or agreements that we would not otherwise consider.

The

market price for our Common Stock is particularly volatile given our status as a relatively unknown company with a small and thinly

traded public float, and lack of profits, which could lead to wide fluctuations in the share price of our Common Stock. You may

be unable to sell any shares of Common Stock that you hold at or above your purchase price, which may result in substantial losses

to you.

The

market for our Common Stock is characterized by significant price volatility when compared to the shares of larger, more established

companies that trade on a national securities exchange and have large public floats, and we expect that the share price of our

Common Stock will continue to be more volatile than the shares of such larger, more established companies for the indefinite future.

The volatility in the share price of our Common Stock is attributable to a number of factors. First, as noted above, our Common

Stock is, compared to the shares of such larger, more established companies, sporadically and thinly traded. The price for our

shares of share price of our Common Stock could, for example, decline precipitously in the event that a large number of shares

of our Common Stock is sold on the market without commensurate demand. Secondly, an investment in our securities is a speculative

or “risky” investment due to our lack of profits to date. As a consequence of this enhanced risk, more risk-adverse

investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be

more inclined to sell their shares of share price of our Common Stock on the market more quickly and at greater discounts than

would be the case with the stock of a larger, more established company that trades on a national securities exchange and has a

large public float. Many of these factors are beyond our control and may decrease the market price of our Common Stock regardless

of our operating performance.

If

and when a larger trading market for our Common Stock develops, the market price of our Common Stock is still likely to be highly

volatile and subject to wide fluctuations, and you may be unable to resell your shares at or above the price at which you acquired

them.

The

market price of our Common Stock may be highly volatile and could be subject to wide fluctuations in response to a number of factors

that are beyond our control, including, but not limited to:

|

|

●

|

variations

in our revenues and operating expenses;

|

|

|

|

|

|

|

●

|

actual

or anticipated changes in the estimates of our operating results or changes in stock market analyst recommendations regarding

our Common Stock, other comparable companies or our industry generally;

|

|

|

|

|

|

|

●

|

market

conditions in our industry, the industries of our customers and the economy as a whole;

|

|

|

|

|

|

|

●

|

actual

or expected changes in our growth rates or our competitors’ growth rates;

|

|

|

|

|

|

|

●

|

developments

in the financial markets and worldwide or regional economies;

|

|

|

|

|

|

|

●

|

announcements

of innovations or new products or services by us or our competitors;

|

|

|

|

|

|

|

●

|

announcements

by the government relating to regulations that govern our industry;

|

|

|

|

|

|

|

●

|

sales

of our Common Stock or other securities by us or in the open market;

|

|

|

|

|

|

|

●

|

changes

in the market valuations of other comparable companies; and

|

|

|

|

|

|

|

●

|

other

events or factors, many of which are beyond our control, including those resulting from such events, or the prospect of such

events, including war, terrorism and other international conflicts, public health issues including health epidemics or pandemics,

such as the recent outbreak of COVID-19, and natural disasters such as fire, hurricanes, earthquakes, tornados or other adverse

weather and climate conditions, whether occurring in the United States or elsewhere, could disrupt our operations, disrupt

the operations of our suppliers or result in political or economic instability.

|

In

addition, if the market for technology stocks or the stock market in general experiences loss of investor confidence, the trading

price of our Common Stock could decline for reasons unrelated to our business, financial condition or operating results. The trading

price of our shares of Common Stock might also decline in reaction to events that affect other companies in our industry, even

if these events do not directly affect us. Each of these factors, among others, could harm the value of your investment in our

securities. In the past, following periods of volatility in the market, securities class-action litigation has often been instituted

against companies. Such litigation, if instituted against us, could result in substantial costs and diversion of management’s

attention and resources, which could materially and adversely affect our business, operating results and financial condition.

We

do not anticipate paying dividends on our Common Stock in the foreseeable future; you should not buy our securities if you expect

dividends.

The

payment of dividends on our Common Stock will depend on earnings, financial condition and other business and economic factors

affecting us at such time as our board of directors (“Board of Directors”) may consider relevant. If we do not pay

dividends, our Common Stock may be less valuable because a return on your investment will only occur if our stock price appreciates.

We

currently intend to retain our future earnings to support operations and to finance expansion and, therefore, we do not anticipate

paying any cash dividends on our Common Stock in the foreseeable future.

