424B3

PROSPECTUS SUPPLEMENT

|

Direct Public Offering of 4,473,940 Shares

|

Pursuant to Rule 424(b)(3)

|

|

of Common Stock – Terminated as of August 17, 2020

|

Registration Number 333-238974

|

|

|

|

|

3,775,163 Shares of Common Stock as part

Of a Secondary Offering by Selling Shareholders

|

|

Cannabis Global, Inc.

This prospectus relates to the resale of 4,473,940

shares of our common stock in a direct public offering, par value $0.001 per share, and, 3,775,163 Shares of Common Stock as part

of a Secondary Offering by Selling Shareholders.

This prospectus relates to the registration

of 8,249,103 shares of common stock in Cannabis Global, Inc., a Nevada corporation (referred to herein as the “Company,”

“we,” “our,” “us,” or other similar pronouns). The Company is registering 4,473,940 shares

of common stock at $0.49 per share in a direct public offering (“Direct Offering”). In addition, the Company is registering

3,775,163 shares of common stock currently held by our “Selling Shareholders,” or individually, “Selling Shareholder.”

The Selling Security Holders will sell the shares of common stock at the fixed price of $0.49 per share until such time, if ever,

that the common stock is quoted on the OTC Bulletin Board, the OTCQX, the OCTQB or listed on a securities exchange.

Our shares of common stock subject to the

Direct Offering and Selling Shareholders are referred to herein collectively as our “Shares.” We estimate our

total offering registration costs to be approximately $524.66 and our legal and auditor related fees will be $6,000 equaling

at total expense to the Company of $6,524.66 relating to the registration, which will be paid from existing corporate funds,

thus not affecting the proceeds of this offering. There is no minimum number of shares that must be sold by us for the

offering to proceed. The Company will retain any proceeds from the Direct Offering, while the Selling Shareholders will

retain the proceeds from the Resale. The Selling Shareholders are deemed to be statutory underwriters under Section 2(a)(11)

of the Securities Act of 1933 (“Securities Act”).

The selling stockholders will sell the shares

of common stock at the fixed price of $0.49 per share until such time, if ever, that the common stock is quoted on the OTC Bulletin

Board, the OTCQX or listed on a securities exchange . Discounts, concessions, commissions and similar selling expenses attributable

to the sale of common stock covered by this prospectus will be borne by the selling stockholders. We will pay all expenses (other

than discounts, concessions, commissions and similar selling expenses) relating to the registration of the common stock with the

Securities and Exchange Commission.

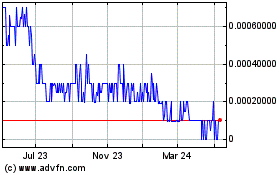

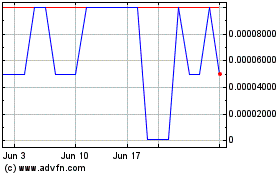

Our Common Stock is currently quoted on the

OTC Markets Pink under the symbol “CBGL”. On January 19, 2021 the closing price as reported was $0.20 per share. This

price will fluctuate based on the demand for our Common Stock.

Investing in our common stock involves risks.

See “Risk Factors” beginning on page 4.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful

or complete. Any representation to the contrary is a criminal offense.

No dealer, salesperson or any other person

is authorized to give any information or make any representations in connection with this offering other than those contained in

this Prospectus and, if given or made, the information or representations must not be relied upon as having been authorized by

us. This Prospectus does not constitute an offer to sell or a solicitation of an offer to buy any security other than the securities

offered by this Prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any jurisdiction

in which the offer or solicitation is not authorized or is unlawful.

The date of this Prospectus is January 20, 2021

TABLE OF CONTENTS

|

|

Page

|

|

Prospectus Summary

|

1

|

|

The Offering

|

1

|

|

Risk Factors

|

4

|

|

Use of Proceeds

|

17

|

|

Selling Security Holders

|

18

|

|

Plan of Distribution; Terms of the Offering

|

19

|

|

Dilution

|

21

|

|

Description of Property

|

22

|

|

Description of Securities

|

22

|

|

Description of Our Business

|

24

|

|

Management’s Discussion and Analysis

|

36

|

|

Directors, Executive Officers, Promoters and Control Persons

|

42

|

|

Executive Compensation

|

45

|

|

Security Ownership of Certain Beneficial Owners and Management

|

48

|

|

Certain Relationships and Related Transactions

|

49

|

|

Legal Matters

|

50

|

|

Experts

|

50

|

|

Where you can find more Information

|

51

|

|

Index to Financial Statements

|

F-1

|

You should rely only on the information

contained or incorporated by reference to this prospectus in deciding whether to purchase our common stock. We have

not authorized anyone to provide you with information different from that contained or incorporated by reference to this prospectus.

Under no circumstances should the delivery to you of this prospectus or any sale made pursuant to this prospectus create any implication

that the information contained in this prospectus is correct as of any time after the date of this prospectus. To the extent that

any facts or events arising after the date of this prospectus, individually or in the aggregate, represent a fundamental change

in the information presented in this prospectus, this prospectus will be updated to the extent required by law.

PROSPECTUS SUMMARY

The following summary highlights material information contained

in this Prospectus. This summary does not contain all of the information you should consider before investing in the securities.

Before making an investment decision, you should read the entire Prospectus carefully, including the risk factors section, the

financial statements and the notes to the financial statements. You should also review the other available information referred

to in the section entitled “Where You Can Find More Information” in this Prospectus and any amendment or supplement

hereto.

Our Business and Corporate History

We are a research and development company primarily focused on entering

a wide array of hemp and related market sectors. Our primary objective is to create and commercialize engineered technologies delivering

hemp extracts and cannabinoids to the human body. We have recently expanded our focus to include middle portions of the hemp value

chain, including the licensing of our core technologies to manufacturers of hemp and related products.

We have an active research & development program focused on

developing technologies to be utilized to develop consumer products, based on these and other technologies.

Our R&D programs included the following;

|

|

1)

|

Development of new routes and vehicles for hemp extract and cannabinoid delivery to the human body.

|

|

|

2)

|

Production of unique polymeric nanoparticles and fibers for use in oral and dermal cannabinoid delivery.

|

|

|

3)

|

Research and commercialization of new methodologies to isolate and/or concentrate various cannabinoids and other substances that comprise industrial hemp oil and other extracts.

|

|

|

4)

|

Establishment of new methods to increase the bioavailability of cannabinoids to the human body through utilization of proven bioenhancers, including d-α-Tocopherol polyethylene glycol 1000 succinate (TPGS), which is widely used as a water-soluble vitamin E formulation and polymeric nanoparticles.

|

|

|

5)

|

Development of other novel inventions for the delivery of cannabinoids to the human body, which at this time are considered trade secrets by the Company.

|

Our principal executive office is located at

520 S Grand Avenue, Suite 320, Los Angeles, California 90071. Our telephone number is (310) 986-4929 and our website is www.cannabisglobalinc.com.

Unless expressly noted, none of the information on our website is part of this Prospectus or any Prospectus Supplement. Our shares

of Common Stock are quoted on the OTC Markets Pink tier, operated by OTC Markets Group, Inc., under the ticker symbol “CBGL.”

