UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of January 2021.

Commission File Number 0-26046

China Natural Resources, Inc.

(Translation of registrant's name into English)

Room 2205, 22/F, West Tower, Shun Tak Centre,

168-200 Connaught Road Central, Sheung Wan, Hong Kong

(Address of principal executive offices)

Indicate by check mark whether the registrant files of will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F þ Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

This report on Form 6-K is hereby incorporated by reference into the Registration Statement on Form F-3 (File No. 333-233852) of China Natural Resources, Inc. (the “Company,” “we,” “us,” and “our”).

Registered Direct Offering of Common Shares and Warrants with Certain Institutional Investors

On January 20, 2021, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain institutional investors (the “Investors”), pursuant to which the Company agreed to issue and sell, (i) in a registered direct offering, up to an aggregate of 3,960,000 of common shares, no par value (the “Shares”) of the Company at a per Share purchase price of $1.85 (the “Registered Offering”), and (ii) in a concurrent private placement, warrants initially exercisable for the purchase of an aggregate of 1,584,000 common shares of the Company (the “Investors Warrants”), for gross proceeds of approximately $7.3 million, before deducting fees to the placement agent and other estimated offering expenses payable by the Company.

The Investors Warrants are exercisable immediately as of the date of issuance until 36 months after the date of issuance at an initial exercise price of $2.35 per share. The exercise price of the Investors Warrants is subject to full-ratchet anti-dilution adjustment in the case of future issuances of common shares of the Company below the Investors Warrants’ exercise price then in effect, as well as customary adjustment in case of stock splits, stock dividends, stock combinations and similar recapitalization transactions. A holder of the Investors Warrants also will have the right to exercise such warrants on a cashless basis if the registration statement or prospectus contained therein is not available for the issuance of all common shares issuable upon exercise thereof. The exercisability of the Investors Warrants may also be limited if, upon exercise, the holder and its affiliates would in aggregate beneficially own more than 4.99% or 9.99% of the Company’s common shares, which percentage shall be elected by the holder on or prior to the issuance date.

Pursuant to the provisions of the Purchase Agreement, the Company and the Investors have agreed that: (i) subject to certain exceptions, the Company will not, within the 90 calendar days following the closing of this offering enter into any agreement to issue or announce the issuance or disposition or proposed issuance or disposition of any securities (each, a “Subsequent Placement”); (ii) within one year following the execution of the Purchase Agreement, the Company will not enter into an agreement to effect a “Variable Rate Transaction,” as that term is defined in the Purchase Agreement; and (iii) within one year following the closing of this offering, the Company shall not effect any Subsequent Placement unless the Investors are offered a participation right, subject to certain terms and conditions as set forth in the Purchase Agreement, to subscribe, on a pro rata basis, up to 35% of the securities offered in the Subsequent Placement.

FT Global Capital, Inc. (the “Placement Agent”) acted as the exclusive placement agent in connection with the Registered Offering and the Private Placement pursuant to the terms of a placement agent agreement, dated January 20, 2021, between the Company and Placement Agent (the “Placement Agent Agreement”). Pursuant to the Placement Agent Agreement, the Company agreed to pay Placement Agent a cash fee equal to eight percent (8%) of the aggregate proceeds received by the Company from the sale of its securities to investors introduced to the Company by the Placement Agent. Placement Agent is also entitled to additional tail compensation for any financings consummated within the 12-month period following the termination of the Placement Agent Agreement to the extent that such financing is provided to the Company by investors that the Placement Agent had introduced to the Company. In addition to the cash fee, the Company agreed to issue to the Placement Agent warrants to purchase an aggregate of up to ten percent (10%) of the aggregate number of Shares sold in the Registered Offering (the “Placement Agent Warrants”). The Placement Agent Warrants shall generally be on the same terms and conditions as the Investors Warrants, exercisable at a price of $2.35 per share, subject to a 180-day delay in the exercise period.

The Shares are being offered by the Company pursuant to an effective shelf registration statement on Form

S

F

-3, which was filed with the Securities and Exchange Commission on September 19, 2019 and was declared effective on November 20, 2019 (File No. 333-233852).

The foregoing descriptions of the Purchase Agreement, the Placement Agent Agreement, Investors Warrant and Placement Agent Warrant do not purport to be complete and are qualified in their entirety by reference to the full text of such agreements, copies or forms of which are attached hereto as Exhibits 4.1, 4.2, 2.1 and 2.2, respectively, and are incorporated herein by reference.

The Company intends to use the net proceeds from this offering for working capital and general corporate purposes. This offering is expected to close on or about January 22, 2021, subject to satisfaction of customary closing conditions.

This Current Report on Form 6-K does not constitute an offer to sell any securities or a solicitation of an offer to buy any securities, nor shall there be any sale of any securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Press Release

On January 20, 2021, the Company issued a press release announcing the offering, a copy of which is attached hereto as Exhibit 15.3.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

CHINA NATURAL RESOURCES, INC.

|

|

|

|

|

|

|

Date: January 20, 2021

|

By:

|

/s/ Wong Wah On Edward

|

|

|

|

|

Wong Wah On Edward

|

|

|

|

|

Chairman, President and Chief Executive Officer

|

|

China Natural Resources (NASDAQ:CHNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

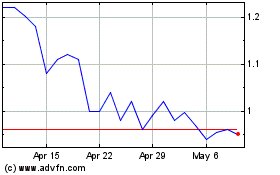

China Natural Resources (NASDAQ:CHNR)

Historical Stock Chart

From Apr 2023 to Apr 2024