UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the six-month period ended September 30, 2020

HAPPINESS

BIOTECH GROUP LIMITED

(Exact

name of registrant as specified in its charter)

No.

11, Dongjiao East Road, Shuangxi, Shunchang, Nanping City

Fujian

Province, People’s Republic of China

+86-0599-782-8808

(Address

of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form40-F.

Form

20-F ☒ Form40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

FORWARD

LOOKING STATEMENT

This

Report of Foreign Private Issuer on Form 6-K filed by Happiness Biotech Group Limited (together with our subsidiaries, unless

the context indicates otherwise, “we,” “us,” “our,” or the “Company”), contains

forward-looking statements within the meaning of the Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. These statements relate to future events or the Company’s future financial

performance. The Company has attempted to identify forward-looking statements by terminology including “anticipates,”

“believes,” “expects,” “can,” “continue,” “could,” “estimates,”

“intends,” “may,” “plans,” “potential,” “predict,” “should”

or “will” or the negative of these terms or other comparable terminology. These statements are only predictions, uncertainties

and other factors may cause the Company’s actual results, levels of activity, performance or achievements to be materially

different from any future results, levels or activity, performance or achievements expressed or implied by these forward-looking

statements. The information in this Report on Form 6-K is not intended to project future performance of the Company. Although

the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company does not guarantee

future results, levels of activity, performance or achievements. The Company expectations are as of the date this Form 6-K is

filed, and the Company does not intend to update any of the forward-looking statements after the date this Report on Form 6-K

is filed to confirm these statements to actual results, unless required by law.

Recent

Development

Registered

Direct Offering

The Company entered into certain securities

purchase agreement on January 4, 2021, and the Company anticipates to enter into additional securities purchase agreements (the

“Purchase Agreements”) relating to the sale of up to 4,200,00 ordinary shares in a registered direct offering

(the “RD Offering”). The RD Offering shall expire on July 4, 2021. Pursuant to the Purchase Agreements, the

ordinary shares shall be sold at a price per share equal to the volume-weighted average trading price of the ordinary shares for

the consecutive five (5) trading days immediately prior to the date when the Company sends a notice to purchase to the purchasers

(each date, a “Pricing Date” ).

The

first Pricing Date was January 4, 2020. The Company agreed to sell 860,214 ordinary shares at a per share purchase price of $1.86

which is the volume-weighted average trading price of the ordinary shares for the consecutive five (5) Trading Days immediately

prior to the first Pricing Date. Assuming that the Company sells all of the 4,200,000 Ordinary Shares at $1.86 per share, the

gross proceeds of this Offering will be $7,812,000 before deducting the offering expenses.

Each

closing of the Offering will occur on the second business day following each Pricing Date.

The

Company currently intends to use the net proceeds from the Offering for developing its e-commerce business carried out by its

wholly-owned subsidiary in China, Happy Buy (Fujian) Internet Technology Co., Limited, and for working capital and capital expenditure

purposes.

The

sale and offering of the Shares pursuant to the Purchase Agreement was effected as a takedown off the Company’s shelf registration

statement on Form F-3, as amended (File No. 333-250026), which became effective on November 23, 2020.

Private

Placement

On September

22, 2020, the Company announced the closing of one private placement of 900,000 ordinary shares, US$0.0005 par value per share

at an offering price of $2.50 per share, for a total of $2,250,000 in gross proceeds. The Company raised total net proceeds of

$2,227,877after deducting offering expenses.

New

Subsidiaries

Happy

Buy (Fujian) Internet Technology Co., Limited (“Happy Buy”) was incorporated on July 16, 2020, which is a wholly owned

subsidiary of Happiness (Nanping) Biotech Co., Limited. Happy Buy will focus on further developing our e-commerce business.

Fujian

Happiness Medical Equipment Co. Ltd a 51% subsidiary of Fujian Happiness Biotech Co., Limited, which specialized in the sale of

facial mask, was set up on April 15, 2020.

Hangzhou

C'est La Vie Interactive Technology Co., Ltd. a 51% subsidiary of Happy Buy, which specialized in the monetization and integration

of new media e-commerce and supply chain, was set up on August 26, 2020.