The following summary highlights material information

contained in this Prospectus. This summary does not contain all of the information you should consider before investing in the

securities. Before making an investment decision, you should read the entire Prospectus carefully, including the risk factors section,

the financial statements and the notes to the financial statements. You should also review the other available information referred

to in the section entitled “Where You Can Find More Information” in this Prospectus and any amendment or supplement

hereto.

Our Business and Corporate History

We are a research and development company primarily

focused on entering a wide array of cannabis, hemp and related market sectors. Our primary objective is to create and commercialize

engineered technologies delivering hemp extracts and cannabinoids to the human body. We have recently expanded our focus to include

middle portions of the hemp value chain, including the licensing of our core technologies to manufacturers of hemp and hemp-related

products. We also invest, or provide managerial services, in specialized areas of the regulated hemp and cannabis industries.

We incorporated in Nevada in 2005 under the

name MultiChannel Technologies Corporation, a wholly owned subsidiary of Octillion Corporation, a development stage technology

company focused on the identification, acquisition and development of emerging solar energy and solar related technologies, and

related products having the potential for commercialization. In April, 2005, we changed our name to MicroChannel Technologies,

Inc., and in June, 2008, began trading on the OTC Markets under the trading symbol “MCTC.” Our business focused on

research and development of a patented combination of physical, chemical and biological cues at the “cellular” level

to facilitate peripheral nerve regeneration.

In August, 2011, we ceased operations and attempted

to identify, locate, and if warranted, acquire new commercial opportunities. On June 27, 2018, we changed domiciles from the State

of Nevada to the State of Delaware and thereafter reorganized under the Delaware Holding Company Statute (Delaware General Corporation

Law Section 251(g). On or about July 12, 2018, we formed two subsidiaries for the purpose of effecting the reorganization. We incorporated

MCTC Holdings, Inc. and MCTC Holdings Inc. incorporated MicroChannel Corp. We then effected a merger involving the three constituent

entities, and under the terms of the merger we were merged into MicroChannel Corp., with MicroChannel Corp. surviving and our separate

corporate existence ceasing. Following the merger, MCTC Holdings, Inc. became the surviving publicly traded issuer and all of our

assets and liabilities were merged into MCTC Holdings, Inc.’s wholly owned subsidiary MicroChannel Corp. Our shareholders

became the shareholders of MCTC Holdings, Inc. on a one for one basis.

On May 25, 2019, Lauderdale Holdings, LLC,

a Florida limited liability company, and beneficial owner 70.7% of our issued and outstanding common stock, sold 130,000,000 common

shares, to Mr. Robert Hymers, Mr. Edward Manolos and Mr. Dan Nguyen, all of whom were previously unaffiliated parties of the Company.

Each individual purchased 43,333,333 common shares for $108,333,333 or an aggregate of $325,000. These series of transactions constituted

a change in control.

On August 9, 2019, the Company filed a DBA

in California registering the operating name Cannabis Global. On July 1, 2019, the Company entered into a 100% business acquisition

with Action Nutraceuticals, Inc., a company owned by our CEO, Arman Tabatabaei in exchange for $1,000.

On February 20, 2020, the Company entered into

a material definitive agreement with Lelantos Biotech, Inc., a Wyoming corporation (“Lelantos”), and its owners Ma

Helen M. Am Is, Inc., a Wyoming corporation (“Helen M.”), East West Pharma Group, Inc., a Wyoming corporation (“East

West”), and New Horizons Laboratory Services, Inc., a Wyoming corporation (“New Horizons”). In exchange for intellectual

properties owned by Lelantos, the Company agreed to issue 400,000 shares of common stock and convertible promissory notes to Lelantos

and its owners. On June 15, 2020, the Company and Lelantos entered into a modification agreement cancelling the Company's obligation

to issue 400,000 shares of common stock and the convertible promissory notes. The Company and Lelantos agreed to a purchase price

of five hundred thousand dollars ($500,000), payable by the issuance of a promissory note. The aggregate unpaid principal amount

of the note is paid in monthly payments of seven thousand, five hundred dollars ($7,500) beginning on September 1, 2020, terminating

on February 1, 2025. There is no interest on the note or on the unpaid balance.

On March 30, 2020, we completed a redomicile

from Delaware to Nevada, and changed the Company’s name to Cannabis Global, Inc. and concurrently its trading symbol to “CBGL.”

On May 6, 2020, the Company signed a joint

venture agreement with RxLeaf, Inc. (“RxLeaf”) a Delaware corporation, creating a joint venture for the purpose of

marketing the Company’s products to consumers. Under the terms of the agreement, the Company will produce products, which

will be sold by RX Leaf via its digital marketing assets. The Company agreed to share the profits from the joint venture on a 50/50

basis.

On July 22, 2020, we signed a management agreement

with Whisper Weed, Inc., a California corporation (“Whisper Weed”). Edward Manolos, a director of the Company, is a

shareholder in Whisper Weed (see “Related Party Transactions”). Whisper Weed conducts licensed delivery activity of

cannabis products in California. The material definitive agreement requires the parties to create a separate entity, CGI Whisper

W, Inc. in California as a wholly owned subsidiary of the Company. The business of CGI Whisper W, Inc. will be to provide management

services for the lawful delivery of cannabis in the State of California. The Company will manage CGI Whisper W, Inc. operations.

In exchange for the Company providing management services to Whisper Weed through the auspices of CGI Whisper W, Inc., the Company

will receive as consideration a quarterly fee of 51% of the net profits earned by Whisper Weed. As separate consideration for the

transaction, the Company agreed to issue to Whisper Weed $150,000 in the Company’s restricted common stock, valued for purposes

of issuance based on the average closing price of the Company’s common stock for the twenty days preceding the entry into

the material definitive agreement. Additionally, the Company agreed to amend its articles of incorporation to designate a new class

of preferred shares. The preferred class shall be designated and issued to Whisper Weed in an amount equal to two times the quarterly

payment made to the Company. The preferred shares shall be convertible into the Company’s common stock after 6 months, and

shall be senior to other debts of the Company. The conversion to common stock will be based on a value of common stock equal to

at least two times the actual sales for the previous 90 day period The Company agreed to include in the designation the obligation

to make a single dividend payment to Whisper Weed equal to 90% of the initial quarterly net profits payable by Whisper Weed. As

of November 30, 2020, the Company has not issued the common or preferred shares.

On August 31, 2020, we entered into a stock

purchase agreement with Robert L. Hymers III (“Hymers”). Pursuant to the Stock Purchase Agreement, the Company purchased

from Hymers 266,667 shares of common stock of Natural Plant Extract of California Inc., a private California corporation (“NPE”),

in exchange for $2,040,000. The purchased shares of common stock represents 18.8% of the outstanding capital stock of NPE on a

fully diluted basis. NPE operates a licensed psychoactive cannabis manufacturing and distribution business operation in Lynwood,

California. In connection with the stock purchase agreement, the Company became a party to a Shareholders Agreement, dated June

5, 2020, by and among Alan Tsai, Hymers, Betterworld Ventures, LLC, Marijuana Company of America, Inc. and NPE. The Shareholders

Agreement contains customary rights and obligations, including restrictions on the transfer of the Shares.

