UnitedHealth's Profit Slips as Health-Care Visits Return--Update

January 20 2021 - 11:06AM

Dow Jones News

By Matt Grossman and Anna Wilde Mathews

UnitedHealth Group Inc. recorded a smaller profit for the last

quarter of 2020 as the company saw rising medical costs tied to

Covid-19.

The Minnetonka, Minn., health-care company, the parent of

insurer UnitedHealthcare as well as the Optum health-services

business, said Wednesday that the pandemic dragged on revenue

growth from commercial insurance customers last year as its

economic fallout disrupted the labor market. But revenue grew

overall for the company's insurance business in the year amid

expansion of its programs to serve communities and seniors.

Fourth-quarter revenue for UnitedHealth climbed to $65.47

billion, up from $60.9 billion in the same quarter a year earlier.

Analysts surveyed by FactSet had forecast revenue of $64.96

billion.

UnitedHealth's revenue from premiums grew to $50.58 billion,

from $47.63 billion a year earlier. The company also logged higher

revenue from products, services and investment income than it did

in the year-ago quarter.

As more people returned to medical providers for care that they

had avoided or postponed earlier in the pandemic, UnitedHealth's

costs rose. UnitedHealthcare also saw rising medical expenses tied

directly to Covid-19.

Costs from Covid-19 represented 11% of health-care activity in

the fourth quarter, the company said during a call with analysts.

Inpatient care spending rose over the course of the quarter. Of the

65,000 Covid-19 admissions during the quarter, about half were in

December, while just 20% came in October.

UnitedHealth posted fourth-quarter net income of $2.21 billion,

or $2.30 a share, compared with $3.54 billion, or $3.68 a share, in

the same period a year earlier.

On an adjusted basis, UnitedHealth's profit was $2.52 a share.

Analysts surveyed by FactSet had forecast an adjusted profit of

$2.41 a share.

Revenue from Optum grew in the quarter as the number of

customers served rose by 2.1% to 98 million and as revenue per

customer jumped 29% year over year. Prescription volume under the

company's OptumRX business started to return to more normal levels

as more health-care services returned after a lull earlier in the

pandemic.

Optum's quarterly revenue was $35.9 billion, up from $29.8

billion a year ago.

Earlier this month, UnitedHealth agreed to pay roughly $8

billion to acquire Change Healthcare Inc., a health-care technology

company that it said it plans to merge into Optum.

UnitedHealth said it expects its full-year profit in 2021 to be

between $16.90 a share and $17.40 a share, or $17.75 a share to

$18.25 a share on an adjusted basis. That estimate includes a

negative effect of $1.80 a share from coronavirus-related concerns,

UnitedHealth said, such as testing and treatment costs, deferred

care from last year and broader economic factors.

During the call with analysts, UnitedHealth said it expected

overall Covid-19 care costs in 2021 to be similar to the total for

2020.

Write to Matt Grossman at matt.grossman@wsj.com and Anna Wilde

Mathews at anna.mathews@wsj.com

(END) Dow Jones Newswires

January 20, 2021 10:51 ET (15:51 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

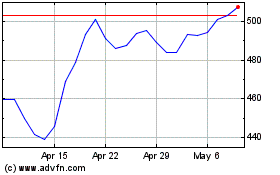

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024