Purchasers

in this offering will experience immediate and substantial dilution in the book value of their investment .

The

public offering price of our Common Stock and accompanying Warrants in this offering will exceed the net tangible book value

per share of our Common Stock outstanding prior to this offering. Therefore, if you purchase shares of Common Stock and

accompanying Warrants in this offering at a public offering price of $2.80 per share and accompanying Warrant,

you will experience immediate dilution of $0.81 per share, or approximately 28.9% of the public offering

price of such shares and accompanying Warrants, representing the difference between our pro forma as adjusted net tangible

book value per share as of September 30, 2020, after giving effect to the issuance of Common Stock and accompanying Warrants

in this offering and on a pro forma basis all other issuances/redemptions subsequent to September 30, 2020 as if they had

occurred as of September 30, 2020. This dilution is due in large part to the fact that the Company has a substantial

accumulated stockholder’s deficit at September 30, 2020. In addition, on a pro forma as adjusted basis, purchasers in

this offering will have contributed approximately 22.8% of the aggregate price paid by all purchasers of our

Common Stock and will own approximately 8.0% of our Common Stock outstanding after this offering, based on the

public offering price of $2.80 per share of Common Stock and accompanying Warrant. The exercise of outstanding

stock options and warrants will result in further dilution of your investment. See the section entitled

“Dilution” on page S-23 of this prospectus supplement.

Exercise

of options or warrants may have a dilutive effect on your percentage ownership of Common Stock, and may result in a dilution of

your voting power and an increase in the number of shares of Common Stock eligible for future resale in the public market, which

may negatively impact the trading price of our shares of Common Stock.

The

exercise of some or all of our outstanding warrants or options could result in significant dilution in the percentage ownership

interest of investors in this offering and in the percentage ownership interest of our existing common stockholders and in a significant

dilution of voting rights and earnings per share.

As of

January 27, 2021, we have warrants outstanding to purchase 12,508,598 shares of Common Stock. The warrants have

a weighted average exercise price of $3.34 and a weighted average years to maturity of approximately 4.3 years.

In addition, as of such date, we have options to purchase 838,313 shares of our Common

Stock outstanding and exercisable at an average price of $3.20 per share.

Subject

to lock-up provisions described under “Plan of Distribution,” we are generally not restricted from issuing additional

securities, including shares of Common Stock, securities that are convertible into or exchangeable for, or that represent the

right to receive, Common Stock or substantially similar securities. In addition to the dilutive effects described above, the exercise,

conversion or repayment, as applicable, of those securities would lead to an increase in the number of shares of Common Stock

eligible for resale in the public market. Sales of substantial numbers of such shares of Common Stock in the public market could

adversely affect the market price of our shares of Common Stock. Substantial dilution and/or a substantial increase in the number

of shares of Common Stock available for future resale may negatively impact the trading price of our shares of Common Stock.

We

may seek to raise additional funds, finance acquisitions or develop strategic relationships by issuing securities that would dilute

the ownership of the Common Stock. Depending on the terms available to us, if these activities result in significant dilution,

it may negatively impact the trading price of our shares of Common Stock.

We

may acquire other technologies or finance strategic alliances by issuing our equity or equity-linked securities, which may result

in additional dilution to our stockholders. We have financed our operations, and we expect to continue to finance our operations,

acquisitions, if any, and the development of strategic relationships by issuing equity and/or convertible securities, which could

significantly reduce the percentage ownership of our existing stockholders. Further, any additional financing that we secure may

require the granting of rights, preferences or privileges senior to, or pari passu with, those of our Common Stock. Any issuances

by us of equity securities may be at or below the prevailing market price of our Common Stock and in any event may have a dilutive

impact on your ownership interest, which could cause the market price of our Common Stock to decline. We may also raise additional

funds through the incurrence of debt or the issuance or sale of other securities or instruments senior to our shares of Common

Stock. The holders of any securities or instruments we may issue may have rights superior to the rights of our common stockholders.

If we experience dilution from issuance of additional securities and we grant superior rights to new securities over common stockholders,

it may negatively impact the trading price of our shares of Common Stock.

We

may not be able to maintain an active, liquid trading market for our Common Stock, which may cause our Common Stock to trade at

a discount and make it difficult for you to sell the Common Stock you hold.