On September 30, 2020, the Company entered

into a securities exchange agreement with Marijuana Company of America, Inc., a Utah corporation (“MCOA”). By virtue

of the agreement, the Company issued 7,222,222 shares of its unregistered common stock to MCOA in exchange for 650,000,000 shares

of MCOA unregistered common stock. The Company and MCOA also entered into a lock up leak out agreement which prevents either party

from sales of the exchanged shares for a period of 12 months. Thereafter the parties may sell not more than the quantity of shares

equaling an aggregate maximum sale value of $20,000 per week, or $80,000 per month until all Shares and Exchange Shares are sold.

On December 1, 2020, the Company entered into

a Securities Purchase Agreement in connection with the issuance of an 8% convertible note with the principal amount of $33,500,

with an accredited investor. The note is convertible any time after 180 days of issuance at a variable conversion price of 63%

of the Market Price at time of conversion. Market Price is defined as the average of the two lowest trading prices during the fifteen

(15) days prior to conversion. The Company received net cash proceeds of $30,000.

On January 3, 2021, we entered into a settlement

agreement with Robert L. Hymers, III (“Hymers”) concerning five delinquent payments totaling $100,000 due under the

stock purchase agreement whereby the Company purchased 266,667 shares of common stock of Natural Plant Extract of California Inc.,

a California corporation (“NPE”), The Company was required to make $20,000 monthly for a period of twenty-seven (27)

months to Hymers, with the first payment commencing September 1, 2020 and the remaining payments due and payable on the first day

of each subsequent month until Hymers received $540,000. On January 3, 2021, we entered into a settlement concerning the outstanding

payments by agreeing to issue to Hymers a total of 1,585,791 shares of registered common stock from our S-1 registration statement

made effective November 12, 2020.

On January 5, 2021, the Company entered into

a Securities Purchase Agreement in connection with the issuance of an 10% convertible note with the principal amount of $110,000,

with an accredited investor. The note is convertible at a fixed conversion price of $0.05. In the event of default by the Company,

or after the public announcement of a change of control transaction as defined in the agreement, the conversion price is $0.01.

The Company received net proceeds of $97,500.

On January 12, 2021, the Company entered into

a Securities Purchase Agreement in connection with the issuance of an 10% convertible note with the principal amount of $115,500,

with an accredited investor. The note is convertible beginning 61 days from issuance at a fixed conversion price of $0.10 per share

or 60% or the lowest trading price for ten days prior to conversion in the event that the Company’s stock trades at less

than $0.10 per share. The Company received net proceeds of $100,000.

RISK FACTORS

Investing in our Common Stock involves a

high degree of risk. You should carefully consider the risks described below, as well as the other information in this Prospectus,

including our financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations,” before deciding whether to invest in our shares of Common Stock. The occurrence of any of the

events or developments described below could harm our business, financial condition, operating results, and growth prospects. In

such an event, the market price of our shares of Common Stock could decline, and you may lose all or part of your investment. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

There could be unidentified risks involved

with an investment in our securities.

The foregoing risk factors are not a complete

list or explanation of the risks involved with an investment in the securities. Additional risks will likely be experienced that

are not presently foreseen by the Company. Prospective investors must not construe the information provided herein as constituting

investment, legal, tax or other professional advice. Before making any decision to invest in our securities, you should read this

entire prospectus and consult with your own investment, legal, tax and other professional advisors. An investment in our securities

is suitable only for investors who can assume the financial risks of an investment in the Company for an indefinite period of time

and who can afford to lose their entire investment. The Company makes no representations or warranties of any kind with respect

to the likelihood of the success or the business of the Company, the value of our securities, any financial returns that may be

generated or any tax benefits or consequences that may result from an investment in the Company.

RISKS RELATED TO OUR BUSINESS

The novel coronavirus (COVID-19) pandemic

may have unexpected effects on our business, financial condition and results of operations.

In March 2020, the World Health Organization

declared COVID-19 a global pandemic, and governmental authorities around the world have implemented measures to reduce the spread

of COVID-19. These measures have adversely affected workforces, customers, supply chains, consumer sentiment, economies, and financial

markets, and, along with decreased consumer spending, have led to an economic downturn across many global economies.

The COVID-19 pandemic has rapidly escalated

in the United States, creating significant uncertainty and economic disruption, and leading to record levels of unemployment nationally.

Numerous state and local jurisdictions have imposed, and others in the future may impose, shelter-in-place orders, quarantines,

shut-downs of non-essential businesses, and similar government orders and restrictions on their residents to control the spread

of COVID-19. Such orders or restrictions have resulted in temporary facility closures (including certain of our third-party VRCs),

work stoppages, slowdowns and travel restrictions, among other effects, thereby adversely impacting our operations. In addition,

we expect to be impacted by a downturn in the United States economy, which could have an adverse impact on discretionary consumer

spending and may have a significant impact on our business operations and/or our ability to generate revenues and profits.

In response to the COVID-19 disruptions, we

have implemented a number of measures designed to protect the health and safety of our staff and contractors. These measures include

restrictions on non-essential business travel, the institution of work-from-home policies wherever feasible and the implementation

of strategies for workplace safety at our facilities that remain open. We are following the guidance from public health officials

and government agencies, including implementation of enhanced cleaning measures, social distancing guidelines and wearing of masks.

The extent to which COVID-19 ultimately impacts

our business, financial condition and results of operations will depend on future developments, which are highly uncertain and

unpredictable, including new information which may emerge concerning the severity and duration of the COVID-19 outbreak and the

effectiveness of actions taken to contain the COVID-19 outbreak or treat its impact, among others. Additionally, while the extent

to which COVID-19 ultimately impacts our operations will depend on a number of factors, many of which will be outside of our control.

The COVID-19 outbreak is evolving and new information emerges daily; accordingly, the ultimate consequences of the COVID-19 outbreak

cannot be predicted with certainty.

In addition to the COVID-19 disruptions possibility

adversely impacting our business and financial results, they may also have the effect of heightening many of the other risks described

in “Risk Factors,” including risks relating to changes due to our limited operating history; our ability to generate

sufficient revenue, to generate positive cash flow; our relationships with third parties, and many other factors. We will endeavor

to minimize these impacts, but there can be no assurance relative to the potential impacts that may be incurred.

Uncertainty of profitability

Our business strategy may result in meaningful

volatility of revenues, loses and/or earnings. As we will only develop a limited number of business efforts, services and products

at a time, our overall success will depend on a limited number of business initiatives, which may cause variability and unsteady

profits and losses depending on the products and/or services offered and their market acceptance.

Our revenues and our profitability may be adversely

affected by economic conditions and changes in the market for our products. Our business is also subject to general economic risks

that could adversely impact the results of operations and financial condition.

