Trucker TFI International Aims to Boost Margins at UPS Freight

January 26 2021 - 4:54PM

Dow Jones News

By Paul Page

TFI International Inc. plans to spend $50 million to $75 million

to upgrade the UPS Freight fleet and renegotiate prices for the

carrier's shipping customers as the Canadian company incorporates

an operation that will make it one of the largest truckers in North

America.

Montreal-based TFI, which agreed to acquire the business for

$800 million, said it would rename the main part of the operation

TForce Freight and will start looking for ways to reduce operating

costs and improve margins. The unit brought in around $3 billion in

revenue at United Parcel Service Inc. last year and had an

operating margin of 2.3%.

"We see compelling opportunities to improve yield, efficiency,

and...productivity, both near and long-term," TFI Chairman and

Chief Executive Officer Alain Bédard said in a Monday call with

analysts.

The sale, which the companies expect to close in the second

quarter, marks the largest deal in North American trucking since

truckload carriers Knight Transportation Inc. and Swift

Transportation Co. merged in 2017 and will jolt a competitive

less-than-truckload market, in which carriers haul loads for

multiple customers on the same truck. UPS Freight is the

sixth-largest business in that field by 2019 revenue, according to

transportation research company SJ Consulting Group Inc.

The acquisition caps a dramatic period of growth for TFI that

has seen the business buy dozens of companies. Many were small

operators, but the deals also include the 2016 acquisition of XPO

Logistics Inc.'s truckload division, and the purchases of trucker

Vitran Corp. and of truckload carrier Transport America Inc. in

2014.

Mr. Bédard said the truckload business at UPS Freight, which

makes up about 10% of the unit's revenue, will be blended into

TFI's existing truckload operations while the main LTL segment,

including 147 terminals and 50 leased sites, will operate on its

own.

The transition will be smoothed by a provision allowing the

business to continue using UPS's domestic package network for five

years to fulfill shipments.

"We have acquired and integrated more than 90 companies since

2008, which has helped us grow considerably," Mr. Bédard said. "We

allow more than 80 companies to operate as independent business

units under the TFI International umbrella with a high degree of

autonomy. This approach is perfectly suited for capitalizing on UPS

Freight's existing strength and allowing us to improve its margin

over time."

Analysts applauded the move and TFI's shares surged more than

40% in the two days after the transaction was announced.

The deal fits with TFI's "prior strategy to find a business

that's not performing as it should and bring the margins up to par

with the rest of its business," Credit Suisse Group AG analyst

Allison Landry wrote in a Monday research note.

Mr. Bédard said some gains would come from treating the

operation more as a stand-alone business rather than "bundling" the

trucking services with parcel services that generally command

higher prices, as UPS had been doing. "LTL was like a loss leader"

for UPS, he said.

"We'll be talking to customers over time" about new contract

terms, Mr. Bédard said. "It will take time. It's not going to

happen within six months. It will take probably 12 to 18 months for

us to start correcting."

"There's some customers that maybe don't fit the company today,"

he said. "And then those guys will have to go out or pay what

is...normal."

Fleet upgrades will come over the next year and help the company

reduce operating costs by replacing about 1,000 trucks. "Trucks

will be our priority No. 1 because of the fuel economy, because of

the huge maintenance cost, because of safety on the truck," Mr.

Bédard said.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

January 26, 2021 16:39 ET (21:39 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

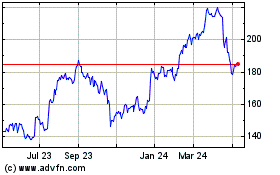

TFI (TSX:TFII)

Historical Stock Chart

From Mar 2024 to Apr 2024

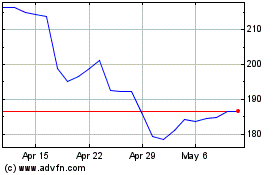

TFI (TSX:TFII)

Historical Stock Chart

From Apr 2023 to Apr 2024