Our

Common Stock is currently listed on Nasdaq. However, there can be no assurance that we will be able to maintain an active market

for our Common Stock either now or in the future. If an active and liquid trading market cannot be sustained, you may have difficulty

selling any of our Common Stock that you hold. The market price of our Common Stock may decline below the applicable public offering

price that you paid in this offering, and you may not be able to sell your shares of our Common Stock at or above the price that

you paid, or at all.

Because

our management will have broad discretion and flexibility in how the net proceeds from this offering are used, our management

may use the net proceeds in ways with which you disagree or which may not prove effective.

We

currently intend to use the net proceeds from this offering as discussed under “Use of Proceeds” in this prospectus

supplement. We have not allocated specific amounts of the net proceeds from this offering for any of the foregoing purposes. Accordingly,

our management will have significant discretion and flexibility in applying the net proceeds of this offering. You will be relying

on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part

of your investment decision, to assess whether the net proceeds are being used appropriately. It is possible that the net proceeds

will be invested in a way that does not yield a favorable, or any, return for us. The failure of our management to use such funds

effectively could have a material adverse effect on our business, financial condition, operating results and cash flow.

In

making your investment decision, you should understand that we and the placement agent have not authorized any other party to

provide you with information concerning us or this offering.

You

should carefully evaluate all of the information in this prospectus supplement and accompanying base prospectus before investing

in our securities. We may receive media coverage regarding our Company, including coverage that is not directly attributable to

statements made by our officers, that incorrectly reports on statements made by our officers or employees, or that is misleading

as a result of omitting information provided by us, our officers or employees. We and the placement agent have not authorized

any other party to provide you with information concerning us or this offering, and you should not rely on this information in

making an investment decision.

There

is no public market for the Pre-Funded Warrants or the Warrants being offered in this offering.

There

is no established public trading market for the Pre-Funded Warrants or the Warrants being offered in this offering, and we do

not expect a market to develop. In addition, we do not intend to apply to list the Pre-Funded Warrants or the Warrants on any

securities exchange or nationally recognized trading system, including Nasdaq. Without an active market, the liquidity of the

Pre-Funded Warrants and the Warrants will be limited.

The

Pre-Funded Warrants and the Warrants are speculative in nature.

The

Pre-Funded Warrants and the Warrants offered hereby do not confer any rights of Common Stock ownership on their respective holders,

such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of Common Stock

at a fixed price. Specifically, commencing on the date of issuance, (i) holders of the Pre-Funded Warrants may exercise their

right to acquire the Common Stock and pay an exercise price of $0.01 per share and (ii) holders of the Warrants may exercise their

right to acquire the Common Stock and pay an exercise price of $3.25 per share. Moreover, following this offering, the market

value of the Pre-Funded Warrants and the Warrants is uncertain and there can be no assurance that the market value of the Pre-Funded

Warrants and the Warrants will equal or exceed their public offering price.

Furthermore,

each Pre-Funded Warrant will expire once exercised in full and each Warrant will expire five years from its initial exercise date.

In the event that our Common Stock price does not exceed the exercise price of the Pre-Funded Warrants or the Warrants during

the period when the Pre-Funded Warrants and the Warrants are exercisable, as applicable, such Warrants may not have any value.

Holders

of the Pre-Funded Warrants and the Warrants purchased in this offering will have no rights as common stockholders until such holders

exercise such warrants and acquire our Common Stock.

Until

holders of the Pre-Funded Warrants and the Warrants acquire shares of our Common Stock upon exercise thereof, holders of such

Pre-Funded Warrants and Warrants will have no rights with respect to the shares of our Common Stock underlying such Pre-Funded

Warrants and Warrants. Upon exercise of the Pre-Funded Warrants or the Warrants, such holders will be entitled to exercise the

rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

Risks

Related to our Business

We

have incurred losses in recent years.

We

have had net losses for several years and had an accumulated deficit of $87,388,619 at December 31, 2019, which includes our net

losses of $10,005,713 for the year ended December 31, 2019, as compared to $15,544,551 for the year ended December 31, 2018. As

of September 30, 2020, we had an accumulated deficit of $89,693,181, which includes net losses of $2,304,562 and for the nine

months ended September 30, 2020. We have included disclosure of our liquidity plan and the substantial doubt about our ability

to continue as a going concern in our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2020. Furthermore,

the report of our independent registered public accounting firm in our Form 10-K included an explanatory paragraph regarding the

substantial doubt about our ability to continue as a going concern. We have implemented several initiatives intended to improve