Because of the anticipated nature of the products

that we offer and attempt to develop, it is difficult to accurately forecast revenues and operating results and these items could

fluctuate in the future due to a number of factors. These factors may include, among other things, the following:

|

•

|

|

Our ability to raise sufficient capital to take advantage of opportunities and generate

sufficient revenues to cover expenses.

|

|

•

|

|

Our ability to source strong opportunities with sufficient risk adjusted returns.

|

|

•

|

|

Our ability to manage our capital and liquidity requirements based on changing market

conditions.

|

|

•

|

|

The amount and timing of operating and other costs and expenses.

|

|

•

|

|

The nature and extent of competition from other companies that may reduce market share

and create pressure on pricing and investment return expectations.

|

We have incurred losses since our inception,

have yet to achieve profitable operations and anticipate that we will continue to incur losses for the foreseeable future.

Even if we obtain more customers or increase

sales to our existing customers, there is no guarantee we will be able to generate a profit. Because we are a small company and

have limited capital, we must limit our products and services. Because we will be limiting our marketing activities, we may not

be able to attract enough customers to buy our products to operate profitably.

We do not have sufficient cash on hand.

As of August 31, 2020, we had $2,338 of cash

on hand. Our cash resources are not sufficient for us to execute our business plan. If we do not generate sufficient

cash from our intended financing activities and sales, we will be unable to continue our operations. We estimate that within

the next 12 months we will need approximately $600-840,000 in cash from either investors or operations. While we intend to

engage in future financings, there is no assurance that these will actually occur. Nor can we assure our shareholders that

we will not be required to obtain additional financing on terms that are dilutive of their interests. You should recognize

that if we are unable to generate sufficient revenues or obtain debt or equity financing, we will not be able to earn profits and

may not be able to continue operations.

We may not be able to continue our business

as a going concern.

The Company's financial statements are prepared

using the generally accepted accounting principles applicable to a going concern, which contemplates the realization of assets

and liquidation of liabilities in the normal course of business. However, the Company has accumulated a deficit of $6,056,949 as

of August 31, 2020. Management plans to raise additional capital through the sale of shares of Common Stock to pursue business

development activities, but there are no assurances of success relative to the efforts.

If we are not able to raise enough funds,

we may not be able to successfully develop and market our products and our business may fail.

We do not have any commitments for financing

and we will need additional financing to meet our obligations and to continue our business. Although we plan to raise funds through

our Public Offering, we cannot guarantee that we will be successful in such efforts.

Our business may suffer if we are unable

to attract or retain talented personnel.

Our success will depend in large measure on

the abilities, expertise, judgment, discretion, integrity and good faith of Management, as well as other personnel. We have a small

management team, and the loss of a key individual or our inability to attract suitably qualified replacements or additional staff

could adversely affect our business. Our success also depends on the ability of Management to form and maintain key commercial

relationships within the marketplace. No assurance can be given that key personnel will continue their association or employment

with us or that replacement personnel with comparable skills will be found. If we are unable to attract and retain key personnel

and additional employees, our business may be adversely affected. We do not maintain key-man life insurance on any of our executive

employees.

The loss of key Management personnel

could adversely affect our business.

We depend on the continued services of our

executive officer and senior consulting team as they work closely with independent associate leaders and are responsible for our

day-to-day operations. Our success depends in part on our ability to retain executive officers, to compensate executive officers

at attractive levels, and to continue to attract additional qualified individuals to our management team. Although we have entered

into an employment agreement with our Chief Executive Officer, and do not believe our Chief Executive Officer is planning to leave

or retire in the near term, we cannot assure you that our Chief Executive Officer or senior managers to be hired will remain with

us. The loss or limitation of the services of any of our executives or members of our senior management team, or the inability

to attract additional qualified management personnel, could have a material adverse effect on our business, financial condition,

results of operations, or independent associate relations.

The lack of available and cost-effective

directors and officer’s insurance coverage in our industry may cause us to be unable to attract and retain qualified executives,

and this may result in our inability to further develop our business.

Our business depends on attracting independent

directors, executives and senior management to advance our business plans. We currently do not have directors and officer’s

insurance to protect our directors, officers and the company against the possible third-party claims. This is due to the significant

lack of availability of such policies in the cannabis industry at reasonably competitive prices. As a result, the Company and our

executive directors and officers are susceptible to liability claims arising by third parties, and as a result, we may be unable

to attract and retain qualified independent directors and executive management causing the development of our business plans to

be impeded as a result.

If we fail to maintain satisfactory relationships

with future customers, our business may be harmed.

Due to competition or other factors, we could

lose business from our future customers, either partially or completely. The future loss of one or more of our significant customers

or a substantial future reduction of orders by any of our significant customers could harm our business and results of operations.

Moreover, our customers may vary their order levels significantly from period to period and customers may not continue to place

orders with us in the future at the same levels as in prior periods. In the event that in the future we lose any of our larger

customers, we may not be able to replace that revenue source. This could harm our financial results.

Management of growth will be necessary

for us to be competitive.

Successful expansion of our business will depend

on our ability to effectively attract and manage staff, strategic business relationships, and shareholders. Specifically, we will

need to hire skilled management and technical personnel as well as manage partnerships to navigate shifts in the general economic

environment. Expansion has the potential to place significant strains on financial, management, and operational resources, yet

failure to expand will inhibit our profitability goals.

We cannot guarantee that we will succeed

in achieving our goals, and our failure to do so would have a material adverse effect on our business, prospects, financial condition

and operating results.

Some of business initiatives in the hemp and

cannabis sectors are new and are only in the early stages of commercialization. As is typical in a new and rapidly evolving industry,

demand and market acceptance for recently introduced products and services are subject to a high level of uncertainty and risk.

Because the market for our Company is new and evolving, it is difficult to predict with any certainty the size of this market and

its growth rate, if any. We cannot guarantee that a market for our Company will develop or that demand for our products will emerge

or be sustainable. If the market fails to develop, develops more slowly than expected or becomes saturated with competitors, our

business, financial condition and operating results would be materially adversely affected.

We are attempting to enter into several

new business areas. We plan to address these new business areas with unproven technologies. Our inability to master the technical

details of these new technologies could negatively impact our business.

We are attempting to enter several new areas

of the hemp and cannabis markets, including THC remediation, the production of highly bioavailable cannabis infused drinks and

the production of functional foods based on nanoparticle technologies. These businesses will require extensive technical expertise.

There can be no assurances we will have the capital, personnel resources, or expertise to be successful relative to these advanced

technologies.

Our chosen method for cannabinoid delivery

is controversial with an unproven safety of efficacy.

The safety profile relative to oral consumption

of polymeric or other forms of nanoparticles is unproven. There can be no guarantee of a proven safety profile for any of our emerging

technologies.

We may be unable to respond to the rapid

technological change in the industry and such change may increase costs and competition that may adversely affect our business.

Rapidly changing technologies, frequent new

product and service introductions and evolving industry standards characterize our market. The continued growth of the Internet

and intense competition in our industry exacerbates these market characteristics. Our future success will depend on our ability

to adapt to rapidly changing technologies by continually improving the performance features and reliability of our products and

services. We may experience difficulties that could delay or prevent the successful development, introduction or marketing of our

products and services. In addition, any new enhancements must meet the requirements of our current and prospective customers and

must achieve significant market acceptance. We could also incur substantial costs if we need to modify our products and services

or infrastructures to adapt to these changes. We also expect that new competitors may introduce products or services that are directly

or indirectly competitive with us. These competitors may succeed in developing products and services that have greater functionality

or are less costly than our products and services and may be more successful in marketing such products and services. This competition

could increase price competition and reduce anticipated profit margins.