Results

of Operations

The

following information is derived from our Unaudited Financial Results for the Six Months Ended September 30, 2020 and 2019, attached

hereto as Exhibit 99.1.

HAPPINESS

BIOTECH GROUP LIMITED

CONSOLIDATED

STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

FOR

THE SIX MONTHS ENDED SEPTEMBER 30, 2020 AND 2019

(UNAUDITED)

(IN

U.S. DOLLARS)

|

|

|

For the six months ended September 30,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

Revenues

|

|

|

21,877,234

|

|

|

|

31,357,546

|

|

|

Cost of revenues

|

|

|

(12,299,331

|

)

|

|

|

(15,532,065

|

)

|

|

Gross profit

|

|

|

9,577,903

|

|

|

|

15,825,481

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Selling and marketing

|

|

|

3,699,676

|

|

|

|

3,593,053

|

|

|

General and administrative

|

|

|

1,441,736

|

|

|

|

1,275,679

|

|

|

Research and development

|

|

|

746,898

|

|

|

|

1,134,505

|

|

|

Total operating expenses

|

|

|

5,888,310

|

|

|

|

6,003,237

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

3,689,593

|

|

|

|

9,822,244

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expenses):

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

67,511

|

|

|

|

29,841

|

|

|

Interest expense

|

|

|

(58,154

|

)

|

|

|

(42,886

|

)

|

|

Other income

|

|

|

210,023

|

|

|

|

95,252

|

|

|

Total other income

|

|

|

219,380

|

|

|

|

82,207

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

3,908,973

|

|

|

|

9,904,451

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax provision

|

|

|

(722,858

|

)

|

|

|

(1,481,154

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

3,186,115

|

|

|

$

|

8,423,297

|

|

|

Less: net income attributable to noncontrolling interests

|

|

|

(1,812

|

)

|

|

|

-

|

|

|

Net income attributable to Happiness Biotech Group Limited

|

|

|

3,184,303

|

|

|

|

8,423,297

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss):

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment

|

|

|

3,015,157

|

|

|

|

(3,099,751

|

)

|

|

Comprehensive income

|

|

$

|

6,201,272

|

|

|

$

|

5,323,546

|

|

|

Less: comprehensive income attributable to noncontrolling interest:

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

(1,812

|

)

|

|

|

-

|

|

|

Foreign currency translation adjustments

|

|

|

(5,166

|

)

|

|

|

-

|

|

|

Comprehensive income attributable to Happiness Biotech Group Limited

|

|

|

6,194,294

|

|

|

|

5,323,546

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted earnings per ordinary share

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

$

|

0.13

|

|

|

$

|

0.37

|

|

|

Weighted average number of ordinary shares outstanding

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

25,039,560

|

|

|

|

23,000,000

|

|

Revenues

We

generated revenues primarily from manufacture and sales of nutraceutical and dietary supplements made of Lucidum spore powder

and others. As of September 30, 2020, we marketed and sold approximately 32 kinds of nutraceutical and dietary supplements products

with “Blue Caps” approved by State Food and Drug Administration of PRC (“SFDA”) encompassing over 200

distributors in 27 different provinces and 30 experience stores in China. Revenues decreased by $9,480,312 or 30.2%, to $21,877,234

for the six months ended September 30, 2020 from $31,357,546 for the six months ended September 30, 2019. The decrease was primarily

attributed to sales drop of Cordyceps mycelia products, Ejiao solution products, Vitamins and dietary supplements products, and

American ginseng products, due to declining retail market, heavier competition and lower pricing in traditional nutrition products

market.

Cost

of Revenue

Cost of revenue decreased by $3,232,734 or 20.8%, from $15,532,065

for the six months ended September 30, 2019 to $12,299,331 for the six months ended September 30, 2020. Gross margin is also lower

by 6.7% for six months period ended September 30, 2020 compared to that for the six months period ended September 30, 2019; amounted

to be 43.8% and 50.5% for the six months ended September 30, 2020 and 2019, respectively.

