Current Report Filing (8-k)

January 28 2021 - 4:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 25, 2021

ACREAGE

HOLDINGS, INC.

(Exact name of registrant as specified in

its charter)

Commission File Number: 000-56021

|

British Columbia, Canada

|

98-1463868

|

|

(State or other jurisdiction of incorporation)

|

(IRS Employer Identification No.)

|

450 LEXINGTON AVENUE, #3308

NEW YORK, NEW YORK, 10163, UNITED STATES

(Address of principal executive offices,

including zip code)

(646) 600-9181

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of

the Act: None

Securities registered pursuant to Section 12(g) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Class E subordinate voting shares

Class D subordinate voting shares

|

|

ACRHF

ACRDF

|

|

OTC Markets Group Inc.

OTC Markets Group Inc.

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Standby Equity Distribution Agreement (SEDA)

On May 29, 2020, Acreage Holdings

Inc. (the “Company” or “we”) entered into the Standby Equity Distribution Agreement (the

“SEDA”) with SAFMB Concord LP (“SAFMB” or the “Institutional Investor”).

pursuant to which we may, in our discretion, periodically sell to the Institutional Investor, and pursuant to which the Institutional

Investor may, at its discretion, require us to sell to it, up to $35.0 million of our Class E subordinate voting shares (each,

a “Fixed Share”) and up to $15.0 million of our Class D subordinate voting shares (each, a “Floating

Share”). For each Fixed Share or Floating Share purchased under the SEDA, the Institutional Investor will pay us the

greater of (i) 95% of the lowest daily volume weighted average price of the Fixed Shares or Floating Shares on the Canadian

Securities Exchange or other principal market on which the Fixed Shares or Floating Shares are traded (the “Principal

Market”) for the five consecutive trading days immediately following the date we or the Institutional Investor delivers

notice requiring the Institutional Investor to purchase or us to sell the Fixed Shares or Floating Shares under the SEDA; or (ii) the

lowest price allowable under the rules of the Principal Market.

The Institutional Investor’s obligation

to purchase, and our obligation to sell, Fixed Shares and Floating Shares under the SEDA is subject to certain conditions, including

obtaining requisite relief from applicable Canadian securities regulators in respect of transactions of this nature, us filing

and maintaining the effectiveness of a registration statement, and a supplement to our Canadian shelf prospectus, qualifying the

issue of the commitment shares described below and up to an aggregate of $35.0 million of Fixed Shares and $15.0 million of Floating

Shares sold under the SEDA, and is limited to $500,000 per advance.

On each of September 28, 2020 and

January 25, 2021, we entered into letter agreements (the “Letter Agreements”) with the Institutional Investor

extending the termination deadline of the SEDA to the earliest of November 30, 2020 and June 30, 2021, respectively,

and the date that we have obtained both a receipt from the Ontario Securities Commission for a short-form final base shelf prospectus

and a declaration from the United States Securities and Exchange Commission that its registration statement is effective, in each

case qualifying an At-The-Market equity offering program.

The Letter Agreements are attached hereto

as Exhibits 109.1 and 10.2 and are incorporated by reference into this Item 1.01 of Form 8-K.

Item 9.01. Financial Statements and Exhibits.

|

(d)

|

Exhibits. The following exhibits are filed as part of this Current Report on Form 8-K.

|

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

ACREAGE HOLDINGS, INC.

|

|

|

|

|

|

|

|

Date: January 28, 2021

|

/s/ Glen Leibowitz

|

|

|

Glen Leibowitz

|

|

|

Chief Financial Officer

|

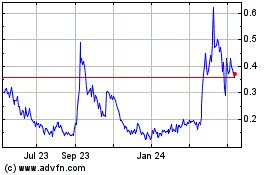

Acreage (QX) (USOTC:ACRHF)

Historical Stock Chart

From Mar 2024 to Apr 2024

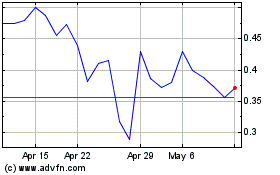

Acreage (QX) (USOTC:ACRHF)

Historical Stock Chart

From Apr 2023 to Apr 2024