The failure to enforce and maintain our

intellectual property rights could adversely affect the value of the Company.

The success of our business will partially

depend on our ability to protect our intellectual property. As of the date hereof, we do not have any federally registered patents

or trademarks owned by us. We do have provisional patent and trademark applications pending. The unauthorized use of our intellectual

property could diminish the value of our business, which would have a material adverse effect on our financial condition and results

of operation.

We have incurred losses since our inception,

have yet to achieve profitable operations and anticipate that we will continue to incur losses for the foreseeable future.

Even if we obtain customers, there is no guarantee

that we will be able to generate a profit. Because we are a small company and have limited capital, we must limit our products

and services. Because we will be limiting our marketing activities, we may not be able to attract enough customers to buy our products

to operate profitably. Further, we are subject to raw material pricing which can erode the profitability of our products and put

additional negative pressure on profitability. If we cannot operate profitably, we may have to suspend or cease operations.

For the fiscal year ended August 31, 2020 we

incurred an operating loss of $3,623,892. For the fiscal year ended August 31, 2019, we incurred an operating loss of $549,918.

At August 31, 2020 we had an accumulated deficit of $6,056,949. Although we anticipate generating revenue in future periods, such

revenues may be insufficient to make the Company profitable. We plan to increase our expenses associated with the development of

our business. There is no assurance we will be able to derive revenues from the development of our business to successfully achieve

positive cash flow or that our business will be successful. If we achieve profitability, we may be unable to sustain or increase

profits on a quarterly or annual basis.

We are reliant on single source suppliers

for several components of our products. In the future, such supplies could be difficult or impossible to obtain, which would affect

our ability to produce our products.

We purchase components for our products from

several larger corporations and from single source providers. Any difficulty in obtaining such supplies could restrict our ability

to manufacture products for sales, which would affect our ability to generate revenues. There can be no assurances such suppliers

of the components we require will not become difficult or impossible to obtain in the future.

RISKS OF GOVERNMENT ACTION AND REGULATORY

UNCERTAINTY

We could be found to be violating laws

related to cannabis.

Our future business activities, including providing

management services for cannabis delivery services in California, and the research and development of cannabis infused drinks,

will fall outside of the Farm Bill. Currently, many U.S. states plus the District of Columbia and Guam, have laws and/or regulations

that recognize, in one form or another, legitimate medical and adult uses for cannabis and consumer use of cannabis in connection

with medical treatment or for recreational use. Many other states are considering similar legislation. Conversely, under the CSA,

the policies and regulations of the federal government and its agencies are that cannabis has no medical benefit and a range of

activities including cultivation and the personal use of cannabis is illegal and prohibited. Unless and until Congress amends the

CSA with respect to cannabis, as to the timing or scope of any such potential amendments there can be no assurance, there is a

risk that federal authorities may enforce current federal law, and we may be deemed to be producing, cultivating, dispensing and/or

aiding or abetting the possession and distribution of cannabis in violation of federal law. Active enforcement of the current CSA

on cannabis may thus directly and adversely affect our revenues and profits.

The Farm Bill recently passed, and undeveloped

shared state-federal regulations over hemp cultivation and production may impact our business.

The Farm Bill was signed into law on December

20, 2018. Under Section 10113 of the Farm Bill, state departments of agriculture must consult with the state’s governor

and chief law enforcement officer to devise a plan that must be submitted to the Secretary of USDA. A state’s plan to license

and regulate hemp can only commence once the Secretary of USDA approves that state’s plan. In states opting not to devise

a hemp regulatory program, USDA will need to construct a regulatory program under which hemp cultivators in those states must apply

for licenses and comply with a federally-run program. The details and scopes of each state’s plans are not known at this

time and may contain varying regulations that may impact our business. Even if a state creates a plan in conjunction with its governor

and chief law enforcement officer, the Secretary of the USDA must approve it. There can be no guarantee that any state plan will

be approved. Review times may be extensive. There may be amendments and the ultimate plans, if approved by the states and the USDA,

may materially limit our business depending upon the scope of the regulations.

Laws and regulations affecting our industry

to be developed under the Farm Bill are in development.

As a result of the Farm Bill’s recent

passage, there will be a constant evolution of laws and regulations affecting the hemp industry that could detrimentally affect

our operations. Local, state and federal hemp laws and regulations may be broad in scope and subject to changing interpretations.

These changes may require us to incur substantial costs associated with legal and compliance fees and ultimately require us to

alter our business plan. Furthermore, violations of these laws, or alleged violations, could disrupt our business and result in

a material adverse effect on our operations. In addition, we cannot predict the nature of any future laws, regulations, interpretations

or applications, and it is possible that regulations may be enacted in the future that will be directly applicable to our business.

The approach to the enforcement of cannabis

laws may be subject to change, which creates uncertainty for our business.

As a result of the conflicting views between

state legislatures and the federal government regarding cannabis, as not strictly defined in the 2018 Farm Bill, investments in,

and the operations of, cannabis businesses in the U.S. are subject to inconsistent laws and regulations. Laws and regulations affecting

the cannabis industry are constantly changing, which could detrimentally affect our operations. Local, state and federal cannabis

laws and regulations are broad in scope and subject to evolving interpretations, which could require us to incur substantial costs

associated with compliance or alter our business plan. In addition, violations of these laws, or allegations of such violations,

could disrupt our business and result in a material adverse effect on our operations. It is also possible that regulations may

be enacted in the future that will be directly applicable to our business. These ever-changing regulations could even affect federal

tax policies that may make it difficult to claim tax deductions on our returns. We cannot predict the nature of any future laws,

regulations, interpretations or applications, nor can we determine what effect additional governmental regulations or administrative

policies and procedures, when and if promulgated, could have on our business.

The possible FDA Regulation of hemp and

industrial hemp derived CBD, and the possible registration of facilities where hemp is grown and CBD products are produced, if

implemented, could negatively affect the cannabis industry generally, which could directly affect our financial condition.

The Farm Bill established that hemp containing

less the 0.3% THC was no longer a Schedule 1 drug under the CSA. Previously, the U.S. Food and Drug Administration (“FDA”)

did not approve hemp or CBD derived from hemp as a safe and effective drug for any indication. The FDA considered hemp and hemp-derived

CBD as illegal Schedule 1 drugs. Further, the FDA has concluded that products containing hemp or CBD derived from hemp are excluded

from the dietary supplement definition under sections 201(ff)(3)(B)(i) and (ii) of the U.S. Food, Drug & Cosmetic Act, respectively.

However, as a result of the passage of the Farm Bill, at some indeterminate future time, the FDA may choose to change its position

concerning products containing hemp, or CBD derived from hemp, and may choose to enact regulations that are applicable to such

products, including, but not limited to: the growth, cultivation, harvesting and processing of hemp; regulations covering the physical

facilities where hemp is grown; and possible testing to determine efficacy and safety of hemp derived CBD. In this hypothetical

event, our powdered drink products, which we plan to introduce will likely contain CBD and may be subject to regulation. In the

hypothetical event that some or all of these regulations are imposed, we do not know what the impact would be on the hemp industry

in general, and what costs, requirements and possible prohibitions may be enforced. If we are unable to comply with the conditions

and possible costs of possible regulations and/or registration, as may be prescribed by the FDA, we may be unable to continue to

operate segments of our business.

