Current Report Filing (8-k)

January 21 2021 - 4:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities and Exchange Act

of 1934

Date of Report (Date of earliest event reported): January 14,

2021

VISIUM TECHNOLOGIES, INC.

(Exact name of Registrant as specified in its charter)

|

Florida

|

|

000-25753

|

|

87-04496677

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

4094 Majestic Lane, Suite 360

Fairfax, Virginia 22033

(Address of principal executive offices, including zip

code)

(703) 273-0383

(Registrant’s telephone number, including area

code)

Check

the appropriate box below if the 8-K filing is intended to

simultaneously satisfy the filing obligations of the registrant

under any of the following provisions:

|

☐

|

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c)).

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging

growth company ☐

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01

Entry into a Material Definitive Agreement

Securities Purchase Agreement and Promissory Note.

On January 12, 2021, Visium Technologies, Inc. a Florida

corporation (the “Company”), entered into that certain

Securities Purchase Agreement (the “Purchase

Agreement”) with Labrys Fund, LP, a Delaware limited

partnership (the “Investor”) pursuant to which the

Investor purchased a promissory note made by the Company in favor

of the Investor (the “Note”) in the principal amount of

$200,000 (the “Principal Amount”) for a purchase price

of $190,000 (the “Purchase Price”). Pursuant to the

Purchase Agreement, the Company issued to the Investor a warrant to

purchase 22,172,949 shares of the Company’s common stock (the

“Warrant”) as a condition to closing. The closing of

the Purchase Agreement occurred on January 14, 2021, with the

Purchase Price funded to the Company on such date.

The Note, which reflects a $10,000 original issuance discount,

bears interest at 8% per year and matures on January 12, 2022 (the

“Maturity Date”). The Note includes an interim payment

of $26,000, payable to the Investor on July 12, 2021. The Company

has the right to prepay the Note in full, including accrued but

unpaid interest, without prepayment penalty provided an event of

default, as defined therein, has not occurred. The Note is

convertible into shares of the Company’s common stock at

conversion price of $0.005 per share, subject to adjustment as

provided therein.

The Warrant is exercisable for a term of two-years from the date of

issuance, at an exercise price equal to 110% of the closing price

of the Company’s common stock on the date of issuance,

subject to adjustment as provided therein. The Warrants provide for

cashless exercise to the extent that the market price (as defined

therein) of one share of the Company’s common stock is

greater than the exercise price of the Warrant.

The foregoing descriptions of the Purchase Agreement, the Note and

the Warrant do not purport to be complete and are qualified in

their entirety by reference to the full text of the Purchase

Agreement, the Note and the Warrant, copies of the forms of which

are filed as Exhibits 10.1, 4.1 and 4.2, respectively, to this

Current Report on Form 8-K and incorporated by reference

herein.

Item 2.03. Creation of a Direct Financial

Obligation or an Obligation under an Off-Balance Sheet Arrangement

of a Registrant.

The information provided above in Item 1.01 herein is incorporated

by reference into this Item 2.03.

Item 3.02. Unregistered Sales of Equity Securities

The applicable information set forth in Item 1.01 of this Current

Report on Form 8-K is incorporated by reference in this Item 3.02.

The issuance of the securities set forth herein was made in

reliance on the exemption provided by Section 4(a)(2) of the

Securities Act for the offer and sale of securities not involving a

public offering. The Company’s reliance upon Section 4(a)(2)

of the Securities Act in issuing the securities was based upon the

following factors: (a) the issuance of the Shares was an isolated

private transaction by us which did not involve a public offering;

(b) there was only one recipient; (c) there were no subsequent or

contemporaneous public offerings of the Shares by the Company; (d)

the Shares were not broken down into smaller denominations; (e) the

negotiations for the issuance of the Shares took place directly

between the individual and the Company; and (f) the recipient of

the Shares is an accredited investor.

Item 9.01. Financial Statements and

Exhibits.

|

|

Description:

|

|

4.1

|

Form of Unsecured

Promissory Note issued on January 12, 2021, by Visium Technologies,

Inc.

|

|

4.2

|

Form of Warrant

issued on January 12, 2021, by Visium Technologies,

Inc.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

VISIUM

TECHNOLOGIES, INC.

|

|

|

|

|

Date:

January 21, 2021

|

By:

|

/s/ Mark

Lucky

|

|

|

|

Mark

Lucky

|

|

|

|

Chief

Executive Officer

|

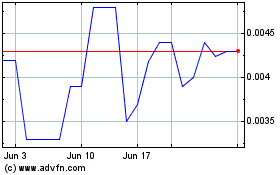

Visium Technologies (PK) (USOTC:VISM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Visium Technologies (PK) (USOTC:VISM)

Historical Stock Chart

From Apr 2023 to Apr 2024