NeuroMetrix Reports Q4 and Full Year 2020 Financial Results

January 28 2021 - 7:00AM

NeuroMetrix, Inc. (Nasdaq: NURO) today reported financial and

business highlights for the quarter and year ended December 31,

2020. The Company is focused on the development and global

commercialization of non-invasive medical devices for the diagnosis

and treatment of disorders involving the nervous system.

Q4 2020 Highlights:

- Revenue of $1.8 million was up 6% from $1.7 million in Q4 2019.

The business continued to experience headwinds from the COVID-19

pandemic and the effects of positioning Quell for profitability.

Gross margin on revenue was $1.3 million or 73.7%, up from 62.2% in

Q4 2019.

- DPNCheck® Medicare Advantage sales continued to grow and

partially offset slow international sales. Substantial

progress was made towards a major upgrade to the product platform

that is expected to launch in H2 2021.

- Quell® made a positive operating contribution reflecting more

efficient and focused advertising. Important progress was made on

developing new clinical indications for the Quell therapeutic

platform.

- Net loss for the quarter was $0.3 million in comparison with a

net loss of $1.1 million in the Q4 2019.

"We are pleased that our prioritization of operating

profitability has been effective in reducing our quarterly loss and

cash consumption. We are now positioned to resume a focus on

growth, while continuing to improve the bottom line,” said Shai N.

Gozani, M.D., Ph.D., President and Chief Executive Officer of

NeuroMetrix. “To this end, we have a number of impactful product

development efforts for both DPNCheck and Quell which we expect to

launch this year.”

Financials:

Q4 2020 revenues of $1.8 million grew 6% from Q4 2019. The gross

margin rate expanded to 73.7%, a gain of 11.5 percentage points

over the prior year quarter. Operating expenses of $1.7 million

represented a drop of 39%, from $2.7 million in Q4 2019. The net

loss of $0.3 million in Q4 2020 was an improvement of $700k from a

loss of $1.1 million in the Q4 2019.

For the year ended December 31, 2020, total revenues of $7.4

million declined from $9.3 million in 2019. However, gross margin

improved to $5.2 million at a margin rate of 71.2% versus $2.2

million and a rate of 24.2% in the prior year. The margin

improvement partially reflected the 2019 business restructuring

which included inventory charges contributing to the lower margins

in that year. The restructuring positioned the Company with lower

operating expenses in 2020 where costs dropped by 47% to $7.3

million versus $13.8 million in the prior year. Net loss in 2020

improved to $2.1 million compared a net loss of $3.8 million in

2019.

Company to Host Live Conference Call and

Webcast

NeuroMetrix will host a conference call at 8:00 a.m. Eastern

today, January 28, 2021. The call may be accessed in the United

States at 844-787-0799, international at 661-378-9630 using

confirmation code 8694435. A replay will be available starting two

hours after the call at 855-859-2056 United States and 404-537-3406

international using confirmation code 8694435. It will remain

available for one week. The call will also be webcast and

accessible at www.NeuroMetrix.com under "Investor Relations".

About NeuroMetrix

NeuroMetrix is an innovation-driven company focused on the

development and global commercialization of non-invasive medical

devices for the diagnosis and treatment of disorders involving the

nervous system. The Company has three commercial

products. DPNCheck® is a diagnostic device that provides

rapid, point-of-care detection of peripheral neuropathies. ADVANCE®

is a diagnostic device that provides automated, in-office nerve

conduction studies for the evaluation of focal

neuropathies. Quell® is a wearable neurostimulation device

indicated for symptomatic relief of chronic pain that is available

over-the-counter. For more information, visit

www.NeuroMetrix.com

Safe Harbor Statement

The statements contained in this press release include

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, including, without

limitation, statements regarding the company’s or management’s

expectations regarding the business, as well as events that could

have a meaningful impact on the company’s revenues and cash

resources. While the company believes the forward-looking

statements contained in this press release are accurate, there are

a number of factors that could cause actual events or results to

differ materially from those indicated by such forward-looking

statements, including, without limitation, the effects of the

COVID-19 pandemic on all aspects of the Company’s business,

estimates of future performance, and the ability to successfully

develop, receive regulatory clearance, commercialize and achieve

market acceptance for any products. There can be no assurance that

future developments will be those that the company has anticipated.