The scheduling status of Tetrahydrocannabivarin

(THC-V) and other cannabinoids with the Drug Enforcement Administration is uncertain.

During August of 2020, Drug Enforcement Administration

(the “DEA”) issued a rule regarding the scheduling of hemp and marijuana. The ruling could affect our ability to successfully

market our THC-V beverage line.

Should the DEA determine the manufactured cannabinoids

we use in some of our products are scheduled under the CSA, our future business opportunities could be negatively impacted.

The Company is currently working with the supplier

of THC-V to determine the impact, if any, the ruling may have on our ability to market THC-V products.

The DEA published the following summary:

The purpose of this interim final rule is to

codify in the Drug Enforcement Administration (DEA) regulations and statutory amendments to the Controlled Substances Act (CSA)

made by the Agriculture Improvement Act of 2018 (AIA), regarding the scope of regulatory controls over marihuana, tetrahydrocannabinols,

and other marihuana-related constituents. This interim final rule merely conforms DEA's regulations to the statutory amendments

to the CSA that have already taken effect, and it does not add additional requirements to the regulations.

The Agriculture Improvement Act of 2018, Public

Law 115-334 (the AIA), was signed into law on December 20, 2018. It provided a new statutory definition of “hemp” and

amended the definition of marihuana under 21 U.S.C. 802(16) and the listing of tetrahydrocannabinols under 21 U.S.C. 812(c). The

AIA thereby amends the regulatory controls over marihuana, tetrahydrocannabinols, and other marihuana-related constituents in the

Controlled Substances Act (CSA).

The rulemaking makes four conforming changes

to DEA's existing regulations:

|

|

•

|

It modifies 21 CFR 1308.11(d)(31) by adding language stating that the definition of “Tetrahydrocannabinols” does not include “any material, compound, mixture, or preparation that falls within the definition of hemp set forth in 7 U.S.C. 1639 o.”

|

|

|

•

|

It removes from control in schedule V under 21 CFR 1308.15(f) a “drug product in finished dosage formulation that has been approved by the U.S. Food and Drug Administration that contains cannabidiol (2-[1R-3-methyl-6R-(1-methylethenyl)-2-cyclohexen-1-yl]-5-pentyl-1,3-benzenediol) derived from cannabis and no more than 0.1% (w/w) residual tetrahydrocannabinols.”

|

|

|

•

|

It also removes the import and export controls described in 21 CFR 1312.30(b) over those same substances.

|

|

|

•

|

It modifies 21 CFR 1308.11(d)(58) by stating that the definition of “Marihuana Extract” is limited to extracts “containing greater than 0.3 percent delta-9-tetrahydrocannabinol on a dry weight basis.”

|

According to the DEA, the AIA does not impact

the control status of synthetically derived tetrahydrocannabinols (for Controlled Substance Code Number 7370) because the statutory

definition of “hemp” is limited to materials that are derived from the plant Cannabis sativa L. For synthetically derived

tetrahydrocannabinols, the concentration of Δ9-THC is not a determining factor in whether the material is a controlled

substance. All synthetically derived tetrahydrocannabinols remain schedule I controlled substances.

We could become subject to other FDA

regulations.

The cannabinoid delivery technologies we are

developing could at a later date become subject to increased government regulation. Such additional regulations and could have

an adverse effect on our business operations.

RISKS ASSOCIATED WITH BANK AND INSURANCE

LAWS AND REGULATIONS

We and our customers may have difficulty

accessing the service of banks, which may make it difficult to sell our products and services and manage our cash flows.

Since the commerce in cannabis, as not strictly

defined in the 2018 Farm Bill, is illegal under federal law, federally most chartered banks will not accept deposit funds from

businesses involved with cannabis. Consequently, businesses involved in the cannabis industry often have trouble finding a bank

willing to accept their business. The inability to open bank accounts may make it difficult for our customers to operate. There

does appear to be recent movement to allow state-chartered banks and credit unions to provide banking to the industry, but as of

the date of this report there are only nominal entities that have been formed that offer these services. Further, in a February

6, 2018, Forbes article, United States Secretary of the Treasury, Steven Mnuchin, is reported to have testified that his department

is “reviewing the existing guidance.” But he clarified that he doesn’t want to rescind it without having an alternate

policy in place to address public safety concerns.

Financial transactions involving proceeds generated

by cannabis-related conduct can form the basis for prosecution under the federal money laundering statutes, unlicensed money transmitter

statute and the U.S. Bank Secrecy Act. Despite guidance from the U.S. Department of the Treasury suggesting it may be possible

for financial institutions to provide services to cannabis-related businesses consistent with their obligations under the Bank

Secrecy Act, banks remain hesitant to offer banking services to cannabis-related businesses. Consequently, those businesses involved

in the cannabis industry continue to encounter difficulty establishing banking relationships. Our inability to maintain our current

bank accounts would make it difficult for us to operate our business, increase our operating costs, and pose additional operational,

logistical and security challenges and could result in our inability to implement our business plan. Similarly, many of our customers

are directly involved in cannabis sales and further restrictions to their ability to access banking services may make it difficult

for them to purchase our products, which could have a material adverse effect on our business, financial condition and results

of operations.

We are subject to certain federal regulations

relating to cash reporting.

The Bank Secrecy Act, enforced by FinCEN, requires

us to report currency transactions in excess of $10,000, including identification of the customer by name and social security number,

to the IRS. This regulation also requires us to report certain suspicious activity, including any transaction that exceeds $5,000

that we know, suspect or have reason to believe involves funds from illegal activity or is designed to evade federal regulations

or reporting requirements and to verify sources of funds. Substantial penalties can be imposed against us if we fail to comply

with this regulation. If we fail to comply with these laws and regulations, the imposition of a substantial penalty could have

a material adverse effect on our business, financial condition and results of operations.

Due to our involvement in the cannabis

industry, we may have a difficult time obtaining the various insurances that are desired to operate our business, which may expose

us to additional risk and financial liability.

Insurance that is otherwise readily available,

such as general liability, and directors and officer’s insurance, is more difficult for us to find, and more expensive, because

we are service providers to companies in the cannabis industry. There are no guarantees that we will be able to find such insurance(s)

in the future, or that the cost will be affordable to us. If we are forced to go without such insurance(s), it may prevent us from

entering into certain business sectors, may inhibit our growth, and may expose us to additional risk and financial liabilities

RISK ASSOCIATED WITH OUR INDUSTRY

Our Business Can be Affected by Unusual

Weather Patterns.

Hemp and cannabis cultivation can be impacted

by weather patterns and these unpredictable weather patterns may impact our ability to harvest hemp. In addition, severe weather,

including drought and hail, can destroy a hemp crop, which could result in us having no hemp to harvest, process and sell. If suppliers

are unable to obtain sufficient hemp from which to process CBD, our ability to meet customer demand, generate sales, and maintain

operations will be impacted.