Selling

and Marketing Expenses

The

selling expenses increased by $106,623, or 3.0%, from $3,593,053 for the six months ended September 30, 2019 to $3,699,676 for

the six months ended September 30, 2020, The slight increase was primarily due to more subsidy to experience stores for the six

months ended September 30, 2020.

General

and Administrative Expenses

The general and administrative expenses increased from $1,275,679

for the six months ended September 30, 2019 to $1,441,736 for the six months ended September 30, 2020, representing a slight increase

of $166,057, or 13.0%. The increase was primarily due to expenses of our Cayman entity, mainly consisting of professional service

charges and repayment to related parties.

Research

and Development Expenses

The research and development expenses decreased from $1,134,505

for the six months ended September 30, 2019 to $746,898 for the six months ended September 30, 2020, representing a decrease of

$387,606, or 34.2%. The decrease was primarily due to an absence of all research staff because of the travel restrictions during

COVID-19 pandemic and volatile supply of research raw materials.

Income

from Operations

The income from operations decreased from $9,822,244 for the

six months ended September 30, 2019 to $3,689,593 for the six months ended September 30, 2020, representing a decrease of $6,132,651,

or 62.4%. The decrease was primarily due to decrease in revenue as a result of sluggish retail market for the six months ended

September 30, 2020.

Income

Tax

We

incurred income tax expense of $722,858 for the six months ended September 30, 2020, representing a decrease of $758,296 or 51.2%,

compared to $1,481,154 for the six months ended September 30, 2019. Our effective income tax rate for the six months ended September

30, 2020 was 18.5%.

Net

income

As

a result of the foregoing, net income for the six months ended September 30, 2020 was $3,186,115 representing a decrease of $5,237,182,

or 62.2% from $8,423,297 for the six months ended September 30, 2019. Net margin was 14.6% for the six months ended September

30. 2020 and 26.9% for the six months ended September 30, 2019, respectively.

Liquidity

and Capital Resources

As

of September 30, 2020, and March 31, 2020, we had cash and cash equivalents of $43,803,330 and $33,654,765, respectively. We did

not have any other short-term investments.

As

of September 30, 2020, and March 31, 2020, our current assets were $75,415,297 and $69,984,749, respectively, and our current

liabilities were $5,883,956 and $5,507,484, respectively.

Net cash provided

by operations for the six months ended September 30, 2020 was $8,638,467 and net cash provided by operations for the six months

ended September 30, 2019 was $8,943,354.

HAPPINESS

BIOTECH GROUP LIMITED

CONSOLIDATED

BALANCE SHEETS

AS

OF SEPTEMBER 30, 2020, AND MARCH 31, 2020

(UNAUDITED)

(IN

U.S. DOLLARS)

|

|

|

As of

September 30,

|

|

|

As of

March 31,

|

|

|

|

|

2020

|

|

|

2020

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

43,803,330

|

|

|

$

|

33,654,765

|

|

|

Accounts receivable

|

|

|

21,804,902

|

|

|

|

30,036,448

|

|

|

Other receivables

|

|

|

246,300

|

|

|

|

-

|

|

|

Inventories

|

|

|

2,126,986

|

|

|

|

2,029,406

|

|

|

Prepaid expenses and other current assets

|

|

|

7,433,779

|

|

|

|

4,264,130

|

|

|

Total current assets

|

|

|

75,415,297

|

|

|

|

69,984,749

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net

|

|

|

9,074,646

|

|

|

|

7,896,501

|

|

|

Land use rights, net

|

|

|

740,712

|

|

|

|

719,722

|

|

|

Other assets

|

|

|

8,333,614

|

|

|

|

6,496,501

|

|

|

TOTAL ASSETS

|

|

$

|

93,564,269

|

|

|

$

|

85,097,473

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

1,515,826

|

|

|

$

|

1,549,255

|

|

|

Other payables and accrued liabilities

|

|

|

1,120,301

|

|

|

|

512,249

|

|

|

Due to related parties

|

|

|

-

|

|

|

|

844,716

|

|

|

Income tax payable

|

|

|

886,032

|

|

|

|

568,830

|

|

|

Short-term bank borrowings

|

|

|

2,361,798

|

|

|

|

2,032,434

|

|

|

TOTAL LIABILITIES

|

|

|

5,883,957

|

|

|

|

5,507,484

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Ordinary shares, $0.0005 par value, 100,000,000 shares authorized, 25,900,000 and 25,000,000 shares issued and outstanding, respectively

