Prudential PLC to Separate Jackson Through Demerger; Mulls Equity Raise

January 28 2021 - 4:24AM

Dow Jones News

By Adria Calatayud

Prudential PLC said Thursday that it plans to separate its U.S.

business Jackson Financial through a demerger, and that it is

considering an equity raise of up to $3 billion as it doubles down

on its Asian markets.

The FTSE 100 insurer said the proposed demerger of Jackson from

the group, set to take place in the second quarter, would

accelerate the separation process and complete its transformation

to focus exclusively on its high-growth Asia and Africa

businesses.

Under the demerger, shares in Jackson would be distributed to

Prudential shareholders, the company said. Prudential said it would

retain a 19.9% noncontrolling interest in Jackson, which it would

seek to monetize over time to support investment in Asia.

A demerger would lead to an earlier separation than would have

been possible through a minority IPO, Prudential said. The plan is

subject to shareholder and regulatory approval, the company

said.

Prudential also said it has appointed former MetLife Inc. chief

Steven Kandarian as nonexecutive chair of Jackson's board.

The company said it is considering raising new equity of between

$2.5 billion and $3 billion in Hong Kong or London, or both, to

increase its financial flexibility in light of the breadth of the

opportunities to invest in growth.

London-listed shares in Prudential at 0845 GMT were down 9.8% at

1,209.50 pence.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

January 28, 2021 04:09 ET (09:09 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

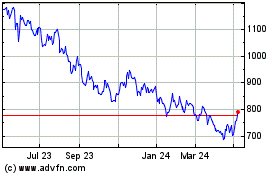

Prudential (LSE:PRU)

Historical Stock Chart

From Mar 2024 to Apr 2024

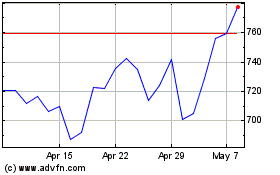

Prudential (LSE:PRU)

Historical Stock Chart

From Apr 2023 to Apr 2024