Our business and financial performance

may be adversely affected by downturns in the target markets that we serve or reduced demand for the types of products we sell.

Demand for our products is often affected by

general economic conditions as well as product-use trends in our target markets. These changes may result in decreased demand for

our products. The occurrence of these conditions is beyond our ability to control and, when they occur, they may have a significant

impact on our sales and results of operations. The inability or unwillingness of our customers to pay a premium for our products

due to general economic conditions or a downturn in the economy may have a significant adverse impact on our sales and results

of operations.

Changes within the cannabis industry

may adversely affect our financial performance.

Changes in the identity, ownership structure

and strategic goals of our competitors and the emergence of new competitors in our target markets may harm our financial performance.

New competitors may include foreign-based companies and commodity-based domestic producers who could enter our specialty markets

if they are unable to compete in their traditional markets. The paper industry has also experienced consolidation of producers

and distribution channels. Further consolidation could unite other producers with distribution channels through which we intend

to sell our products, thereby limiting access to our target markets.

We may be subject to certain tax risks

and treatments that could negatively impact our results of operations.

Section 280E of the Internal Revenue Code,

as amended, prohibits businesses from deducting certain expenses associated with trafficking-controlled substances (within the

meaning of Schedule I and II of the Controlled Substances Act). The IRS has invoked Section 280E in tax audits against various

cannabis businesses in the U.S. that are permitted under applicable state laws. Although the IRS issued a clarification allowing

the deduction of certain expenses, the scope of such items is interpreted very narrowly, and the bulk of operating costs and general

administrative costs are not permitted to be deducted. While there are currently several pending cases before various administrative

and federal courts challenging these restrictions, there is no guarantee that these courts will issue an interpretation of Section

280E favorable to cannabis businesses.

The Company’s industry is highly

competitive, and we have less capital and resources than many of our competitors which may give them an advantage in developing

and marketing products similar to ours or make our products obsolete.

We are involved in a highly competitive industry

where we may compete with numerous other companies who offer alternative methods or approaches, who may have far greater resources,

more experience, and personnel perhaps more qualified than we do. Such resources may give our competitors an advantage in developing

and marketing products similar to ours or products that make our products less desirable to consumers or obsolete. There can be

no assurance that we will be able to successfully compete against these other entities.

We may be unable to respond to the rapid

technological change in the industry and such change may increase costs and competition that may adversely affect our business.

Rapidly changing technologies, frequent new

product and service introductions and evolving industry standards characterize our market. The continued growth of the Internet

and intense competition in our industry exacerbates these market characteristics. Our future success will depend on our ability

to adapt to rapidly changing technologies by continually improving the performance features and reliability of our products. We

may experience difficulties that could delay or prevent the successful development, introduction or marketing of our products.

In addition, any new enhancements must meet the requirements of our current and prospective customers and must achieve significant

market acceptance. We could also incur substantial costs if we need to modify our products and services or infrastructures to adapt

to these changes.

We also expect that new competitors may introduce

products or services that are directly or indirectly competitive with us. These competitors may succeed in developing products

and services that have greater functionality or are less costly than our products and services and may be more successful in marketing

such products and services. Technological changes have lowered the cost of operating, communications and computer systems and purchasing

software. These changes reduce our cost of selling products and providing services, but also facilitate increased competition by

reducing competitors’ costs in providing similar products and services. This competition could increase price competition

and reduce anticipated profit margins.

RISKS RELATED TO OUR COMMON STOCK

We may need additional capital

that will dilute the ownership interest of investors.

We may require additional capital to fund our

future business operations. If we raise additional funds through the issuance of equity, equity-related or convertible debt securities,

these securities may have rights, preferences or privileges senior to those of the rights of holders of our shares of common stock,

who may experience dilution of their ownership interest of our shares of Common Stock. We cannot predict whether additional financing

will be available to us on favorable terms when required, or at all. Since our inception, we have experienced negative cash flow

from operations and expect to experience significant negative cash flow from operations in the future. The issuance of additional

shares of Common Stock by our board of directors may have the effect of further diluting the proportionate equity interest and

voting power of holders of our shares of Common Stock.

Our shares of Common Stock qualify as

a penny stock. As such, we are subject to the risks associated with "penny stocks". Regulations relating to "penny

stocks" limit the ability of our shareholders to sell their shares and, as a result, our shareholders may have to hold their

shares indefinitely.

Our shares of Common Stock are deemed to be

"penny stock" as that term is defined in Regulation Section 240.3a51-1 of the Securities and Exchange Commission. Penny

stocks are stocks: (a) with a price of less than $5.00 per share; (b) that are not traded on a "recognized" national

exchange; (c) whose prices are not quoted on the NASDAQ automated quotation system (NASDAQ - where listed stocks must still meet

requirement (a) above); or (d) in issuers with net tangible assets of less than $2,000,000 (if the issuer has been in continuous

operation for at least three years) or $5,000,000 (if in continuous operation for less than three years), or with average revenues

of less than $6,000,000 for the last three years.

Section 15(g) of the Securities Exchange Act

of 1934 and Regulation 240.15g(c)2 of the Securities and Exchange Commission require broker dealers dealing in penny stocks to

provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written

receipt of the document before effecting any transaction in a penny stock for the investor's account. Potential investors in our

shares of Common Stock are urged to obtain and read such disclosure carefully before purchasing any shares of Common Stock that

are deemed to be "penny stock".

Moreover, Regulation 240.15g-9 of the SEC requires

broker dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny

stock to that investor. This procedure requires the broker dealer to: (a) obtain from the investor information concerning his or

her financial situation, investment experience and investment objectives; (b) reasonably determine, based on that information,

that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as

to be reasonably capable of evaluating the risks of penny stock transactions; (c) provide the investor with a written statement

setting forth the basis on which the broker dealer made the determination in (ii) above; and (d) receive a signed and dated copy

of such statement from the investor confirming that it accurately reflects the investor's financial situation, investment experience

and investment objectives. Compliance with these requirements may make it more difficult for investors in our shares of Common

Stock to resell their shares to third parties or to otherwise dispose of them. Holders should be aware that, according to SEC Release

No. 34-29093, dated April 17, 1991, the market for penny stocks suffers from patterns of fraud and abuse.

Our Management is aware of the abuses that

have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of

the market or of broker-dealers who participate in the market, Management will strive within the confines of practical limitations

to prevent the described patterns from being established with respect to our securities.

We will be controlled by existing shareholders.

Our directors and officers currently in place

control a significant portion of our shares and have super voting rights relative to preferred shares. Thus, they will continue

to oversee the Company’s operations. As a result, our directors and officers will likely have a significant influence on

the affairs and management of the Company, as well as on all matters requiring stockholder approval, including electing and removing

members of its board of directors, causing the Company to engage in transactions with affiliated entities, causing or restricting

the sale or merger of the Company and changing the company’s dividend policy. Such concentration of ownership and control

could have the effect of delaying, deferring or preventing a change in control of the Company, even when such a change of control

would be in the best interests of the company’s other stockholders.

We have the ability to issue additional

shares of our shares of preferred stock without asking for stockholder approval, which could cause your investment to be diluted.