|

|

|

12,950

|

|

|

|

12,500

|

|

|

Preferred shares, $0.0005 par value, 10,000,000 shares authorized, 0 shares issued and outstanding

|

|

|

-

|

|

|

|

-

|

|

|

Additional paid-in capital

|

|

|

17,271,429

|

|

|

|

15,044,002

|

|

|

Statutory surplus reserve

|

|

|

2,064,096

|

|

|

|

2,064,096

|

|

|

Retained earnings

|

|

|

69,432,507

|

|

|

|

66,623,204

|

|

|

Accumulated other comprehensive loss

|

|

|

(1,143,822

|

)

|

|

|

(4,153,813

|

)

|

|

Total Happiness Biotech Group Limited Shareholders’ Equity

|

|

|

87,637,160

|

|

|

|

79,589,989

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interests

|

|

|

43,152

|

|

|

|

-

|

|

|

TOTAL SHAREHOLDERS’ EQUITY

|

|

|

87,680,312

|

|

|

|

79,589,989

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

$

|

93,564,269

|

|

|

$

|

85,097,473

|

|

Cash

Flows Summary

|

|

|

For the Six Months Ended

September 30,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

Net cash provided by operating activities

|

|

$

|

8,638,467

|

|

|

$

|

8,943,354

|

|

|

Net cash used in investing activities

|

|

|

(1,231,874

|

)

|

|

|

(61,831

|

)

|

|

Net cash provided by financing activities

|

|

|

1,204,769

|

|

|

|

1,068,659

|

|

|

Effect of exchange rate changes on cash

|

|

|

1,537,203

|

|

|

|

(918,906

|

)

|

|

Net increase in cash

|

|

$

|

10,148,565

|

|

|

$

|

9,031,276

|

|

Operating

activities

Net

cash provided by operating activities was approximately $8.6 million for the six months ended September 30, 2020, as compared

to approximately $8.9 million for the six months ended September 30, 2019.

Net

cash provided by operating activities for the six months ended September 30, 2020 was mainly due to the increase of prepaid expenses

and other assets of approximately $2.9 million and $1.6 million respectively, offset by decrease of account receivable of approximately

$9.2 million and increase of other payable and accrued liabilities of approximately $0.4 million.

Investing

activities

Net

cash used in investing activities was approximately $1.2 million for the six months ended September 30, 2020, as compared to approximately

$0.06 million for the six months ended September 30, 2019, due to purchases of equipment for the new subsidiaries.

Financing

activities

Net

cash used in financing activities was approximately $1.2 million for the six months ended September 30, 2020, as compared to approximately

$1.1 million for the six months ended September 30, 2019.

Net

cash used in financing activities for the six months ended September 30, 2020 was mainly due to repayment to related parties of

approximately $0.8 million, offset by an approximately $2.1 million capital contribution from issue of new shares.

Statement

Regarding Unaudited Financial Information

The

unaudited financial information set forth above is subject to adjustments that may be identified when audit work is performed

on the Company’s year-end financial statements, which could result in significant differences from this unaudited financial

information.

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

|

|

Happiness

Biotech Group Limited

|

|

|

|

|

|

Date:

January 22, 2021

|

By:

|

/s/

Xuezhu Wang

|

|

|

|

Xuezhu

Wang

Chief

Executive Officer

|

7

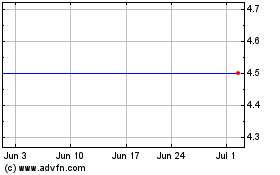

Happiness Development (NASDAQ:HAPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Happiness Development (NASDAQ:HAPP)

Historical Stock Chart

From Apr 2023 to Apr 2024