Current Report Filing (8-k)

January 26 2021 - 4:56PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

January

21, 2021

Date

of Report (Date of earliest event reported)

ODYSSEY

GROUP INTERNATIONAL, INC.

(Exact

name of registrant as specified in its charter)

333-250896

(Commission

File Number)

|

Nevada

|

47-1022125

|

|

(State or other jurisdiction of incorporation)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

2372 Morse Ave., Irvine, CA

|

92614

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(619) 832-2900

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

o

|

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered

pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Symbol

|

Name of each exchange on which registered

|

|

None

|

N/A

|

N/A

|

Securities

registered pursuant to Section 12(g) of the Act:

|

Title of

each Class

|

Trading

Symbol

|

Name

of each exchange on which registered

|

|

Common

Stock ($0.001 par value)

|

ODYY

|

OTC

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

ITEM

1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On

January 21, 2021, the Board of Directors of Odyssey Group International, Inc. (the “Company”) entered into employment

agreements with Mr. Michael Redmond and Ms. Christine Farrell. See Item 5.02 below for a description of the agreements.

ITEM

5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS

OF CERTAIN OFFICERS.

Mr. Redmond

Employment Agreement

On

January 21, 2021, the Board of Directors of the Company and Mr. Redmond entered into an employment agreement (the “Agreement”)

for a three (3) year term. Mr. Redmond will initially receive a base salary of Three Hundred Thousand Dollars ($300,000) per year,

subject to increases after certain Company milestones are obtained as noted in the Agreement. Mr. Redmond is eligible to participate

in the Company’s performance-based cash incentive bonus program. Mr. Redmond has accrued One Hundred Eighty Three Thousand

Eight Hundred Forty Six Dollars ($183,846) in unpaid salary from December 2017 through the effective date of the Agreement. Mr.

Redmond may have the accrued salary converted to Company common stock at the then current stock price. Mr. Redmond shall

be eligible to receive a bonus for each calendar year during the term of the Agreement, of between Fifty Percent (50%) and One

Fifty Percent (150%) of Base Salary, commencing with the 2021 calendar year, based on the attainment of individual and

corporate performance goals and targets established by mutual agreement between the Board and Mr. Redmond prior to January 31st

of each calendar year. Mr. Redmond will be granted Restricted Stock Units (“RSUs”) covering Three Million (3,000,000)

shares of the Company’s common stock (or stock options at Mr. Redmond’s choosing), vesting in equal monthly installments

over Thirty Six (36) months.

The

Agreement provides for certain payments and benefits in the event of a termination of Mr. Redmond’s employment under specific

circumstances. If, during the term of the Agreement, his employment is terminated by the Company other than for “cause,”

death or disability as defined in the Agreement, he would be entitled to continuation of his base salary at the rate in effect

immediately prior to the termination date for twenty four (24) months following the termination date.

Ms. Farrell

Employment Agreement

On

January 21, 2021, the Board of Directors of the Company and Ms. Christine M. Farrell entered into an employment agreement (the

“Agreement”) for a three-year term, as Chief Financial Officer. Ms. Farrell will initially receive a base salary of

One Hundred Twenty Thousand Dollars ($120,000) per year, subject to increases after certain Company milestones are obtained as

noted in the Agreement. Ms. Farrell is eligible to receive a bonus for each calendar year during the term of the Agreement, of

between up to Twenty Percent (20%) of base salary, commencing with the 2021 calendar year, based on the attainment of individual

and corporate performance goals and targets established by the Board. Ms. Farrell will be granted RSU’s covering One Million

(1,000,000) shares of our common stock (or stock options at Ms. Farrell’s choosing), vesting in equal monthly installments

over Thirty Six (36) months.

The

Agreement provides for certain payments and benefits in the event of a termination of Ms. Farrell’s employment under specific

circumstances. If, during the term of the Agreement, her employment is terminated by the Company other than for “cause,”

death or disability, as defined in his agreement, she would be entitled to continuation of her base salary at the rate in effect

immediately prior to the termination date for six (6) months following the termination date.

Mr.

Redmond and Ms. Farrell have also agreed to customary restrictions with respect to the disclosure and use of the Company’s

confidential information, and have agreed that work product or inventions developed or conceived by them while employed with the

Company relating to its business is the Company’s property.

The

foregoing description of the employment agreements is a summary and is qualified in its entirety by reference to the employment

agreements which are attached hereto as Exhibit 10.1 and Exhibit 10.2 and are incorporated by reference herein.

Item

9.01 Financial Statements and Exhibits

SIGNATURE

Pursuant to

the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

ODYSSEY GROUP

INTERNATIONAL, INC.

|

|

|

|

|

|

Date: January 26, 2021

|

By:

|

/s/ Joseph Michael Redmond

|

|

|

|

Name: Joseph Michael Redmond

|

|

|

|

Title: Chief Executive Officer

|

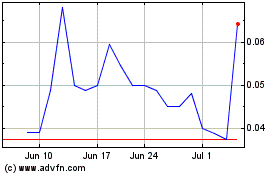

Odyssey (QB) (USOTC:ODYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

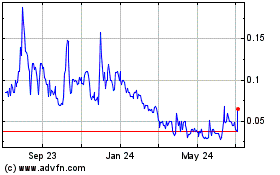

Odyssey (QB) (USOTC:ODYY)

Historical Stock Chart

From Apr 2023 to Apr 2024