Our Articles of Incorporation authorizes the

Board of Directors to issue up to 290,000,000 shares of Common Stock. The power of the Board of Directors to issue shares

of Common Stock, preferred stock or warrants or options to purchase shares of Common Stock or preferred stock is generally not

subject to stockholder approval. Accordingly, any additional issuance of our shares of Common Stock, or shares of preferred stock

that may be convertible into Common Stock, may have the effect of diluting your investment. Currently authorized are ten million

(10,000,000) shares of preferred stock, par value $0.0001 per share, of the Company Preferred Stock in one or more series, and

expressly authorized the Board of Directors of the Company, subject to limitations prescribed by law, to provide, out of the unissued

shares of Preferred Stock, for series of Preferred Stock, and, with respect to each such series, to establish and fix the number

of shares to be included in any series of Preferred Stock and the designation, rights, preferences, powers, restrictions, and limitations

of the shares of such series. On December 16, 2019, the Board of Directors authorized the issuance of eight million (8,000,000)

preferred shares as “Series A Preferred Stock.” The Series A Preferred Stock is not convertible into any other form

of Securities, including common shares, of the Company. Holders of Series A Preferred Stock shall be entitled to fifty (50) votes

for every Share of Series A Preferred Stock beneficially owned as of the record date for any shareholder vote or written consent.

On May 28, 2020, Mr. Robert L. Hymers III, a former director and former chief financial officer, returned 2,000,000 Series A Preferred

shares to the corporate treasury. As of the date of this filing, there were 6,000,000 Series A Preferred shares issued and outstanding.

FINRA sales practice requirements may

also limit a stockholder’s ability to buy and sell our stock and to deposit certificates in paper form or to clear shares

for trading under Safe Harbor exemptions and regulations for unregistered shares.

In addition to the “penny stock”

rules described above, the Financial Industry Regulatory Authority (known as “FINRA”) has adopted rules that require

that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment

is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers

must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives

and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced

securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker- dealers to recommend

that their customers buy our shares of Common Stock, which may limit your ability to buy and sell our stock and have an adverse

effect on the market for our shares. FINRA requirements make it more difficult for our investors to deposit paper stock certificates

or to clear our shares of Common Stock that are transferred electronically to brokerage accounts. There can be no assurances that

our investors will be able to clear our shares for eventual resale.

Costs and expenses of being a reporting

company under the 1934 Securities Exchange Act may be burdensome and prevent us from achieving profitability.

As a public company, we are subject to the

reporting requirements of the Securities Exchange Act of 1934, as amended, and parts of the Sarbanes-Oxley Act. We expect that

the requirements of these rules and regulations will continue to increase our legal, accounting and financial compliance costs,

make some activities more difficult, time-consuming and costly, and place significant strain on our personnel, systems and resources.

Since our shares of Common Stock is thinly

traded it is more susceptible to extreme rises or declines in price, and you may not be able to sell your shares at or above the

price paid.

Since our shares of Common Stock are thinly

traded its trading price is likely to be highly volatile and could be subject to extreme fluctuations in response to various factors,

many of which are beyond our control, including (but not necessarily limited to): the trading volume of our shares, the number

of analysts, market-makers and brokers following our shares of Common Stock, new products or services introduced or announced by

us or our competitors, actual or anticipated variations in quarterly operating results, conditions or trends in our business industries,

additions or departures of key personnel, sales of our shares of Common Stock and general stock market price and volume fluctuations

of publicly traded, and particularly microcap, companies.

Investors may have difficulty reselling shares

of our Common Stock, either at or above the price they paid for our stock, or even at fair market value. The stock markets often

experience significant price and volume changes that are not related to the operating performance of individual companies, and

because our shares of Common Stock are thinly traded it is particularly susceptible to such changes. These broad market changes

may cause the market price of our shares of Common Stock to decline regardless of how well we perform as a company. In addition,

there is a history of securities class action litigation following periods of volatility in the market price of a company’s

securities. Although there is no such litigation currently pending or threatened against us, such a suit against us could result

in the incursion of substantial legal fees, potential liabilities and the diversion of management’s attention and resources

from our business. Moreover, and as noted below, our shares are currently traded on the OTC Markets Pink and, further, are subject

to the penny stock regulations. Price fluctuations in such shares are particularly volatile and subject to potential manipulation

by market-makers, short-sellers and option traders.

We do not expect to pay any dividends

on our common stock.

We do not anticipate that we will pay any cash

dividends to holders of our common stock in the foreseeable future. Instead, we plan to retain any earnings to maintain and expand

our existing operations. Accordingly, investors must rely on sales of their common stock after price appreciation, which may never

occur, as the only way to realize any return on their investment.

We are involved in litigation, the outcome

of which could affect the value of our common shares.

On November 22, 2019, the Company filed suit

against Jeet Sidhru and Jatinder Bhogal in the District Court of Clark County Nevada, Case number A-19-805943-C. Mr. Sidhru and

Mr. Bhogal were formerly directors and officers of the Company. The Company’s complaint alleges that Mr. Sidhru and Mr. Bhogal

breached their fiduciary duties to the Company, including their fiduciary duties of due care, good faith and loyalty, by recklessly

and intentionally failing to maintain the Company’s statutory corporate filings with the State of Nevada, OTC Markets and

the U.S. Securities and Exchange Commission, and abandoning the Company and its shareholders. The Company’s complaint also

alleges that Mr. Sidhru and Mr. Bhogal engaged in conflicted transactions involving the Company, in which each were unjustly enriched.

The Company served Mr. Bhogal, and received notice of representation of both defendants. The case is currently in its early phase,

as neither defendant has answered the complaint. The outcome of this suit againt Mr. Bhogal and Mr. Sidjru is uncertain. If the

Company were unable to prevail in the suit, the value of the common shares and the overall value of the Company could be negatively

affected.

There could be unidentified risks involved

with an investment in our securities or relating to our Company.

The foregoing risk factors are not a complete

list or explanation of the risks involved with an investment in the securities. Additional risks will likely be experienced that

are not presently foreseen by the Company. Prospective investors must not construe this and the information provided herein as

constituting investment, legal, tax or other professional advice. Before making any decision to invest in our securities, you should

read this entire filing and consult with your own investment, legal, tax and other professional advisors. An investment in our

securities is suitable only for investors who can assume the financial risks of an investment in the Company for an indefinite

period of time and who can afford to lose their entire investment. The Company makes no representations or warranties of any kind

with respect to the likelihood of the success or the business of the Company, the value of our securities, any financial returns

that may be generated or any tax benefits or consequences that may result from an investment in the Company.

RISKS RELATED TO THE OFFERING

Since our shares of Common Stock is thinly

traded it is more susceptible to extreme rises or declines in price, and you may not be able to sell your shares at or above the

price paid.

Since our shares of Common Stock are thinly

traded its trading price is likely to be highly volatile and could be subject to extreme fluctuations in response to various factors,

many of which are beyond our control, including (but not necessarily limited to): the trading volume of our shares, the number

of analysts, market-makers and brokers following our shares of Common Stock, new products or services introduced or announced by

us or our competitors, actual or anticipated variations in quarterly operating results, conditions or trends in our business industries,