Such forward-looking statements involve known and unknown risks,

uncertainties and other factors including those risks,

uncertainties and factors referred to in the company’s most recent

Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, as well

as other documents that may be filed from time to time with the

Securities and Exchange Commission or otherwise made public. The

company is providing the information in this press release only as

of the date hereof, and expressly disclaims any intent or

obligation to update the information included in this press release

or revise any forward-looking statements.

Source: NeuroMetrix, Inc.

Thomas T. HigginsSVP and Chief Financial

Officer781-314-2761neurometrix.ir@neurometrix.com

NeuroMetrix,

Inc.Statements of

Operations(Unaudited)

| |

Quarters Ended December 31, |

|

Year Ended December 31, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

| |

|

|

|

|

|

|

|

|

Revenues |

$ |

1,809,732 |

|

|

$ |

1,706,903 |

|

|

$ |

7,377,975 |

|

|

$ |

9,272,522 |

|

| |

|

|

|

|

|

|

|

| Cost of revenues |

475,527 |

|

|

644,560 |

|

|

2,128,417 |

|

|

7,026,899 |

|

| |

|

|

|

|

|

|

|

|

Gross profit |

1,334,205 |

|

|

1,062,343 |

|

|

5,249,558 |

|

|

2,245,623 |

|

| |

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

544,747 |

|

|

736,836 |

|

|

2,391,316 |

|

|

3,101,976 |

|

|

Sales and marketing |

292,417 |

|

|

708,212 |

|

|

1,436,806 |

|

|

4,755,168 |

|

|

General and administrative |

823,194 |

|

|

1,276,258 |

|

|

3,516,340 |

|

|

5,923,190 |

|

| |

|

|

|

|

|

|

|

|

Total operating expenses |

1,660,358 |

|

|

2,721,306 |

|

|

7,344,462 |

|

|

13,780,334 |

|

| |

|

|

|

|

|

|

|

|

Loss from operations |

(326,153 |

) |

|

(1,658,963 |

) |

|

(2,094,904 |

) |

|

(11,534,711 |

) |

| |

|

|

|

|

|

|

|

| Other income: |

|

|

|

|

|

|

|

|

Collaboration income |

— |

|

|

600,000 |

|

|

— |

|

|

7,116,667 |

|

|

Other income |

386 |

|

|

2,233 |

|

|

2,709 |

|

|

45,030 |

|

| |

|

|

|

|

|

|

|

|

Total other income |

386 |

|

|

602,233 |

|

|

2,709 |

|

|

7,761,697 |

|

| |

|

|

|

|

|

|

|

| Net loss |

$ |

(325,767 |

) |

|

$ |

(1,056,730 |

) |

|

$ |

(2,092,195 |

) |

|

$ |

(3,773,014 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NeuroMetrix, Inc.Condensed Balance

Sheets(Unaudited)

|

|

December

31,2020 |

|

December 31,2019 |

| |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

5,226,213 |

|

|

$ |

3,126,206 |

|

| Other current assets |

|

1,863,653 |

|

|

|

2,304,608 |

|

| Noncurrent assets |

|

904,709 |

|

|

|

1,462,872 |

|

|

Total assets |

$ |

7,994,575 |

|

|

$ |

6,893,686 |

|

| |

|

|

|

|

|

|

|

| Current liabilities |

$ |

2,285,390 |

|

|

$ |

3,446,778 |

|

| Lease Obligation, net of

current portion |

|

461,410 |

|

|

|

916,674 |

|

| Stockholders’ equity |

|

5,247,775 |

|

|

|

2,530,234 |

|

|

Total liabilities and stockholders’ equity |

$ |

7,994,575 |

|

|

$ |

6,893,686 |

|

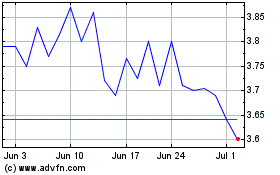

NeuroMetrix (NASDAQ:NURO)

Historical Stock Chart

From Mar 2024 to Apr 2024

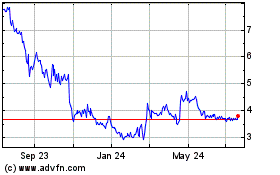

NeuroMetrix (NASDAQ:NURO)

Historical Stock Chart

From Apr 2023 to Apr 2024